If you’ve been anywhere on crypto Twitter or on other social media, you may have at least once asked (or heard) the question “Are NFTs Dead?“. Today, we’re going to attempt to answer this nuanced question.

Embark on a journey through the rise, fall, and potential resurgence of NFTs. From the glorious NFT heyday of 2021 to the surprising twists of 2023, explore the challenges, market recalibrations, and shifting sentiments that shape the narrative.

As questions about the sustainability of NFT values emerge, discover the key factors influencing their future beyond the world of art. Dive into this comprehensive guide, navigating the complex evolution and transformative potential of NFTs in the digital landscape.

What Are NFTs?

Non-Fungible Tokens (NFTs) are unique digital assets on a blockchain, distinct and not interchangeable like cryptocurrencies. They’re akin to Pokémon cards, each with a unique identity.

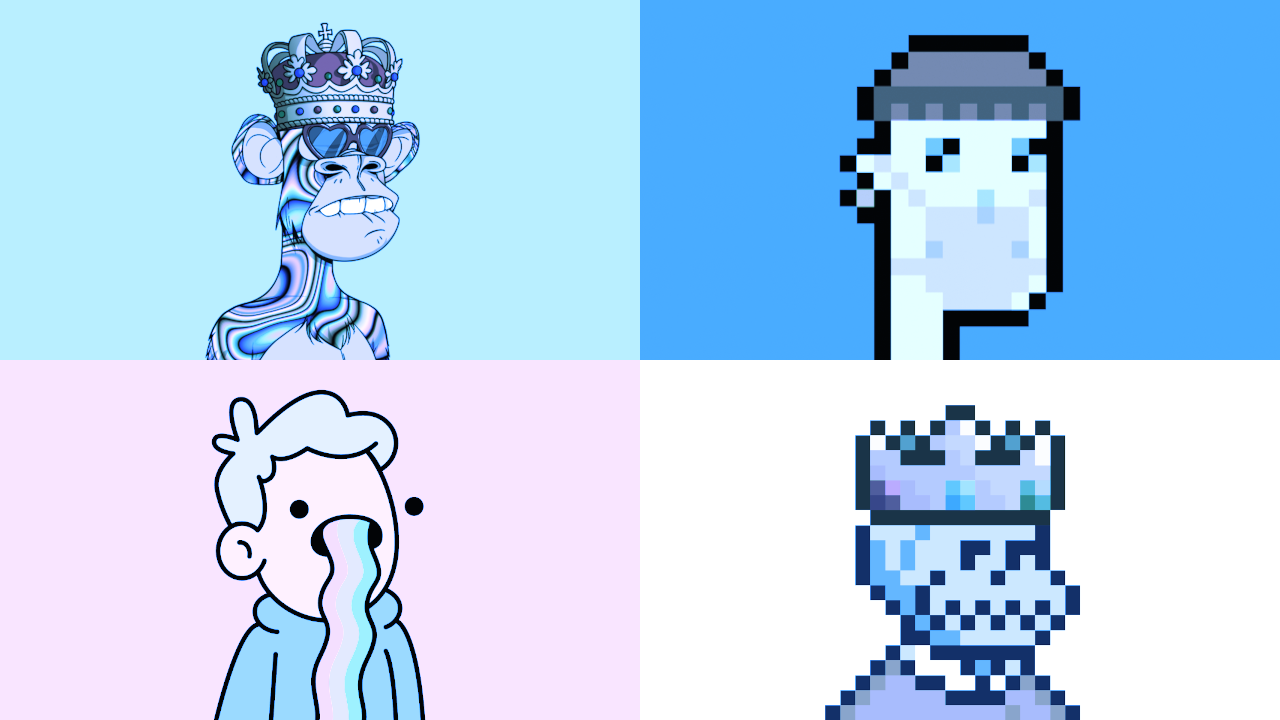

Notable examples include Bored Ape Yacht Club and Doodles. NFTs use blockchain to establish ownership and rights for digital files, preventing easy duplication.

While copies may exist, the authentic original’s sole ownership lies with one individual. This creates new markets for digital items and art. Explore our in depth NFT 101 guide to understand this tech in extensive detail!

The Good Old Days – NFTs in 2021

In the glorious NFT heyday of 2021, the seeds of the phenomenon were sown in 2017 when Ethereum pioneered token standards, empowering developers to embed tokens in smart contracts. Enter Matt Hall and John Watkinson, creators of Crypto Punks, igniting the NFT spark. Yet, it wasn’t until 2019 that the craze reached a crescendo, with Grimes amassing a staggering $6 million from NFT sales, setting the stage for a cultural tidal wave.

NFTs transcended mere digital assets; they became a cultural zeitgeist. The memorable sale of ‘Nyan Cat,’ a decade-old internet meme, for over $600,000 signaled an era where the intangible held tangible value. Gaming and metaverse leapt into the NFT realm with Decentraland, a virtual reality platform, amplifying the frenzy.

