In the crypto market, there are many trading platforms to buy and sell cryptocurrencies. One of the notable names is the KuCoin crypto exchange. This KuCoin review will explain what it is, how it works, and what it’s good for, all in easy-to-understand words.

Key Takeaways:

- KuCoin is a popular crypto trading platform that offers a variety of services, including spot trading, futures, margin trading, and P2P trading.

- It has a competitive fee structure starting at 0.1% for spot trading, with significant discounts available for users holding the KuCoin token (KCS), which can lower fees by up to 20%.

- With over 820 cryptocurrencies and more than 1290 trading pairs, it provides access to a diverse range of digital assets, including many emerging altcoins.

KuCoin Review – At a Glance

|

Launched Date |

2017 |

|

Headquarters |

Seychelles |

|

Available Assets |

820+ tokens and 1290+ trading pairs |

|

Trading Features |

Spot, futures, margin, trading, bots, leveraged tokens, staking services, API trading, P2P trading |

|

Trading Fees |

|

|

Earn Services |

Savings, snowball, shark fin, dual investment, lending, and more |

|

Trading Bots |

Spot & Futures Grid, Rebalance, martingale, DCA |

|

Security |

2FA, cold storage, SSL encryption, address whitelisting, PoR, security audits |

|

US availability |

No |

|

KuCoin Mobile App |

Android and iOS |

What is KuCoin Exchange?

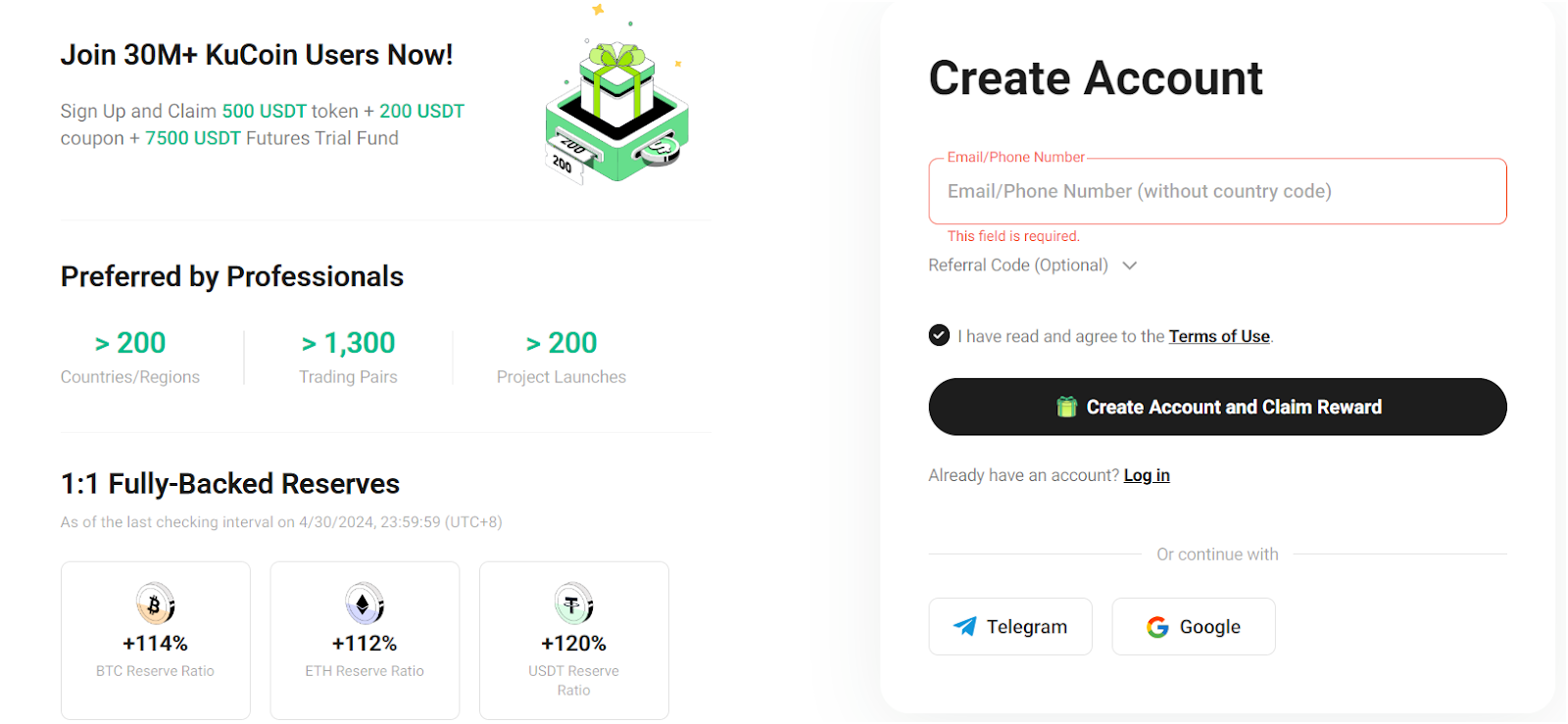

KuCoin is a well-known cryptocurrency exchange that began operations in September 2017. Headquartered in Seychelles, it has grown rapidly, now serving over 30 million KuCoin users in more than 200 countries. Despite its large user base, it is not regulated by any national licensing bodies but operates legally as a Digital Asset Exchange under Seychelles law.

The exchange provides a wide range of advanced trading features. You can engage in spot trading, margin trading, futures trading, and trading leveraged tokens. The platform supports approximately 820 cryptocurrencies and 1290+ trading pairs, including BTC, ETH, and its native KCS.

The platform is designed to be accessible, with a user-friendly interface available on both the website and mobile app, supporting multiple languages. This makes it easier for users around the world to trade cryptocurrencies. However, while some features are beginner-friendly, KuCoin is best suited for experienced and advanced traders.

