Volatility rocked the Korean crypto markets on Tuesday after the government briefly declared martial law, sending Korean Won (KRW)-priced digital assets into discount territory.

South Korean President Yoon Suk Yeol declared martial law in a seemingly politically motivated move, prompting the military to attempt to enter parliament in Seoul.

However, shortly thereafter, every single member of Korean parliament voted against the president’s declaration, making it invalid.

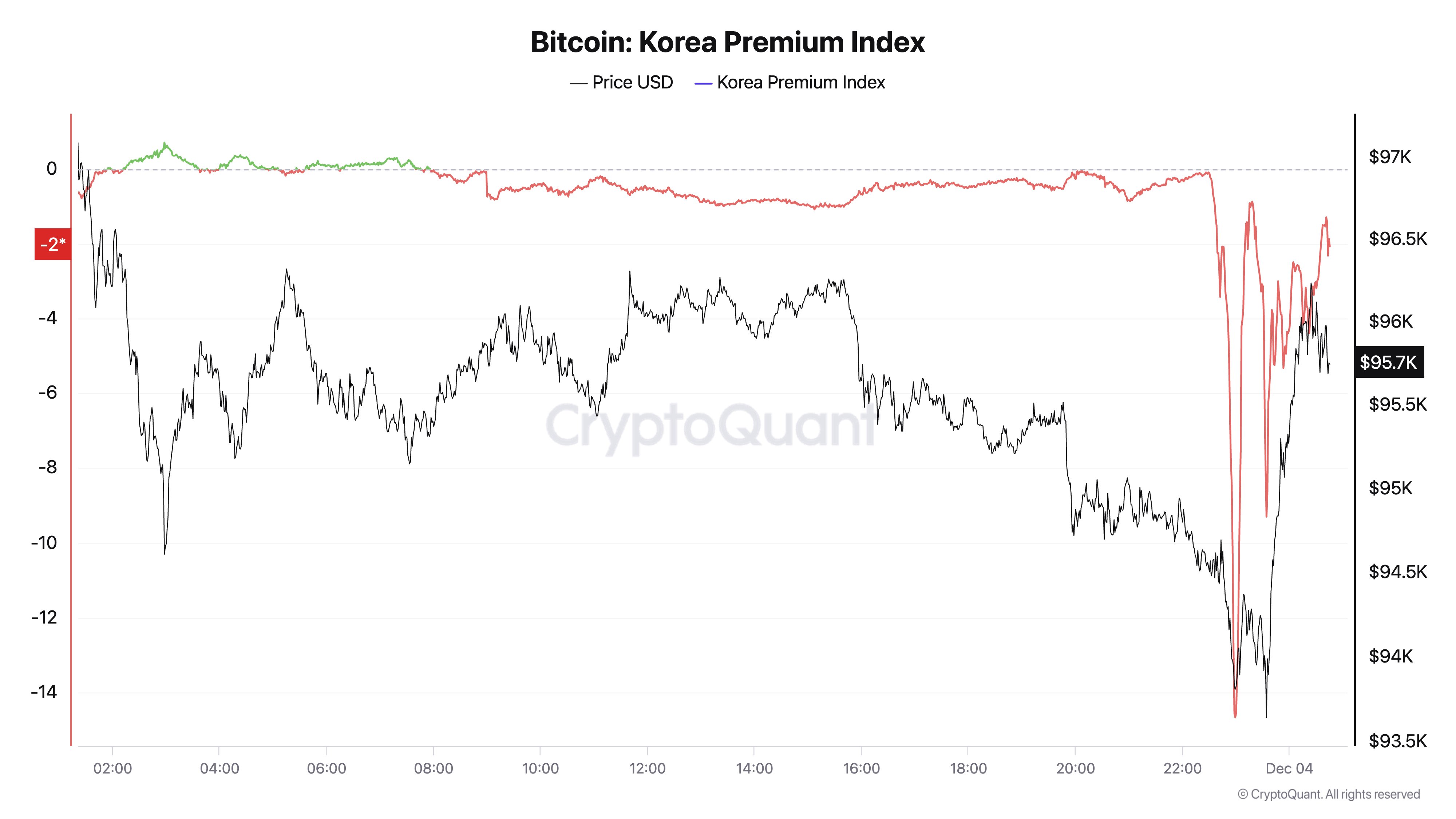

During the commotion, BTC prices in KRW dipped dramatically.

Says Korean-based CryptoQuant CEO Ki Young Ju,

“South Korea’s financial markets are in chaos because of the president’s political show.”

Traders often watch the price of Bitcoin in South Korea to spot arbitrage opportunities with the “kimchi premium,” which refers to the gap between BTC’s price in the country and US markets. According to Ju, the political scuffle in Seoul pushed the kimchi premium down to all-time lows.

“Bitcoin kimchi premium hits an all-time low.

Shouldn’t Bitcoin go up during times of political instability?

Why did the people selling now even buy Bitcoin in the first place?”

According to blockchain tracking firm Lookonchain, many whales deposited stablecoins into Upbit, one of South Korea’s largest crypto exchanges, trying to catch “bottom-fishing opportunities” amid the price crash in Bitcoin.

“The Korean crypto market has plummeted following South Korea’s declaration of ‘martial law.’

Many whales transferred large amounts of USDT to Upbit, likely aiming for bottom-fishing opportunities.

Within 1 hour after the declaration of ‘martial law’ over 163M USDT flowed into Upbit.”

At time of writing, Bitcoin is trading at $95,772.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/iurii/Sensvector

Read the full article here