New data from market intelligence firm CryptoQuant reveals that new Bitcoin (BTC) wallets are now holding a staggering 9.3% of the crypto king’s total supply.

In a thread on the social media platform X, CryptoQuant chief executive Ki Young Ju says that new Bitcoin whale wallets have seen their balances increase by a massive 813% year-to-date.

New whale wallets are defined as having an average coin age under 155 days.

“New whale wallets now hold 1.97 million Bitcoin. Each has over 1,000 BTC, average coin age under 155 days, excluding exchange and miner wallets, likely custodial. Their BTC balance surged 813% year-to-date, taking up 9.3% of the total supply, valued at $132 billion today.”

According to Ju, institutional demand for Bitcoin changed the “gambling” nature of BTC, encouraging larger, longer-term positions

“At first, I thought this might be a data error, as the numbers seemed unrealistically high. To put it into perspective, it’s like institutional investors acquiring an additional 8.2% stake in a company named Bitcoin within a year.

The cap table for Bitcoin has become more diversified with the entry of institutional players. No one calls Bitcoin gambling anymore, and I feel the atmosphere is becoming more mature.”

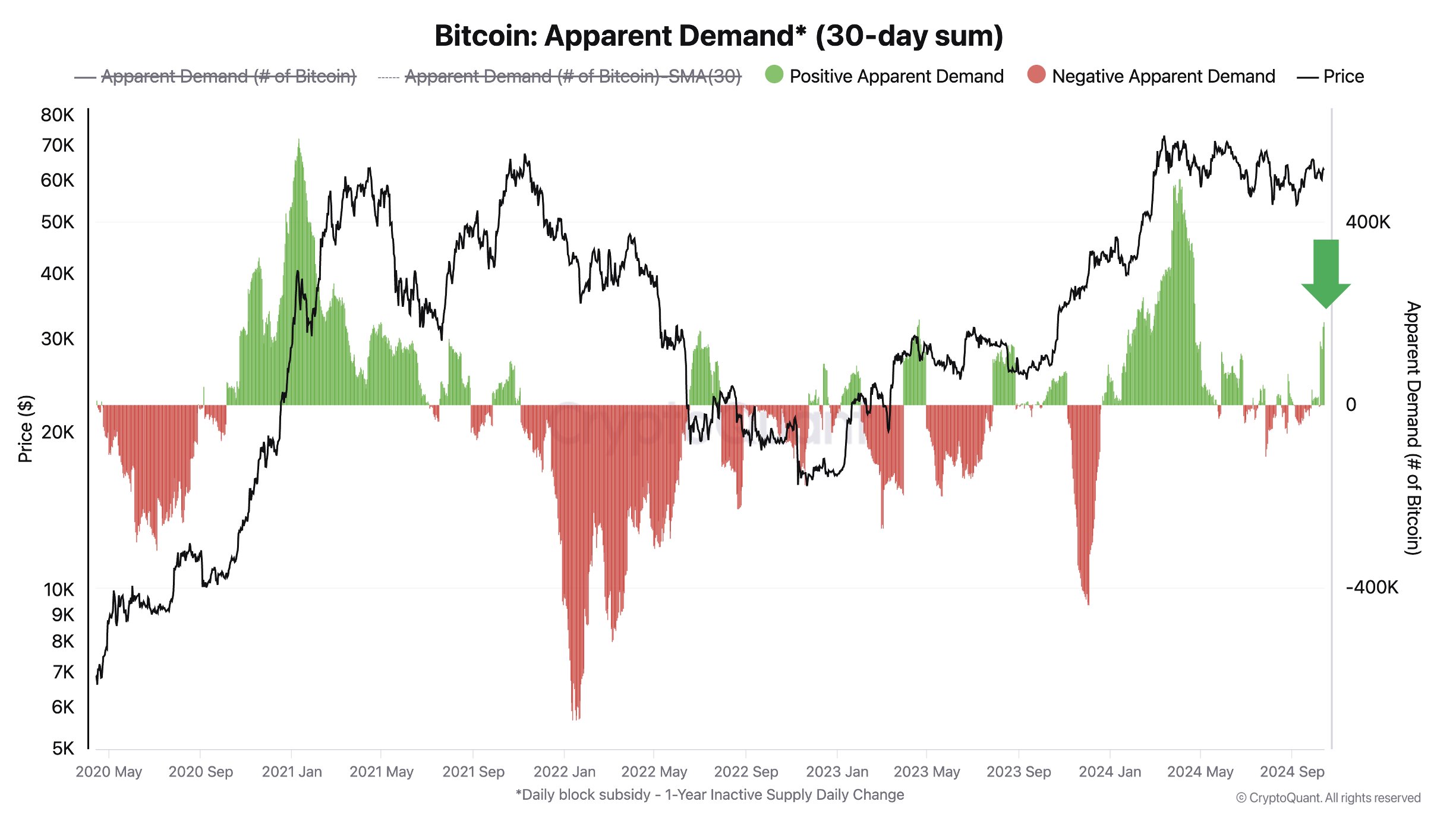

Ju also says that apparent demand – an on-chain metric used to compare production and inventory changes for BTC – is back in the green.

Bitcoin is trading for $67,639 at time of writing, a 2.64% gain during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here