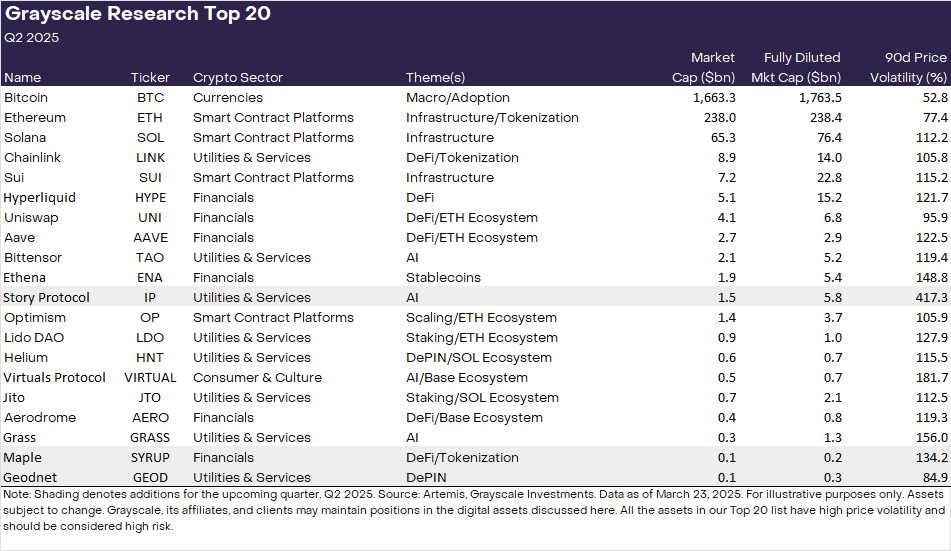

Recently, Grayscale, the world’s leading crypto asset management company, released its Top 20 potential projects for Q2 2025. This updated list features newcomers such as Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP), while removing three tokens – Akash, Arweave, and Jupiter.

Top 20 Crypto Assets from Grayscale Research

For Q2 2025, according to Grayscale Research, it emphasizes three key sectors: DePIN (Decentralized Physical Infrastructure), RWA (Real World Assets), and IP (Intellectual Property Tokenization).

3 new additions to the Top 20 List are:

- Maple (SYRUP) – A DeFi lending platform catering to institutional clients, unlike retail-focused platforms such as Compound and AAVE. It currently holds a TVL of over $600M and has generated $20M in network fees over the past 30 days. Maple aims to surpass $2B TVL in 2025 through partnerships with other DeFi platforms like Pendle.

- Geodnet (GEOD) – A DePIN project providing real-time positioning data with 1cm accuracy, benefiting farmers, transportation, and robotics industries. Now active in 130+ countries with 14,000 devices, the network has surpassed $3M in annualized fee revenue over the past 30 days.

- Story Protocol (IP) – Aiming to tokenize the $70 trillion IP market, this project enables AI model training monetization through IP. It has already brought music from stars like Justin Bieber and BTS onto the blockchain, signaling strong celebrity collaborations.

Learn more: What is Story Protocol?

Grayscale warns that all assets in the Top 20 list are high volatility and high risk, making them unsuitable for all investors. In particular, GEOD is noted as a low-market-cap coin, lacking listings on major CEXs, making it significantly riskier than other assets in the list.

The US Dgital Asset Company also removes Arweave (AR), Akash (AKT), and Jupiter (JUP) from the Top 20 due to its recent performance. They announced that they will monitor carefully in the future to see whether a crypto asset is potential or not.

Additionally, Grayscale has provided an assessment of the cryptocurrency market value for Q1 2025, highlighting a significant decline in market capitalization. Furthermore, the Consumer & Culture segment has weakened considerably due to the downturn of the memecoin culture and the Solana ecosystem.

About Grayscale

Grayscale Investments is a leading digital asset management firm founded in 2013 by Digital Currency Group (DCG). Headquartered in New York, Grayscale offers investors exposure to cryptocurrencies like Bitcoin and Ethereum through regulated investment products, such as the Grayscale Bitcoin Trust (GBTC), without requiring direct ownership of the assets. It bridges traditional finance and the crypto world, catering to institutional and accredited investors seeking a secure, familiar way to invest in digital currencies.

Grayscale Research, an arm of the company, focuses on analyzing trends, market dynamics, and the evolving landscape of blockchain and cryptocurrencies. It provides in-depth reports and insights to educate investors and demystify the complexities of the digital asset space. With a mission to advance the adoption of cryptocurrencies, Grayscale combines financial expertise with innovative research to support the growth of this transformative industry.

Read the full article here