A bull market began when the prices of stocks, cryptocurrencies, and NFTs rose significantly. This positive trend often lasts for an extended period of time, encouraging more investments. This guide will explore the concept of a bull market, its impact on the NFT market, and the key bullish signals to watch for.

Key Takeaways:

- A crypto bull market is when digital asset prices are on the rise and investor confidence is high, whereas a bear market is when prices are falling significantly and pessimism dominates the market.

- In NFTs, a bull market means increased demand, high trading volume, and higher prices for unique digital collectibles.

- The top signals of an NFT bull market are a surge in NFT volume, high-profile sales, media coverage, institutional investments, increased use cases of NFTs in DeFi, and more.

What is a Bull Market vs a Bear Market?

Bull Market Explained

A bull market occurs when the stock markets, crypto, and NFT market go up significantly over time. It usually means people feel good about the economy. They buy more digital assets because they think they will make money (positive sentiment). This kind of market can last for years.

To understand it better, let’s look at some historic bull markets. The longest bull market in U.S. history started in 2009 and ended in 2020. During this time, the S&P 500, a key stock index, increased by about 400%.

The same concept applies to cryptocurrencies. For example, Bitcoin experienced a bull market from late 2020 to early 2021, where its price surged from around $12,000 to over $64,000. And, the current bull market run for BTC, with a price surge from $16,000 in January 2023 to $62,000 at the time of writing.

In a bull market, companies and crypto projects also feel more confident. Companies invest more in their businesses, hire more people, and sometimes even pay bigger dividends to their shareholders.

Similarly, crypto projects may see increased investment and development during bull markets, leading to more innovation and higher coin prices. This can create a positive cycle, where good economic news leads to higher stock prices and crypto values, which leads to more good news.

Bear Market Explained

A bear market occurs when the prices of investments, such as stocks, cryptocurrencies, or NFTs, are falling, and investors feel pessimistic or worried about the future. This typically happens when the market drops by 20% or more from its recent highs.

For instance, During the 2008 financial crisis, the stock market fell sharply. Many investors sold their stocks, and prices dropped significantly. In late 2021, after the huge rise in Bitcoin’s price, the market crashed, and prices fell drastically from $64,000 to $16,000 (check above chart).

Why it Happens:

- Economic Problems: Issues like high unemployment, low consumer spending, global wars, or political instability can cause a bear market.

- Panic Selling (common in cryptocurrencies): When prices start to fall, some investors might panic and sell their investments quickly, causing prices to drop even more.

- Decreasing Confidence: If investors lose confidence in the market or the economy, they may pull their money out of investments.

Bull Market and Bear Market in NFTs

Bull markets tend to occur when the demand for NFTs is high, leading to a significant increase in their prices and trading volume. This is often driven by factors such as increased adoption and awareness, high-profile sales and celebrity involvement, and investments by major companies (explained below in detail).

Bear markets in NFTs occur when the demand and prices of NFTs decline. This can be influenced by two major factors:

- Market Saturation and Oversupply: When too many NFTs are created, supply can exceed demand, leading to price drops.

- Economic Uncertainty: If investors are uncertain about the economy, they might pull back on purchasing high-risk assets like NFTs.

Top Signals in the NFT Bull Market

1. Surge in NFT Trading Volume

A significant increase in trading volume on NFT marketplaces is a strong indicator of an NFT bull market. Increased sales and trading volume show that more people are buying and selling NFTs, which usually means the market is active and growing.

