Looking for the best crypto platforms in Australia? With the growing popularity of digital currencies, choosing the right platform is crucial. The best crypto exchanges in Australia offer various features, from competitive fees to strong security measures and a wide range of supported coins.

In this guide, we will review the best Australian crypto exchanges based on their trading fees, supported cryptocurrencies, AUSTRAC licensing, and AUD payment methods.

Key Takeaways:

- The best crypto exchanges in Australia are Swyftx, CoinSpot, OKX, Coinbase, Kraken, CoinJar, Bybit, eToro Australia, Independent Reserve, and Crypto.com due to their high security, AUSTRAC registration, and competitive fees.

- The most popular Australian cryptocurrency exchanges support many AUD payment methods like bank transfers, PayID, and credit/debit cards for convenient deposits and withdrawals.

List of Top Australian Crypto Exchanges and Platforms

We have reviewed 30+ top crypto trading platforms in Australia based on features such as fees, security, regulations, supported coins, ease of use, and AUD deposit methods. Here is the list of the 14 best crypto exchanges in Australia:

- Swyftx: Overall best crypto exchange Australia

- CoinSpot: Best due to AUSTRAC registration

- OKX: Best for advanced crypto trading tools

- Coinbase: Best for high-security standards

- Kraken: Best for crypto and NFT trading

- CoinJar: Best for long-standing reputation

- Bybit: Best for leveraged trading in Australia

- eToro Australia: Best for social trading features

- Independent Reserve: Best for trading with advanced crypto tax reporting

- Crypto.com: Best crypto staking platform in Australia

- BTC Markets: Best for efficient AUD transactions

- Digital Surge: Best for competitive trading fees

- Uniswap: Best Australian decentralized exchange

- MEXC: Best for zero trading fees

Best Bitcoin and Crypto Exchanges in Australia Reviewed

Here is a detailed overview of top Australian cryptocurrency trading platforms:

Swyftx

Swyftx has emerged as a leading cryptocurrency exchange in Australia since its launch in 2018. The platform now serves over 700,000 users across Australia and New Zealand. Swyftx offers trading for 400+ cryptocurrencies, including popular coins like Bitcoin, Ethereum, and Dogecoin, as well as a wide range of altcoins.

The exchange boasts competitive fees, with a flat 0.6% trading fee that decreases for high-volume traders. Deposits via AUD bank transfers are free, while third-party payment processing incurs a small fee. Swyftx’s user-friendly interface caters to both beginners and experienced traders, featuring a demo mode for practice trading with virtual funds.

Swyftx prioritizes security, implementing measures like two-factor authentication and biometric login. The platform stores 90% of user funds in offline cold storage for added protection. Swyftx is registered with AUSTRAC and complies with Australian regulations, providing users with a sense of legitimacy and trust.

The exchange offers additional features like recurring buys for dollar-cost averaging and a mobile app for on-the-go trading. Swyftx’s customer support is available 24/7 via live chat, with an average response time of under 5 minutes.

