Stablecoins have long fueled crypto bull runs by injecting liquidity into the market, but their role is evolving beyond speculation. As stablecoin adoption hits record highs, how will this impact the next crypto cycle?

Recent Stablecoin ATH

In November 2024, the global stablecoin market capitalization surged to an unexpected $190 billion, exceeding the previous all-time high of $188 billion recorded in April 2022. Moreover, stablecoin trading volumes on centralized exchanges surged, rising 77.5% month-over-month to $1.81 trillion as of November 25.

Meanwhile, USDT remained dominant, accounting for 82.7% of total volume across centralized exchanges. FDUSD ranked second with a 9.01% market share, followed by USDC at 8.09%. According to the report, FDUSD’s rising dominance reflects strong adoption in Asian markets, particularly in cross-border payments. On the other hand, euro-denominated stablecoins saw a 52.9% surge in trading activity, reaching $657 million, signaling growing adoption among European users.

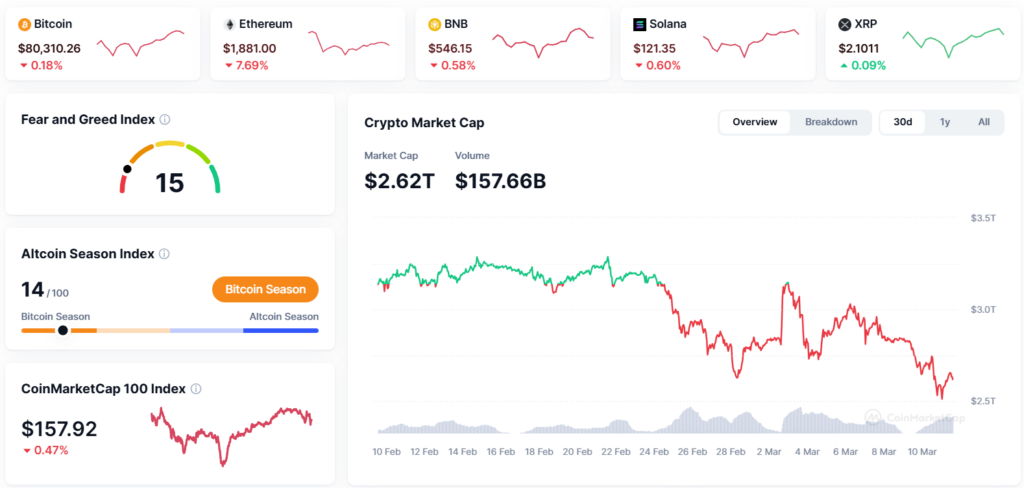

TradFi with Stablecoin during the “red color” market

Amid the gloomy days of the crypto market, the rise of stablecoins has caught the attention of both the traditional finance (TradFi) market and the crypto market. According to the Trump administration’s Stablecoin bill, several opportunities are opening for both conventional investors and crypto investors. As a result, major TradFi players like Bank of America, Standard Chartered, PayPal, and Stripe actively captured the bills through their actions. With the government providing regulatory clarity on stablecoins and increasing trust and adoption, institutions utilized stablecoins for short-term trading liquidity, real-world utility, and even planned to launch their own stablecoins if regulations permitted.

Case studies for stablecoin fuelling the crypto market

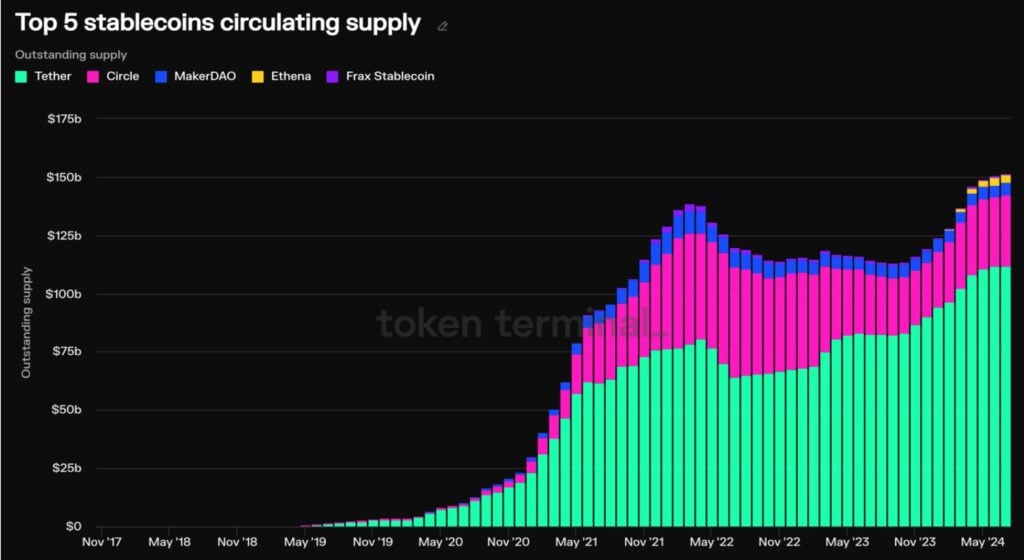

Since 2017, stablecoin supply growth (e.g., USDT, USDC) has been closely tied to crypto liquidity, enabling investors to buy Bitcoin, Ethereum, and altcoins. Such developments often led to price surges, as stablecoins act as a stable bridge between fiat and crypto, allowing seamless asset conversion within the blockchain ecosystem.

During the period of 2017 – 2018, Tether (USDT) minted large amounts of USDT on Ethereum and Tron to meet surging liquidity demand during the crypto bull run. USDT supply grew from a few billion USD in early 2017 to over $2 billion by year-end, continuing to rise in 2018 (CoinGecko, BeInCrypto). The reason behind it is that USDT was used to buy BTC and ETH, fueling a price surge as investors avoided fiat volatility and traded easily on exchanges like Binance, Coinbase, and Bitfinex. Eventually, BTC hit $20,000 in December 2017, partly driven by USDT liquidity. However, in 2018, the market crashed, partly due to concerns over Tether’s transparency and allegations of unbacked USDT issuance.

Another case with USDC, it saw a significant supply increase in 2021, particularly on Ethereum. According to CoinMarketCap, its market cap surged from a few billion USD in early 2021 to over $50 billion by year-end. USDC provided liquidity for DeFi and major exchanges like Coinbase, so investors used it to buy BTC, ETH, and DeFi tokens, contributing to the price surge during this period. As a result, BTC and ETH hit all-time highs, while DeFi protocols like Aave and Uniswap benefited from increased TVL (total value locked) driven by USDC growth.

Most recently, a continuous minting of USDT and USDC from March to September 2024 has been predicted as a precursor to a strong pump in late 2024 (November and December). Therefore, stablecoin minting signals from whales toward the end of 2024 could indicate a bullish trend for crypto prices soon, particularly in the first half of 2025, amid the current market uncertainty and skepticism.

Updated: Today, Circle has minted an additional $250 million in USDC on the Solana blockchain.

Looking forward

In the past, stablecoin minting, including USDT and USDC, was primarily used to provide liquidity and fuel crypto market pumps, especially during bull cycles like 2017-2018 and 2020-2021. However, in 2025, stablecoins have expanded beyond just market pumps due to deep intervention from TradFi and current affairs, now being used for payments, DeFi yield generation, and real-world applications. With the optimistic growth of stablecoins recently, more yield generation opportunities will open to both conventional and crypto traders and investors.

Read the full article here