Hyperliquid is a decentralized derivatives trading platform (DEX derivatives) that has been gaining traction in the DeFi ecosystem thanks to its unique operational model, transparent governance, and deep integration of security and risk management mechanisms.

Hyperliquid Liquidity Model (HLP)

Hyperliquidity Provider (HLP) is the shared liquidity vault of Hyperliquid, funded by the community to execute market-making and liquidation strategies on the platform. Anyone can deposit USDC into HLP and earn profits or bear losses proportional to their contribution. HLP serves as the primary trading counterparty for most orders on the platform, similar to how GLP operates on GMX, but with a more active and adaptive approach.

HLP does not charge any management fees; all profits and losses are fully distributed to depositors, as the vault is entirely community-owned.

In practice, HLP is structured into several sub-vaults, each implementing different strategies. Specifically, there are two vaults focused on market-making (referred to as Vault A and Vault B) and one vault designated for liquidations (the Liquidator vault). Vaults A and B continuously place buy/sell orders to provide liquidity to the order book, while the Liquidator vault handles positions that are being liquidated.

Learn more: What is Hyperliquid?

HLP displays the net position aggregated across all three sub-vaults. For example, if Vault A is long 100 million USD worth of ETH, Vault B is long 200 million USD, and Liquidator is short 300 million USD, the overall net position of HLP would be zero since the long and short positions offset one another.

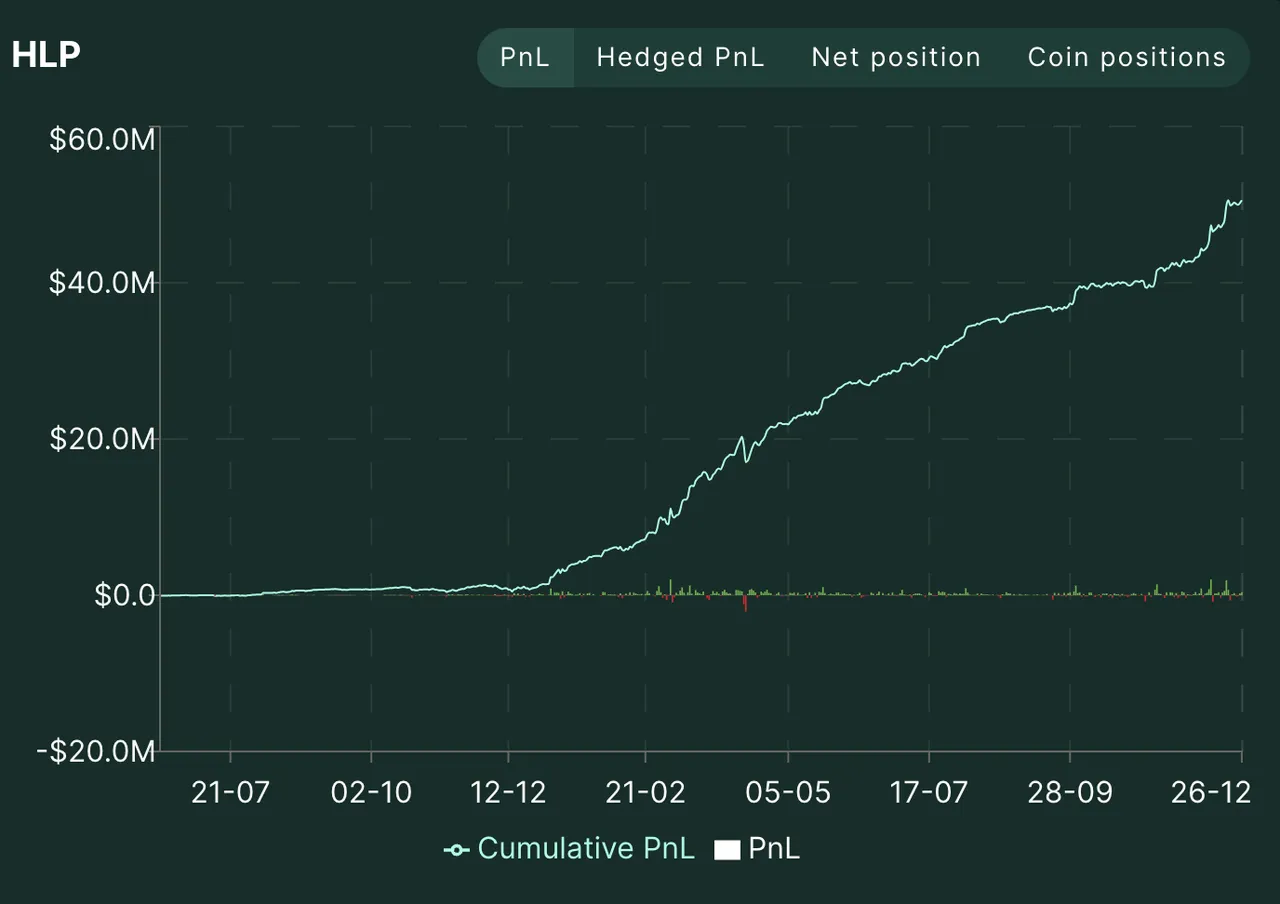

HLP Performance

Since its launch, HLP has generally remained profitable – thanks to its market-making strategy and trading fee revenue. By the end of 2024, the HLP vault had reached a total value locked (TVL) of approximately 350 million USDC and had accumulated around 50 million USDC in profit, reflecting a consistently positive APR.

