Indicators are now strongly hinting that Bitcoin’s (BTC) recent rallies have a lot more gas left in the tank and that much bigger gains are about to be witnessed, a closely followed crypto analyst says.

The pseudonymous analyst known as TechDev tells his 444,000 followers on the social media platform X that Bitcoin is currently pushing up on the 2x multiple of its 350 daily moving average (DMA) while it consolidates near all-time highs.

TechDev also notes that BTC’s moving average convergence divergence (MACD) indicator on the two-month chart has simultaneously flipped green.

The analyst says that together, the three characteristics of Bitcoin’s current price action have historically coincided with a parabolic rally, which he notes will likely end when the 111 DMA touches the 2×350 DMA.

“BTC consolidation at the intersection of prior all-time high and 2 x 350 DMA soon after a two-month MACD flip is nothing new.

On the contrary, it’s been the precursor to a parabolic surge up to a cross with the 111 DMA.”

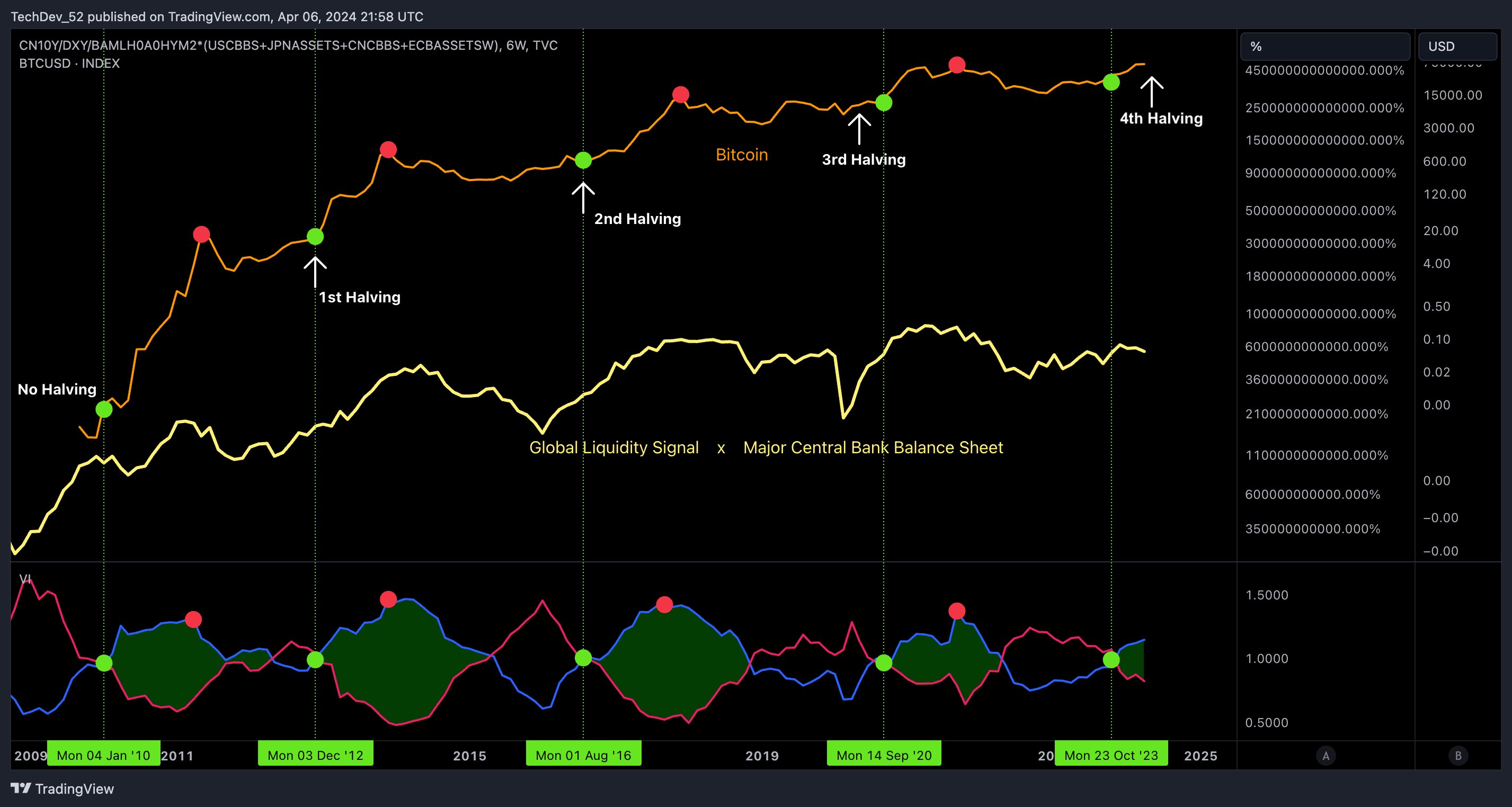

TechDev is of the viewpoint that Bitcoin’s market cycles may have little to do with the halving, which happens roughly every four years and slashes miners’ BTC rewards in half.

Instead, the analyst says that Bitcoin is more likely correlated with global liquidity cycles. He shares a long-term chart suggesting a correlation between BTC, global liquidity and the balance sheets of major central banks.

“This is the first time a new Bitcoin all-time high has come before a halving…

Because this has been the first liquidity cycle to start before a halving.

Reveals which has been driving these runs, and which has happened to align (except this time).”

At time of writing, Bitcoin is trading at $69,780.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Generated Image: DALLE-3

Read the full article here