The chief executive of market intelligence firm CryptoQuant says that Bitcoin (BTC) is nearing the longest sideways consolidation period ever during one of its halving years.

In a new thread on the social media platform X, Ki Young Ju says that if the crypto king doesn’t spark a rally within the next two weeks, it would mark the longest consolidation period in a halving year.

“285 days have passed in 2024. If there is no Bitcoin bull market within the next 14 days, this will mark the longest sideways in a halving year in history.”

Bitcoin’s halving cycle occurs every four years when its mining rewards are slashed in half. Bitcoin has historically rallied to fresh all-time highs after a halving event.

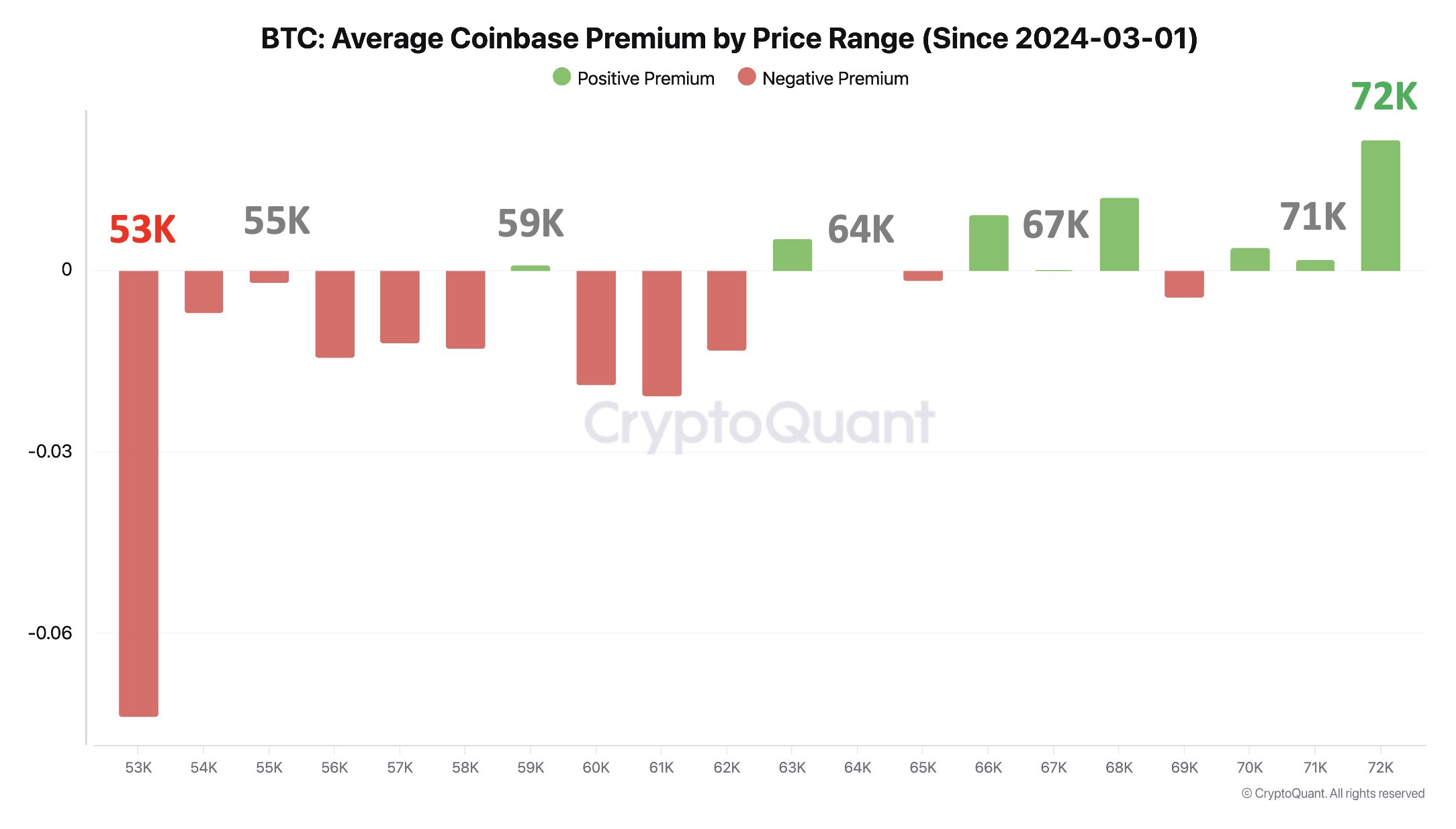

Ki Young Ju is also keeping a close watch on Coinbase premium, a metric that measures the difference between the price of Bitcoin on Coinbase Pro and the value of BTC on the crypto exchange Binance.

According to the CryptoQuant boss, whales trading on Binance have kept BTC from soaring to new all-time highs.

“Since March, Bitcoin has fluctuated widely. Coinbase premium showed large differences at $53,000 and $72,000, with whales buying at $72,000 and selling at $53,000. Meanwhile, whales on global exchanges blocked an all-time high breakout and defended $53,000. A near-zero premium may act as support/resistance, [in my opinion].”

Bitcoin is trading for $62,741 at time of writing, a fractional gain during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here