The co-founders of the crypto analytics platform Glassnode are issuing a warning that Bitcoin (BTC) may be heading for a severe correction after its historic $100,000 breakthrough.

Jan Happel and Yann Allemann, who go by the handle Negentropic, tell their 63,200 followers on the social media platform X that the Bitcoin Fundamental Index (BFI) metric is singling a weakening market.

The BFI evaluates several aspects of the Bitcoin market, including wallet activity and transaction volume. When it declines, the risk of a market correction increases.

“Not to rain on the parade, but Bitcoin has crossed $100,000, yet the Bitcoin Fundamental Index (BFI) is starting to weaken. Should we be concerned? This indicator often sends early warning signals, and once confirmed, they’re hard to ignore. Take the market peak in Q1 this year as an example: the BFI showed the exit point ahead of a significant correction. For now, we’ll keep monitoring, but the bull run still has fuel left.”

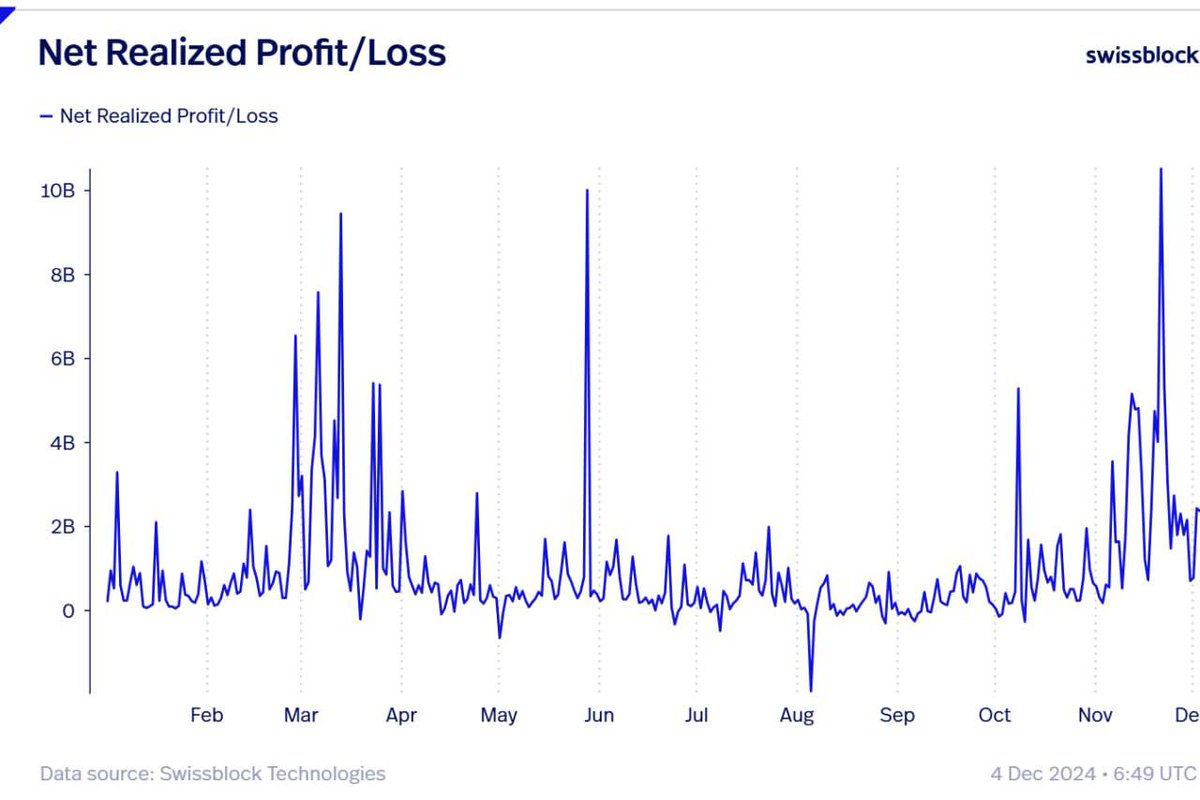

Prior to Bitcoin breaking the $100,000 resistance level, the analysts said the net realized profit/loss metric, which tracks whether Bitcoin holders are selling at a loss or a profit, indicated holders were waiting for higher price targets before they’d likely start taking profits.

“Bitcoin traders hold out for higher levels. Another sign of Bitcoin’s price consolidation is traders’ reluctance to take profits in this range. They’re aiming for higher levels, expecting gains once Bitcoin starts challenging key resistances. Once Bitcoin overcomes its resistance and establishes itself above $100,000, we’ll likely witness spikes to the upside on this chart, signaling trader confidence turning into action.”

Bitcoin is trading for $96,579 at time of writing, down 6.8% from its new all-time high of $103,679.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here