Real Vision’s head crypto analyst Jamie Coutts says that during the last two years, about $1.1 trillion of the world’s money supply has been fed into Bitcoin (BTC) and other assets.

In a new thread on the social media platform X, Coutts tells his 29,200 followers that the crypto king blossomed after the M2 money supply, a measure of the sum of cash and checking account balance plus savings deposits and money market mutual funds, bottomed out at $94 trillion in Q4 2022 before subsequently shooting up to $105 trillion.

“Global M2 bottomed at $94 trillion in Q4 2022 and has since climbed to $105 trillion. During this period, Bitcoin’s market cap 5x’ed, adding $1.5 trillion.

In other words, 10% of the new money supply has leaked from the fiat system into the emerging global reserve asset of Bitcoin (gold, equities etc have absorbed new money as well). What happens if M2 expands by the usual $30 trillion this cycle?”

Coutt’s chart suggests that by the end of 2026, the global M2 supply will be about $118 trillion, which could help push the growth of BTC.

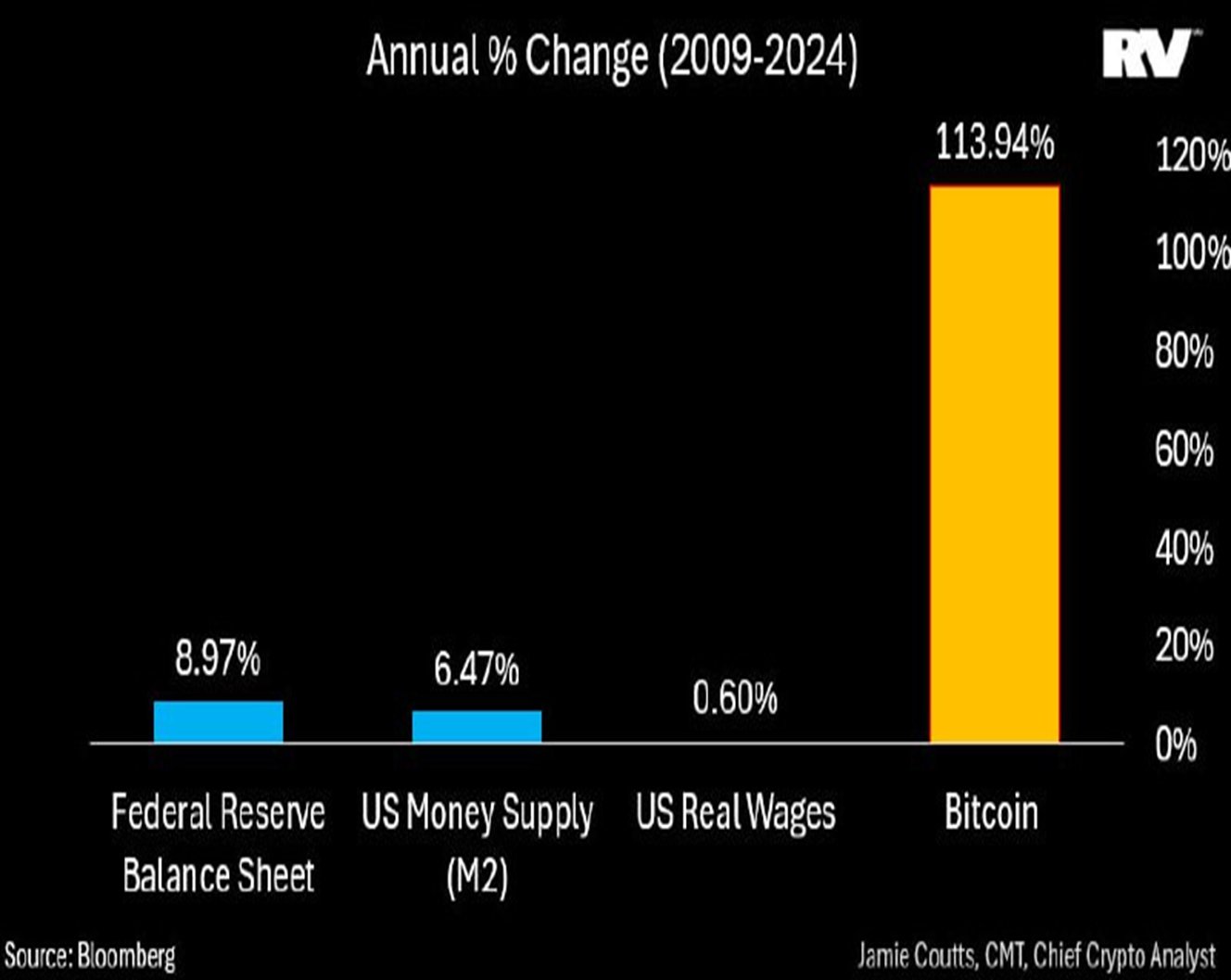

According to the analyst, since the top crypto asset by market cap’s annual growth dwarfs that of the Fed’s balance sheet, the M2 money supply and real wages in the US, BTC may offer economic solutions for many.

“It’s pretty straightforward: for individuals, companies, and sovereigns, Bitcoin is one of the few ways out of this mess.”

Bitcoin is trading for $98,035 at time of writing, a 2.94% gain during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: DALLE-3

Read the full article here