Bloomberg Intelligence senior macro strategist Mike McGlone is warning that Bitcoin (BTC) is facing mounting resistance at one key level.

McGlone says that changing macroeconomic conditions and exceptions that the Fed will cut rates less than previously thought in 2025 may prevent Bitcoin from flipping the $100,000 resistance level into support any time soon.

“Can Bitcoin breach $100,000? Model headwinds rising: Bitcoin peaked at $108,000 on December 17th, the day before the Federal Reserve eased, and our model might help determine what to look for in 2025. My bias is that $100,000 is formidable resistance, and the model shows top forces for Bitcoin’s almost 15% drawdown have been changing monetary policy expectations and crypto-specific factors.”

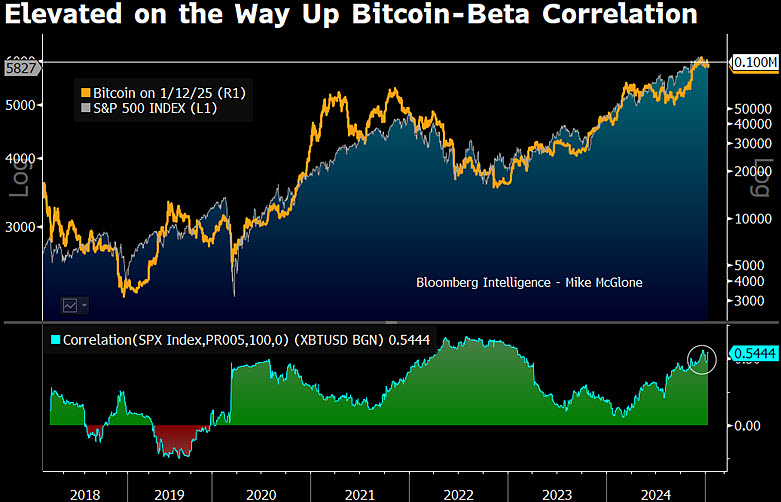

McGlone is warning that Bitcoin’s correlation with the performance of the S&P 500 (SPX) is elevated, suggesting price volatility.

However, he says if Bitcoin could stay above $100,000 it may suggest the flagship crypto asset is acting more as a store of value like gold, rather than a risk-on tech stock.

“Bitcoin strategic reserve dependency in 2025? Bitcoin may need to stay above the $100,000 threshold achieved in 2024 to show risk-asset stabilization. My bias is last year’s launch of US exchange-traded funds, Bitcoin halving, record-setting stock market and re-election of convert turned zealot, [US President-elect Donald] Trump, may be about as good as it gets for stretched speculative digital assets.”

He also warns that gold is showing market strength against the SPX, which could signal stocks may decline as well as Bitcoin if BTC’s high correlation with the SPX remains intact.

“Do stocks face a lose-lose versus gold, Bitcoin? Despite increasing competition from Bitcoin, gold has been outperforming the S&P 500 (SPX), with implications for risk assets. Did the launch of US ETFs and Trump’s reelection change the trajectory/correlation for highly speculative digital assets?”

Bitcoin is trading for $99,790 at time of writing, up 1.1% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/Alexander56891/Sensvector

Read the full article here