Recently, ETH supporters witnessed a sudden plunge below $1,900, triggering market panic along with speculation and doubts about the recent performance of the world’s second-largest cryptocurrency.

ETH Unexpectedly Plummets to $1,900, Dragging Down the Crypto Market

Today, Ethereum ETH has suddenly experienced a sharp decline, dropping to $1,900. This is a level that has sent shockwaves through the cryptocurrency market. This move has sparked widespread buzz among ETH holders and the crypto market as a whole.

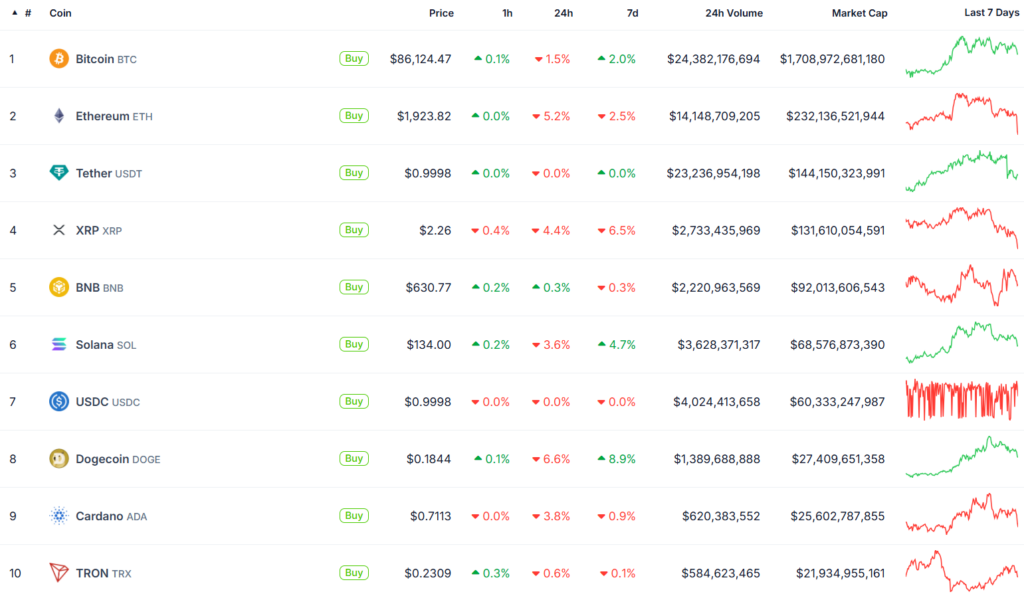

This sudden plunge has not occurred in isolation. It has triggered a domino effect, pulling down major altcoins’ prices, including Ripple XRP, Solana SOL, and Cardano ADA. Even Bitcoin BTC, the market leader, has not been immune to this downward pressure, recording a noticeable dip in its value. The deep fall in ETH’s price has left investors and traders scrambling to assess the situation, raising questions about what could have sparked this dramatic sell-off.

Analysts point to a combination of factors that may have contributed to ETH’s steep decline. Market sentiment has been shaky in recent weeks due to macroeconomic uncertainties, regulatory concerns, and profit-taking after a period of relative stability.

The cascading effect on altcoins highlights Ethereum’s pivotal role in the crypto ecosystem, as its movements often dictate trends for smaller tokens. Bitcoin, though more resilient, has also felt the strain, underscoring the interconnected nature of the market. For now, the crypto community is on edge, watching closely for signs of stabilization or further drops.

Market Predictions and Liquidity Concerns

Looking ahead, the immediate future of ETH and the broader crypto market remains uncertain, particularly over the weekend. Practically, ETF funds and institutional players, which often inject significant liquidity into the market, do not operate during weekends. This lack of activity typically results in lower trading volumes and reduced liquidity, meaning the market may remain stagnant or volatile without fresh capital inflows.

As a result, experts suggest that any major price recovery or shift—whether upward or downward—is unlikely to materialize until the following week when trading activity resumes in full force.

For ETH holders and crypto enthusiasts, this could mean a period of cautious observation. The $1,900 level may act as a psychological support zone, but if it fails to hold, further declines could be on the horizon. Conversely, a resurgence of buying interest early next week could spark a rebound. Until then, the market’s next big move hinges on external catalysts and the return of institutional participation, leaving traders to brace for a tense few days ahead.

Read more: What is Ethereum?

Read the full article here