Pros

- Wide selection of 400+ cryptocurrencies

- Advanced features including recurring buys, bundles, and SMSF accounts

- User-friendly interface with demo mode

- Registered with AUSTRAC, enhancing trust

- 24/7 customer support and mobile app for Android and iOS

Cons

- No leverage trading or futures contracts for advanced traders

- High withdrawal fees apply for some cryptocurrencies

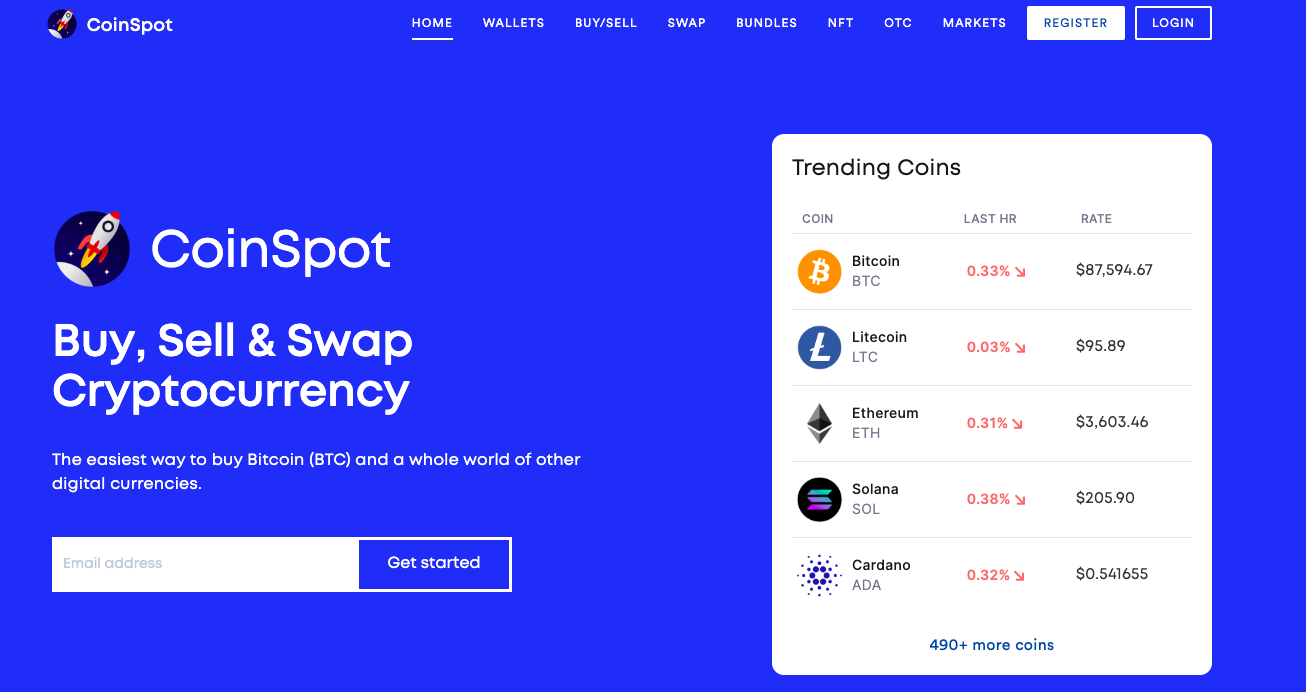

CoinSpot

CoinSpot, founded in 2013 and headquartered in Melbourne, is one of Australia’s largest and most trusted cryptocurrency exchanges. With over 2.5 million users, it supports more than 490 cryptocurrencies, offering the widest variety of digital assets among Australian exchanges.

It is certified by Blockchain Australia and has achieved ISO 27001 certification for information security, ensuring a high level of safety for users’ funds and data.

The exchange charges a flat 1% trading fee, which is relatively high compared to some international competitors like Binance but competitive within the Australian market. It offers several deposit methods, including POLi, PayID, and bank transfers, all free of charge. However, card and cash deposits incur fees of 1.88% and 2.5%, respectively.

CoinSpot also provides unique features like crypto staking with flexible options, allowing users to earn returns without locking their assets for extended periods. It offers 23 staking options, with some assets yielding as high as 78% APY. Plus, CoinSpot has an NFT marketplace that supports direct purchases of popular NFTs such as Bored Ape Yacht Club and Cool Cats.

Pros

- Over 490 cryptocurrencies available for trading

- Strong security with ISO 27001 certification and features like 2FA and anti-phishing measures

- Easy for beginners with various deposit methods

- 24/7 Australian-based customer support

- Diverse staking options and an integrated NFT marketplace

Cons

- A flat 1% fee on trades, which is higher than competitors

- It lacks advanced trading tools like futures and margin trading

OKX

OKX is a well-known Australian cryptocurrency exchange that was launched in 2017. It operates globally and offers a broad range of trading options, including spot trading, futures, and decentralized finance (DeFi) products.

OKX supports over 350 cryptocurrencies, which makes it a versatile platform for traders. The exchange is recognized for its competitive fee structure, with trading fees starting as low as 0.08% for makers and 0.1% for takers. These fees can be further reduced through high trading volumes or holding OKB, the platform’s native token.

The platform uses multiple layers of protection, including multi-factor authentication and cold storage for assets, which helps safeguard user funds. OKX also publishes regular Proof of Reserves reports to maintain transparency. However, it’s important to note that OKX is not available in the U.S. and Canada due to regulatory restrictions, which limit its accessibility in those regions.

OKX provides a variety of passive income opportunities, including staking, savings accounts, and more complicated products like Shark Fin and Dual Investment. These products let you earn interest on your investments throughout a variety of periods, whether flexible or fixed.

The platform also includes advanced trading tools like copy trading, which allows newbies to emulate the techniques of experienced traders, and trading bots, which automate transactions based on established strategies.

Pros

- Low and competitive trading fees

- No deposit and crypto-to-crypto currency conversion fees

- Wide range of supported cryptocurrencies

- Offers advanced tools like copy trading, and trading bots

- Strong security measures and transparent operations

Cons

- Not available in the U.S. and Canada

- Past controversies related to false trading volumes

Coinbase Australia

Coinbase is one of the best crypto trading platforms in Australia, offering a platform for buying, selling, and storing digital assets. It was founded in 2012 and became the first major cryptocurrency exchange to go public on NASDAQ in 2021 under the ticker COIN.

Coinbase is available in over 100 countries, including Australia, and serves over 103 million verified users with $250+ billion in assets on the platform.

In Australia, Coinbase supports over 240 cryptocurrencies, including popular assets like BTC, ETH, MATIC, and ADA. Coinbase provides features like a user-friendly interface, a mobile app, and educational tools through Coinbase Earn, where users can earn crypto by learning about various digital assets.

Coinbase’s fees are higher compared to other Australian exchanges, with transaction costs ranging from 0.4% to 4.5% depending on the method and volume of trade. The platform supports AUD deposits via PayID, and you can make direct purchases using credit or debit cards with fees of around 3.99% per transaction.

Pros

- High-security standards, including 98% of assets stored in offline cold storage

- High liquidity and trading volume

- Make fast AUD deposits and withdrawals using PayID

- $20 worth of BTC welcome bonus

- Coinbase Wallet for DeFi users

Cons

- Higher transaction and deposit fees compared to other Australian exchanges

- Users cannot withdraw AUD directly to the bank account

Kraken

Kraken is another global cryptocurrency exchange for Australians that has been in business since 2011. It provides services to over 10 million customers in more than 190 nations. It offers spot trading, margin trading with leverage up to 5x, trading futures with more than 100 contracts, and staking services. More than 200 coins are supported on the site.

