Many crypto investors and traders want to make profits, but they may not have the time or skills to do it all manually. This is where crypto trading bots come in. These bots can help you trade automatically, making it easier to buy and sell coins.

In this guide, we will look at 8 best crypto trading bots. We will compare them based on the number of exchanges they support, their prices, trading strategies, and whether they offer a free plan. This will help you find the right bot for your trading needs.

Key Takeaways:

- The crypto trading bot is a software tool designed to automate cryptocurrency trading and execute trades based on pre-set algorithms.

- The best crypto trading bots are 3Commas, Cryptohopper, Pionex, Quadency, TradeSanta, WunderTrading, Coinrule, and Bitsgap due to their diverse features, ease of use, and performance across major exchanges.

- The different types of crypto bots and strategies are Grid Bots, Arbitrage Bots, DCA Bots, Leverage Trading Bots, and Market Making Bots.

List of Best Crypto AI Trading Bots: Our Top Picks

We have reviewed and tested over 30 cryptocurrency trading bots based on factors such as types of bots, price, security, user interface, and more. Here is our list of the 8 best crypto trading bots.

- 3Commas: Overall Best Crypto Trading Bot

- Cryptohopper: Best Crypto Bot for AI Trading

- Pionex: Best Free Trading Bot and Exchange

- Quadency: Best Free KuCoin Trading Bot

- TradeSanta: Best Crypto Signal Trading Bot

- WunderTrading: Best Grid Trading Bot

- Coinrule: Best Crypto Copy Trading Bot

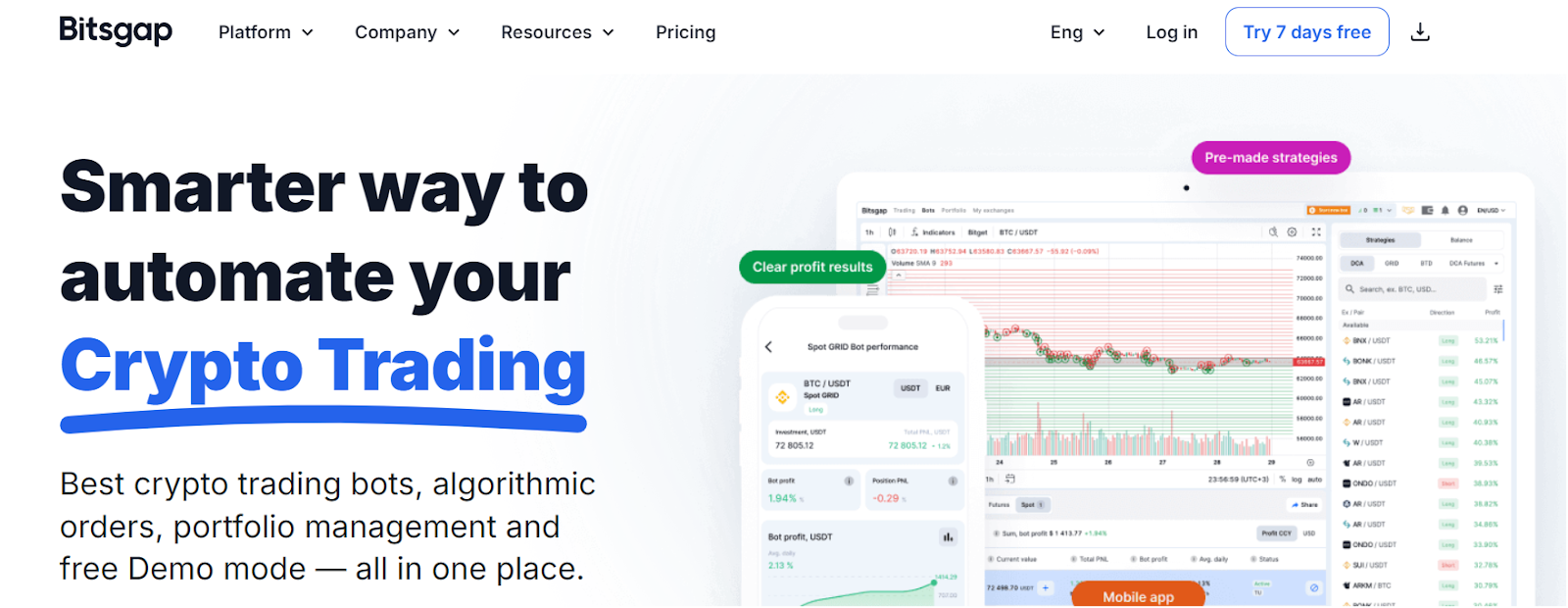

- Bitsgap: Best Binance Trading Bot

8 Best Crypto Trading Bots Reviewed

3Commas: Overall Best Crypto Trading Bot

3Commas is a crypto trading bot that helps you automate trades across different crypto exchanges. Established in 2017, it provides tools like the SmartTrade terminal, letting you manage multiple trades at once. Features like Take Profit, Stop Loss, and Trailing options make it easier to maximize profits and minimize risks.

With 3Commas, you can use bots like the Dollar-Cost Averaging (DCA) and Signal Bot. The DCA Bot allows you to invest gradually, lowering the impact of price fluctuations by averaging your entry prices. The Signal Bot reacts to real-time signals, such as price movements or social media trends. It also offers “Bot presets”. You can copy the bot perimeters from other seasoned traders and start trading. It’s similar to crypto copy trading. These bots work seamlessly with exchanges like Binance and Coinbase.

