A lack of demand growth is keeping Bitcoin’s (BTC) price down, according to the head of research at the digital asset analytics firm CryptoQuant.

Julio Moreno notes on the social media platform X that BTC demand is declining and “basically all valuation metrics are in bearish territory.”

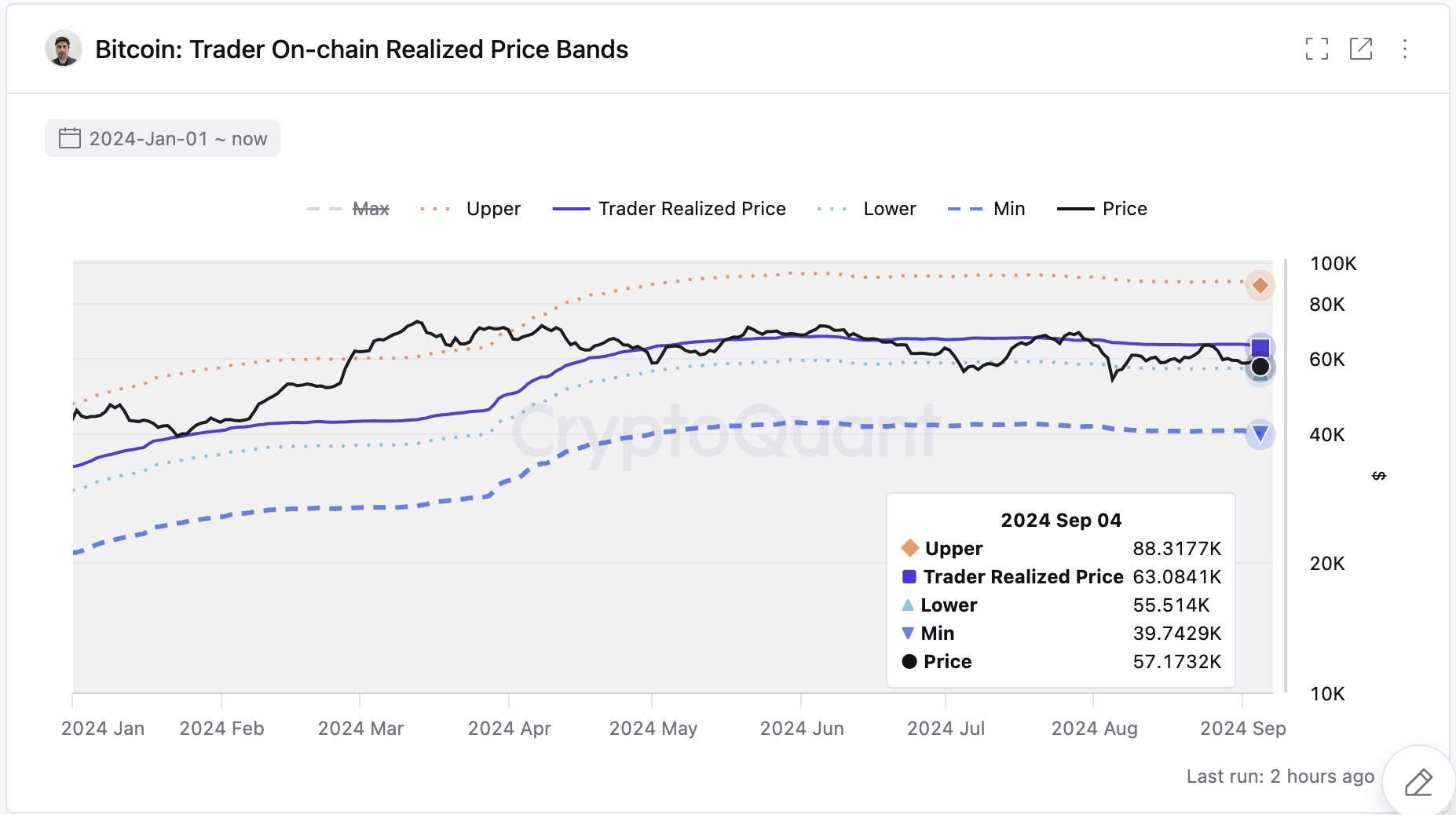

Moreno notes a key price level to watch is $55,000, the trader on-chain realized price lower band.

The realized price is the average price of Bitcoins in circulation calculated based on the price at which they were last moved.

BTC, currently priced at $53,836, is trading below that mark at time of writing. The top-ranked crypto asset by market cap is down more than 4% in the past 24 hours and more than 9% in the past week.