Kraken operates in Australia as a registered Digital Currency Exchange Provider with AUSTRAC and holds ISO 27001 certification, demonstrating its commitment to high-security standards and regulatory compliance. As a leader in transparency, Kraken also pioneered the Proof of Reserves Audit.

You can enjoy the convenience of free and instant AUD deposits and withdrawals through reliable methods like PayID and Osko bank transfers, making it easy to move funds in and out of the platform.

Kraken offers deep liquidity and competitive spreads across a variety of AUD trading pairs, including popular ones like BTC/AUD, USDT/AUD, and ADA/AUD. If you’re looking for more trading options, you can also convert your AUD to USD, giving you access to a wider selection of global crypto markets.

With Kraken Pro, you start with a low fee of 0.25%, and by increasing your 30-day trading volume, you could even reduce your fees to zero. This low-cost structure is ideal if you’re a frequent trader. For advanced trading, Kraken Pro provides a customizable interface that allows you to engage in spot trading, manage AUD funding, and more—all within one powerful platform.

If you are interested in more private and personalized trading experiences, Kraken’s Over-The-Counter (OTC) trade desk offers tailored services for high-value and institutional transactions. You can trade directly with the desk in AUD through chat or via the OTC portal.

Pros

- Advanced security measures, including 2FA, AUSTRAC registration, and cold storage for most funds

- NFT marketplace for artists and art collectors

- Offers margin, futures, and staking, suitable for more experienced traders

- High trading volume supports large transactions with minimal price impact

- Supports AUD deposits with instant funding options like PayID

Cons

- Some features, like leverage trading, may not be available in all regions due to regulatory requirements

- Does not support new or low-cap altcoins for trading

CoinJar

CoinJar is Australia’s longest-running cryptocurrency exchange, founded in 2013. The platform supports over 60 cryptocurrencies. It allows users to start trading with as little as $10 and offers easy-to-use mobile and web interfaces. It also supports multiple currencies, including AUD, EUR, and GBP, for deposits and trading, with funds quickly accessible through bank transfers, PayID, or credit and debit cards.

CoinJar is known for its strong security measures, storing over 90% of its digital assets offline in secure locations and using private key-enabled, multi-sig wallets. Plus, it offers the CoinJar Card, a prepaid Mastercard that enables users to spend their cryptocurrencies like cash, either online or in-store, without monthly fees. The card integrates with Apple Pay and Google Pay.

The exchange also features CoinJar Bundles, which allow you to invest in themed baskets of cryptocurrencies, facilitating portfolio diversification and automated investing through dollar cost averaging.

Despite its many advantages, CoinJar charges a 2% fee on credit card purchases. CoinJar’s strong customer support and its recognition as Blockchain Australia’s 2023 Digital Currency Exchange of the Year further enhance its reputation as a reliable and accessible option for cryptocurrency trading in Australia.

Pros

- Fast transactions with PayID and bank transfers

- CoinJar Card offers crypto spending with no monthly fees

- Fully registered and compliant with AUSTRAC and the Financial Conduct Authority UK

- Buy Bitcoin and other cryptocurrencies with your SMSF account

- OTC market for high-volume traders

Cons

- High trading fees, 1% for buying/selling crypto

- No advanced trading tools and markets

- A limited selection of coins

Bybit

Bybit is Australia’s top derivatives exchange, known for its comprehensive trading capabilities and easy-to-use design. Bybit was founded in 2018 and has developed significantly, with over 40 million registered users worldwide.

The platform provides a variety of trading alternatives, including spot trading, derivatives, and futures. Bybit offers over 1200 coins, giving a diverse range of trading pairings.

One of Bybit’s key strengths is its advanced trading tools. The exchange offers leveraged trading up to 100x on various contracts, allowing traders to maximize their potential profits, albeit with higher risks. Bybit’s trading engine is designed to handle up to 100,000 transactions per second, ensuring a smooth trading experience even during high volatility periods. The platform is also known for its 99.99% system functionality uptime.

Furthermore, Bybit has introduced unique solutions such as the Unified Trading Account, which streamlines trading by merging many asset classes into a single account. The platform also has a copy trading tool, which allows inexperienced traders to duplicate the techniques of top-performing traders.

Pros

- Up to 100x leverage on derivatives trading

- Multi-signature cold wallet storage and a dedicated insurance fund

- Handles 100,000 transactions per second, ensuring smooth trades

- User-friendly mobile app for beginners

- Crypto trading bots with DCA and grid strategies

Cons

- Leveraged trading may be limited for Australians due to regulations

- Limited options for direct AUD fiat currency deposits

eToro Australia

eToro is the best cryptocurrency broker in Australia, noted for its extensive asset class offerings and user-friendly layout. Founded in 2007, eToro has grown into a worldwide network that supports more than 30 cryptocurrencies, including Bitcoin, Ethereum, and XRP.

It is a multi-asset platform that allows users to trade equities, ETFs, commodities, as well as cryptocurrency. The platform has built a strong reputation for its novel CopyTrader function, which allows users to mimic successful investors’ transactions, making it a good alternative for newbies.

There is a minimal $10 minimum investment required for cryptocurrency trading, even smaller investors can participate. Plus, stock trading on the site is charged a fixed price of $2.

eToro’s social trading network, which enables users to interact with others, exchange ideas, and track market movements, is one of its most notable features. The app helps novice users practice their trading methods risk-free by providing a $100,000 virtual fund trial account.