Plus, the platform has extensive portfolio management capabilities that let you track your assets across different exchanges, as well as a Grid Bot that is helpful for trading during a sideways market. It also ensures the security of your transactions by using IP whitelisting and secure API access to protect your data.

Supported Exchanges

3Comms supports over 14 popular crypto exchanges including Binance, Coinbase, OKX, Bitget, Bitfinex, Gate.io, Kraken, Gemini, KuCoin, and more.

Pricing

The Free plan offers basic access, with three active SmarTrades and one active bot for each category. The Pro package is $39 per month and includes up to 50 SmartTrades and 10 running bots. The Expert package ($59 per month) adds limitless trading bots to the Pro plan’s functionality. A yearly subscription comes with a 25% discount.

Cryptohopper: Best Crypto Bot for AI Trading

Cryptohopper is a cryptocurrency AI trading bot platform. Launched in 2017, it provides tools that simplify trading while maximizing efficiency, whether through algorithmic trading, portfolio management, or copying experienced traders‘ strategies.

The platform is known for its algorithmic trading bots, which operate 24/7 and are customizable according to user preferences. These bots use technical indicators and strategies, including signals from external analysts, to execute trades without manual intervention.

For beginners, the platform offers pre-configured bots, while experienced traders can fine-tune their strategies using features like backtesting and paper trading. In addition to algorithmic trading, Cryptohopper’s marketplace allows you to purchase bot strategies from expert traders.

Supported Exchanges

Cryptohopper supports over 17 major exchanges, including Binance, HTX, Coinbase, Bybit, and Kraken. You can trade across different markets from one central hub.

Pricing

Cryptohopper offers several pricing plans. The free plan gives access to unlimited copy bots and portfolio management, with a limit of 20 open positions per exchange.

The Explorer plan costs $29.00 per month and includes everything from the basic plan, along with 80 open positions and market scanning using 15 bots. It also offers backtesting, strategy building, and portfolio bots. You can save with annual plans for long-term use.

Pionex: Best Free Trading Bot and Exchange

Pionex is a cryptocurrency exchange featuring automated trading bots. It debuted in 2019 and seeks to make automated trading available to everyone.

Pionex provides 16 free trading bots that can operate continuously without human interaction. The most popular bot is the Grid Trading Bot. It buys low and sells high in a predetermined price range. Another handy bot is the Dollar-Cost Averaging Bot, which invests a certain amount at regular intervals.

