Analyst and trader Ali Martinez is leaning bearish on Bitcoin (BTC) as the flagship crypto asset sits around 20% below the all-time high.

Martinez tells his 71,000 followers on the social media platform X that Bitcoin has fallen below a key moving average, a development which could lead to the largest crypto asset by market cap falling by around 47% from the current price to levels last witnessed in October of 2023.

“Bitcoin trading above its 200-day moving average often signals strong returns, while dropping below it can lead to sharp corrections.

BTC has now been below this key level, at $64,000, for over a month, hinting at a potential drop towards its Realized Price of $31,500!”

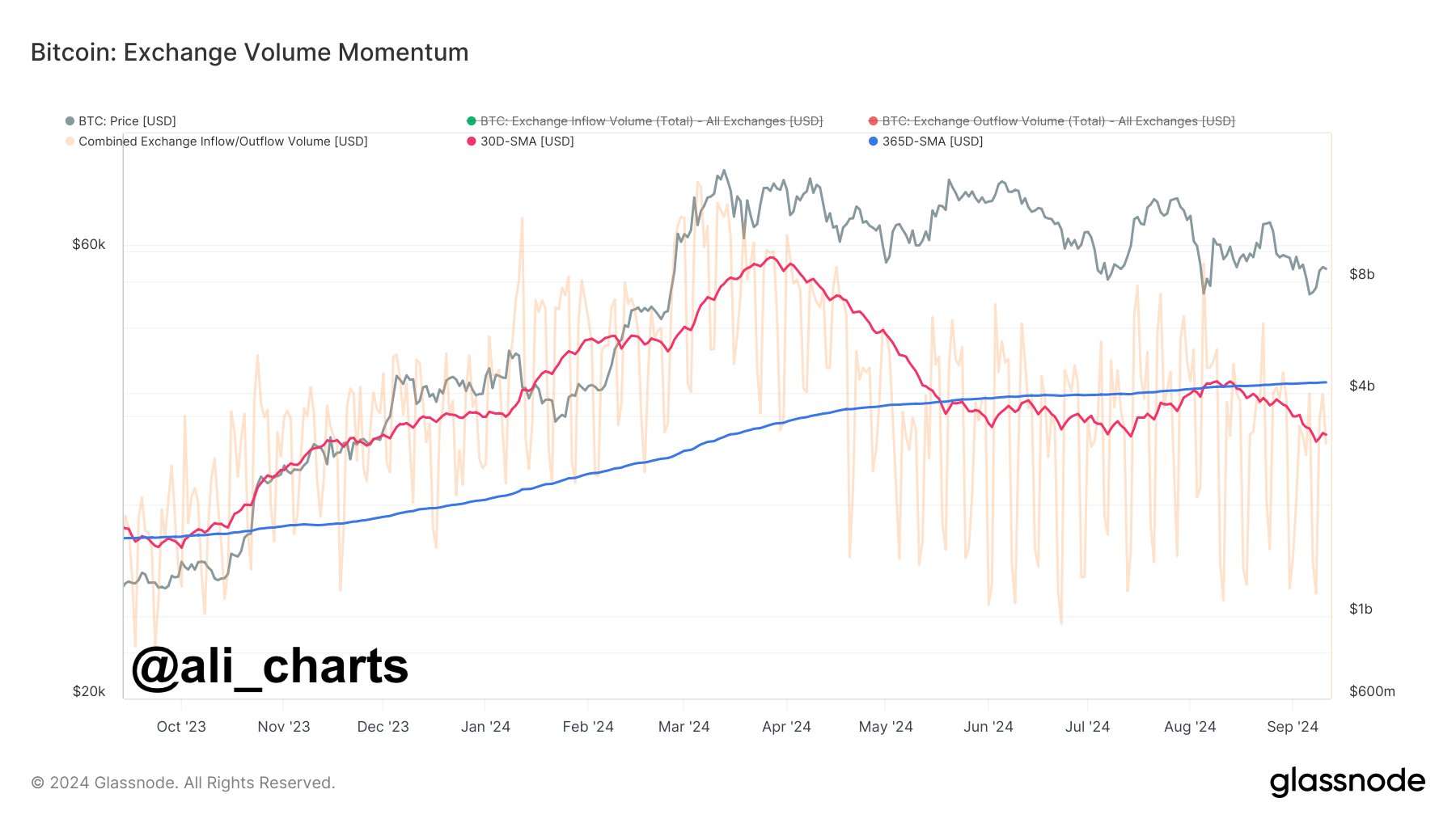

Martinez further says that the exchange volume momentum metric for Bitcoin is also flashing a bearish signal. The exchange volume momentum metric compares the monthly average of BTC’s exchange inflows and outflows to its yearly average, with a decrease hinting at lower investor interest and an increase signaling rising investor interest.

Says Martinez,

“The Bitcoin Exchange Volume Momentum shows a decline in on-chain activity tied to exchanges, signaling lower investor interest in BTC.”

The crypto trader and analyst also says that the Tom DeMark (TD) Sequential indicator has flashed a sell signal for Bitcoin on the 12-hour time frame in anticipation of a “brief correction.” The TD Sequential indicator is used in technical analysis to determine potential bullish or bearish reversal points.

Bitcoin is trading at $60,442 at time of writing, up over 4% on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here