Analytics firm IntoTheBlock is issuing an alert, saying that deep-pocketed Bitcoin (BTC) investors are starting to flash signs of exhaustion.

IntoTheBlock says on the social media platform X that Bitcoin whales have taken every opportunity since March of this year to load up on BTC whenever the crypto king pulls back.

But the analytics firm warns that wallets holding more than 1,000 BTC are starting to show disinterest in buying the dip as Bitcoin struggles to maintain bullish momentum above $60,000.

IntoTheBlock says that large holders’ netflow, a metric tracking the Bitcoin moving in and out of whale wallets by measuring the amount of inflows minus outflows, has plummeted since its huge spike in March.

“Whales are buying the dip, but is their conviction dwindling?

Addresses holding over 1,000 BTC have accumulated strongly in recent months, especially during dips.

Prices have increased shortly following every accumulation.

However, note that each spike in accumulation by these holders is smaller than the last.

Could this indicate that whales have less and less appetite to buy the dip?”

At time of writing, Bitcoin is worth $62,671, down 1.31% in the last 24 hours.

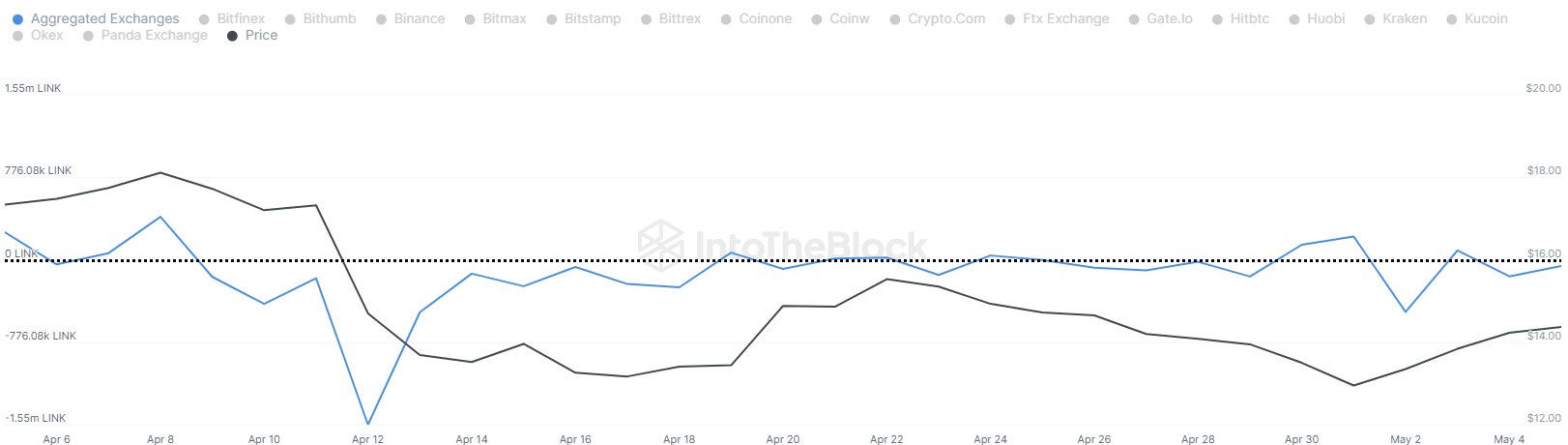

IntoTheBlock is also closely watching the activities of investors in Chainlink (LINK), a decentralized oracle crypto project. According to the analytics firm, market participants are loading up LINK despite its bearish price action as of late.

“Despite recent price movements, data from the past month shows a negative net flow from exchanges for LINK, indicating accumulation.

During this period, the total net outflow amounted to nearly 3.6 million LINK.”

At time of writing, LINK is worth $14, down more than 3.6% on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: DALLE3

Read the full article here