KuCoin’s financial performance is also robust, with an average daily trading volume of approximately $1 billion USD. This significant volume reflects the platform’s liquidity and high trading activity. The matching engine is also super fast, with low latency and minimal price slippage.

Pros of KuCoin

- Lists a massive variety of over 820 cryptocurrencies, including many up-and-coming altcoins

- Competitive fee structure with 20% discounts for holding their native token (KCS)

- Offers various ways to earn interest on your crypto holdings through staking, lending, and flexible earning

- Automate your trading strategies with built-in KuCoin bots

- The user-friendly mobile app allows for convenient crypto management

Cons of KuCoin

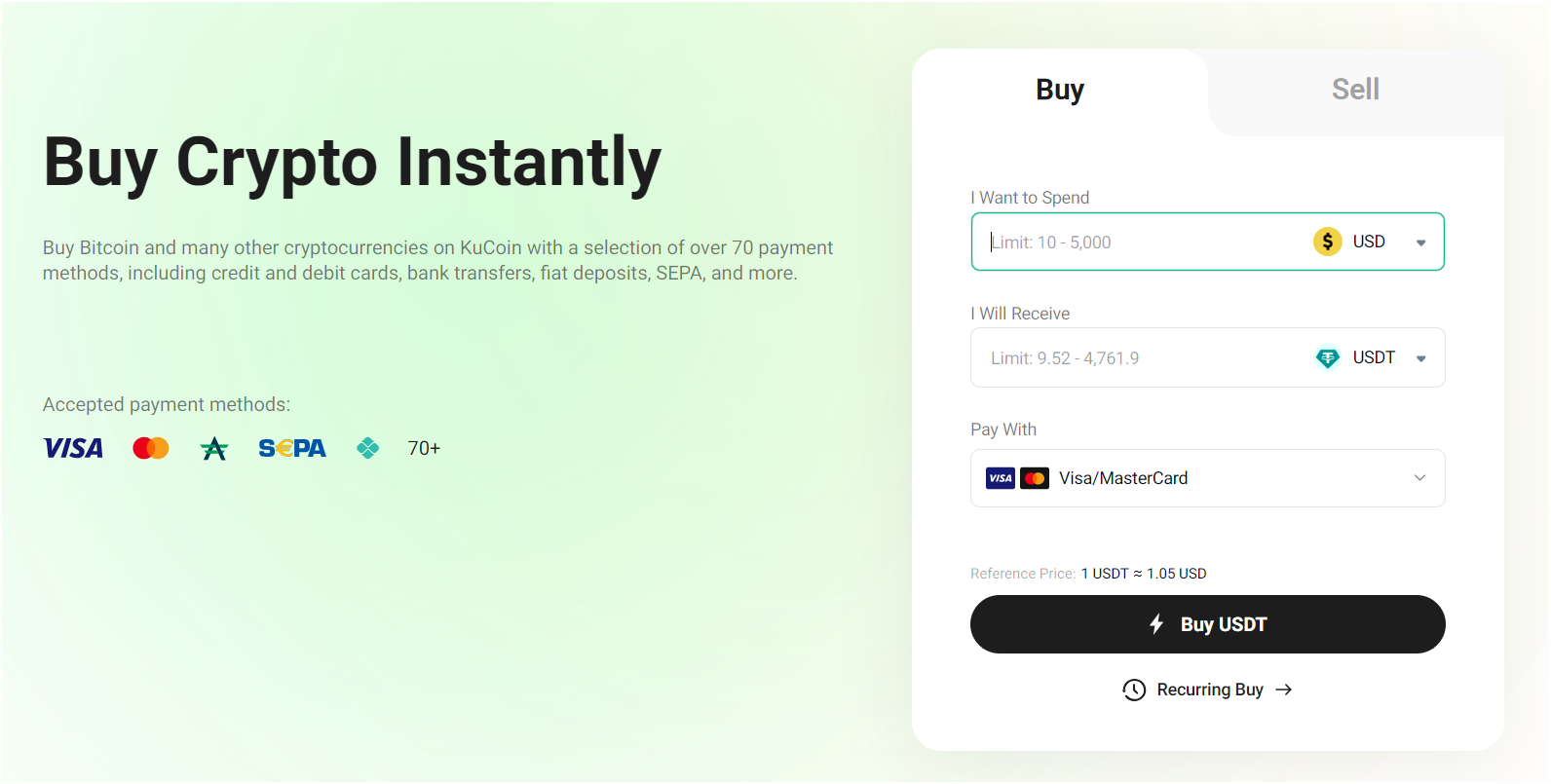

- Primarily crypto-to-crypto exchange, with limited fiat-off-ramp (withdrawal)

- Copy trading is not available

- Not available for the US crypto traders

What are KuCoin Fees?

KuCoin Spot Trading Fees

On KuCoin, the standard spot trading fees start at 0.1% for both makers and takers.

- Makers add liquidity to the market by placing limit orders. These orders sit on the order book until they are matched by a taker. Makers generally benefit from lower fees compared to takers.

- Takers remove liquidity from the market by fulfilling existing orders. Takers usually pay a higher fee than makers.

Furthermore, KuCoin operates a VIP program, providing additional benefits and lower fees for high-volume traders. The VIP tiers are based on trading volume and KCS holdings, offering incremental benefits as you progress through the levels.

