Real Vision analyst Jamie Coutts believes that Bitcoin (BTC) and other digital assets may be about to break out of a bearish phase as the flagship crypto reclaims the $63,000 level.

Coutts says that increasing global liquidity and a healthy crypto ecosystem suggest that the market correction may be reaching an end before the start of a year-long bull run.

“I accept this may be premature given the state of the world geopolitically and the fact that technicals (price action) are still bearish. However, I suspect we are in the final throes of the big flush of the past months, which, for allocators, will make Q4 critical for 12-month forward returns.”

Coutts is also watching closely the altcoin season index, which measures the profitability of digital assets relative to BTC. He says the indicator is flashing bullishness.

“Seeing a sharp move higher on the alt season indicator (alts outperforming BTC). Without a sustained Bitcoin rally, which requires [greater than its] all-time high, this may be a short-lived phenomenon. But I suspect we are in the final throes of the bearish thrust.”

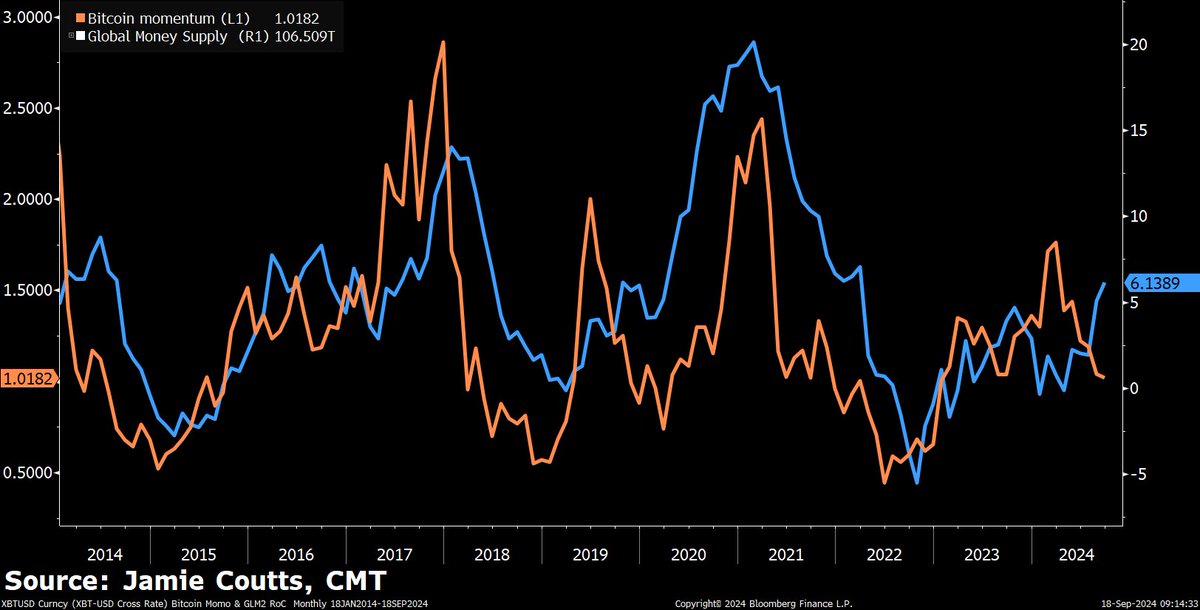

Coutts says an increase in the money supply sets the stage for BTC’s next leg up, citing a historical relationship between the two.

“Ultimately, liquidity is what ultimately drives everything, and this has now turned decisively bullish.”

He also says that data from the analytics platform Artemis, shows smart contract platforms have had strong network activity in the past six months. Coutts says that the surge in such metrics as daily active users and daily transactions during a market correction is a positive sign for digital assets moving into the fourth quarter.

“Key crypto ecosystem fundamental metrics have performed well during the six months of price decline.”

Bitcoin is trading for $63,343 at time of writing, up more than 6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/prodigital art

Read the full article here