Pionex also provides spot and futures trading. The exchange offers approximately 350 trading pairs. It employs smart order routing to discover the cheapest rates across many exchanges. This helps to maintain strong liquidity and narrow spreads. Pionex features lower fees than other exchanges. The trading fee is 0.05% per trade.

Supported Exchanges

Pionex is itself a crypto exchange with many trading bots. Therefore, it does not support external crypto trading platforms like Binance or OKX for API trading.

Pricing

The Pionex trading bots are free of charge. You don’t need to pay any subscription fees. However, there is a trading fee of 0.05% maker/taker.

Quadency: Best Free KuCoin Trading Bot

Quadency is a cryptocurrency trading platform that combines manual and automated trading tools. The platform provides real-time market data, portfolio tracking, and advanced charting tools. You can create custom trading strategies or use pre-built bots.

Quadency’s bots can perform various functions, including market-making, rebalancing, and grid trading. The platform supports both spot and futures trading. It includes features like trailing stop-loss and take-profit orders to help manage risk. Quadency also has a governance token “QUAD”. The QUAD token holders get premium access to trading features like Cody AI, which can be used on top crypto exchanges.

The platform also provides backtesting capabilities to simulate strategies using historical data. You can easily manage multiple exchange accounts from one dashboard. It offers mobile apps for iOS and Android.

Supported Exchanges

Quadency supports over 20 major cryptocurrency exchanges. These include Binance.us, Coinbase Pro, Kraken, OKX, and KuCoin. The platform continues to add new exchange integrations.

Pricing

Quadency offers a free plan with basic features like one exchange integration and one live spot trading bot. Their paid plans start at $40 per month for the “Pro” tier, which includes all automated trading features. The “Premium” plan costs $80 monthly and offers unlimited exchange integrations and trading bots.

Note: For KuCoin Exchange users, it offers a free premium plan.

TradeSanta: Best Crypto Signal Trading Bot

TradeSanta is another cloud-based crypto trading bot. It offers an easy setup with customizable strategies like Grid, DCA (Dollar Cost Averaging), and Smart Orders, all aimed at maximizing profits in various market conditions.

With TradeSanta, traders can set up their bots to handle different trading pairs, implement custom signals, and use tools like trailing take profit to capture gains as the market moves.

It also offers a mirror trading marketplace. You can copy trading trading bot strategies of more experienced traders and apply them in your own account.

TradeSanta also provides an easy-to-use interface and a mobile app for trading. The program is ideal for people who want to automate cryptocurrency trading without continually watching the market.

Supported Exchanges

TradeSanta supports a wide range of crypto exchanges, currently working with over 10 exchanges, including popular platforms like Binance, HitBTC, Coinbase Pro, ByBit, and OKX.

Pricing

TradeSanta offers three main plans. The Basic plan starts at $25 per month and includes up to 49 bots, unlimited trading pairs, and access to all strategies.

The Advanced plan, priced at $45 monthly, includes up to 99 bots and additional features like Trailing Take Profit and TradingView signals. For professional traders, the Maximum plan offers unlimited bots and advanced trading tools at $90 per month.

WunderTrading: Best Grid Trading Bot

WunderTrading is a platform that offers top-tier crypto trading bots, AI-powered statistical arbitrage, grid trading, signal, and DCA bots. It lets users create and run automated trading strategies without coding. The platform offers copy trading, where users can follow expert traders. It supports both manual and automated trading. Users can backtest strategies using historical data before going live.

The platform has a visual pump-screener Telegram bot. This means you get a notification for low-cap coins pumping. You can also set up email and Telegram notifications for trades and market events. WunderTrading provides detailed performance analytics and reports. It uses TradingView charts for technical analysis.

Security is a focus, with two-factor authentication and encrypted data storage. The platform runs on secure Amazon Web Services infrastructure. It offers paper trading accounts for practice. The platform is designed to be user-friendly for beginners and advanced traders alike.

