Former Coinbase executive Balaji Srinivasan isn’t a fan of the U.S. Federal Reserve.

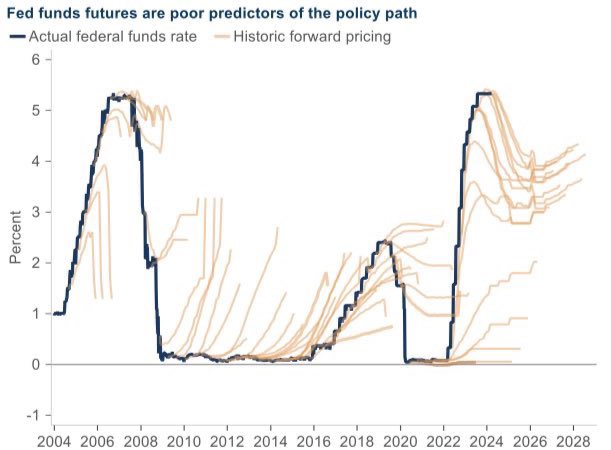

Srinivasan says on the social media platform X that the Fed represents “unpredictable monetary policy,” compared to Bitcoin (BTC), which he says is “predictable monetary policy.”

“If you made the graph of Bitcoin’s predicted issuance versus its actual issuance over the last 15 years, they would be exactly superimposed.

This predictability is as crucial as the scarcity of the currency itself.”

The former Coinbase chief technology officer says the Fed plagues the markets with risk.

“That is: all the unpredictability and volatility comes from the Fed committee. They just pick rates out of a hat based on months-old data and political incentives.”

Some elected US politicians are also wary of the Fed and want to limit the central bank’s power. Last week, the House of Representatives passed a bill that would prevent the Fed from launching a central bank digital currency (CBDC) without Congressional authorization.

Republican Majority Whip Tom Emmer sponsored H.R. 5403, known as the CBDC Anti-Surveillance State Act.

Emmer says he wants to protect Americans’ right to privacy.

“My legislation ensures that the United States’ digital currency policy remains in the hands of the American people so that any development of digital money reflects our values of privacy, individual sovereignty, and free market competitiveness.

This is what the future global digital economy needs. We are proud to have led this effort and thank my colleagues for their support.”

In March, Fed Chair Jerome Powell said the agency was “nowhere near” recommending or adopting a CBDC.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: DALLE-3

Read the full article here