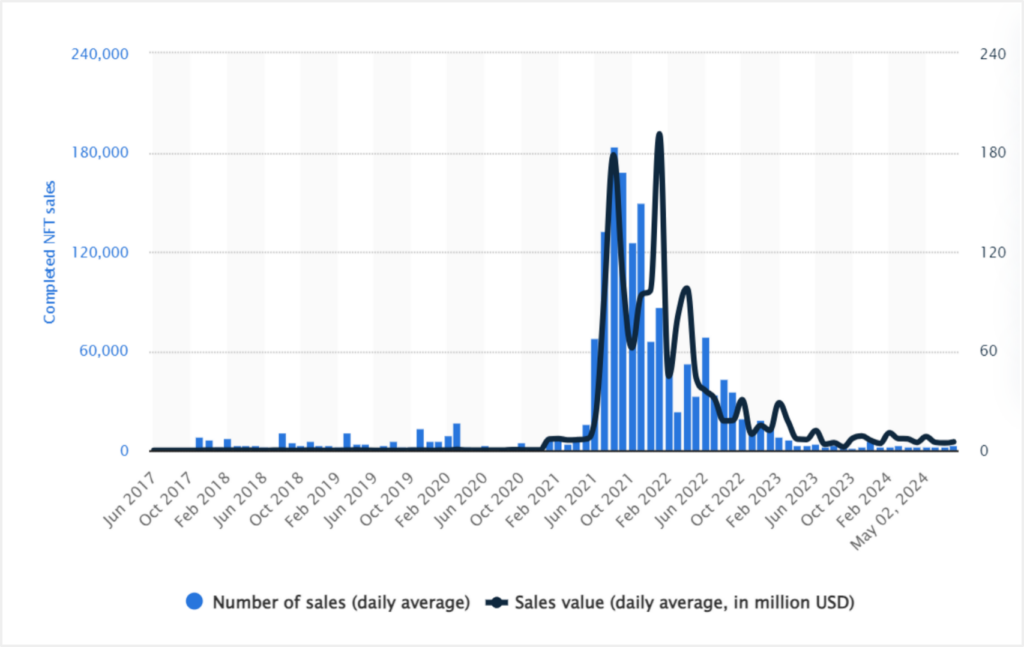

According to Statista, in May 2021, total trading volume and NFT sales started increasing, which resulted in an NFT bull market for several months (check the chart below).

2. High-Profile Sales

Record-breaking sales of NFTs often signal a bull market. When Beeple’s “Everydays: The First 5000 Days” sold for $69.3 million in 2021, it brought massive attention to the NFT market, catalyzing further interest and investments. High-profile sales can create a buzz and attract more buyers and sellers, boosting overall market activity.

3. Celebrity Endorsements and Involvement

Celebrity involvement can also significantly boost the NFT market. In 2021, celebrities like Snoop Dogg, Grimes, and Paris Hilton launched their own NFT collections, attracting their fan bases and driving up demand and prices.

When celebrities talk about or create NFTs, their followers often get interested and start buying NFTs themselves, which can lead to a bull market.

4. Mainstream Media Coverage

Increased coverage of NFTs in mainstream media often precedes a bull market. The media buzz surrounding the Beeple sale and other high-profile NFT transactions in early 2021 contributed to a widespread surge in interest and investments.

Articles in major newspapers, TV segments, and online news can also introduce NFTs to a larger audience, increasing demand and prices.

5. Institutional Investments

When big investors or companies put money into NFT platforms or projects, it shows they believe in the market. In 2021, Andreessen Horowitz invested $100 million in OpenSea, showing that more big investors are interested and trust the NFT ecosystem (Source).

These large investments give the needed funds for platforms to grow and create new ideas, which brings in more users and investors, thus increasing trading volume.

6. Development of the NFT Ecosystem

The growth of infrastructure and platforms supporting NFTs is another bullish signal. The expansion of NFT marketplaces like OpenSea, Rarible, and NBA Top Shot, along with improvements in blockchain technologies (e.g., Ethereum 2.0), supports increased activity and investment.

When the ecosystem develops, it becomes easier for people to create, buy, and sell NFTs, which can lead to a more active market.

7. Integration with DeFi (Decentralized Finance)

When NFTs are connected with DeFi, it attracts more investors and boosts demand. This connection helps NFTs grow in popularity and value. For example, platforms like Fractional and NFTfi allow you to use NFTs as collateral for loans.

This idea of fractional ownership makes NFTs more useful and appealing. Because of this, more people want to buy and use NFTs, which increases market activity.

What to do in the NFT Bull Market?

A bull market in NFTs can be exciting, but it’s important to be strategic. Here’s how to make the most of it:

If you’re looking to invest:

- Do Your Research: Don’t just follow the hype. Look into the purpose of the NFT project. Does it solve a problem or offer unique benefits? Check if it has a strong community and a reliable team. This will help you find projects with lasting value.

- Think Long-Term: Look beyond the artwork. Some NFTs offer access to exclusive content, events, or voting rights in a community. For example, owning a Decentraland NFT gives you virtual land, which can increase in value. Utility can make an NFT more valuable over time.

