On-chain analyst Willy Woo believes that a critical time is arriving for Bitcoin (BTC) as he says bearish momentum subsides.

Woo tells his 1.1 million followers on the social media platform X that key indicators suggest Bitcoin could soon see a bullish reversal.

“Summary: it’s crunch time. BTC needs to make a decision. Technical indicators point bearish. The majority of my fundamentals signals point bullish. Macro liquidity will probably decide this.”

The analyst says that Bitcoin’s cumulative volume delta (CVD), an indicator that aims to spot divergences by comparing buying and selling volume over a given time period, is starting to read less bearish.

“Finally urgent market sells (CVD) is subsiding, i.e. local bearish regime subsiding. That dotted line is $59,600 which historically is the line between bullish and bearish regimes. Bitcoin needs to stay above this.”

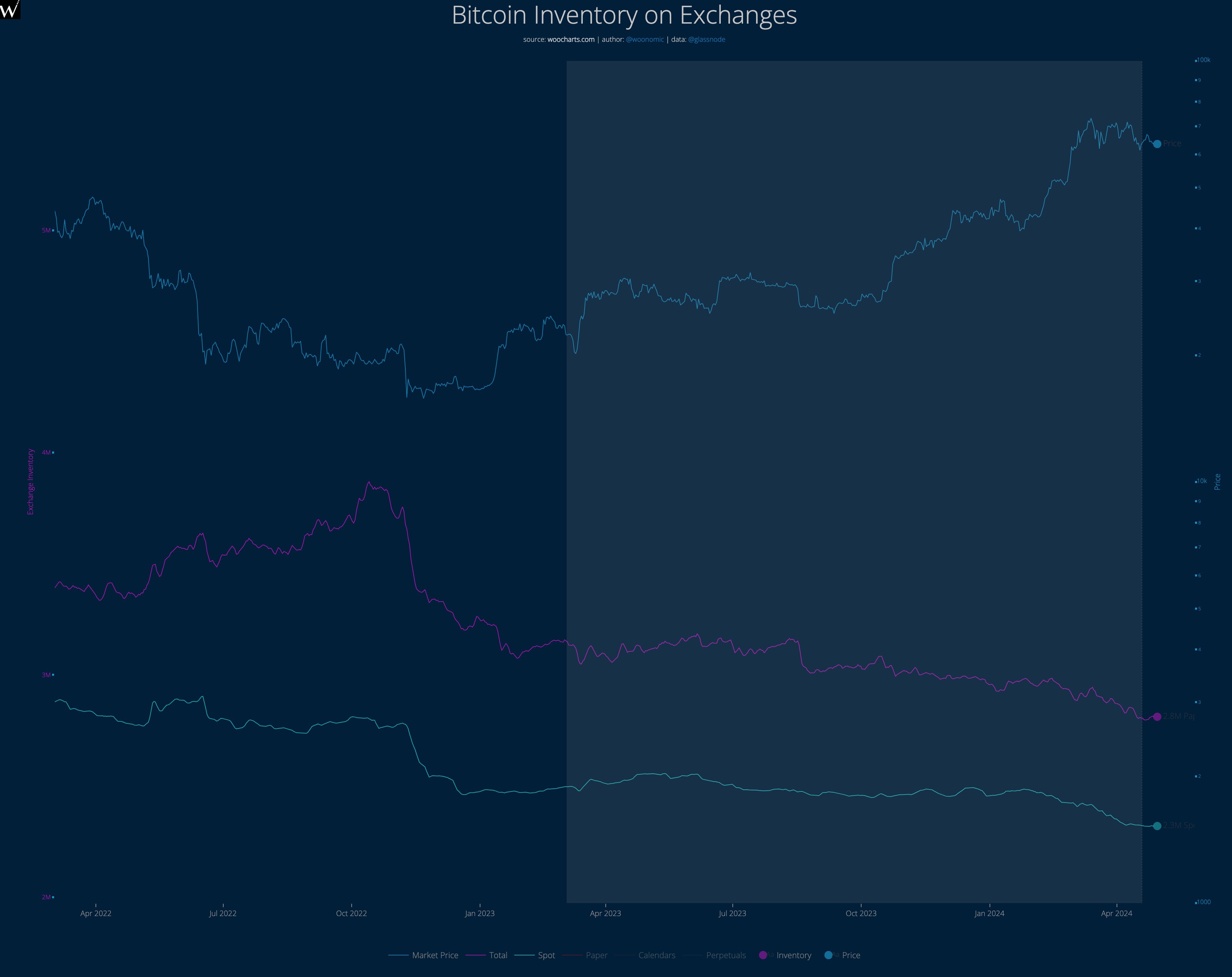

The analyst also says that Bitcoin on crypto exchanges is starting to decline, which can often be interpreted as bullish since it suggests more coins are held in cold storage and therefore can’t be immediately sold.

“Bulls will like the inventory of paper and spot BTC declining, history says this is a bullish divergence.”

Another bullish indicator, according to Woo, is the Bitcoin Risk Signal, which compares BTC’s network flows to price action and gauges the level of risk of a major price dip.

“On the positive side, risk signal has been dropping.”

However, the analyst says that the weekly and monthly Bitcoin charts are signaling bearish momentum.

“Bears will like the bearish divergence that’s printed on weekly candles, soon to be monthly candles in a day when the month closes. Price needs to rip to break this divergence.”

Bitcoin is trading for $63,001 at time of writing, down 4.6% in the past seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/Gorodenkoff/deepme

Read the full article here