HLP’s tendency to maintain a net short position throughout the 2023–2024 bull market allowed it to deliver steady returns, even as asset prices were trending upward.

However, HLP is not without risk. On several occasions, the vault recorded significant losses due to unexpected market volatility.

Jelly and a Hard-learned Lesson for Hyperliquid

One of the most notable incidents occurred in late March 2025, involving a short squeeze on the token JELLY. A trader opened a short position worth approximately 8 million USDC on JELLY, then proceeded to buy up the token on decentralized exchanges (DEXs), causing the price to surge dramatically. As a result, the short position was liquidated and fully transferred to the HLP vault.

Read more: Recap of the Price Manipulation in Hyperliquid

The price of JELLY on DEXs skyrocketed by several hundred percent, pushing HLP into an unrealized loss of over 10 million USD.

Facing the risk that a 230 million USD vault could lose everything to a small memecoin, the team acted quickly: they delisted JELLY and set a mandatory liquidation price at 0.0095 USD – exactly the level where the attacker had originally opened the short.

However, this move sparked widespread controversy regarding Hyperliquid’s decentralization and transparency. Many argued that this was effectively a “validator bailout” (or “validator put”)—a” situation where the network steps in to cap losses when the vault is hit too hard. This raised concerns that Hyperliquid may be willing to override market mechanisms to protect HLP’s capital, potentially at the expense of other users.

In response, Hyperliquid upgraded its blockchain to include on-chain validator voting for future asset delistings – a step toward deterring manipulation. Still, questions remain about the platform’s commitment to true decentralization.

Hyperliquid’s Risk Management Measures

Following the JELLY incident, Hyperliquid implemented a series of risk management upgrades to prevent similar scenarios from occurring in the future. One major change involved reducing the portion of HLP capital used for liquidation strategies. The team set this allocation at a fixed, clearly defined amount and also decreased the rebalancing frequency for the Liquidator vault to help limit potential losses during major liquidation events.

In addition, Hyperliquid introduced a mechanism for loss thresholds and Auto-Deleveraging (ADL). This system automatically triggers deleveraging when losses from liquidation strategies exceed a specific threshold. Once the losses hit that limit, the protocol activates ADL, which draws on unrealized profits from other traders within the same asset pair to cover the deficit.

To further enhance stability, the platform also adopted dynamic Open Interest (OI) caps. The platform adjusts these caps based on each asset’s liquidity and market capitalization, enforcing much stricter limits on low-cap tokens. This measure helps prevent a small number of traders from opening oversized positions that could distort market depth and introduce systemic risk.

These recent improvements reflect Hyperliquid’s recognition of the vulnerabilities exposed by the JELLY episode and its commitment to building a more resilient system. HLP shares profits with users but needs strong risk controls during volatile market conditions.

One recent example that highlights Hyperliquid’s evolving governance and risk management practices is the delisting of MYRO perpetuals. On March 29, 2025, validators 2-5 voted to delist MYRO due to low liquidity and manipulation risks.

ASXN backed delisting due to low volume, poor liquidity, and thin order books across CEXs, DEXs, and Hyperliquid. These conditions made MYRO highly susceptible to price manipulation and posed unnecessary risk to HLP

Exchanges Supporting HYPE and Liquidity

Following its token launch, Hyperliquid quickly drew significant attention from the crypto community. HYPE jumped 60% in half a day, hitting 6 USD and nearing 2B USD in market cap.

Users swapped USDC for HYPE directly on Hyperliquid DEX after connecting their wallet.

In the weeks following the airdrop, several mid-tier centralized exchanges began listing HYPE, further expanding its liquidity. KuCoin was the first CEX to enable HYPE deposits, withdrawals, and trading (starting December 7, 2024). Today, exchanges such as KuCoin, Gate.io, Bitget, LBank, and CoinW account for the highest trading volumes of HYPE.

Learn more: Why Hyperliquid Doesn’t Need to List on Binance

Despite no Binance listing, HYPE trades actively, driven by strong community interest after the major airdrop. In its early days, HYPE saw strong volatility from profit-taking and fallout after the JELLY incident. However, in recent weeks, the price has shown signs of stabilization.

Conclusion

Hyperliquid gains traction in DeFi with community-backed liquidity and strong, proactive risk controls. HLP vaults generate yield, but the JELLY incident exposed tough trade-offs between user safety and decentralization.

The Layer 1 Perpetual DEX’s swift upgrades and HYPE’s strong debut show rising trust in the protocol’s long-term potential.

Read more: Hyperliquid Airdrop Season 2 Guide

Read the full article here