However, the true turning point was 2021, hailed as the “Year of NFTs.” Traditional art auction houses like Sotheby’s and Christie’s plunged into the digital fray. Christie’s groundbreaking $69 million NFT sale reverberated across markets, fueling a surge in B2B, B2C, and C2C transactions. Facebook’s rebranding as Meta and its metaverse foray acted as the NFT apotheosis. This was the golden age (as of yet) for the tech, with nobody asking “Are NFTs Dead?” yet!

By January 2022, OpenSea orchestrated a staggering $4.87 billion in sales, solidifying NFTs as more than a fad. Alas, the exuberance appears to have waned, with Q1 2023 witnessing a stark decline to under $300 million, revealing a market recalibration. The NFT spectacle of 2021, a wild ride now settling into nuanced terrain.

State of the NFT Market: Are They Dead in 2023?

As the meteoric rise of NFTs gave way to a tumultuous period, marked by the fall of crypto evangelists and the broader crypto market slump, questions about the sustainability of NFT values emerged. In 2022, a notable decline in prices, exemplified by Bored Apes dropping from a peak of $429,000 worth of ether in April to under $60,000 in November, raised concerns. Reports even hinted at dubious transactions influencing some of the highest NFT prices.

In the art and luxury space, NFTs experienced a rollercoaster. Transaction volumes plummeted, with OpenSea’s deal values collapsing by 89% from December 2021 to December 2022. Sotheby’s trimmed its NFT team despite high-profile sales. However, the first quarter of 2023 witnessed a resurgence, with transactions hitting $4.7 billion, hinting at a potential NFT revival. NFTs in 2023 are far from dead.

Navigating the Shifting Tides of NFTs in 2023

However, the narrative took a surprising turn in the first quarter of 2023. Transactions surged to $4.7 billion, a significant leap from the previous three months’ $1.9 billion, though still distant from the glory days of early 2022 at $12.6 billion. This unexpected resurgence hints at a complex evolution within the NFT space.

The pulse of high-net-worth individuals regarding NFTs in early 2023 reflects a divided sentiment. While a third sees continued potential, an equal number remains skeptical. Yet, contrasting voices caution against overestimating the current market. The first quarter of 2023 saw a substantial decrease from January 2022’s $4.87 billion in sales on OpenSea to under $300 million.

The evolving role of NFTs in the art world also became evident as Centre Pompidou, a renowned modern art museum, invests in NFTs. The move signifies not just acceptance but recognition of the creative potential NFTs offer to artists. Luxury brands, too, are redefining their approach. Tiffany & Co., for instance, shifted its focus from mere NFTs to leveraging technology for valuable assets and enhanced user experiences.

The NFT landscape, while grappling with challenges such as declining interest, regulatory uncertainties, and technological intricacies, continues to evolve. The dynamics of ownership, community engagement, and decentralization shape its trajectory.

As we navigate this digital frontier, the narrative of NFTs in 2023 unfolds as a complex interplay of skepticism, resilience, and transformative potential, hinting at a nuanced future for this once-revolutionary technology.

What Happened to NFTs? The NFT Crash

The origins of the “NFTs are so Dead” narrative can be traced back to early 2021, when non-fungible tokens first captured the public’s attention. Record-breaking NFT sales like Beeple’s $69 million dollar sale for “Everydays” and the $11.8 million sale of CryptoPunk #7523 generated headlines across mainstream media outlets. This is where speculations started around the industry.

This attention, combined with a booming cryptocurrency market that saw Bitcoin reach nearly $65,000, drove a speculative frenzy. Wealthy crypto investors, eager to capitalize early on the next big thing, began snapping up rare NFTs from top projects. These include projects like CryptoPunks and Bored Ape Yacht Club. Their purchases drove prices upwards, creating a hype-fueled bidding war.

Wash Trading NFTs

Behind the scenes, rampant wash trading was artificially inflating prices further. Dune Analytics found that over 80% of NFT volume in January 2022 was fake. Traders would buy an NFT and “sell” it to themselves to make the floor price appear higher. The superficial value attracted new retail investors seeking quick profits, who were unaware of the manipulation.

The house of cards peaked in April 2022, with weekly trading volumes exceeding $1.5 billion. Moreover, Bored Apes reached a floor price of over $150,000. But the momentum was unsustainable. When the broader crypto market crashed in May and June 2022, skittish NFT traders rushed for the exits. Volumes plunged below $300 million per week in June as top NFTs shed over 50% of their value.

FTX Collapse Aftermath

The NFT crash accelerated through the summer and fall against the backdrop of a bear crypto market and recession fears. Inflation was squeezing discretionary income needed to speculate on JPEGs. Savings accumulated during pandemic stimulus programs had dwindled for many retail investors. Even November’s FTX collapse contributed to deteriorating sentiment. By December 2022, weekly trading volumes had plunged below $100 million. Prices for highly sought after NFTs like CryptoPunks were down over 70% from all-time highs.