Earlier this week, Moreno simulated the price of Bitcoin for the month of September, with the simulation prices on average ending the month around $55,000.

“Prices would mostly be between $44,000 and $66,000. These simulations only take into account historical daily returns in the month of September.”

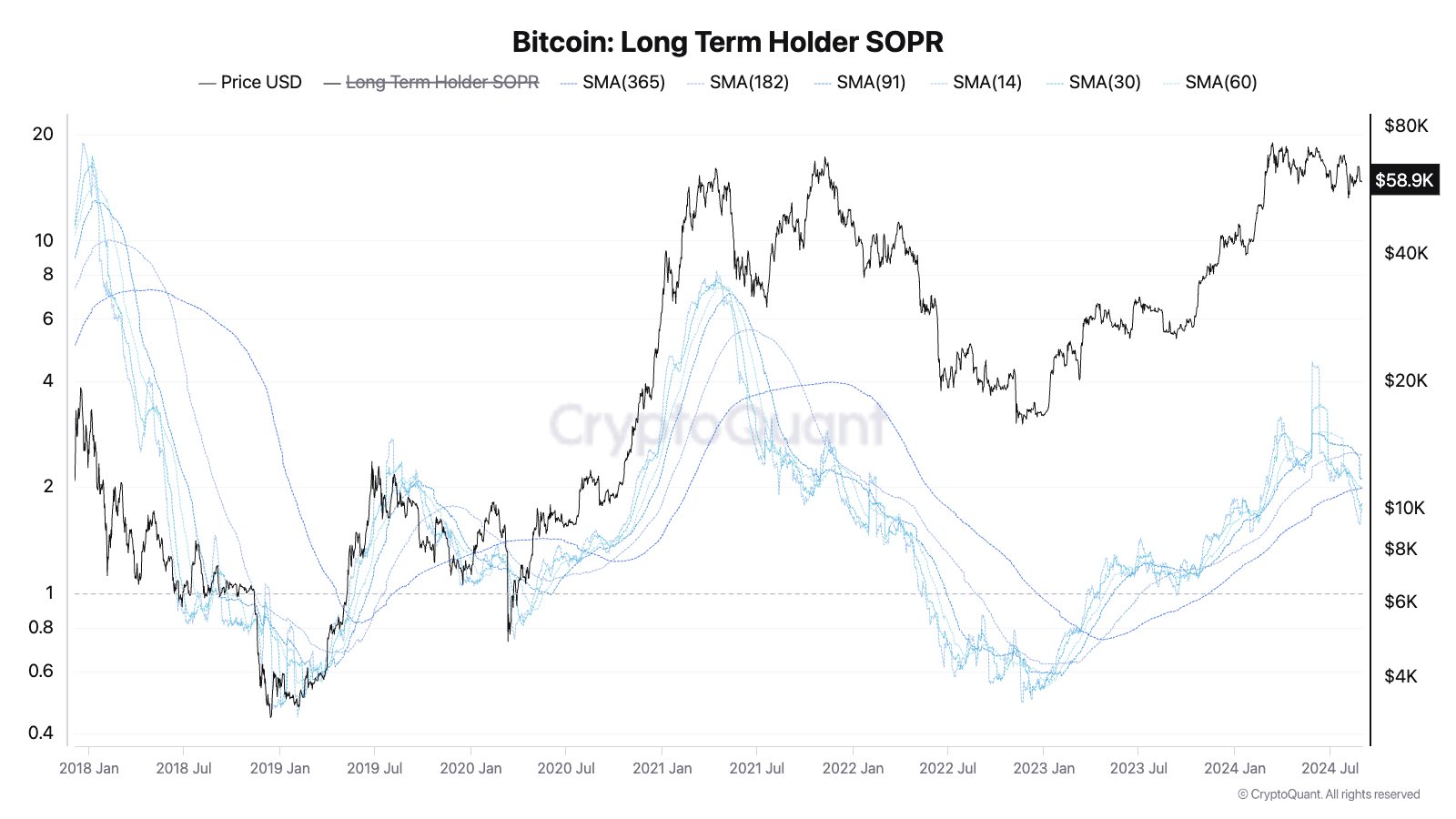

Moreno also noted last weekend that long-term BTC holders are spending at lower profit margins, a bearish indicator.

“Long-term holder SOPR ribbons: most moving averages are trending downwards since late July.

Buying signal would be when the moving averages start to trend upwards.”

SOPR stands for spent output profit ratio, which tracks whether coins are being sold at a profit or loss.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here