Popular on-chain analyst Willy Woo believes Bitcoin (BTC) is now in a position to kick start a fresh leg up after months of consolidation.

Woo tells his 1.1 million followers on the social media platform X that he’s looking at Bitcoin’s spent output profit ratio (SOPR), which tracks whether coins are being sold at a profit or loss.

According to Woo, the metric currently shows that BTC holders are done taking profits close to record highs, suggesting that sell pressure is losing momentum.

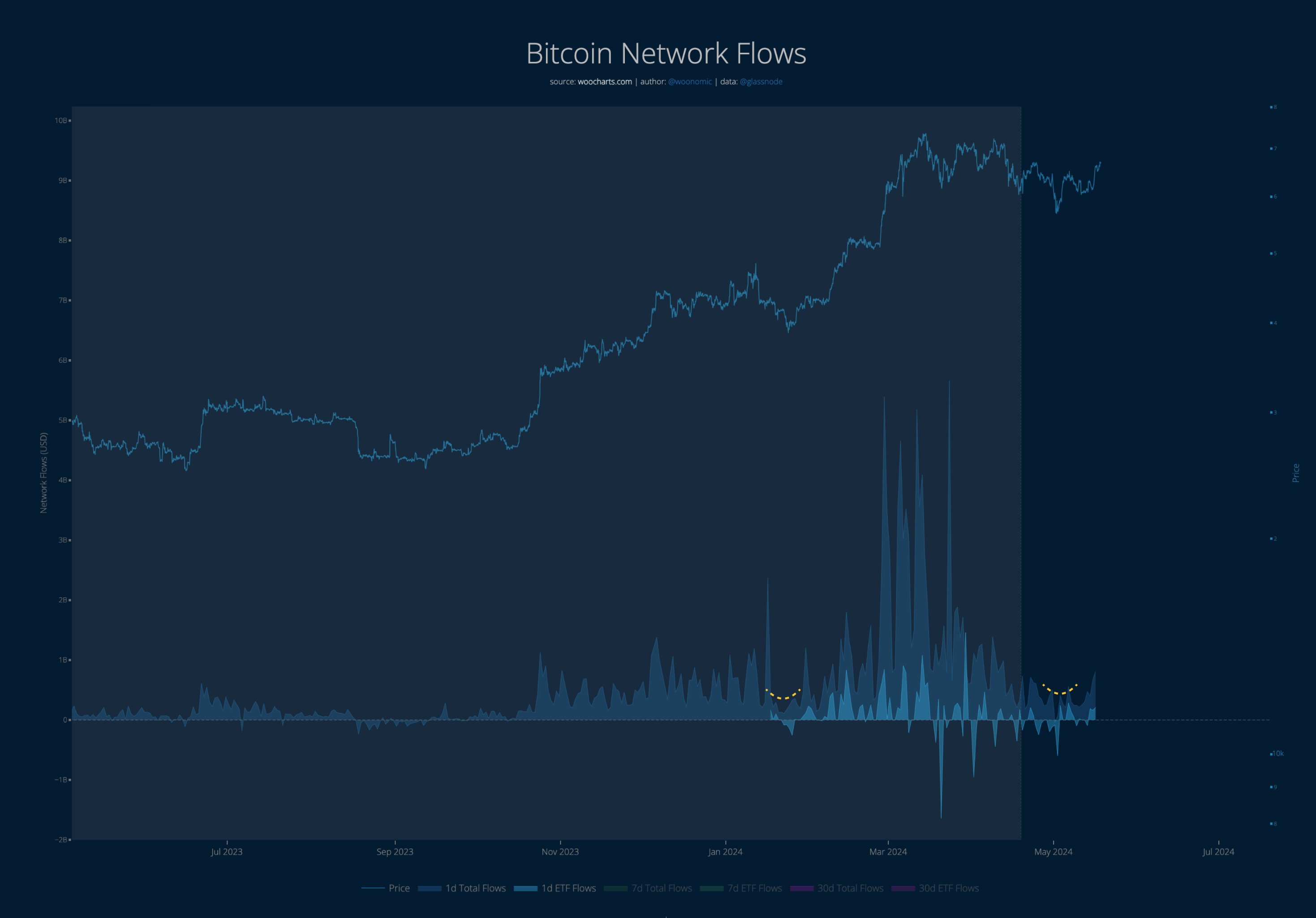

“Profit-taking has completed, it took two months. A very healthy reset, against a backdrop of capital flows into the network climbing again.”

The on-chain analyst also shares a chart suggesting that capital inflows into BTC are starting to pick up.