This is ideal for institutional traders or individuals trading large amounts of cryptocurrency. The discount can be as high as 20% when paying fees using KCS.

|

VIP Level |

KCS Held |

Spot Trading Volume (USDT, 30 Days) |

Maker Fee |

Taker Fee |

24h Withdrawal Limit (USDT) |

|

LV0 |

– |

– |

0.100% |

0.100% |

1,000,000 |

|

LV1 |

≥ 1,000 |

≥ 3,000,000 |

0.090% |

0.100% |

3,000,000 |

|

LV2 |

≥ 10,000 |

≥ 6,000,000 |

0.075% |

0.090% |

3,000,000 |

|

LV3 |

≥ 20,000 |

≥ 13,000,000 |

0.065% |

0.085% |

5,000,000 |

|

LV4 |

≥ 30,000 |

≥ 35,000,000 |

0.045% |

0.065% |

5,000,000 |

|

LV5 |

≥ 40,000 |

≥ 55,000,000 |

0.035% |

0.055% |

10,000,000 |

KuCoin Futures Fees

KuCoin also offers competitive fees for futures trading, which are based on a tiered system similar to their spot trading fees. The base rate starts at 0.02% makers and 0.06% takers.

|

VIP Level |

30-Day Futures Trading Volume (USDT) |

Maker Fee |

Taker Fee |

|

VIP 0 |

– |

0.02% |

0.06% |

|

VIP 1 |

≥ 5,000,000 |

0.018% |

0.06% |

|

VIP 2 |

≥ 8,000,000 |

0.015% |

0.06% |

|

VIP 3 |

≥ 16,000,000 |

0.010% |

0.06% |

|

VIP 4 |

≥ 40,000,000 |

0.008% |

0.053% |

|

VIP 5 |

≥ 60,000,000 |

0.006% |

0.048% |

You can check the full KuCoin fee structure here.

KuCoin Deposit & Withdrawal Fees

Deposits on KuCoin are generally free. This means you can transfer your crypto assets to your KuCoin account without any cost. Withdrawal fees on KuCoin vary depending on the cryptocurrency and network. Here are some examples:

- Bitcoin (BTC network): The withdrawal fee is 0.0005 BTC.

- Ethereum (ERC20): The withdrawal fee is 0.005 ETH.

- Tether (USDT): The fee depends on the network used. For instance, withdrawing USDT via the ERC20 network costs 10 USDT, while using the TRC20 network costs 1 USDT.

KuCoin also supports internal transfers between accounts. These transfers are free of charge and can be completed by providing the recipient’s KuCoin email, phone number, or UID.

Minimum Deposit and Withdrawal Times

The amount of the minimum deposit can differ depending on the type of cryptocurrency and its network. Here’s a breakdown of some of the most popular ones:

|

Bitcoin (BTC network) |

0.0006 BTC |

|

Ethereum (ERC20) |

0.01 ETH |

|

USDT (TRC20) |

3 USDT |

|

Solana |

0.02 SOL |

|

Dogecoin |

40 DOGE |

|

XRP |

30 XRP |

KuCoin’s deposit and withdrawal times also vary based on the type of transaction and the network used. For cryptocurrency deposits, the processing time depends on the blockchain network’s confirmation times.

Typically, cryptocurrency deposits are credited after a few confirmations on the network, which can take anywhere from a few minutes to several hours depending on network congestion and the specific cryptocurrency.

What Cryptocurrency is Available for Trading on KuCoin?

KuCoin offers trading for a vast amount of cryptocurrencies, over 820 tokens and 1290+ trading pairs. This includes a wide variety of tokens from well-established categories like AI, Metaverse, and DeFi, to more niche areas like Real World Assets (RWAs). You can find your desired trading pair easily. They also cater to both popular and lesser-known tokens, including many low-cap coins.

KuCoin Security & Licensing – Is It Safe?

KuCoin prioritizes the security of its users through multiple robust measures and strategic partnerships:

- Offline User Fund Storage: This strategy ensures that the majority of user funds are kept in multisig cold wallets, which are offline and thus protected from online threats.

- Real-Time Monitoring: The platform features a 24/7 risk monitoring system that constantly checks for suspicious activities. It also offers a bug bounty program.

- Two-Factor Authentication (2FA): Users are encouraged to enable 2FA for an additional layer of security. You can use Google Authenticator for added security.

There are some other popular security measures like:

- Withdrawal address whitelisting

- Anti-phishing code

- Fund Password

- Mandatory AML & CFT Policies

Plus, KuCoin provides transparency through monthly Proof of Reserves audits using the Merkle Tree technique. This allows users to verify that the platform holds sufficient reserves to cover all user balances.

Additionally, the platform partners with leading security firms like PCI DSS and CyberSource to enhance their security infrastructure. However, KuCoin does not hold any major regulatory license in major crypto hubs. This is a significant drawback.

KuCoin Features & Products Explained

Derivatives Trading

KuCoin’s derivatives market includes futures trading, allowing you to trade on the future price of an asset. KuCoin offers over 300 different futures contracts. These contracts let you bet on whether the price of an asset will go up or down (Long or Short).

You can use leverage up to 125x. This means you can control a large position with a small amount of money. For example, with 125x leverage, you can trade $1,250 with only $10 of your own money.

There are two types of futures on KuCoin: USDT-margined and Coin-margined.

- In USDT-margined futures, you use USDT as collateral. Profits and losses are also in USDT. For example, if you trade a BTC/USDT contract, your earnings will be in USDT.

- In coin-margined futures, you use a specific cryptocurrency to trade. Profits and losses are in the same cryptocurrency. For example, if you trade a BTC/USD contract using BTC, your earnings will be in BTC.

KuCoin also offers margin trading. This type of trading lets you borrow money to trade larger amounts. On KuCoin, you can use up to 10x leverage for margin trading.

KuCoin Order Types

KuCoin supports advanced order types besides limit and market orders. These help you manage your trades better.

- Stop-Limit and Stop-Market Orders: These help you enter or exit trades when the price reaches a specific point. Stop-limit orders give you more control over the execution price, while stop-market orders prioritize getting filled quickly.