Regarding costs, eToro charges a 1% fee on cryptocurrency transactions yet provides competitive spreads for cryptocurrency trading.

Pros

- Low $10 minimum deposit for crypto trades

- CopyTrader feature for replicating successful trades

- Regulated by ASIC, providing a secure environment

- User-friendly interface with a mobile app

- Demo account with $100,000 virtual funds for practice

Cons

- Limited numbers of digital assets are supported

- Customer support can be slow at times

- Higher spreads on some cryptocurrency pairs

Independent Reserve

Independent Reserve is one of Australia’s most trusted cryptocurrency exchanges, established in 2013 and based in Sydney. It has over 300,000 users across Australia, New Zealand, and Southeast Asia, and supports 30 of the most popular cryptocurrencies. The exchange allows trading with four fiat currencies: Australian Dollar (AUD), New Zealand Dollar (NZD), U.S. Dollar (USD), and Singapore Dollar (SGD).

The platform offers insurance against large-scale hacks, making it one of the safest options for Australian crypto traders. The exchange is regulated by AUSTRAC, ensuring compliance with Australian financial laws.

Independent Reserve is especially popular among high-net-worth investors and self-managed super fund (SMSF) users. This is due to its over-the-counter (OTC) desk and advanced tax reporting features. These tools help users manage their portfolios and simplify tax obligations.

However, the exchange has a few drawbacks. Its selection of cryptocurrencies is smaller compared to other Australian exchanges like Swyftx, which may not appeal to those seeking to trade lesser-known coins. Additionally, while the platform offers advanced trading tools, its interface may feel less intuitive for beginners.

Pros

- Secure with 2FA, cold storage, and optional insurance

- Low fees, starting at 0.5%, dropping to 0.02% for large traders

- Excellent SMSF support and advanced tax reporting tools

- Instant deposits via Osko/PayID

Cons

- Limited cryptocurrency options (only 30+ available)

- The trading interface may be complex for beginners

Crypto.com

Crypto.com is one of the safest Australian crypto exchanges. Established in 2016, it offers a robust platform for trading over 350 cryptocurrencies. It offers features like staking, lending, and earning interest on crypto assets. Users can also buy and sell NFTs through its marketplace.

Australian users can easily deposit and withdraw Australian dollars (AUD) via bank transfer, credit cards, and PayID, among other methods. The platform provides a competitive edge for users who hold Crypto.com’s native CRO token, offering fee discounts and higher returns on staking—up to 14.5% annually on certain cryptocurrencies.

Crypto.com’s Visa debit card is a key feature that allows you to spend crypto on everyday purchases. Depending on the amount of CRO staked, cardholders can earn up to 5% cashback. Additionally, the app is available on desktop and mobile, providing seamless access to manage assets.

Pros

- Transfer AUD via NPP and Apple/Google Pay

- Registered with AUSTRAC and licensed by ASIC

- Trusted by over 100 million users worldwide

- Recurring buys with daily, weekly, or monthly trades

- Enjoy up to 5% back on all spending with a Crypto.com Visa card

Cons

- Slow customer support times

- Higher trading fees for non-CRO holders

- Lack of advanced trading tools

BTC Markets

BTC Markets is another of Australia’s Bitcoin exchanges, founded in 2013. Based in Melbourne, it serves over 325,000 users and has processed more than AUD 24 billion in trades. It’s a platform tailored to both retail and institutional investors, offering a range of services from simple crypto purchases to advanced trading options.

The platform supports 36 different cryptocurrencies, including Bitcoin, Ethereum, XRP, and stablecoins like USDT. For fiat-to-crypto transactions, BTC Markets facilitates Australian Dollar (AUD) deposits and withdrawals through PayID and Osko, ensuring quick and fee-free transactions. It also supports recurring buys, making it easy for long-term investors to automate purchases over time.

It has obtained ISO 27001 certification and is registered with AUSTRAC. Furthermore, a robust 99.99% uptime on the platform guarantees trustworthy trade execution. The platform also caters to large trades through an Over-the-Counter (OTC) desk for institutional clients. However, its services may feel limited due to a lack of advanced tools and a relatively smaller selection of cryptocurrencies compared to international exchanges.

Pros

- Strong security (ISO 27001 certified)

- Supports AUD transactions and fast deposits

- Access advanced order types including limit, market, stop limit, and dollar cost averaging

- Track your total asset holdings, values, and equity over time

- Credit your wallet with AUD in seconds using Osko PayID, direct deposit, or card

Cons

- Limited cryptocurrency selection (only 36 assets)

- No live chat customer support

Digital Surge

Digital Surge is a popular Australian crypto exchange offering access to over 310 cryptocurrencies. The platform is known for its competitive fees, charging a flat rate of 0.5% on trades. There are no fees for AUD deposits made via PayID or bank transfers, which is a significant cost-saving feature.

High-volume traders can reduce fees further. Digital Surge offers fast and free AUD withdrawals, making it efficient for moving funds in and out of the exchange. To improve safety, the platform also employs strong identity verification procedures, is registered with AUSTRAC, and adheres to stringent regulatory compliance.

