1. The Week of TGEs and New Token Introductions: Story Protocol, Doodles, OpenSea, Solayer, and Kaito AI

The crypto market experienced a jolt of enthusiasm last week with numerous new TGEs and token unveilings. Story Protocol took center stage by launching its mainnet on February 13, unveiling the $IP token. Boasting a total supply of 1 billion tokens and 25% unlocked at launch, Story Protocol aspires to transform the IP market by enabling programmable intellectual property on the blockchain. This truly visionary venture has already attracted very considerable interest from both developers and investors alike.

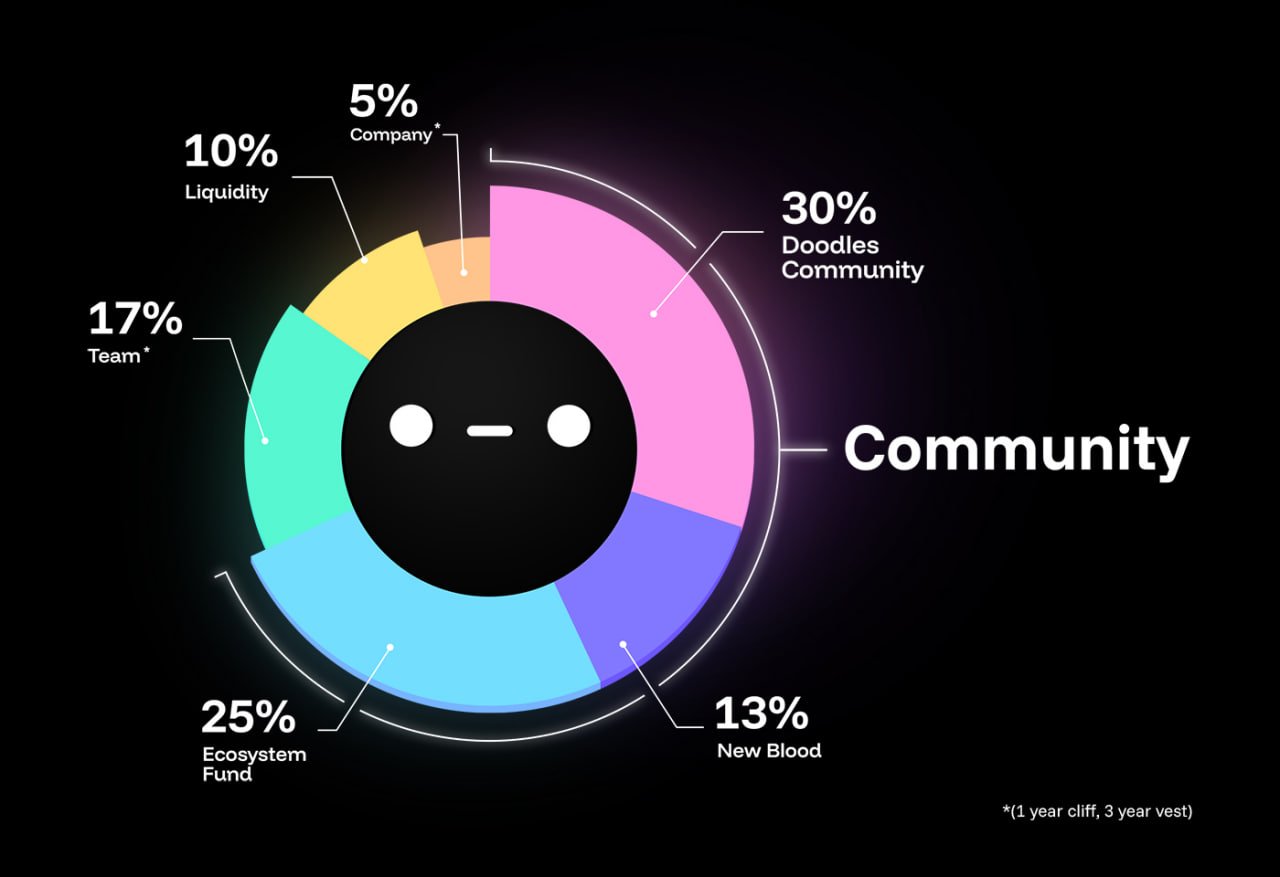

Meanwhile, Doodles, an outstanding NFT collection recently has revealed its highly-anticipated $DOOD token. With an emphasis on community involvement, 35% of the token supply was reserved for the community, while 25% was allocated to an ecosystem fund. OpenSea, the premier NFT marketplace, likewise announced overall plans for its $SEA token, aiming to broaden platform utility and motivate user participation.

