In the ever-evolving landscape of the NFT market, an NFT bear market emerges as a pivotal chapter, especially for artists and creators. This period signifies a decline in both the prices and fervor surrounding NFTs, marking a stark contrast to the exuberance that swept through the space in 2021.

As collectors and investors once hailed NFTs as the new frontier of digital assets and creative expression, a sobering reality now sets in. This bearish sentiment prompts critical questions about the future of NFTs and their profound impact on artists and investors alike.

Within this turbulence, artists confront unique challenges as their once-thriving market undergoes a transformation. Meanwhile, investors must navigate new uncertainties, seeking strategies to weather the downturn and uncover hidden opportunities.

Amidst it all, a select group of visionary NFT artists continues to thrive, showcasing resilience and innovation in a space marked by both chaos and creativity. As the NFT bear market persists, the quest to discern its conclusion remains enigmatic, driven by a constellation of factors that defy easy prediction.

What is an NFT Bear Market?

An NFT bear market refers to a period in the Non-Fungible Token (NFT) market when prices and enthusiasm for NFTs are on the decline. In 2021, NFTs experienced a surge in popularity as collectibles became a hot investment. However, this initial excitement has waned, and some investors have withdrawn from the market, resulting in a bearish sentiment.

During a bear market, NFT investors face new challenges and uncertainties. Nevertheless, it doesn’t necessarily mean the end of opportunities. Strategies for navigating an NFT bear market include diversification, thorough research and due diligence, maintaining a long-term perspective, buying undervalued NFTs, and using a value-based approach to identify undervalued assets.

NFT explorer tools like NFTScan play a crucial role in making informed decisions during a bear market. Features to look for in these tools include comprehensive search capabilities, detailed information about NFTs, real-time data updates, user-friendly interfaces, and reliability.

How Does the Bear Market Affect NFT Artists?

The bear market in the NFT space has significant implications for NFT artists. Initially, NFTs enjoyed immense popularity, attracting collectors and investors. However, as the excitement waned, many participants withdrew from the market, leaving artists facing a challenging environment.

During a bear market, artists may find it more difficult to sell their NFT creations as demand decreases and prices drop. Collectors become more selective, focusing on established artists or undervalued assets. This can lead to decreased income and recognition for emerging artists.

Additionally, the bear market can affect artists’ confidence and motivation. The uncertainty and negativity in the market may discourage artists from creating new NFTs or exploring innovative ideas. Artists may need to adapt their strategies, such as pricing their NFTs competitively or exploring alternative revenue streams like commissions or collaborations.

How Can NFT Artists Survive the Bear Market?

To survive the NFT bear market, artists should:

1. Diversify: Spread investments across various NFT categories to mitigate risk.

2. Conduct Due Diligence: Thoroughly research NFTs, including creator background, rarity, and market demand.

3. Maintain a Long-Term Perspective: Stay committed despite short-term market fluctuations for potential long-term gains.

4. Buy Low: Take advantage of falling prices in a bear market, but ensure the price drop aligns with market trends.

5. Value Approach: Identify undervalued NFTs with strong fundamentals rather than following trends.

For successful navigation, leverage NFT explorer tools like NFTScan for real-time data, comprehensive searches, detailed information, and a user-friendly interface. Keep an eye on whale activity, market imbalances, and unusual price volatility changes to spot opportunities. Ultimately, approach NFTs as a means to leverage Ethereum and consider budget, risk tolerance, and community involvement when making buying decisions. Recognize the social influence on market sentiment and stay focused on long-term conviction in NFTs.

Which NFT Artists are Still Thriving in 2023?

Fewocious

Fewocious, a dynamic NFT artist, has seized the digital art realm with their unique style and exceptional talent. Born in 2003 in Las Vegas, Nevada, Fewocious began their artistic journey at a young age, diving into drawing and painting. In 2020, they made a splash in the NFT world, garnering recognition for their bold, colorful, and imaginative creations.