Its bill payment service, which enables customers to pay Australian bills with Bitcoin, is one of its distinctive features. Moreover, Digital Surge facilitates smooth interaction with tax reporting software, which helps customers handle tax liabilities associated with Bitcoin holdings.

Although the platform is great for novices, experienced traders may find it less appealing because it does not have sophisticated features like margin trading. Additionally, it is less helpful for users from other countries because it only accepts AUD for currency transactions.

Pros

- Over 310 cryptocurrencies are available

- Secure with 2FA and cold storage

- Bitcoin bill payment option

- Simple interface, ideal for beginners

- Secure & instant 24/7 deposits via PayID

Cons

- Lacks advanced trading features

- Only supports AUD for fiat transactions

- No credit card deposit option

Uniswap

Uniswap is a decentralized exchange (DEX) in Australia. It runs on the Ethereum blockchain. Using an Automated Market Maker (AMM) system, users can trade ERC-20 tokens without the need for middlemen. This platform performs transactions directly between peers via liquidity pools, removing the requirement for an order book or a central authority.

For Australians, Uniswap provides a decentralized, self-custody alternative to centralized exchanges. You can retain control over your crypto assets rather than third-party accounts. However, one notable disadvantage is Ethereum’s high gas prices, which can make smaller trades costly, particularly during times of network congestion.

All smart contracts and transaction data on Uniswap are verifiable and publicly accessible due to its transparency and open-source nature. Nevertheless, You must have digital currency to start trading because it does not support fiat money.

Pros

- Supports thousands of ERC-20 tokens on the Ethereum blockchain

- No account or identity verification is required

- Users retain full control of their funds

- Liquidity providers earn 0.3% from trades

- No central authority, enhancing security and privacy

Cons

- Ethereum transaction costs can be high

- Only crypto-to-crypto trades are allowed

- Smaller pools can lead to price slippage during trading

MEXC

MEXC is the cheapest cryptocurrency exchange in Australia. One of its standout features is the no-KYC crypto trading, allowing users to withdraw up to 10 BTC daily without completing identity verification. This makes it an appealing choice for privacy-conscious traders. Additionally, MEXC is also a zero-fee crypto exchange. It charges zero fees for maker trades on its spot market, which helps users save on trading costs.

The platform supports more than 2,800 cryptocurrencies, including lesser-known tokens not available on most exchanges. Its comprehensive selection caters to users looking to diversify their portfolios with niche assets. MEXC also offers a variety of advanced trading tools, such as copy trading and futures trading, with leverage options up to 200x for futures.

With its customizable TradingView charts, easy-to-use user interface, and instructional features like demo trading, the platform caters to traders of all skill levels. It provides additional features like trailing stop orders and API integration for experienced traders.

Pros

- Withdraw up to 10 BTC daily without verification

- Zero maker fees on spot trading

- Wide selection of coins, over 2,800 cryptocurrencies

- High leverage with up to 200x on futures

- Robust security like Multi-factor authentication and cold storage

Cons

- Does not support AUD deposits and withdrawals

- It is a highly unregulated crypto trading platform

How to Choose the Best Crypto Exchange for Australian Investors?

When deciding on the finest cryptocurrency exchange in Australia, numerous criteria must be examined. Each component has a direct impact on the experience of trading digital assets, from simplicity of use to security and cost.

Here’s a full breakdown of the major aspects to consider when choosing an Australian cryptocurrency exchange.

1. Security and Regulatory Compliance

Top Australian platforms implement multi-layered security protocols, including advanced encryption techniques, regular penetration testing, and cold storage solutions that keep up to 95% of user assets offline. Two-factor authentication (2FA) is now standard, with some exchanges offering biometric verification for added security.

AUSTRAC registration is crucial, ensuring exchanges adhere to Australia’s strict anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Leading exchanges also conduct regular third-party audits, providing transparency about their security measures and financial health. Some have even established bug bounty programs, offering rewards of up to $100,000 for identifying critical vulnerabilities.

2. Trading Fees

The next consideration is fees. All crypto exchanges charge fees for trading, depositing, and withdrawing funds. The fee structure varies from one exchange to another. In some cases, there are flat fees for each transaction, while others may use a percentage-based system.

On average, trading fees in Australia range between 0.1% and 1%. For instance, if you trade $1,000 worth of Bitcoin, a 0.5% fee would cost $5. While these fees may seem small, they can accumulate over time, especially for frequent traders.

However, it’s important to look beyond just trading fees. Deposit fees for bank transfers are often free, but credit card deposits can incur charges of 2-4%. Withdrawal fees vary by cryptocurrency, with Bitcoin withdrawals typically costing around 0.0005 BTC.

Some Australian exchanges have introduced fee-free trading periods for new users or during promotional events. Additionally, be aware of spread fees on instant buy/sell features, which can be as high as 5% on some platforms.

3. Liquidity and Trading Volume

Liquidity is the lifeblood of efficient trading, directly impacting the speed and cost of transactions. Australian trading exchanges have seen significant growth in trading volumes, with top platforms handling anywhere from $500 million to over $5 billion in daily trades.

Higher liquidity typically translates to tighter bid-ask spreads, reducing slippage and ensuring better price execution. Some exchanges provide liquidity data for each trading pair, allowing traders to assess market depth.

