A crypto analytics platform says that two under-the-radar altcoins are flashing bullish signals as fear, uncertainty, and doubt (FUD) centered around digital assets rise.

According to new data from market intelligence firm Santiment, low-cap altcoins such as decentralized finance (DeFI) platform Balancer (BAL) and decentralized application builder Chromia (CHR) are primed to see gains after traders who are shorting them face liquidation.

“Altcoins with extremely low funding rates are a great signal to buy into the crowd’s FUD right now. In the previous 24 hours, three prominent assets stand out as projects with heavy shorting on Binance: Balancer, Chromia, and Celer. Short liquidations lead to rises.”

Balancer and Chromia are trading for $2.53 and $0.231 at time of writing, respectively.

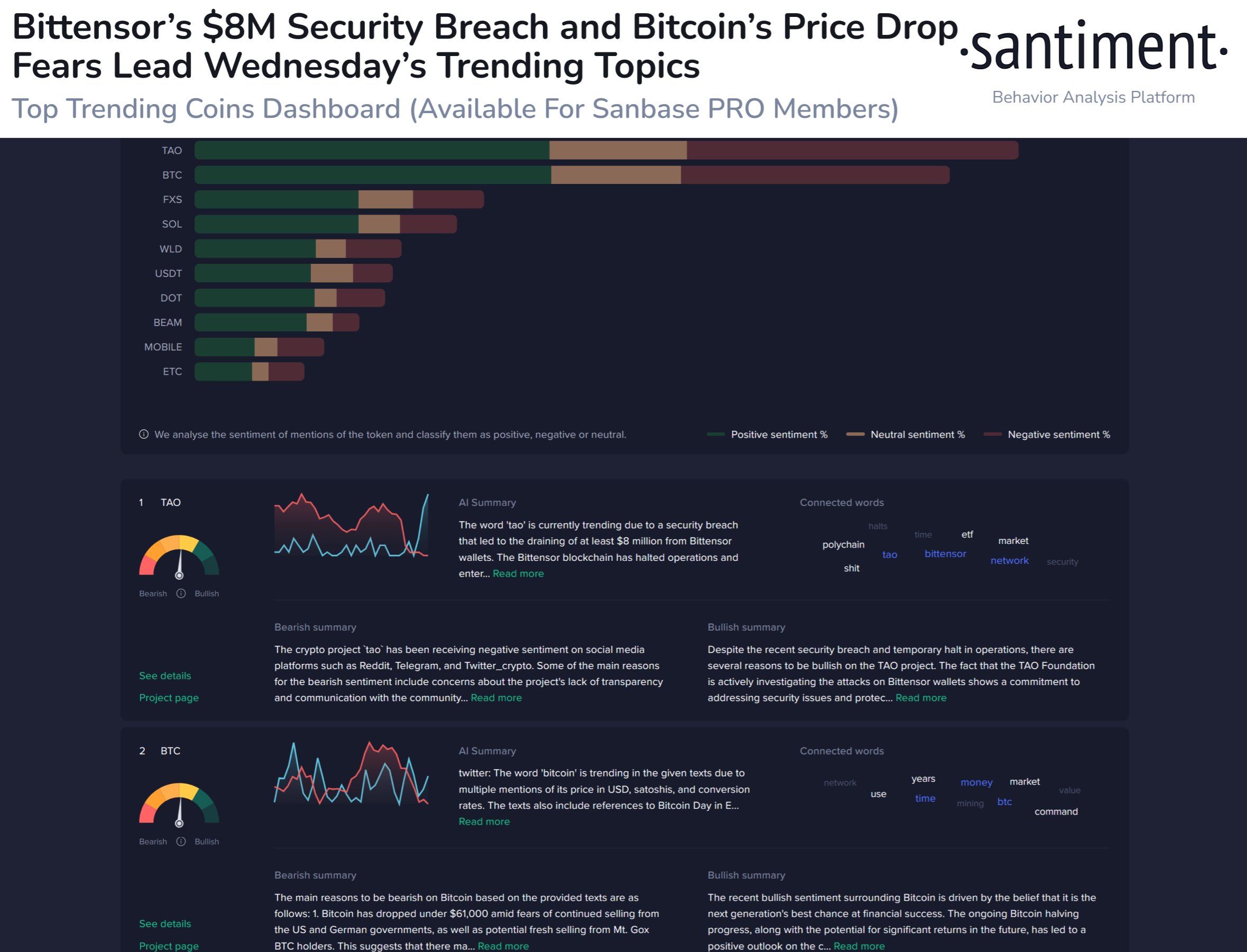

Santiment says that certain key events – such as the hack of machine intelligence marketplace Bittensor (TAO) and Bitcoin (BTC) dropping below the $60,000 price level – have heightened discussions of FUD related to the crypto markets.

“Fear is in the air, as traders are discussing:

-Bittensor has plummeted following a security breach that collectively drained $8 million worth of TAO from wallets.

-Bitcoin briefly dropped below $60,000, leading to traders expressing worrying narratives and interest in ‘selling their bags’ before it’s too late.

There should be a window to capitalize while FUD is this high from the crowd.”

Bitcoin and Bittensor are trading for $58,226 and $224 at time of writing, respectively.

Lastly, Santiment highlights that altcoin trader wallets indicate that they are “well underwater.” Furthermore, the analytics firm notes some altcoins are historically in “historically good buy zones,” including CHR, metaverse gaming protocol Highstreet (HIGH), and digital advertising blockchain Basic Attention Token (BAT).

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Featured Image: Shutterstock/VAlex/Mingirov Yuriy

Read the full article here