Bitcoin (BTC) is up 6.6% on the day and back above the psychological threshold of $100,000 after US Consumer Price Index (CPI) data came in as forecasted.

The U.S. Bureau of Labor Statistics announced Wednesday that CPI had risen 0.3% in November, up 2.7% year-on-year, in line with forecasts.

Markets responded positively to the likelihood that the Federal Reserve will follow through on its hints of more rate cuts given purportedly under-control inflation.

Bitcoin, Ethereum (ETH), Solana (SOL) and most of the top 100 digital assets rallied on the news.

Pseudonymous crypto analyst TechDev tells his 488,000 followers on the social media platform X that based on the Chaikin Money Flow (CMF) indicator, which is a volume-weighted average of accumulation and distribution in a given time period, BTC is entering a period where the majority of its gains are made.

“Green and red are where the vast majority of gains are made.

And it’s our first visit in 8 years.”

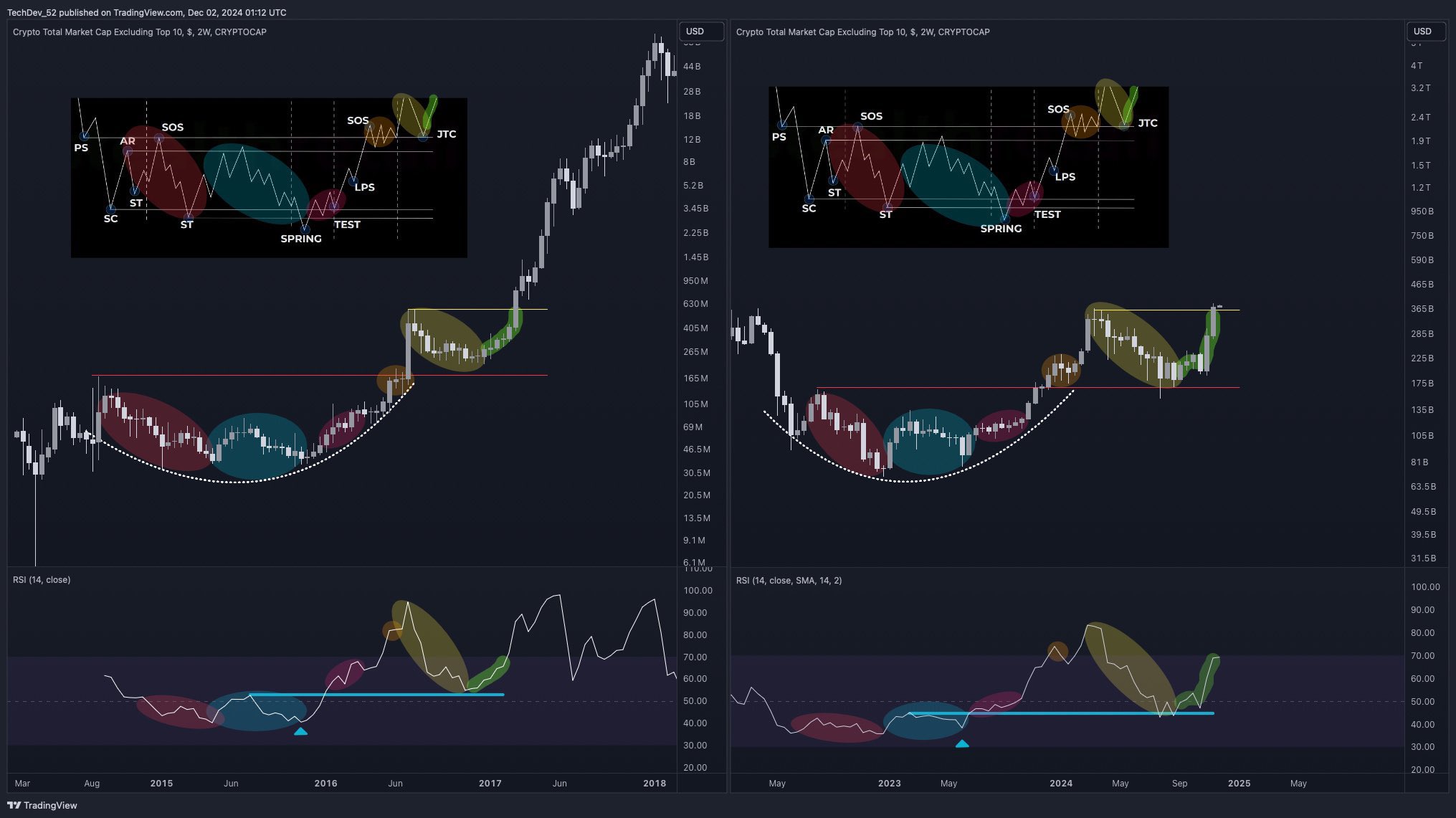

TechDev also shares an OTHERS chart, which measures the market cap of all digital assets excluding the top 10, and is used to gauge altcoin strength. He suggests that OTHERS has just printed a classic Wyckoff accumulation pattern, suggesting another imminent leg up for altcoins.

“Higher.”

TechDev says that current market conditions are almost perfectly mirroring the environment of early 2021 just before a massive altcoin season. He notes similarities in the price action of Bitcoin, Ethereum, Dogecoin (DOGE), as well as a move in Bitcoin dominance (BTC.D), which measures how much of the total crypto market cap belongs to BTC.

“It was early January 2021.

BTC in week 4 of price discovery.

ETH 20% below all-time highs.

DOGE at its first pause.

BTC.D had reversed.

The next 4 months brought a historic altcoin run as capital rotated and mania hit.

It’s early December 2024.

BTC is on week 5 of price discovery.

ETH 20% below all-time highs.

DOGE at its first pause.

BTC.D has reversed.

Prepare…”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/Agor2012

Read the full article here