Despite their youth, Fewocious has achieved remarkable success as an NFT artist, participating in exhibitions and selling pieces for thousands. Beyond their artistic prowess, Fewocious is a savvy entrepreneur who values brand-building and audience connection. They actively engage with fans on social media and collaborate with fellow artists and brands, crafting distinctive NFT collections.

Fewocious’s “Nice to Meet You, I’m Mr. MiSUNDERSTOOD” became Sotheby’s highest-selling digital art in September 2021. In April 2022, they shattered records, earning $20 million with their “Paint Drop” NFT collection on Nifty Gateway. Fewocious’s vibrant, graphic designs are a testament to resilience, offering an escape from a challenging past into a more playful world.

Tyler Hobbs

Tyler Hobbs, a Texan maverick in generative art, wields code as his artistic palette. His groundbreaking creation, Fidenza, a series of 999 computer-generated NFTs, melds the digital and analog realms, amassing a staggering $177 million in October 2021.

Hobbs is renowned for his Incomplete Control collection, exploring imperfections through algorithmic artistry, pre-selling for $7 million. His art is rooted in ‘flow fields,’ where fluid dynamics intersect with code. By relinquishing control to his computer, he births unique artworks as code randomly applies layers, altering color, scale, and turbulence.

Fidenza catapulted Hobbs into the digital art pantheon, resilient in the fluctuating NFT market, securing his place as a luminary.

XCOPY

XCOPY, an enigmatic London-based crypto artist, stands as a legendary figure in the NFT realm, known for his iconic style and unwavering support for the crypto community.

His non-generative art, distinguishable by its bold colors and dark themes. They explore death, dystopia, and apathy through distorted visual loops, often accompanied by jarring glitch-based motion. XCOPY’s work finds a punk aesthetic. It features skulls, fire, and neon with witty and flippant titles and captions that satirize the absurdities of capitalism.

One of his standout pieces, “Right-click and Save As guy,” was acquired by rapper Snoop Dogg for a reported $7 million, challenging the notion of digital art’s worth in the online world. XCOPY’s creations, like “Some Asshole,” continue to garner attention, selling for substantial sums. His Nifty Gateway collection “Max Pain” achieved nearly $23 million in just 10 minutes in March 2022, solidifying his status as a prominent and provocative digital artist in the NFT universe.

