Macro investor Luke Gromen says that in the coming years, Bitcoin (BTC) and risk assets will benefit from a souring sentiment in US long-term bonds.

In a new video update, Gromen says that due to inflationary pressures, capital will likely rotate from the bond market into stocks, gold and Bitcoin.

The investor says that because of these pressures, the iShares 20+ Year Treasury Bond exchange-traded fund (TLT) is signaling weakness against risk assets and inflation hedges.

“There’s a $130 trillion global bond market that will need to run into a $65 trillion stock market which I think is happening. [There’s a] $14 trillion gold market and a $1.3 trillion Bitcoin market for safety from that inflation. And you’re seeing that in the charts.

If you look at the S&P 500 over the TLT – the long bond ETF – it looks like a hockey stick. Nasdaq over TLT: hockey stick. Industrials over TLT: hockey stick. Gold over TLT, all together now: hockey stick. Bitcoin over TLT: hockey stick but very volatile hockey stick.

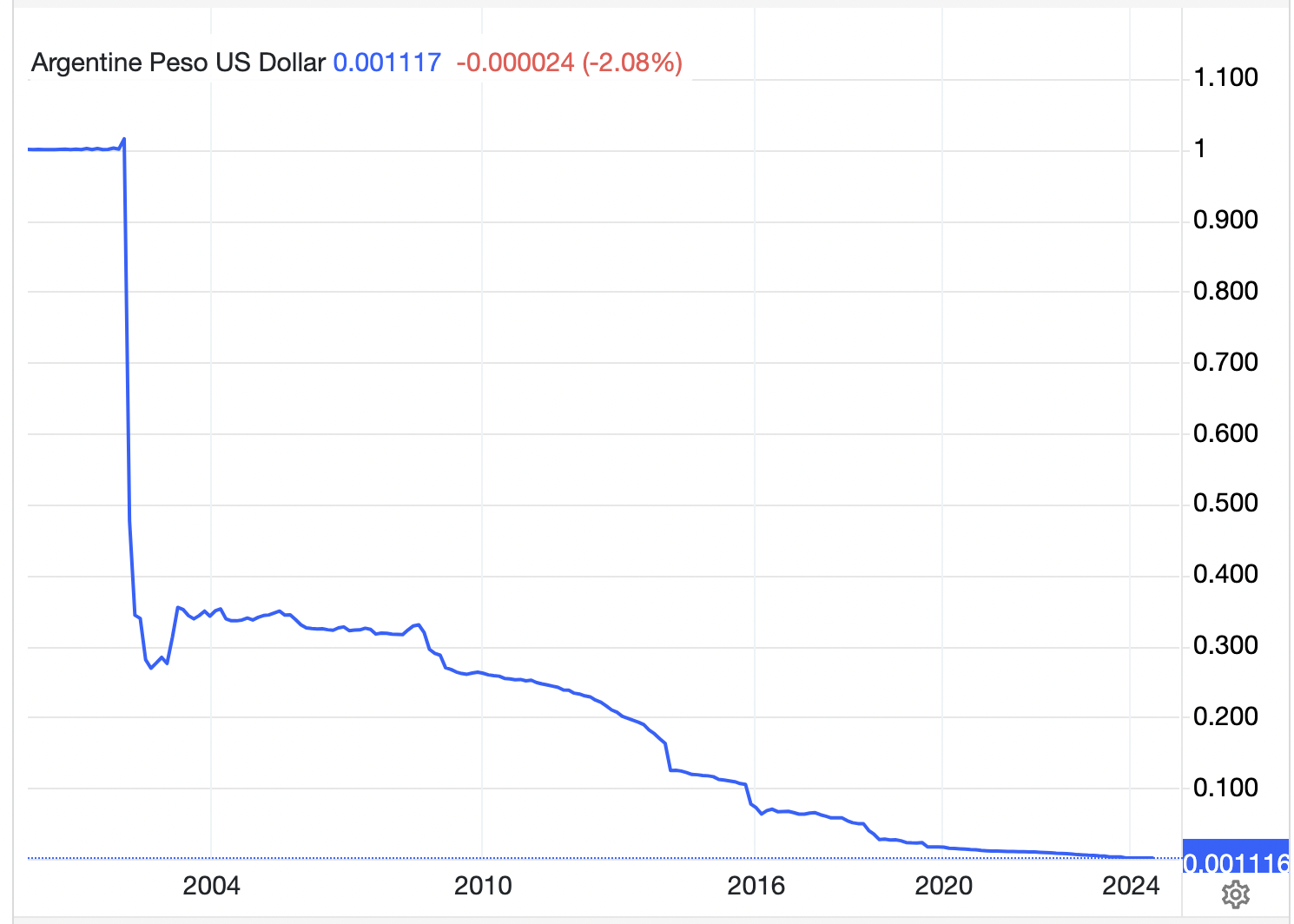

So my view is in the secular inflation that we are in the early days of, you’ll see stocks up in dollar terms [but] down in gold and Bitcoin terms. Basically Argentina with US characteristics.”

Due to heavy inflation, the Argentinian stock market index (MERVAL) has skyrocketed over 3,779% in the last twenty years, averaging more than 188% returns each year.

However, in dollar terms, the Argentinian peso has essentially gone to zero in the same timeframe.

At time of writing, Bitcoin is trading at $64,689.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: DALLE3

Read the full article here