Supported Exchanges

WunderTrading supports over 16 cryptocurrency exchanges. Some major supported exchanges include Binance, Coinbase Pro, Deribit, and Bitfinex. It also works with KuCoin, Woo X, and Bybit.

Pricing

The free plan is a good option for beginners, allowing the use of basic features like portfolio tracking, paper trading, and social trading. For those needing more, the Starter plan costs $4.95 per month and allows one bot of each category. The Basic plan, priced at $19.95 monthly, provides up to 5 bots.

Coinrule: Best Crypto Copy Trading Bot

Coinrule is another automated crypto trading tool suitable for both novice and professional traders. It enables users to construct customized trading strategies without having any coding experience. You can also copy bots and strategies of other crypto traders.

The platform runs on the “If This Then That” (IFTTT) principle, allowing traders to specify the conditions under which their bots would execute transactions.

Coinrule provides a library of over 150 pre-designed strategies, ranging from simple buy/sell rules to complicated strategies based on technical indicators like Bollinger Bands and golden crosses.

It also contains backtesting capabilities, which allow users to evaluate tactics against historical data before going live. Additionally, Coinrule provides a demo trading option, which allows users to experiment and perfect their tactics without risking real money.

Supported Exchanges

Coinrule integrates with more than 10 leading exchanges, such as Binance, Coinbase Pro, Kraken, Bitfinex, and KuCoin.

Pricing

Coinrule offers four pricing tiers. The Starter plan is free but limits features. The Hobbyist plan costs $29.99 per month. The Trader plan is $59.99 monthly. The Pro plan, with the most features, costs $749.99 per month. All paid plans offer a 30-day money-back guarantee.

Bitsgap: Best Binance Trading Bot

Bitsgap is the best crypto trading bot for Binance. It offers automated trading bots, portfolio management, and market analysis tools.

It helps you to create custom trading strategies or use pre-made bots. Bitsgap also provides a demo mode for testing strategies without risking real money. The platform includes features like smart orders, which help you maximize profits and minimize losses.

Bitsgap’s interface shows real-time market data and portfolio performance. You can track your assets and trades across 15+ different exchanges in one place. The platform offers over 10,000 trading pairs and supports various order types. It also includes a grid trading bot, BTD trading bot, and COMBO trading bot.

Supported Exchanges

Bitsgap supports over 15 major cryptocurrency exchanges. These include popular platforms like Binance, OKX, Coinbase Pro, and HTX. Users can connect multiple exchange accounts to trade and manage their assets from a single interface.

Pricing

Bitsgap offers a limited free plan with only manual trading and demo trading features. Its premium plan starts at $28/month and includes 3 Active Grid bots and 10 Active DCA bots. For more bots, you can purchase higher plans.

Comparison between Crypto Trading Bots

| Platforms | Supported Exchanges | Price | Free Plan |

| 3Commas | 14+ | Free plan, Pro: $39/month, Expert: $59/month | Yes |

| Cryptohopper | 17+ | Free plan, Explorer: $29/month | Yes |

| Pionex | – | No subscription fee, Trading fee: 0.05% per trade | Yes |

| Quadency | 20+ | Free plan, Pro: $40/month, Premium: $80/month | Yes |

| TradeSanta | 10+ | Basic: $25/month, Advanced: $45/month, Maximum: $90/month | Yes |

| WunderTrading | 16+ | Free plan, Starter: $4.95/month, Basic: $19.95/month | Yes |

| Coinrule | 10+ | Free plan, Hobbyist: $29.99/month, Trader: $59.99/month, Pro: $749.99/month | Yes |

| Bitsgap | 15+ | Free plan (limited), Premium: $28/month | Yes (only manual trading) |

How to Choose the Best Crypto Trading Bot?

Choosing a top crypto trading bot requires careful thinking. Picking the right one is important because it can affect your profits. Below are some factors to help you choose the best bot for crypto trading.