Jack Butcher

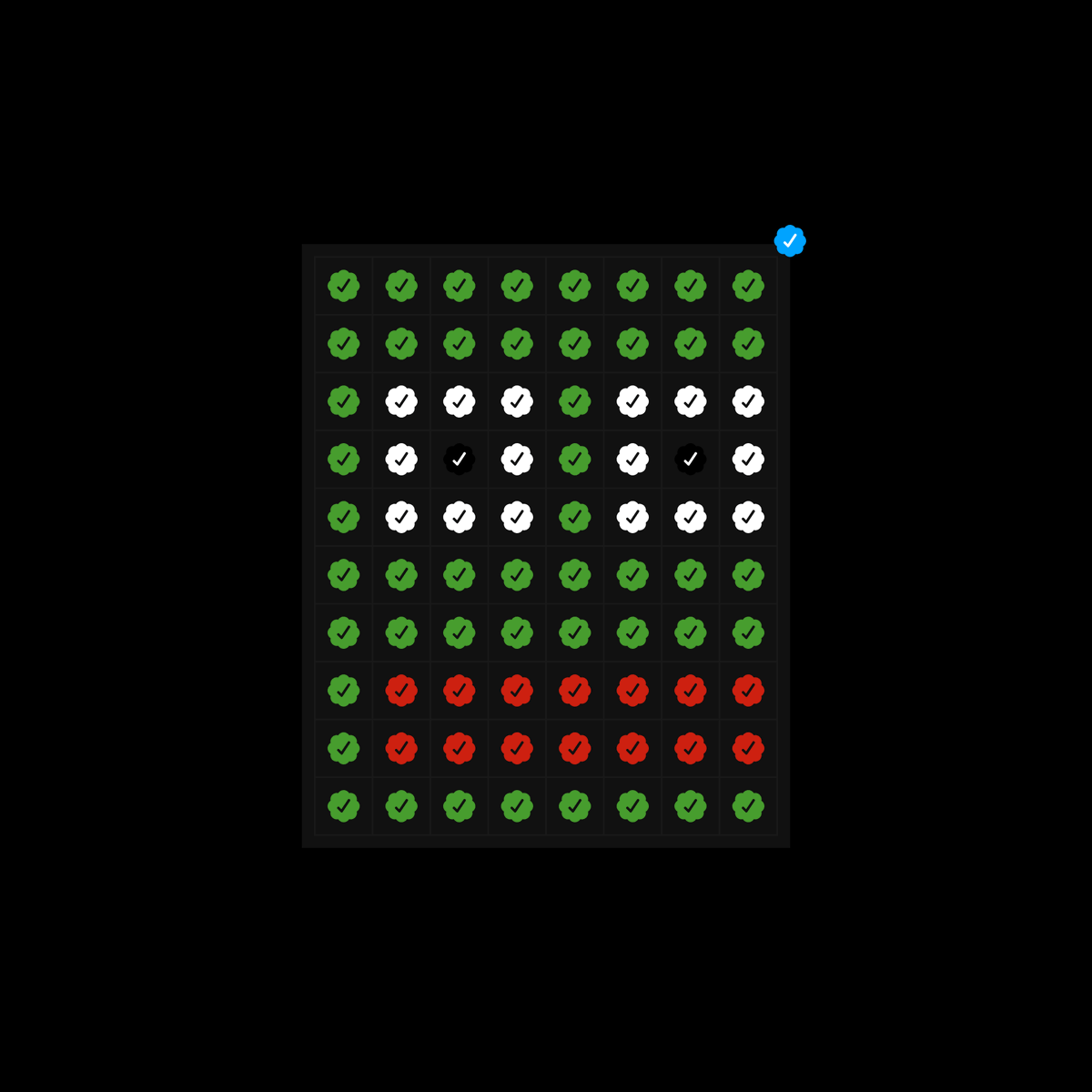

Jack Butcher is a versatile artist, entrepreneur, and founder of Visualize Value. He is renowned for his iconic Checks VV and Open Edition NFT collections. In January 2018, amidst challenging times, he initiated ‘Opponent,’ a design-centric venture, demonstrating his resilience in the face of adversity.

In January 2019, Butcher launched Visualize Value, an innovative communication channel that not only crafts distinctive artworks but also offers invaluable insights into the realm of crypto art. His business acumen swiftly propelled Visualize Value to nearly $1 million in annual revenue within just 18 months, primarily through his Twitter following.

Butcher’s minimalist designs have left a mark in the corporate world. He visualizes concepts for notable companies like Google, Pepsi, and Airbnb. He ventured into the NFT space, where a simple yet thought-provoking piece, featuring white rectangles with JPG and NFT text, fetched an impressive 74 ETH at auction. This work is adorned with a blue checkmark and symbolizes approval. It sparked a viral trend of users creating and selling NFTs by screenshotting the original artwork.

On March 9, 2021, Butcher introduced the Checks project, offering 100 unique NFTs representing real-life business transactions in the form of checks, receipts, and invoices. Subsequently, he launched the Checks VV project on January 3, 2023, as an open edition, leveraging the acquisition of a blue checkmark on Twitter.

Moreover, Butcher’s innovative Open Edition NFT, inaugurated on January 8, 2023, marked a significant contribution to the Ethereum blockchain. His journey is a testament to resilience, creativity, and the transformative power of crypto art.

