New data from market intelligence firm DappRadar reveals that the total value locked (TVL) within the decentralized finance (DeFi) sector has skyrocketed to the highest level in 15 months.

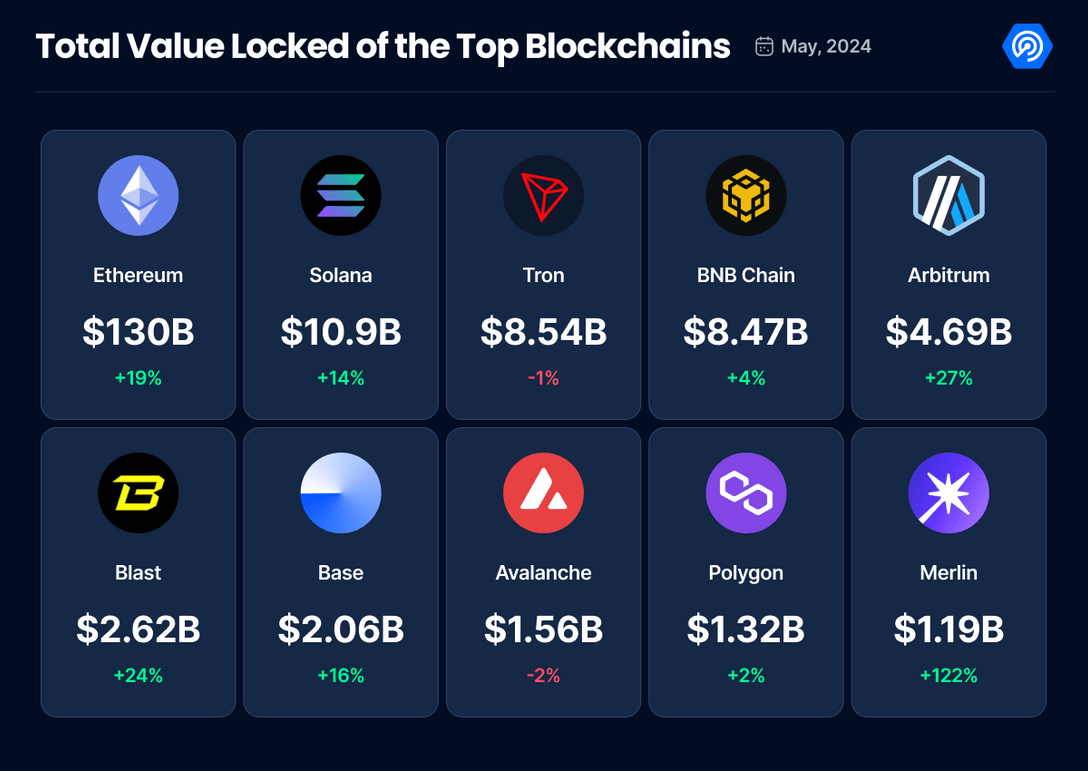

In a new blog post, DappRadar notes that DeFi’s TVL has reached $192 billion, a 17% rise from the previous month and the best it has registered since February 2022.

TVL refers to the amount of capital deposited within a protocol’s smart contracts and is often used to gauge the health of a crypto ecosystem.

According to the crypto analytics firm, the majority of the growth was driven by an increase in token prices, particularly those of smart contract platforms Ethereum (ETH) and Solana (SOL).

“Ethereum holds the bigger portion of the whole DeFi’s TVL, and this month its dominance is at 68%. Followed by Solana, which in the past months has been propelled by memecoin trading and DeFi activity on its network. Moreover, the native SOL token has surged by 11% in the past 30 days.”

ETH is trading for $3,692 at time of writing while SOL is worth $158.94.

DappRadar goes on to note that Bitcoin’s (BTC) layer-2 solution Merlin Chain (MERL) also greatly contributed in May, becoming the crypto king’s largest sidechain, dwarfing the Lightning Network.

“The narrative around the Layer-2 networks continues to be strong, but the real top performer this month has been Merlin. It has become the largest Bitcoin sidechain and more than three times as large as the payments-focused Lightning Network.

More than half of Merlin’s $1 billion is held in Solv Finance, a protocol that allows users to deposit Wrapped Bitcoin and receive ‘Solv Points’ in return.”

MERL is trading for $0.441 at time of writing, an 10.10% decrease during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here