During peak trading times, usually between 10 AM and 2 PM AEST, liquidity tends to be at its highest. Exchanges with global operations often provide better liquidity due to their larger user base, but ensure they still cater specifically to the Australian market with AUD trading pairs.

4. Supported Cryptocurrencies

While Bitcoin and Ethereum continue to dominate trade volume on most exchanges, demand for altcoins is increasing. Top exchanges currently list cryptocurrencies ranging from 50 to over 400, including developing DeFi tokens, NFT-related coins, and blockchain gaming assets.

Some platforms have included “launchpad” capabilities, which let you participate in initial coin offerings (ICOs) and token sales for new projects. The option to stake a variety of proof-of-stake coins directly on the exchange is growing more popular, with some giving yearly APR of up to 20% on specific assets.

5. User Experience and Interface

Leading Australian exchanges have invested heavily in intuitive designs, with features like customizable dashboards, real-time charting tools, and one-click trading.

Mobile apps have become increasingly sophisticated, with some boasting over 500,000 downloads and ratings above 4.5 stars on app stores. These apps often include features like price alerts, portfolio tracking, and even biometric login for enhanced security.

Some exchanges have introduced “lite” versions of their platforms, catering to beginners with simplified interfaces while still offering advanced trading views for experienced users. The ability to customize the trading interface, including dark mode options and widget arrangements, is becoming a standard feature on top Australian platforms.

6. AUD Payment Methods

While bank transfers remain the most cost-effective method, with processing times typically between 1-3 business days, instant options are gaining popularity.

PayID and NPP (New Payments Platform) transfers offer near-instant AUD deposits at most major exchanges. Credit and debit card payments, while convenient, often incur fees of 2-4%.

Some exchanges have partnered with specific Australian banks to offer reduced fees or instant transfers. POLi payments are supported by several Australian platforms, providing a quick deposit option without credit card fees.

A few forward-thinking exchanges have even begun exploring integration with emerging payment technologies like Open Banking, potentially offering more seamless and secure fund transfers in the future.

7. Customer Support

Reliable customer service may make or break the user experience. Top Australian crypto exchanges now provide 24/7 service via several channels. Some have deployed AI-powered chatbots capable of answering common questions promptly.

Response times vary, but top exchanges strive to answer simple questions in minutes and handle most difficulties within 24 hours. Some platforms now provide VIP service for high-volume traders, including specialized account managers and priority resolution.

Community-driven help via forums and knowledge bases is also becoming more widespread, with some exchanges featuring libraries of over 500 articles and video courses.

Trading Features and Tools

Many Australian exchanges now accept advanced order types like OCO (One-Cancels-the-Other) and trailing stops, in addition to the normal market, limit, and stop-loss orders.

Most major platforms provide standard API access for algorithmic trading, and some even include simple tools for building bots to automate trading processes. You can also check features such as staking, leverage trading, options trading, and the NFT market.

8. Reputation

Finally, it’s critical to assess the exchange’s general repute. This can be accomplished by looking through ratings, reading user reviews, and finding out if the platform has ever been a part of any hacks or scandals.

It’s more probable that a reputable exchange with excellent feedback from other Australian consumers would offer a safe and dependable service. For example, Swyftx and CoinSpot have a solid reputation as reliable platforms. Seek out exchanges that have a track record of success, since this is a reliable sign.

Comparing the Best Cryptocurrency Exchanges in Australia

| Exchange | Trading Fees | Supported Coins | AUSTRAC Licensed | Payment Methods |

| Swyftx | Flat 0.6% (decreases for high volume) | 400+ | Yes | Bank, PayID, Credit/Debit Cards |

| CoinSpot | Flat 1% | 490+ | Yes | POLi, PayID, Bank Transfers, Credit/Debit Cards |

| OKX | From 0.08% (makers) to 0.1% (takers) | 350+ | Yes | Bank, PayID, Credit/Debit Cards |

| Coinbase | 0.4% – 4.5% | 240+ | Yes | PayID, Credit/Debit Cards |

| Kraken | From 0.4% (takers) to 0.25% (makers) | 200+ | Yes | PayID, Osko, Bank Transfers |

| CoinJar | 1% for trades, 2% for credit card purchases | 60+ | Yes | Bank Transfers, PayID, Credit/Debit Cards |

| Bybit | 0.1% maker/taker | 1200+ | No | Third-party payments only |

| eToro Australia | 1% | 30+ | Yes | Bank Account, Credit/Debit Cards |

| Independent Reserve | From 0.5% to 0.02% (high volume) | 30+ | Yes | Osko, PayID, Bank Transfers |

| Crypto.com | 0.15% maker and 0.3% taker | 350+ | Yes | Bank, PayID, Credit/Debit Cards |

| BTC Markets | Flat 0.1% | 36 | Yes | PayID, Osko, Bank Transfers |

| Digital Surge | Flat 0.5% | 310+ | Yes | PayID, Bank Transfers |

| Uniswap | Gas fees (variable) | Thousands (ERC-20) | No | – |

| MEXC | 0% | 2800+ | No | Not supported |

What is a Crypto Exchange?

A cryptocurrency exchange is an online marketplace where crypto tokens and products can be purchased, sold, and traded. By serving as middlemen between buyers and sellers, these platforms let users convert fiat money, such as Australian dollars (AUD), into digital assets, such as BTC, ETH, and countless other cryptocurrencies.