- Trailing Stop: A trailing stop order moves with the market price. It helps you lock in profits by selling when the price drops by a certain amount.

- OCO (One Cancels the Other): OCO orders combine two orders. If one order is triggered, the other is canceled. For example, you can set a take-profit order and a stop-loss order at the same time.

- TWAP (Time-Weighted Average Price): This order type tries to buy or sell your desired amount of cryptocurrency at an average price over a set time period. Like spreading out your purchase throughout the day to get a better overall price.

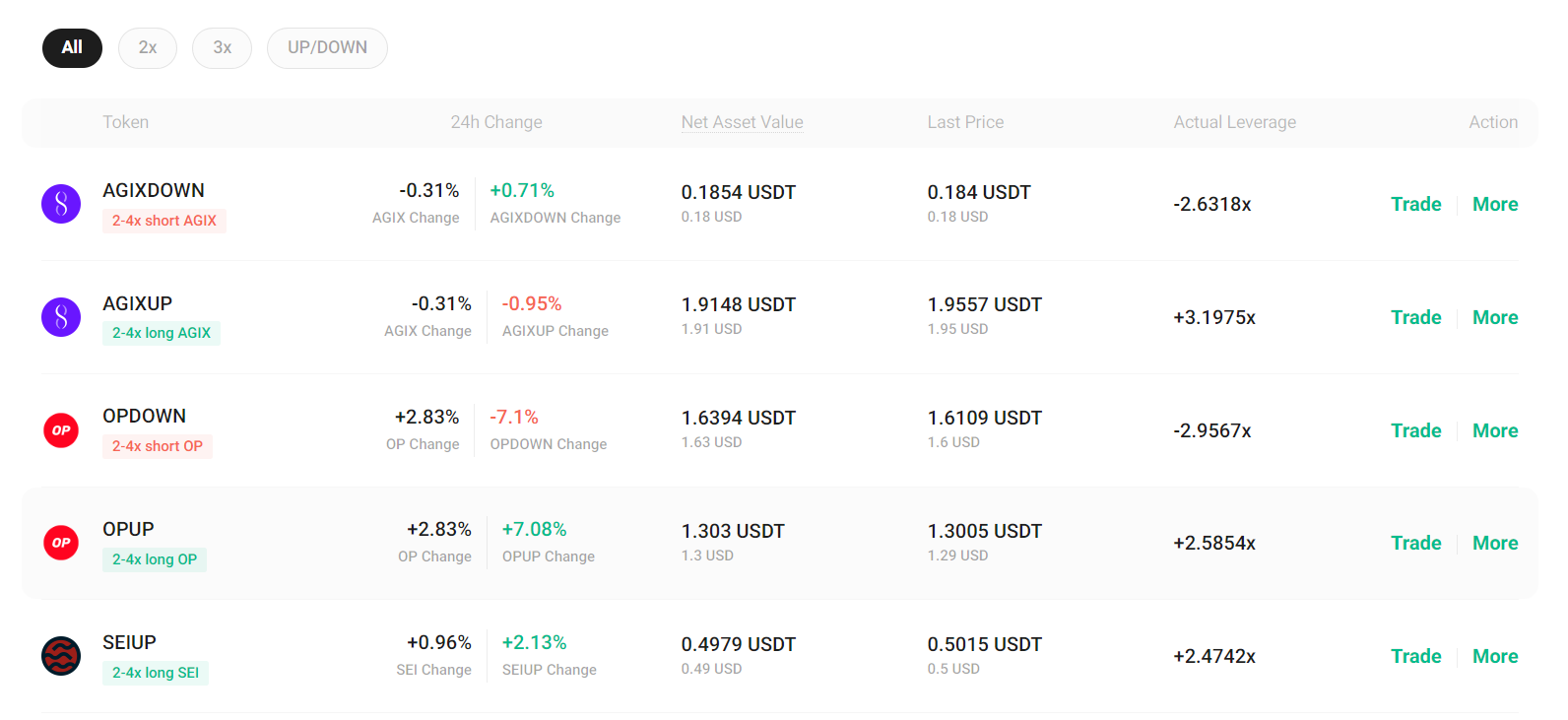

Leveraged Tokens

Leveraged tokens are another product of KuCoin. They let you trade with leverage without worrying about margin or liquidation. Leveraged tokens represent a basket of futures positions.

For example, BTC3L is a leveraged token that gives you 3 times the profit or loss of Bitcoin. If Bitcoin’s price goes up by 1%, BTC3L goes up by 3%. These tokens are easy to trade like regular tokens. However, they are meant for short-term trading.