The mania of 2021 had evaporated completely, leaving die-hard collectors and speculators still actively trading in this bear market. The NFT bubble had decisively popped. While the market will recover during the next crypto bull run in 2023, intense volatility is likely to persist. This may be due to issues like wash trading and lack of asset diversity, unless meaningful reforms are enacted.

So, Are NFTs Dead Yet?

While NFTs face a challenging outlook, likening them to historical bubbles implies premature predictions of their demise. Drawing parallels to enduring elements of past frenzies like tulips and dotcoms, the critical factor for NFT survival is finding practical utility beyond art. Without tangible functionality, NFTs risk becoming historical speculative follies.

Despite current price downturns and the threat of fading interest, optimism surrounds NFTs’ future. The potential diversification into digital identity, real-world asset tokenization, gaming, and the music industry holds promise. Forecasts for market evolution emphasize increased standardization and interoperability, potentially leading to a more diverse and stable NFT market. So no, NFTs aren’t dead yet in 2023!

Additionally, the ongoing correction might catalyze improved regulation and enhanced transaction quality, fostering a more secure environment for NFT activities. In essence, current challenges could propel NFTs toward transformation and resilience in the digital landscape.

In case you need more information, check out what Mark Cuban has to say about NFTs in 2023, skip to 6:06:

Also, is Bitcoin Dead?

Is Bitcoin dead, or is it gearing up for another rollercoaster ride? After a tumultuous 2023 rally, Bitcoin has settled around $34,000 USD, prompting both bullish and bearish sentiments.

- Optimistic bulls highlight the easing of concerns over crypto contagion that fueled the 2022 crypto winter, pointing to BlackRock’s recent filing for a Bitcoin spot ETF as a sign of resurging institutional interest.

- On the flip side, cautious bears express concerns about rising interest rates and regulatory crackdowns on crypto exchanges potentially limiting investor access.

Recent developments, such as the launch of EDX Markets by Wall Street firms and regulatory actions against major exchanges like Coinbase and Binance.US, add a layer of uncertainty. Bitcoin’s fate hangs on monetary policy, regulatory clarity, and the SEC’s decision on a major U.S. exchange-traded Bitcoin fund. This is delayed until late 2023. Despite regulatory crackdowns, Bitcoin investors remain undeterred.

The potential approval of a Bitcoin spot ETF could reshape the landscape, opening avenues for institutional investment and propelling Bitcoin to new heights. While Bitcoin’s history is a rollercoaster of gains and losses, the current momentum, supported by stock-to-flow models and bullish trends, suggests that the saga of Bitcoin’s survival and resurgence continues into the unpredictable terrain of 2023. If Bitcoin dies, NFTs (and crypto) are dead.

However, as of the time of writing (November 2023), Bitcoin is chilling at around a cool $34,500 USD. In 2023 so far, Bitcoin’s value has skyrocketed, with a change of 106.97%! As the most well-known cryptocurrency, Bitcoin is prone to major price swings driven by hype and speculation. Predicting its future remains a challenge, with market experts offering varied perspectives, leaving the crypto community eagerly anticipating the next twist in Bitcoin’s unpredictable journey.

The Future of NFTs

In the midst of a seemingly lackluster phase for NFTs, the future holds a promising narrative that extends beyond the current slump. While the market correction might suggest a decline, industry experts are redefining the narrative, envisioning NFTs as more than just tradable assets.

The exploration of use cases beyond art and collectibles offers a glimpse into the potential transformation of digital identity and ownership. NFTs could soon represent verifiable ownership of diverse digital assets, from domain names and social media handles to personal data.

The adoption of NFT technology across various industries is on the horizon, with real-world assets like real estate and luxury goods poised for tokenization. The gaming industry is expected to leverage NFTs for true ownership of in-game items, fostering a digital economy within gaming ecosystems. Similarly, the music industry anticipates benefiting from artist tokenization, granting creators greater control over distribution and monetization.

Statista data suggests the market could reach $3.2 billion by 2027, reflecting a compound annual growth rate of 18.55%. The number of NFT users is anticipated to surpass 19 million, further underlining the resilience and potential of NFTs in the evolving digital landscape.

Looking beyond the traditional perception of NFTs as mere investments, industry leaders advocate for a broader understanding of their utility. The true power of blockchain and web3 technology, according to experts, lies not in artificial scarcity but in ownership of digital assets.

The evolving landscape of NFTs, particularly in the metaverse, suggests a profound role in showcasing ownership of digital items. Despite the current challenges, the narrative surrounding NFTs is evolving. Now, with a focus on utility, innovation, and their indispensable role in the emerging Web3 ecosystem.

Read the full article here