The co-founders of the blockchain analysis platform Glassnode are warning that Bitcoin (BTC) may have a sudden pullback even as it continues to hold a critical range as support.

Glassnode and Swissblock co-founders Jan Happel and Yann Alleman, who share the social media handle Negentropic, say that low trading volume suggests there is a risk Bitcoin may suddenly correct by more than 7% of its current value if it fails to hold $91,500 as support.

The analysts also say that the latest US job data released Friday morning may create market volatility.

“Bitcoin is holding support at $91,500-$92,500 but lacks volume and strength – could this be a pullback before testing $86,500-$90,000? All eyes on US employment data! Will it fuel a breakout above $95,500 toward $97,200-$98,500, or will BTC fall back to support?”

The analysts say another bearish factor for Bitcoin may be due to concerns over market impacts from the reported potential sale of a large amount of Bitcoin by the US government that it seized from the Silk Road darknet marketplace.

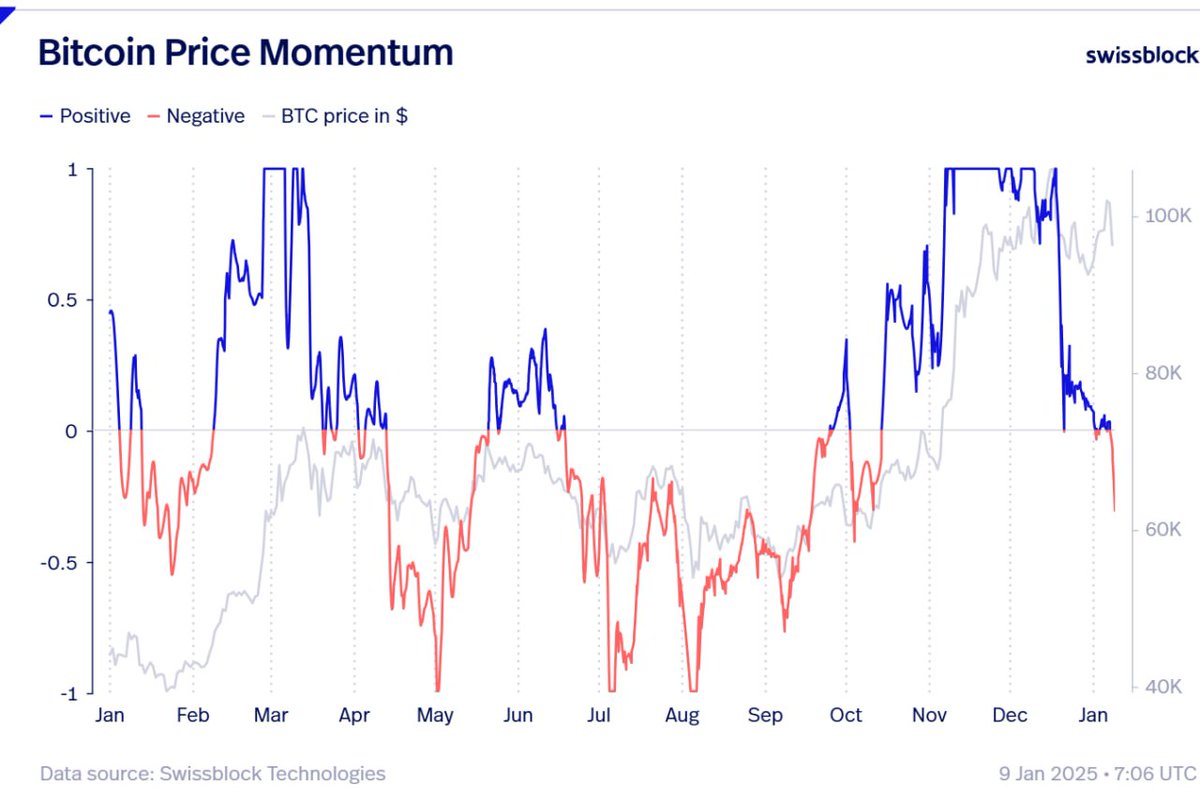

“Price momentum turns bearish as Bitcoin retests $92,500. With fear, uncertainty and doubt over the US government’s 198,000 BTC and potential sales, could we see a break below and a move to $90,000? Historically, a bearish flip after prolonged bullishness signals corrections to lower support. $90,000 is the key zone to watch!”

However, the analysts say some key metrics are signaling bullishness for Bitcoin in the coming months, including a declining amount of BTC on crypto exchanges.

“BTC exchange balances reveal bullish sentiment. After a year-end rise in BTC moving to exchanges (likely for selling or collateral), the trend has reversed in 2025. Significant outflows from exchanges (e.g., Binance) suggest buyers are withdrawing BTC to cold storage, signaling HODL intentions for the medium term.”

The analysts also say that the number of short-term holders taking a loss on their investments during the current market correction is not as high as in prior corrections, suggesting a more bullish outlook.

“Tracking short-term holder behavior: many retail participants moved BTC to exchanges at a loss during corrections, likely to sell – but not as intensely as in past drops. Short-term holders are growing bolder, showing more patience to sell in profit. Bullish sentiment rising!”

Bitcoin is trading for $93,490 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/Sergey Nivens/Fotomay

Read the full article here