“Capital inflows update.”

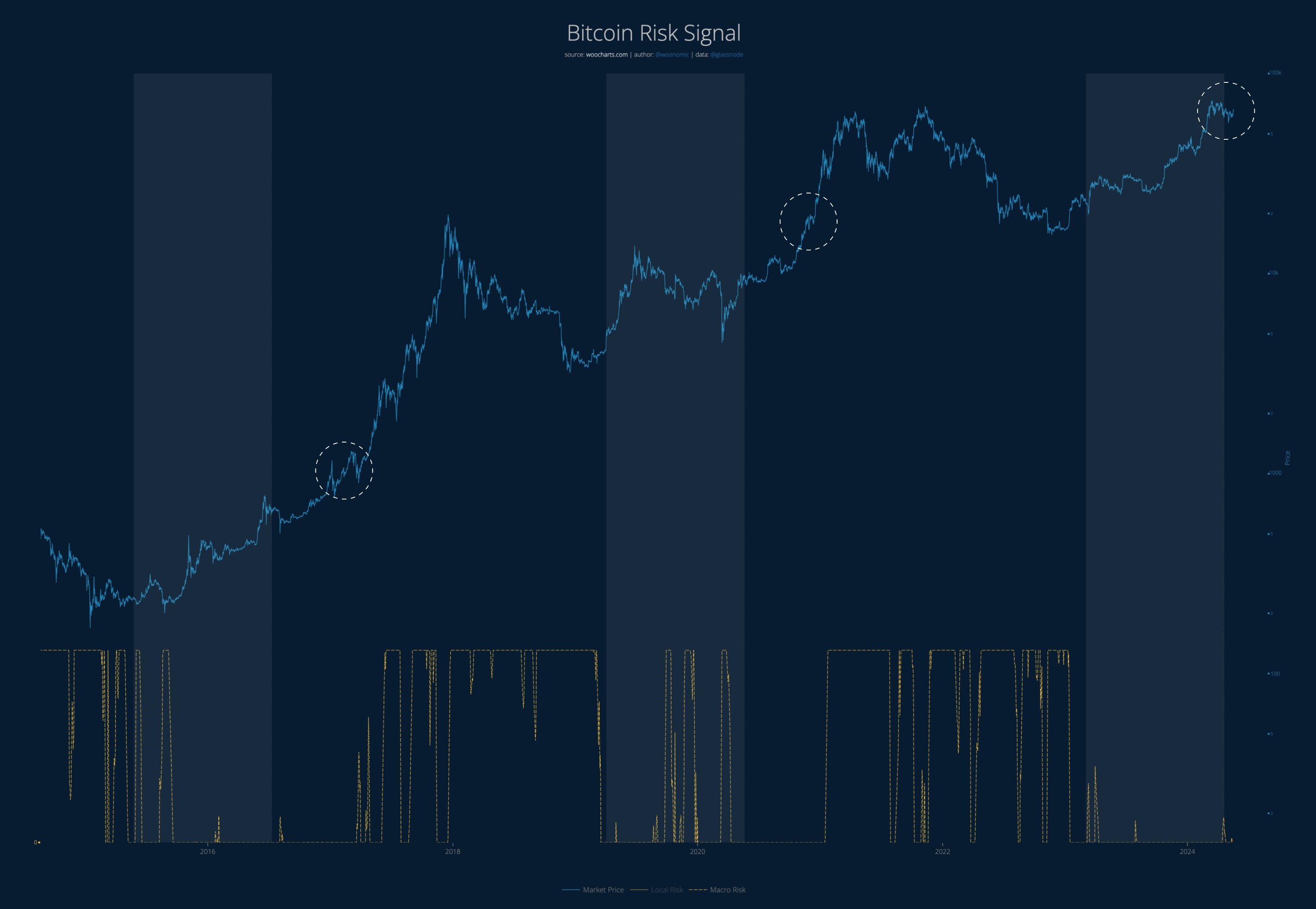

Looking at the bigger picture, Woo believes that Bitcoin is gearing up to ignite the next leg of its bull market.

“Here’s the bigger picture of where Bitcoin is in its liquidity cycle… it’s still doing warm-up exercises.

It’s consolidating under all-time highs, during this time, long time frame risk signal is quite low. Risk only starts climbing after the floodgates open.”

Based on the analyst’s chart, he seems to suggest that Bitcoin appears to be mirroring the bull market setups of 2017 and 2020 when BTC was consolidating close to record highs before a steep upside rally.

At time of writing, Bitcoin is worth $67,097.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: DALLE3

Read the full article here