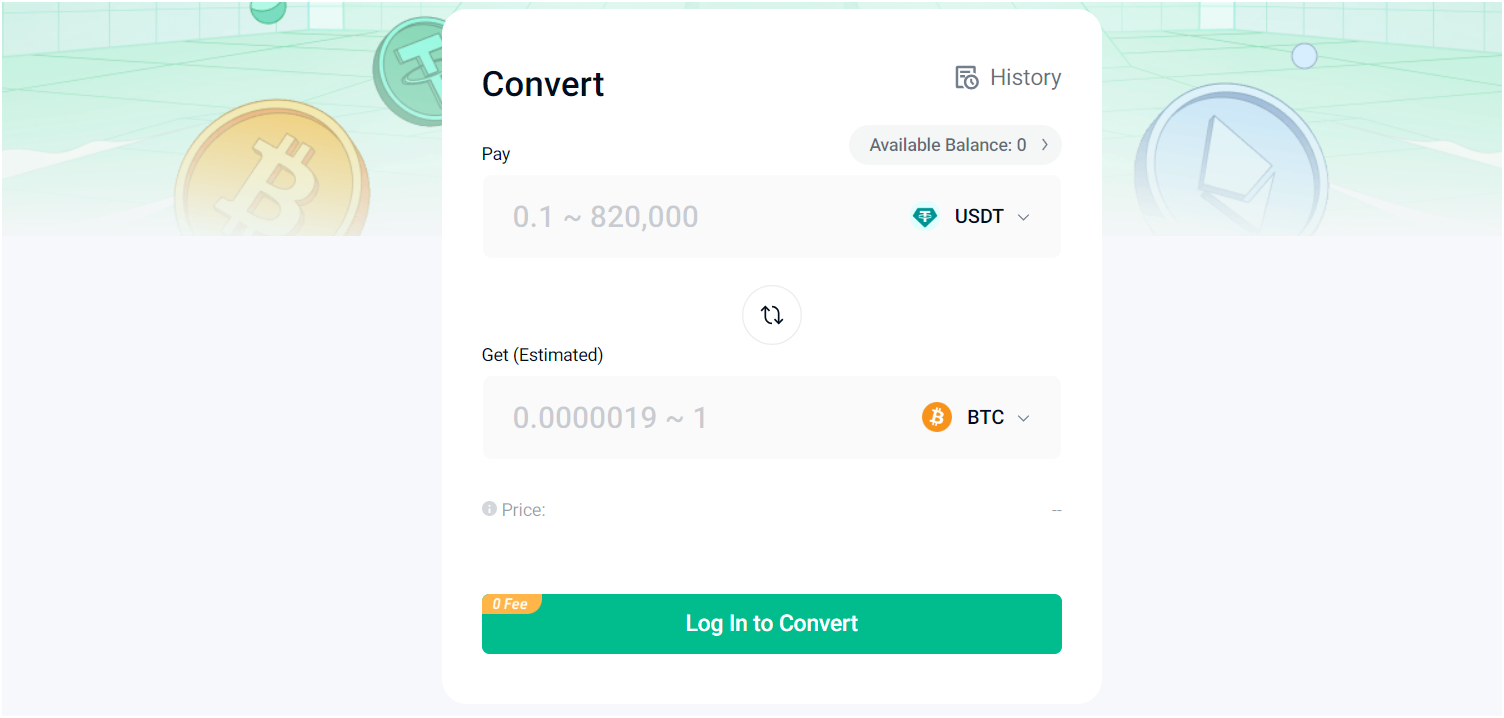

Instant Crypto-to-Crypto Convert

The KuCoin “Convert” feature is a simple and convenient tool that allows you to quickly swap one cryptocurrency for another without the need for complex trading. This means that you don’t have to wait for an order to be filled, as you might on the spot market, and there is zero price slippage.

The feature supports a wide range of cryptocurrencies. You can convert between major coins like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and many other altcoins.

It provides transparent conversion rates. Before completing your conversion, you can see the exact rate and the amount of cryptocurrency you will receive. Unlike traditional spot trading, where you might incur various fees, the “Convert” feature typically doesn’t charge trading fees. This makes it a cost-effective way to swap your assets.

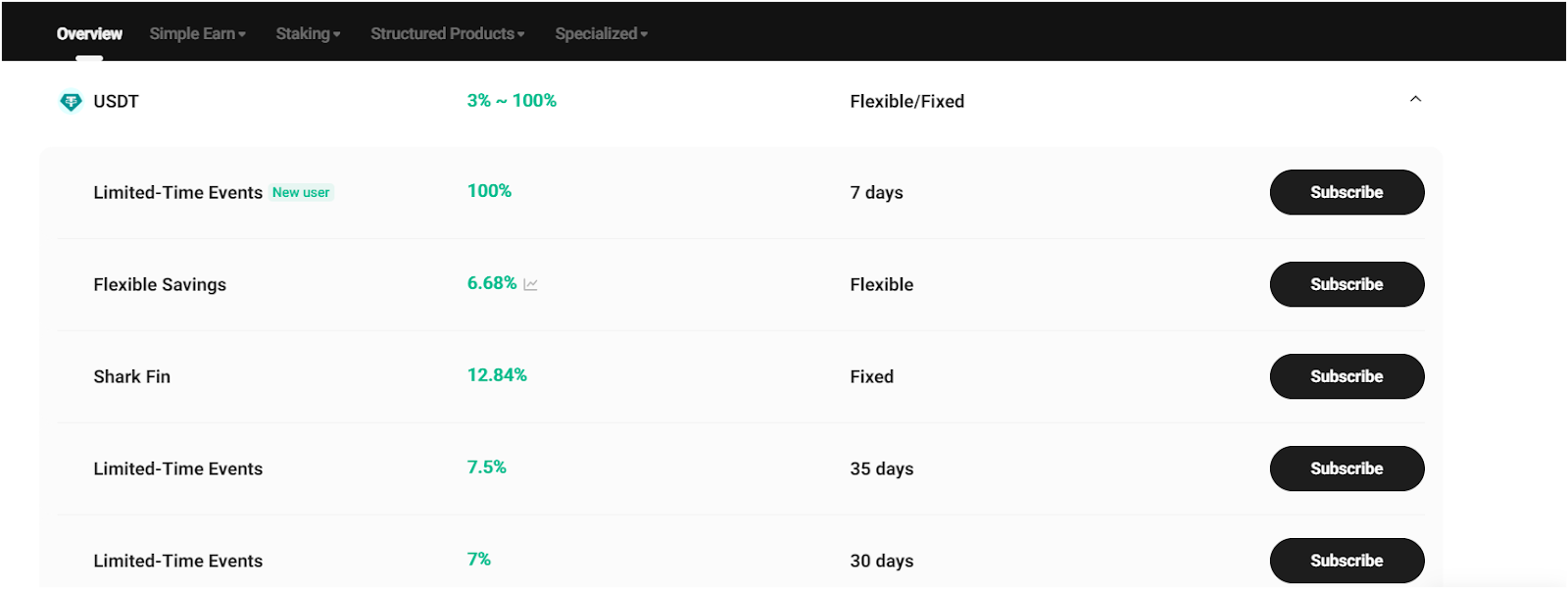

KuCoin Earn

KuCoin Earn is a service that allows you to earn interest on your cryptocurrency holdings. It has many ways to earn. Here is a simple overview of each method:

- Flexible Savings: This is the simplest and safest option. You deposit your crypto into a KuCoin savings account and earn a small amount of interest over time. There’s usually no lock-in period, so you can withdraw your crypto anytime you need it. Currently, it is offering 6.68% APR on USDT.

- Fixed Staking: This is another way to earn interest on your crypto. With staking, you lock up your crypto for a certain period (like a fixed deposit at a bank) and earn a higher interest rate. The longer you lock up your crypto, the higher the interest rate you’ll typically get.

- Dual Investment: It is a way to earn money based on future crypto prices. You deposit one crypto and agree to convert it to another if the price reaches a set level by a certain date. You deposit 1 BTC and choose to convert it to USDT if the price of BTC reaches $60,000 in a month. If the price hits $60,000, your 1 BTC is converted to $60,000 USDT. If not, you still earn interest on your BTC.

- Shark Fin. This is a way to earn money with a guaranteed minimum return and a chance for higher returns based on price movement. You deposit USDT in Shark Fin and set a range. If the price of Bitcoin stays within a set range during maturity, you earn a higher return. If the price goes out of range, you still get a guaranteed return, but it is lower.

- Crypto Lending Pro: This is like loaning out your crypto to others and earning interest on the loan. You lend 1 ETH at a 10% interest rate for 30 days. After 30 days, you get back 1.083 ETH (1 ETH + 10% annualized interest for 30 days).

- Spotlight: It is a way to invest in new crypto projects before they are listed on the exchange. You buy the token at a low price before it becomes available to everyone. If the token’s price goes up after it is listed, you can sell it for a profit.

KuCoin Trading Bot Review

KuCoin trading bots are like programmed assistants that can handle your cryptocurrency trades on autopilot. Instead of constantly monitoring charts and making decisions, you can set up a bot with specific instructions and let it do the work.

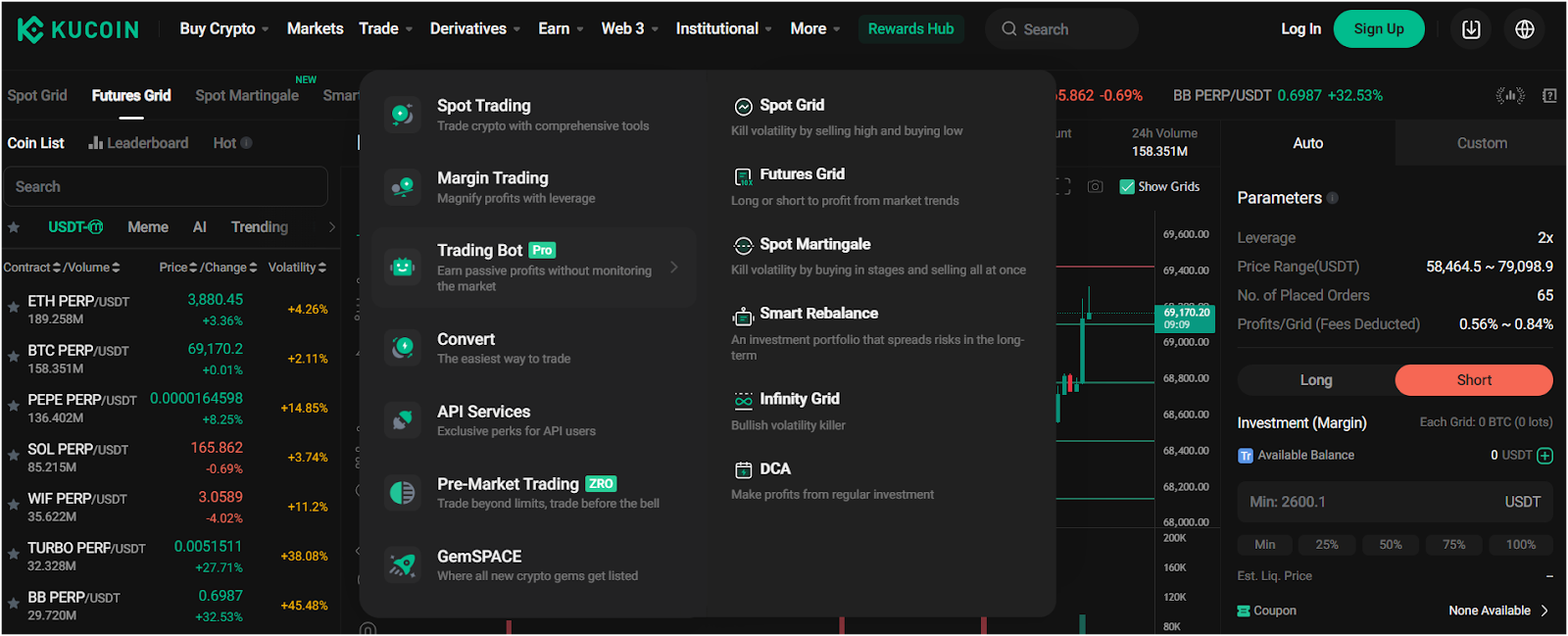

The exchange offers a variety of bots suited for different strategies, so let’s break down what each one does:

- Spot Grid and Futures Grid: You set a price range, and the bot will automatically place buy and sell orders at intervals within that range. It works well in volatile markets where prices fluctuate up and down.