- Diversify: Don’t invest all your money in one NFT project. Spread your investments across several promising projects. This way, you reduce risk and increase your chances of success.

If you already own NFTs:

- Hold or Sell Wisely: Decide based on the NFT’s performance and your situation. If the project is doing well, holding might be good. But if you need money or the project is declining, selling could be smart. Look at the project’s roadmap also before deciding.

- Stay Informed: Keep up with the latest NFT trends and news about your projects. This helps you make better decisions about holding, selling, or buying more. Follow industry news, project updates, and influencers for valuable information.

Important Tip: Avoid FOMO (Fear of Missing Out), don’t buy impulsively just because everyone else is. Stick to your research and plan to avoid regrettable decisions.

Is 2024 a NFT bull market?

To determine if 2024 is an NFT bull market, we can run through a checklist of the key signals discussed earlier. We’ll look at recent data and trends to see if they match the indicators of a bull market. Here’s the checklist:

| NFT Bullish Signals | Checklist | Explanation |

| Surge in Trading Volume | No | OpenSea trading volume is flat with no spike in trading volume (Source: Dune) |

| High-Profile Sales | No | The highest NFT sale in the last 30 days is Chibi #2930, which sold for $100.58k (Source: DappRadar) |

| Celebrity Endorsements | No | There are not many recent celebrity endorsements on Crypto Twitter; most celebrities are now busy launching meme coins |

| Mainstream Media Coverage | No | No major news outlets are regularly covering NFT stories |

| Institutional Investments | No | There are not many high-profile investments in NFTs so far in 2024 |

| Development of the NFT Ecosystem | Yes | Many new NFT marketplaces and features have emerged since the last NFT bull run |

| Integration with DeFi | Yes | There is an increasing use of NFTs in DeFi, including NFT staking and loans |

The above checklist shows that there are no major signals indicating bull and bear markets. However, as the crypto market continues to evolve and new Layer 2 solutions are launched, we may see their involvement in the NFT market and a significant increase in interest due to lower NFT trading fees by the end of Q4 2024.

Future of NFTs

The future of NFTs, or Non-Fungible Tokens, is promising and full of potential. We may see NFTs being used in various industries beyond art and collectibles. In real estate, virtual properties in digital worlds like Decentraland could become more popular, and in entertainment, musicians, filmmakers, and other creators might sell exclusive content or experiences as NFTs.

The technology behind NFTs is continually improving, which will drive their future growth. Scalability improvements, through new blockchain technologies and Layer 2 solutions like Ethereum’s updates, will make transactions faster and cheaper, encouraging more people to use NFTs.

Additionally, interoperability between different blockchain networks will likely improve, allowing NFTs to be used across various platforms and ecosystems.

NFTs may also find uses in many new areas. In education, certificates and degrees could be issued as NFTs, making it easier to verify credentials. When it comes to healthcare, medical records could be securely stored and shared as NFTs, ensuring privacy and accuracy. Also, NFTs can be used to track the origin and history of products in supply chains.

Conclusion

A bull market in NFTs offers exciting opportunities for making money. When the demand and prices for NFTs go up, it is a good time to invest. Look for signs like more people trading NFTs, high-volume sales, and famous celebrities getting involved.

However, It is also important to do your research, spread your investments, and keep up with the latest news. By understanding these signals and staying informed, you can make smart choices and take advantage of the growth in the NFT market.

FAQs

Is it good to buy in bull market?

A bull market is generally a good time to invest because of rising prices in the financial markets. This means you have a better chance of making money if you buy and hold for the long term. However, there’s no guarantee, and even bull markets can have periods of ups and downs.

What are the risks of investing in a bull market?

One big risk of investing in a bull market is getting caught up in the excitement and overpaying for stocks. Prices can become inflated during a bull market. Another risk is that the bull market could end suddenly, leading to a drop in stock prices or NFT prices.

What are the strategies for investing in a bull market?

One strategy for investing in a bull market is to buy strong, well-known assets early before prices go too high. Another strategy is to diversify, spreading investments across different assets to reduce risk. Some investors also set target prices to sell their assets and secure profits. It’s important to stay informed and be ready to adjust your strategy if the market prices rise or fall.

Read the full article here