Kaito AI revealed its intentions for the $KAITO token. This remarkable leading InfoFi project aims at the attention economy by providing revenue avenues through AI-driven algorithms. Though the official launch remains pending, the anticipation around Kaito AI underscores the surge occurring at the crossroads of AI and blockchain technology.

Read more: Kaito Introduces $KAITO Token to Revolutionize Attention Economy

2. Binance Introduces $CHEEMS and $TST & BNB Chain Performance Surges

Binance continued to capture attention across the crypto market by rolling out $CHEEMS and $TST, two meme coins on the BNB Chain. These listings were purposeful, designed to leverage elevated market sentiment while directing trading volume toward the BNB Chain. Both tokens quickly gained strong momentum, illustrating the strength of meme culture within the crypto arena.

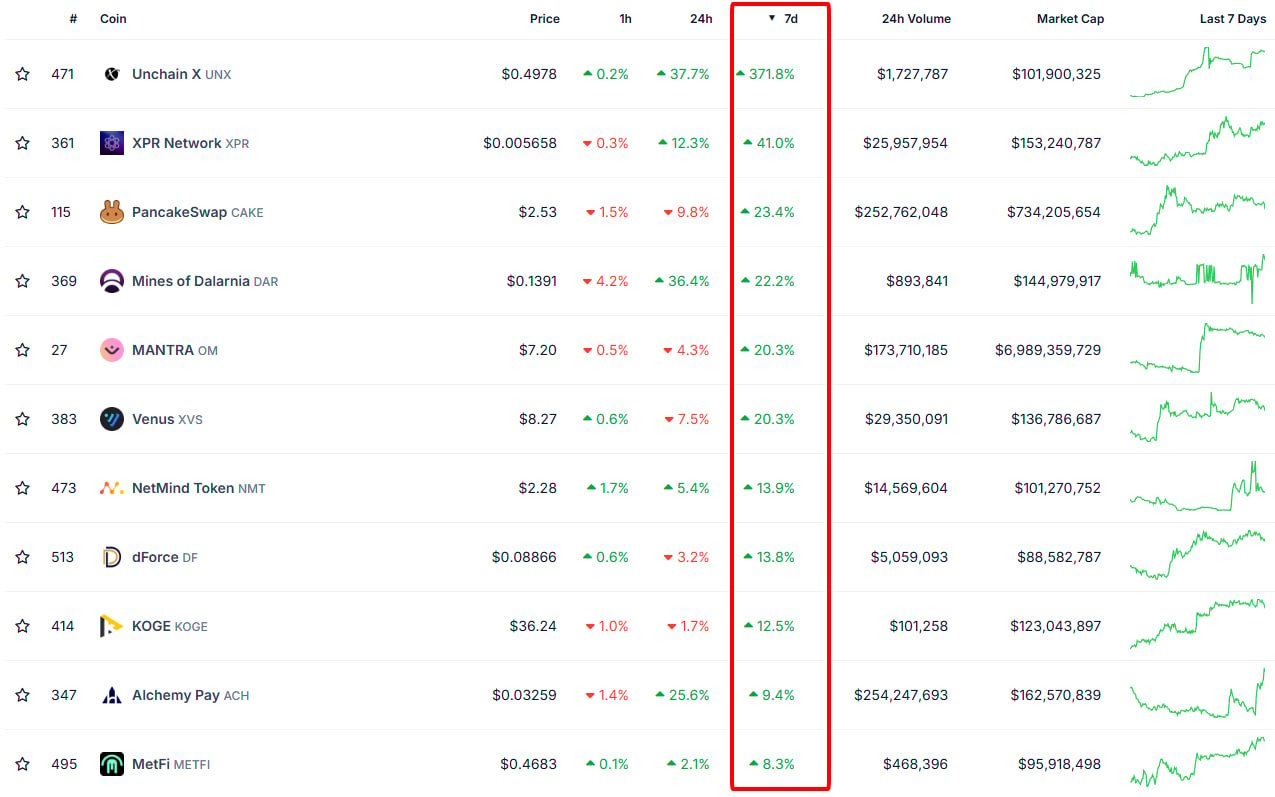

The BNB Chain has been surpassing other blockchain networks lately, propelled by successful projects such as $THE, $ID, $CAKE, and XVS. These tokens have achieved notable growth, drawing in a diverse group of investors and traders. $ID soared by over 180% in the last month, showcasing robust investor faith, while $CAKE’s recent deflationary mechanisms and staking incentives have boosted its endurance and price climb. XVS, the governance token for Venus Protocol, has benefited from growing lending and borrowing activity throughout the BNB Chain ecosystem.

This move by Binance highlights its ongoing effort to boost the BNB Chain’s market presence and maintain its position as a leading blockchain network. The success of $CHEEMS and $TST also demonstrates the continued popularity and profitability of meme tokens, especially when backed by a major exchange like Binance. With BNB Chain consistently ranking among the most active blockchain networks by transaction volume, it remains a dominant force in the evolving crypto landscape.