Approximately 17.7% of the population in Australia, or over 4.6 individuals, possess cryptocurrencies, with Bitcoin being the most widely used. Cryptocurrency exchanges are essential to these transactions because they give Australians an easy-to-use interface to dive into the realm of digital assets.

Types of Crypto Exchange in Australia

- Centralized Exchanges (CEX): These are the most common type of crypto exchange. They are run by companies that manage the transactions and hold users’ assets. CEXs are popular because of their ease of use, security features, and liquidity. Examples include OKX Australia, CoinSpot, and Swyftx.

- Decentralized Exchanges (DEX): DEXs allow peer-to-peer trading without the need for a central authority. Transactions are conducted directly between users, and the platform does not control funds. This type of exchange offers more privacy but less customer support. Popular DEXs include Uniswap and PancakeSwap.

- Brokerage Exchanges: These platforms allow users to buy cryptocurrencies directly from the exchange at a fixed price. Brokerages are ideal for beginners due to their simplicity, though they often charge higher fees. Examples include eToro Australia.

- Peer-to-peer (P2P) Cryptocurrency Exchanges: P2P exchanges in Australia let users transact with each other directly and without the need for middlemen. Unlike traditional exchanges, these platforms – like Paxful and LocalBitcoins – allow buyers and sellers to bargain over pricing and payment options. To guarantee safe transfers, P2P exchanges usually use escrow services, which store bitcoin until both parties fulfill their end of the bargain. They are well-liked because they provide anonymity and a range of payment options, like as cash and bank transfers, for trading.

How to Buy Cryptocurrency in Australia: Step-by-Step Guide

Buying cryptocurrency in Australia is a straightforward process. Here’s a step-by-step guide:

- Choose a Crypto Exchange: Select an Australian exchange that suits your needs. For beginners, platforms like CoinSpot and Swyftx are popular due to their user-friendly interfaces. If you prefer advanced trading features, OKX Australia is a great choice.

- Create an Account: To register on the exchange, enter your email address, password, and identification. In Australia, the majority of exchanges need to Know Your Customer (KYC) verification, which entails submitting identity-verifying papers such as a passport or driver’s license.

- Deposit Money: Put money into your exchange wallet as soon as your account has been validated. The majority of Australian exchanges let users deposit AUD by PayID, credit card, or bank transfer. Some also take POLi and PayPal payments.

- Pick a Cryptocurrency: Look over the list of cryptocurrencies that are available and decide which one you wish to buy. Notable options include Ripple, Ethereum, and Bitcoin.

- Buy Crypto: To purchase cryptocurrencies, enter the desired amount and complete the transaction. You have the option to purchase a certain amount of cryptocurrencies or a predetermined amount of AUD. After the trade is completed, your cryptocurrency will show up in your exchange wallet.

- Transfer to a Secure Wallet (Optional): To increase security, consider transferring your BTC to a personal hardware wallet. This reduces the danger of losing digital assets if the exchange is hacked. You can use wallets like Ledger and Trezor.

Are Crypto Exchanges Legal in Australia?

Yes, crypto exchanges are legal in Australia. The government has adopted a progressive approach to cryptocurrency regulation, attempting to strike a balance between innovation and consumer safety. Since 2018, cryptocurrency exchanges in Australia have been required to register with AUSTRAC (Australian Transaction Reports and Analysis Centre) and follow AML/CTF legislation.

Exchanges that provide certain cryptocurrency-related financial products, such as crypto derivatives, are required by the Australian Securities and Investments Commission (ASIC) to possess an Australian Financial Services (AFS) license. To improve consumer safety, the Australian government said in 2022 that it would be implementing a regulatory structure for cryptocurrency exchanges in the upcoming years.

While crypto exchanges are legal, it’s important to note that not all cryptocurrencies or crypto-related activities are permitted. For example, initial coin offerings (ICOs) are subject to strict regulations, and some privacy coins have been delisted from Australian exchanges due to regulatory concerns.

How is Cryptocurrency Taxed in Australia?

The Australian Taxation Office (ATO) views cryptocurrency as an asset that is liable to capital gains tax (CGT). This implies that any profit or loss will be subject to capital gains or losses taxation.

This is how it operates:

Buying and Holding: When you buy a cryptocurrency and hold it as an investment, you don’t need to pay taxes until you sell or trade it.

Selling or Trading: When you sell or trade cryptocurrency for fiat currency (like AUD) or another cryptocurrency, you are required to calculate your capital gain or loss. If you hold the asset for more than 12 months before selling, you may be eligible for a 50% CGT discount.

Let’s say, if you bought 1 Bitcoin for $30,000 and sold it for $50,000, your capital gain is $20,000. If you held it for more than 12 months, you only need to report $10,000 (50% of the gain) in your taxable income.

Using Cryptocurrency for Purchases: According to the ATO, using cryptocurrency to pay for products or services is equivalent to selling the asset.

Airdrops and Staking Rewards: Any cryptocurrency that you get through staking rewards or airdrops is treated as regular income and is to be reported at the current fair market value. Your tax burden will be determined by your income tax rate.

Cryptocurrency as a Business: If you trade cryptocurrencies as a business (e.g., day trading), any profits will be taxed as business income rather than capital gains. In this case, you can also claim deductions for any expenses related to your trading activities.