- Spot Martingale: It uses a strategy where it doubles the investment after each loss, hoping to recover losses with one profitable trade. For example, you buy $100 of ETH at $1,000. If the price falls to $500, the bot might buy $200 worth of ETH, averaging your cost per ETH.

- Auto Rebalance: This bot helps you maintain a desired allocation of cryptocurrencies in your portfolio. Imagine you want to hold 60% BTC and 40% ETH. Over time, price movements can change this balance.

- Infinity Grid: This is an advanced version of the Spot Grid, where the grid has no upper or lower limits. The bot keeps placing buy and sell orders at progressively higher and lower prices as the market fluctuates.

- DCA (Dollar-Cost Averaging: This strategy is about consistently buying a fixed amount of cryptocurrency at regular intervals, regardless of the price. The KuCoin DCA bot automates this process.

KuCoin Shares (KCS)

KCS is the native token of the KuCoin exchange. It allows users to enjoy various benefits and rewards on the platform. One of the main attractions of holding KCS is the ability to earn passive income. KuCoin shares a portion of its trading fee revenue with KCS holders. This means you can earn daily rewards just by staking KCS in your account.

KCS holders also get up to 20% discounts on trading fees. The more KCS you hold, the bigger the discount you receive. This makes trading cheaper for frequent users of the exchange. Plus, holders often get early access to new token sales and special events. This can provide opportunities to invest in new projects before they become widely available.

According to Coingecko, the current market capitalization of KCS is roughly $985.4 million. The total supply of KCS is capped at 143.3 million tokens. As of now, there are approximately 95.8 million KCS in circulation. This supply is gradually being reduced through a buyback and burn program initiated by KuCoin.

What KuCoin Can Do to Improve?

U.S. License

To improve its presence and trustworthiness, KuCoin should prioritize obtaining a U.S. license. This move would significantly expand its market by allowing it to operate legally within the United States. Currently, KuCoin is restricted from U.S. customers due to regulatory issues.

Complying with U.S. regulations would involve rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. It would not only gain access to a larger user base but also increase its credibility and security standards, aligning itself with major competitors who already operate in the U.S. market like Coinbase and Kraken.

Beginner-Friendly Features

KuCoin does not offer some beginner-friendly features like “copy trading”. This feature is almost available on all major crypto exchanges like Binance, Bybit, MEXC, and OKX.

Crypto copy trading involves automatically copying the trades of experienced traders in the cryptocurrency market. As a beginner, you can replicate the trades of chosen traders in real-time. This strategy allows less experienced traders to benefit from the expertise of others, potentially improving their investment returns.

KuCoin Customer Support and Reviews

KuCoin’s Help Center is a great place to start for many common questions. It’s available 24/7 and packed with helpful articles, FAQs (Frequently Asked Questions), and guides on using the platform.

If you can’t find what you need in the Help Center, the KuCoin exchange offers online chat support. This is a good option if you prefer talking to a real person about your problem. For more complex issues, you can try contacting KuCoin via email ([email protected]). This might be a good option if you need to provide detailed information or documentation about your problem.

Customer reviews on KuCoin are mostly positive. It receives a 4.4/5 rating on the Play Store. Users say it’s easy to use, has a lot of trading features, and charges lower fees than some other crypto platforms. However, Trustpilot ratings on KuCoin support are mostly negative with a 79% negative score. Some traders have had trouble getting help from customer service and found it hard to trade some coins that aren’t very popular due to low liquidity.

KuCoin App Review

KuCoin offers a mobile app for both iOS and Android devices. It lets you trade cryptocurrencies on the go. It supports all the features of the desktop version like spot trading, derivatives trading, P2P marketplace, and instantly buying crypto using fiat currencies.

The interface is designed for ease of use. You can monitor your crypto portfolio value at a glance and navigate buying, selling, and trading with a few taps only.

KuCoin vs Other Crypto Exchanges

Bybit and Binance are the two best alternatives to the KuCoin exchange. Here is a quick comparison:

|

Features |

KuCoin |

Bybit |

Binance |

|

Best For |

Derivatives Trading |

Copy Trading |

High-Volume Crypto Traders |

|

Supported Coins and Tokens |

820+ |

1200+ |

380+ |

|

Trading Fees |

|

|

|

|

Leverage Trading |

Yes |

Yes |

Yes |

|

Maximum Futures Leverage |

125x |

100x |

125x |

|

Earn & Staking Services |

Yes |

Yes |

yes |

|

Automated Trading |

Grid, Rebalance, martingale, DCA |

Martingale, Grid, DCA |

Arbitrage, Grid, Smart Algo |

|

Security |

High |

High |

High |

|

Licenses |

– |

Dubai and Cyprus |

Multiple licenses in Europe and Asia |

How to Open a KuCoin Account and Trade Crypto?

Step 1: Create an Account

Visit the official KuCoin website and click “Sign Up” in the top right corner. Choose your preferred method, email or phone number, and create a strong password. Remember to check your inbox/phone for a verification code to activate your account.