Trevor Jones

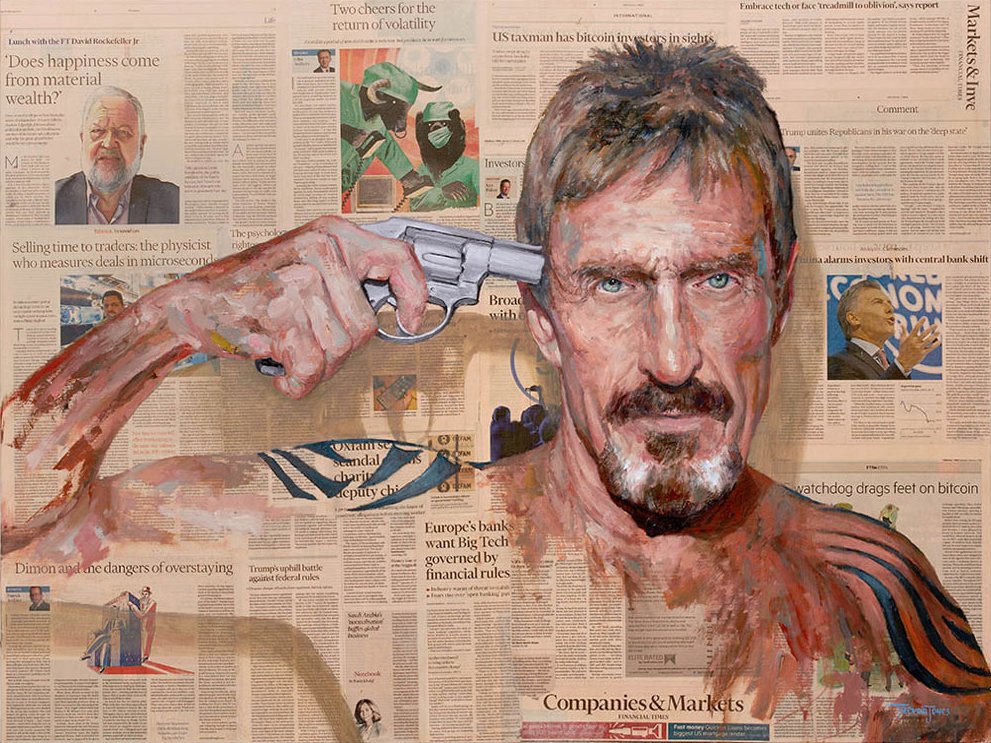

Trevor Jones is a trailblazing NFT artist renowned globally for his distinctive digital artworks. Rooted in traditional painting, Jones seamlessly melds classic techniques with cutting-edge digital tools, resulting in visually captivating and thought-provoking creations.

Among his remarkable portfolio, Jones’s “Bitcoin Angel” series stands out. These pieces feature vibrant, winged figures gracefully hovering above iconic global landmarks. Each work is a unique masterpiece, meticulously crafted through a fusion of digital painting methods and advanced 3D modeling.

Beyond his artistry, Jones actively engages in the NFT community. He advocates for emerging artists and spotlighting Blockchain Technology’s potential in the art sphere. With his fearless innovation and unwavering commitment to the NFT realm, Trevor Jones emerges as a thrilling and dynamic artist of our time.

When Will the NFT Bear Market End?

Determining the precise end of the NFT bear market is challenging due to various factors at play. To draw parallels with the last crypto bear market, we must consider the following key aspects:

1. Lack of Buying and Selling Interest: Historically, bear markets have ended when unsustainable projects exhausted their funds, and there was a lack of both selling pressure and retail buying interest.

2. Valuations: The subjective nature of crypto and NFT valuations suggests that when the market fails to recognize the dollar value of certain NFT projects, it may signal a turning point.

3. Existing Participants and New Interest: Bear markets often coincide with weariness among existing participants and a lack of interest from the general public. During such times, despite reduced enthusiasm, active project development continues.

While these historical indicators are valuable, predicting the exact end of the NFT bear market remains uncertain. Recent market data indicates a decline in trading volume, transactions, and unique users in August 2023, suggesting ongoing bearish sentiment. Factors such as regulatory developments and external market influences further complicate the outlook.

In conclusion, while there may be positive signs, the NFT bear market’s conclusion is contingent on various dynamic factors, and careful monitoring of market trends and developments is essential for a more accurate prediction.

Read the full article here