3. Mantra (OM) Continues Its Remarkable Rise

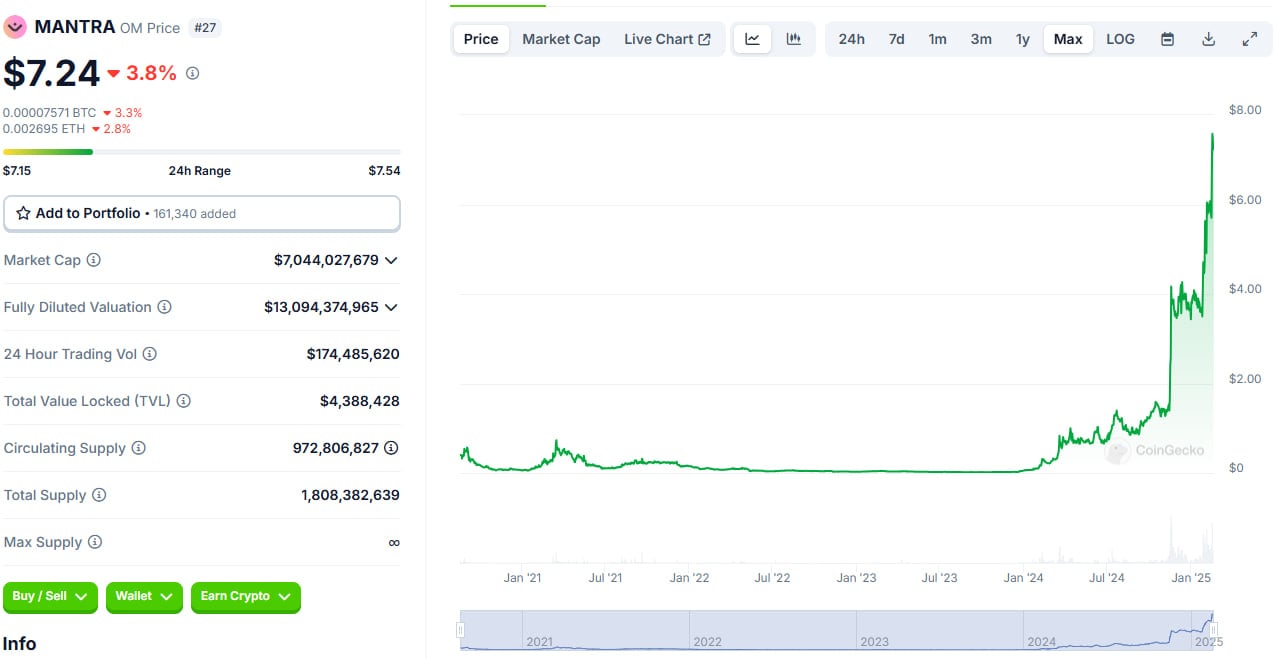

Mantra has seen an astonishing ascent over the past few weeks, continuing to gain steam in the market. Trading at $7.24 on its way up as of February 17, the token’s price leap clearly stems from a combination of factors, including strategic partnerships, platform enhancements, and growing user uptake. Mantra’s emphasis on DeFi solutions, encompassing staking and lending, has elevated its standing as a key player within the DeFi ecosystem.

The platform’s latest integration with major blockchain networks and its dedication to delivering secure and transparent financial services have substantially lifted investor confidence. Furthermore, the rising enthusiasm for DeFi and the growing need for decentralized financial products have further fed Mantra’s upward trajectory overall.

Armed with a loyal community and a well-defined vision for the future, Mantra continues to draw interest from both retail and institutional investors. Its robust market showing echoes the wider trend of DeFi projects gaining momentum and offering novel solutions throughout the crypto space.

4. $LIBRA: The Memecoin Tied to Argentina’s Political Drama

The memecoin $LIBRA has dominated headlines lately, not for its tech innovations but due to its surprising link with Argentina’s political upheaval. After rumors that Argentine President Javier Milei was allegedly involved in a financial scandal resulting in the rug pull of investors, $LIBRA’s price soon saw wild fluctuations that astonished many observers.

Read more: $LIBRA Token’s Shocking Rug Pull and Fallout

The uproar around President Milei’s ties to financial wrongdoing rippled across the crypto market, prompting traders to scramble either to profit from the buzz or exit their positions ahead of further losses. Some sources indicate that a single investor lost as much as $5 million during the maelstrom, spotlighting the dangers linked with trading speculative memecoins.

5. Tether’s Strategic Investment in Juventus Football Club

