Seasoned trader Peter Brandt is leaning bullish on Bitcoin (BTC) as the flagship crypto asset lingers around 17% below the all-time high.

Brandt tells his 741,800 followers on the social media platform X that his price target for Bitcoin is $135,000, a level he sees being reached in either August or September of 2025.

According to Brandt, Bitcoin typically records massive gains during the second half of the halving cycles.

On what could invalidate his bullish thesis for the crypto king, the veteran trader says,

“Close below $48,000 negates my chart analysis.”

Bitcoin is trading at $61,070 at time of writing.

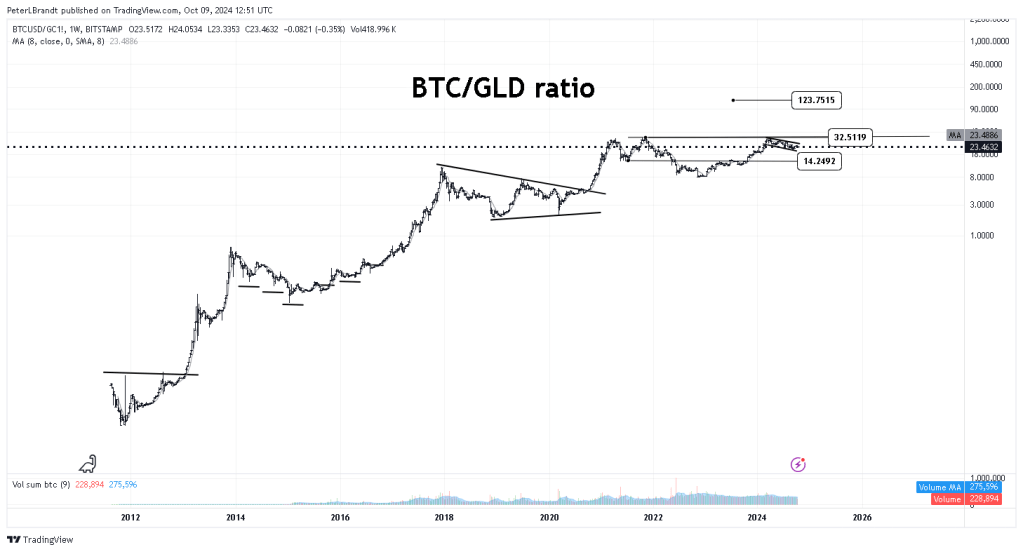

The seasoned trader also says that Bitcoin is outperforming gold as a store of value.

Brandt notes how based on Bayesian analysis, a tool used to compute probabilities for a hypothesis as more data is obtained, the Bitcoin-to-gold ratio could remain above 100 once the three-figure threshold is crossed.

“Bitcoin or Gold / BTC vs XAU

Which is king of the store of value story?

-Bitcoin is kicking Gold’s arse

-Resistance at 32 to 1

-Currently at 23 to 1

-Support in high teens to 1

-New ATH sets target at 100+ to 1

-Bayesian analysis at 30% that market rolling over for good”

Brandt’s bullish stance on Bitcoin is similar to that of the co-founders of blockchain analytics platform Glassnode. Earlier this week, Glassnode co-founders Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, said a correction which saw Bitcoin drop from around $66,500 to slightly below $60,000 amid tensions in the Middle East would be short-lived.

“Last week’s geopolitical risks led to a Bitcoin correction, but fundamentals strengthened regardless. This positive shift is driven by network growth and rising liquidity.

The BTC move up is just starting.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here