1. Security Features

Security is the first thing you should check when selecting a trading bot. You will connect the bot to your trading account, so strong security features are essential. Look for bots that offer two-factor authentication (2FA), API key encryption, and withdrawal protection.

2. Costs or Pricing

Many crypto trading bots come with fees. Some charge a monthly or yearly subscription, while others may take a percentage of your profits. Make sure you know how much the bot will cost before you commit to it.

For example, crypto bots cost around $20 per month on average, while others can cost up to $100 or more. Choose a bot that fits your budget but also offers good features.

3. Ease of Use

Not all trading bots are easy to use. If you are new to crypto trading, you will want a bot with a user-friendly interface. Look for bots that offer pre-built strategies and easy setup processes.

Some bots, like 3Commas and Cryptohopper, allow you to copy strategies from experienced traders. This feature is helpful if you are still learning.

4. Performance Track Record

Before you choose a crypto trading bot, check its performance history. Reliable bots often show their performance over time, allowing you to see how well they have done in the past.

Look for bots with transparent performance data. A good bot should have at least a few months of positive performance. You can also check for features like backtesting and paper trading.

5. Supported Crypto Exchanges

Different crypto bots work with different exchanges. For example, some bots only work with popular exchanges like Binance, Kraken, or Coinbase, while others may support smaller ones. Make sure the bot you choose supports the exchange you use. This will make your trading smoother and less complicated.

6. Customization Options

Advanced traders often need bots that can be customized. Look for bots that allow you to set your own strategies and conditions. For example, a bot like Cryptohopper lets you adjust your strategies based on technical indicators. This feature is useful if you want more control over your trading strategy.

7. Reviews and Testimonials

User reviews can give you an idea of how well a bot works in real-world trading. Read online reviews on platforms like Trustpilot, Reddit, or specialized forums. Look for bots with positive feedback, especially regarding customer support and ease of use.

8. Free Trial or Demo

Some crypto trading bots offer free trials or demo accounts. These allow you to test the bot without risking your money. Bots like Pionex, 3Commas, and Cryptohopper offer free plans that let you see how the bot works before committing. This is a good way to see if the bot suits your trading style.

9. Mobile App

If you want to monitor your automated crypto trades on the go, look for bots with mobile apps. Not all bots offer this feature, so check if it’s important to you.

What is a Crypto Trading Bot?

A crypto trading bot is a software program that automatically buys and sells cryptocurrency for you. These bots employ established pre-defined algorithms to execute trades.

You can create specific rules for when the bot should purchase or sell based on market circumstances. The objective is to increase earnings while reducing losses. Crypto trading bots can be active around the clock, which is convenient given that the cryptocurrency market never closes.

Pros

- Time-Saving: Crypto trading bots save time by automating trades. You don’t have to sit in front of a computer all day watching price charts. This is particularly useful for people who have other commitments.

- Emotional Control: Bots base their choices on data, not feelings. When traders panic during market volatility, they often make terrible judgments. A bot removes the emotional component and adheres to the strategy.

- 24/7 Trading: Unlike human traders, bots can work around the clock. The crypto market is open 24 hours a day, 7 days a week, so a bot can take advantage of market opportunities even while you sleep.

- Speed: A bot can place hundreds of trades in a minute, something that no human can match.

- Multiple Exchanges: If you manage your funds on multiple crypto exchanges, a trading bot can perform trades on all exchanges at the same time from a single dashboard. This brings efficiency to trading.

Cons

- Requires Monitoring: While a bot can automate trading, it still requires monitoring. Market conditions can change, and the bot may need adjustments to its strategy. Failing to update the bot can lead to losses.

- Cost: Many crypto trading bots come with a subscription fee. For instance, advanced bots like 3Commas can cost up to $49 per month. You also may need to pay fees to the exchange where you trade.

- Not Foolproof: Crypto trading bots are not guaranteed to make profits. They rely on the strategies you set, and if the strategy is poor, the bot will lose money. Additionally, bots cannot predict market crashes.