In an audacious move blending sports and blockchain, Tether has announced a strategic minority stake investment in Juventus Football Club, one of Italy’s most renowned football teams. This represents a pivotal milestone for the stablecoin issuer, as it continues expanding its reach beyond digital finance and into mainstream commercial sectors worldwide.

This investment supports Tether’s larger goal of integrating blockchain technology into traditional commerce. By obtaining a stake in Juventus, Tether not only strengthens its brand footing in Europe but also bolsters the idea that crypto firms are ever more impacting legacy industries globally.

The alliance may also spur Juventus to use Tether’s blockchain know-how for fan engagement strategies, digital ticketing, or even blockchain-driven loyalty programs. This decision mirrors the rising pattern of crypto companies forging paths into mainstream markets, establishing a standard for upcoming partnerships between sports organizations and blockchain entities.

6. Next Steps

The past week’s crypto market movements have laid the foundation for ongoing innovation and instability. With prominent token releases such as $IP, $DOOD, and $KAITO sparking interest, investors will closely observe how these projects evolve and if they can maintain their traction. Moreover, Binance’s planned drive to lead trading volume via the BNB Chain implies that additional token launches and liquidity incentives could lie on the horizon.

Meanwhile, the memecoin scene stays as unpredictable as ever, with $LIBRA showcasing the strength of social and political narratives in steering price moves. Traders must stay alert, as sentiment-driven price spikes can prove both profitable and risky, as the recent rug pull revealed.

Tether’s involvement with Juventus indicates a rising trend of blockchain players embedding themselves in traditional industries. It will be intriguing to observe if this drives further alliances between crypto entities and mainstream brands, possibly introducing new use cases for blockchain technology.

Looking forward, carefully monitor regulatory shifts, Layer 2 uptake, and broad macroeconomic drivers that may impact Bitcoin and altcoin movement in the weeks to come. Remaining well-informed and nimble will prove essential to navigating the ever-shifting crypto space with confidence.

Read the full article here