One indicator suggests that rallies are on the horizon for one Telegram-based gaming token, according to a popular crypto analyst.

Ali Martinez tells his 72,600 followers on the social media platform X that Notcoin (NOT) flashed a bullish signal on its Supertrend Indicator, which provides buy and sell signals based on price action and volatility.

NOT is a community token for the popular Telegram-based tap-to-earn mining game Notcoin.

Says Martinez,

“Increased buying pressure could potentially push NOT toward $0.012 to $0.014.”

With NOT trading at $0.000976 at time of writing, a jump to $0.014 would represent a gain of more than 40%. The 86th-ranked crypto asset by market cap is already up over 13% in the past 24 hours.

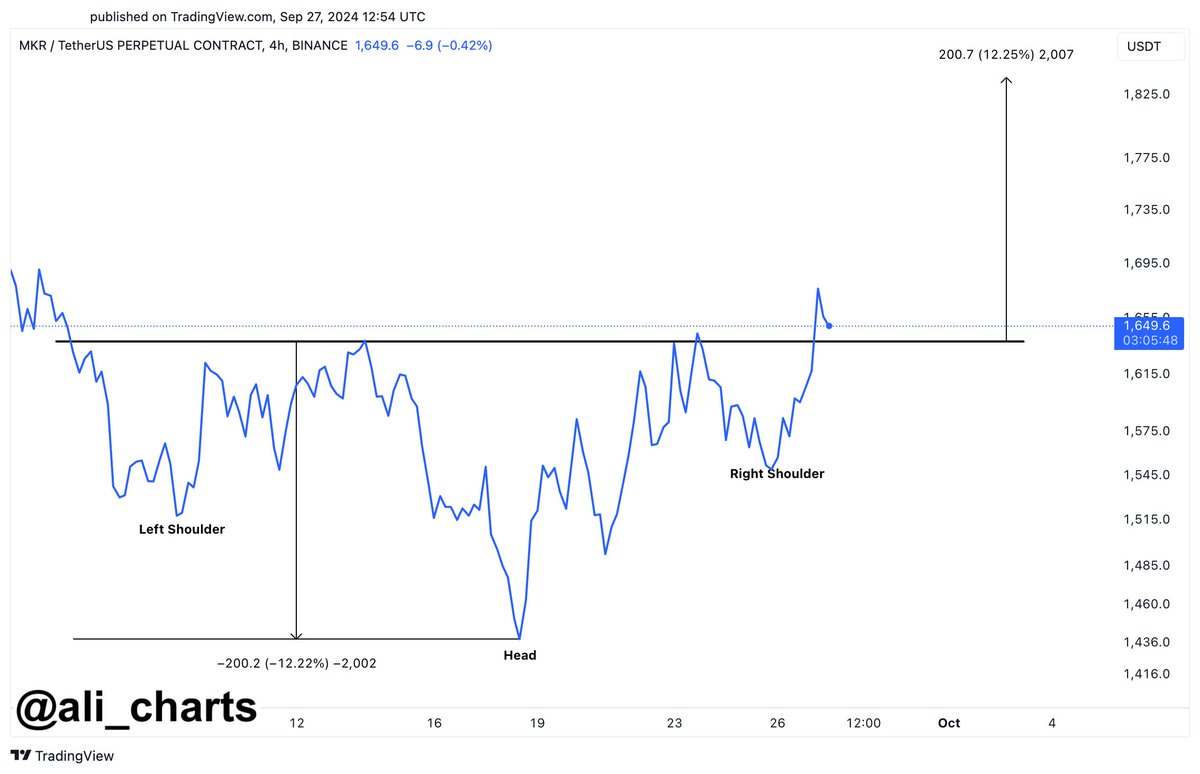

Martinez also notes the decentralized finance (DeFi) protocol Maker (MKR) appears to be forming an inverse head and shoulders pattern in the four-hour time frame. An inverse head and shoulders structure is typically considered a bullish reversal pattern as it indicates that buyers are no longer waiting for prices to revisit recent lows before stepping in.

The analyst notes the pattern indicates a possible 12% breakout for MKR, which is trading at $1,700 at time of writing. The 65th-ranked crypto asset by market cap is up over 5% in the past 24 hours.

Conversely, Martinez notes that the Tom DeMark (TD) Sequential indicator presented a bearish signal on the daily chart for LINK, the native asset of the decentralized oracle network Chainlink. The signal indicates the possibility of a brief correction.

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

LINK is trading at $12.72 at time of writing. The 17th-ranked crypto asset by market cap is up more than 1% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here