- Technical Knowledge Required: Some crypto bots require a good understanding of how cryptocurrency markets work. You may need to know technical analysis and other trading strategies. For beginners, this can be difficult.

Types of Crypto Trading Bots

1. Grid Bots

Grid Bots use a simple strategy of buying low and selling high at regular intervals. They create a “grid” of buy and sell orders. For example, if Bitcoin is trading at $65,000, the bot may place buy orders at every $500 below that price and sell orders at every $500 above. This method allows the bot to profit from price fluctuations.

2. Arbitrage Bots

Arbitrage bots take advantage of pricing disparities across exchanges. For example, if Bitcoin is valued at $65,000 on Exchange A and $65,100 on Exchange B, the bot will purchase Bitcoin on Exchange A and sell it on Exchange B, profiting on the difference.

3. DCA (Dollar-Cost Averaging) Bots

DCA Bots invest a set amount at regular intervals, regardless of the asset’s price. This is a long-term strategy to reduce the impact of price volatility. It helps avoid investing all at once when the price might be high.

Example: A bot can invest $100 in Bitcoin every week, gradually accumulating more over time, regardless of whether the price goes up or down.

4. Leverage Trading Bots

Leverage Trading Bots allow you to trade in derivatives markets like perpetual futures contracts and options trading. For instance, if you have $1,000, the bot can trade as if you had $10,000 by borrowing additional funds.

5. Market Making Bots

Market-making bots generate buy and sell orders to provide liquidity in the market. These bots benefit from the little discrepancies between bid (buy) and ask (sell) prices. They are continually updating these orders to reflect market movements.

Conclusion

In a nutshell, picking the best crypto trading bots is important for making your trading better. These bots do trades for you, which helps avoid making choices based on feelings or emotions. Some top bots are 3Commas, Cryptohopper, and Pionex. They have cool automated features and are easy to use.

The best crypto trading bots cater to different needs with various strategies, from Grid and DCA to Arbitrage and Market Making. Using these bots can help you make more money while dealing with the ups and downs of crypto prices.

FAQs

Which is the Best Crypto Trading Bot for You in 2024?

3Commas, Cryptohopper, and Pionex are the best crypto trading bots due to free trading plans, high-security measures, and advanced bot strategies.

Are Crypto Trading Bots Legal?

Yes, crypto trading bots are legal in most countries. However, you should confirm that the bot uses a legal cryptocurrency exchange and follows local rules and regulations. Some areas may impose limitations or prohibitions on automated trading. To prevent legal difficulties, always examine the integrated crypto platform’s regulations.

Can a Trading Bot Guarantee Profits?

No, a trading bot cannot guarantee profits. Crypto markets are volatile, and bots operate based on programmed strategies, which may not always predict market movements accurately.

While bots can help you make quicker and more efficient trades, they are not foolproof. Factors like market crashes or sudden price fluctuations can still lead to losses. Trading bots can assist you, but the risk of loss is always present in crypto trading.

How Much Do Crypto Trading Bots Cost?

The cost of crypto trading bots varies, but it averages around $20-$40 per month. For example, Cryptohopper offers subscription plans starting at around $29 per month, with higher tiers offering more advanced features. On the other hand, Pionex offers free bots, making it an affordable option for beginners.

What Are the Best Strategies for Using Trading Bots?

The best strategies for using crypto trading bots are grid trading, DCA (Dollar-Cost Averaging), arbitrage trading, market-making bot strategy, and crypto leverage trading with borrowed funds.

Are There Free Crypto Trading Bots Available?

Yes, Pionex is a free crypto bot and has 16 built-in trading bots that cater to various trading techniques. This makes it an excellent choice for novices who wish to practice automatic trading without spending any money. 3Commas and Cryptohopper also offer free plans. The free options are still handy for individuals who wish to try the platform before committing to a subscription.

Read the full article here