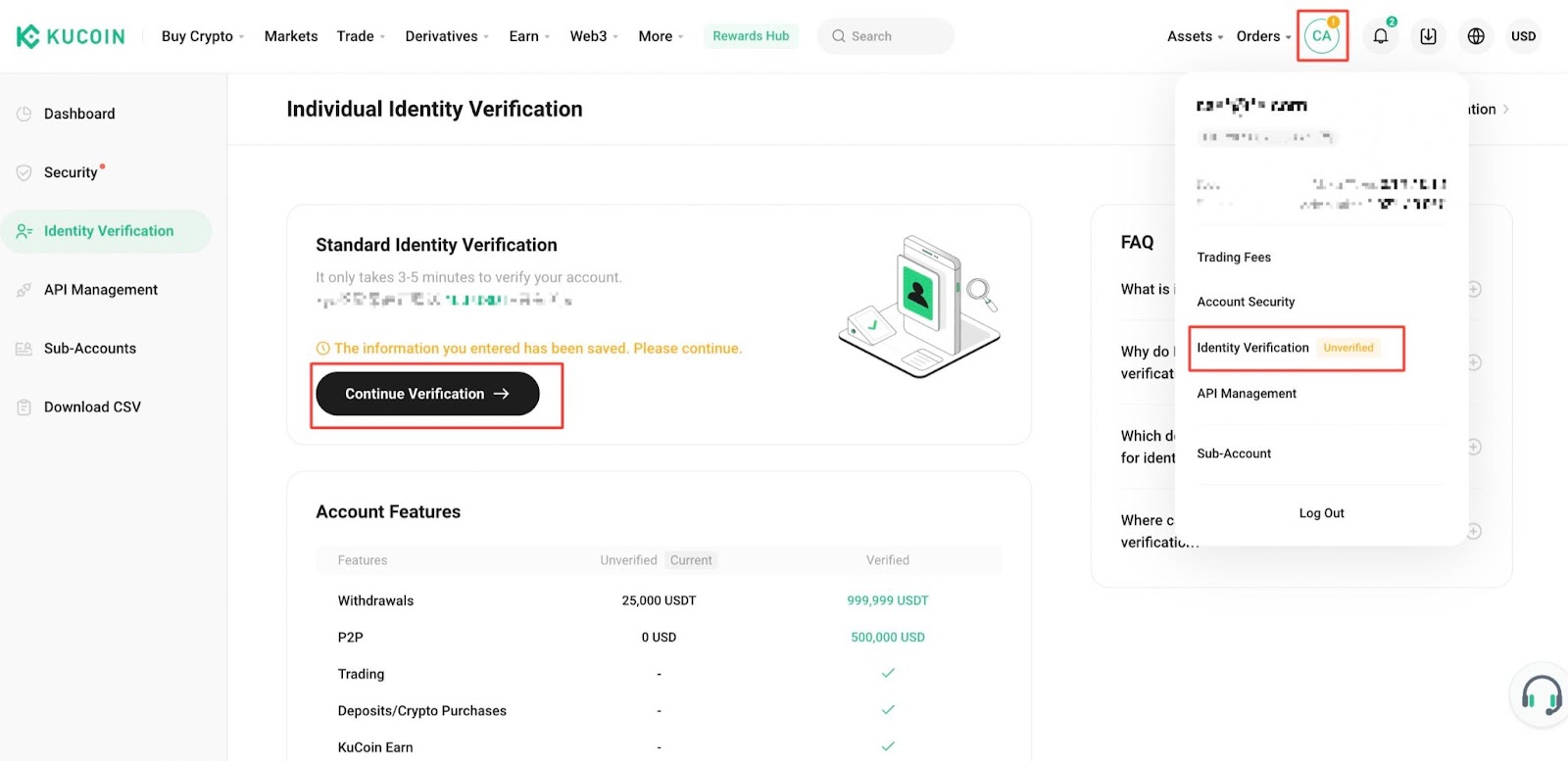

Step 2: KYC Verification

For added protection, navigate to your account settings and enable two-factor authentication (2FA) using Google Authenticator. This adds an extra login step to deter unauthorized access. You also need to verify your identity by providing ID proof (driving license or national ID card) and a selfie.

Step 3: Deposit Crypto on KuCoin

Locate the “Deposit” section and choose your preferred deposit method. You can deposit crypto from another wallet or use a credit/debit card (availability varies by region). Follow the on-screen instructions to complete your deposit.

Step 4: Trading Crypto on KuCoin

Once your funds arrive, head to the “Markets” section. Here, you’ll find a vast selection of cryptocurrencies. Search for your desired crypto, choose a trading pair (e.g., BTC/USDT), and explore the order types (buy/sell, limit/market). Once you’re comfortable, place your trade.

Final Thoughts: Is It Right For You?

Our KuCoin review highlights that it is a versatile and user-friendly cryptocurrency exchange, suitable for both novice and experienced traders. With its extensive range of cryptocurrencies, competitive fee structure, and robust security measures, it offers a reliable platform for trading digital assets.

While it excels in many areas, such as advanced trading tools and earning opportunities, the lack of regulation in major markets and limited fiat withdrawal options might be a drawback for some users. If you are looking for more crypto exchanges, you can also check out our Bitget review guide.

KuCoin Exchange Review – FAQs

Is KuCoin a legitimate and reliable exchange?

Yes, KuCoin is a legitimate and reliable cryptocurrency exchange with over 30 million users across more than 200 countries. Despite not being regulated by major national licensing bodies, it operates legally under Seychelles law as a Digital Asset Exchange. The platform employs robust security measures, such as offline fund storage, real-time risk monitoring, and two-factor authentication, which help protect users’ assets and personal information.

Does KuCoin require KYC?

Yes, KuCoin has a mandatory KYC verification. You can not deposit and trade crypto without identity verification. However, you can withdraw only up to 30,000 USDT without KYC.

Which is better Binance or KuCoin?

KuCoin is known for listing a large number of emerging altcoins and provides advanced trading tools, such as leveraged tokens and a variety of trading bots. On the other hand, Binance has a wider range of features, including copy trading and a more extensive fiat-to-crypto gateway. Also, Binance is highly regulated with multiple licenses globally, making it a suitable choice for users in regions where regulatory compliance is critical.

Read the full article here