New data reveals that the overall trading volume of centralized crypto exchanges (CEXs) plummeted in April after six consecutive months of gains.

According to blockchain tracker CCData, the combined volume of spot market and derivatives trading on centralized exchange platforms fell by a staggering 43.8% to $6.58 trillion.

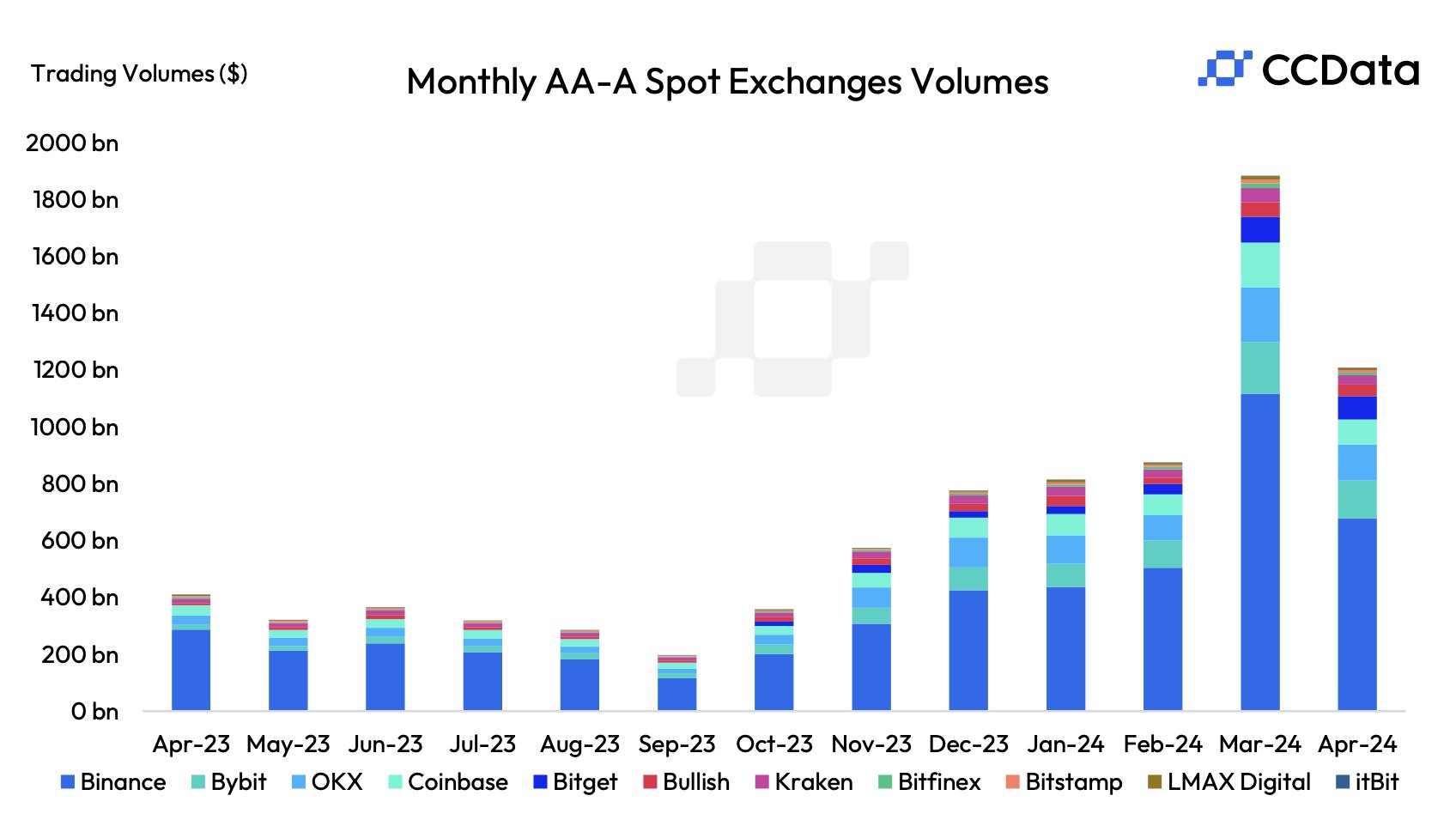

The firm’s charts indicate that in March, the combined volume was about $11 trillion and in February, it was approximately $8 trillion. However, the chart also reveals that the overall volume in April 2024 is still higher than it was during any month in 2023 except for December.

CCData goes on to note the crypto exchanges that saw the most fall in volume. According to the firm, Bybit, OKX and Binance, the world’s largest crypto exchange by volume, were hit the hardest.

“Considering individual exchanges, Binance (Grade A) was the largest Top-Tier spot exchange among AA-A graded exchanges by volume in April, trading $679 trillion (down 39.2%). Followed by Bybit (Grade AA) trading $133 billion (down 26.9%) and OKX (Grade A) trading $126 billion (down 34.8%).”

The data-aggregating firm also says that metaverse gaming, artificial intelligence (AI) and meme tokens have seen double-digit returns month-to-date while layer-2 scaling solutions are in the negatives. The biggest rise was in the metaverse/gaming sector, which saw a 32.4% climb in returns from last month.

“Basket Performance Returns Month-to-Date:

Metaverse/Gaming: 32.4%

Meme: 16.2%

AI: 17.4%

Layer-1: 7.1%

DeFi: 6.7%

Staking: 4.0%

ExchangeToken: 3.5%

Infrastructure: 1.6%

Layer-2: -4.2%

As of May 10th.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here