Record-Keeping: You must maintain thorough records of every transaction that you make, according to the ATO. This contains details on the date of the transaction, the kind of cryptocurrency, the amount, the value in Australian dollars, and the transaction’s intended use. Penalties may result from inaccurately reporting your profits.

You can track and compute your Bitcoin taxes with the use of programs like Koinly and ClearTax.

Conclusion

When exploring the best crypto exchanges Australia, platforms like Swyftx, CoinSpot, OKX, and others stand out for their robust security measures, Australian financial services license, and competitive fee structures.

These exchanges cater to a variety of trading needs, from casual to advanced, with support for diverse AUD payment methods and comprehensive trading tools. Choosing the right exchange depends on your specific requirements, but focusing on those with high security and regulatory compliance is crucial for a safe and efficient trading experience.

FAQs

Is Binance available in Australia?

Binance is available in Australia, but its services are significantly restricted. While Australian users can access basic spot trading for cryptocurrencies, other features like futures, options, and leveraged tokens have been discontinued. This follows increased scrutiny by Australian regulators, leading to the cancellation of Binance Australia’s derivatives license.

As a result, only institutional or wholesale investors may have access to more advanced trading products, but most retail users are barred from derivatives trading.

Are Australian Bitcoin exchanges safe?

Bitcoin exchanges in Australia operate under strict government scrutiny, which enhances their safety. Regulatory bodies mandate that these platforms register with AUSTRAC and follow stringent anti-money laundering protocols.

Many exchanges employ robust security measures, such as offline storage and multi-factor authentication. When selecting an exchange, it’s wise to consider those with an established presence in Australia and a proven track record.

Although exchanges strive to safeguard users’ funds, it’s generally advisable to transfer substantial cryptocurrency holdings to a personal cold wallet for extended storage.

What are the best crypto apps in Australia?

Swyftx and OKX are indeed among the top crypto apps in Australia, each offering unique features. Swyftx is known for its user-friendly interface, competitive fees, and wide range of supported cryptocurrencies. It also provides a demo mode for beginners to practice trading without risk.

OKX, on the other hand, offers a more advanced trading platform with features like futures and margin trading. Both apps provide robust security measures and are compliant with Australian regulations.

Swyftx might be more suitable for beginners and those focused on the Australian market, while OKX could appeal to more experienced traders looking for advanced features.

What is the best crypto exchange for beginners in Australia?

For beginners in Australia, both Swyftx and CoinSpot are excellent crypto exchanges. Swyftx offers a user-friendly interface, competitive fees, and a demo mode for practice trading. It also provides educational resources. CoinSpot is known for its simplicity and wide range of supported cryptocurrencies. It offers instant buy/sell features and a straightforward fee structure.

Swyftx might edge out those looking for lower fees and more advanced features as they grow, while CoinSpot could be preferable for those prioritizing simplicity and a wider selection of cryptocurrencies.

Can I trade AUD directly on Australian exchanges?

Yes, you can trade Australian Dollars (AUD) directly on Australian cryptocurrency exchanges. Most reputable Australian exchanges offer BTC/AUD, ETH/AUD, and more trading pairs.

Exchanges like Swyftx, CoinSpot, and others provide various methods to deposit AUD, including bank transfers, POLi payments, and sometimes credit/debit cards. Trading with AUD also simplifies tax reporting, as there’s no need to calculate gains or losses from currency exchange.

What are the AUSTRAC-licensed crypto exchanges?

All digital currency exchange companies operating in Australia are required by AUSTRAC (Australian Transaction Reports and Analysis Centre) to register and comply with AML/CTF regulations.

Most major Australian exchanges, including Swyftx, CoinSpot, and Independent Reserve, are AUSTRAC-registered. You can examine the status of an exchange’s licensing on the AUSTRAC website.

How do I deposit AUD into a crypto exchange?

The methods for depositing AUD into a crypto exchange can vary between platforms, but common options include:

- Bank Transfer: Often the most cost-effective method, though it may take 1-2 business days.

- PayID: Offers near-instant transfers for supported banks.

- BPAY: Available on some exchanges, usually takes 1-3 business days.

- Credit/Debit Card: Offers instant deposits but often comes with higher fees.

- Cash Deposits: Some exchanges allow cash deposits at specific locations.

Check your chosen exchange’s deposit options and associated fees before making a transaction.

What are the fees for trading cryptocurrency in Australia?

The fees for trading cryptocurrencies in Australia vary according to the exchange and the kind of transaction. In general, you pay deposit, trading, and withdrawal fees.

Bank transfers often have little or no deposit fees, however, credit card deposits may have higher costs. Trading costs generally vary between 0.1% and 1% per transaction. There is also a withdrawal fee and spreads.

Is cryptocurrency trading legal in Australia?

Yes, cryptocurrency trading is legal in Australia. The government has taken a progressive approach to regulating the crypto industry, aiming to foster innovation while protecting consumers and maintaining financial system integrity.

However, crypto exchanges and certain crypto-related services must comply with regulatory requirements, including registration with AUSTRAC and adherence to AML/CTF regulations.

Are there any Australian crypto platforms with no fees?

MEXC is the best no-fee crypto exchange in Australia. It charges 0% maker fees for spot trading. It also has very low (0.01%-0.1%) taker fees. The exchange is highly reliable with no-KYC trading and multiple advanced crypto trading features.

Read the full article here