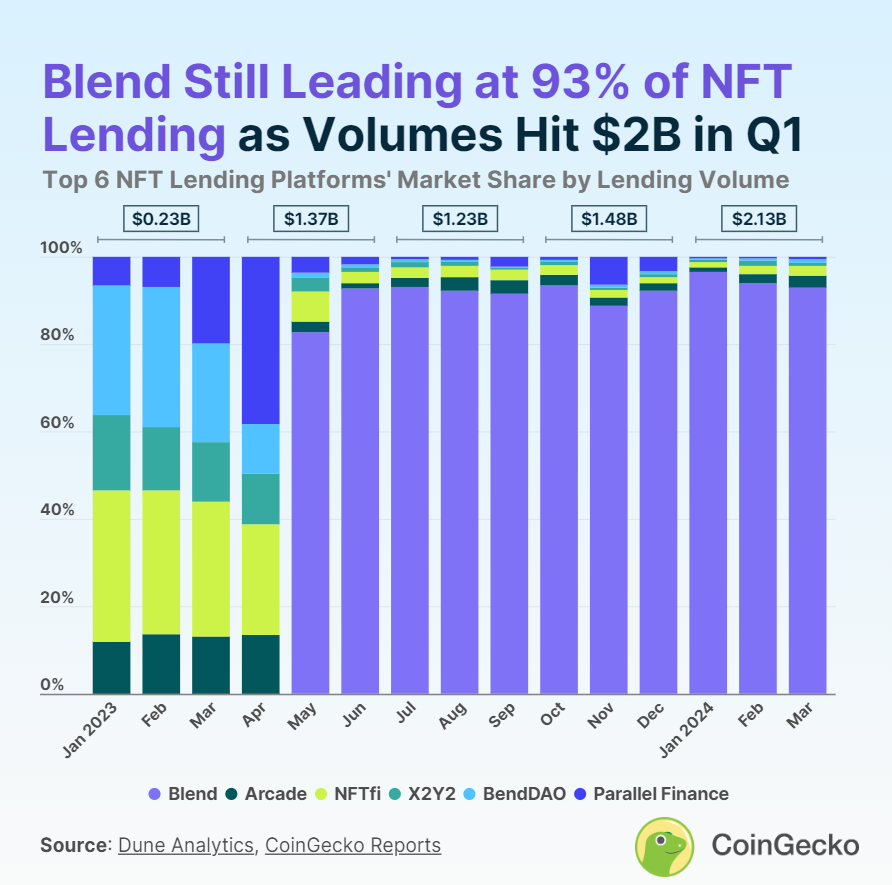

The latest report by NonFungible.com highlights a big milestone in the NFT lending world. In the first part of 2024, the market hit over $2 billion in volume, showing a 44% increase from the end of 2023. The quick rise is catching the eye of investors and NFT owners alike.

What is the purpose of NFT lending?

It is quite easy to use your NFTs to secure a loan. Platforms for lending let users lock up their NFTs and get a loan in return. This means they can access cash without selling off their precious digital assets.

The driving force behind the surge in NFT lending lies with long-time NFT holders. These individuals or entities hold onto their unique digital assets, leveraging NFT lending to access liquidity without parting ways with their valuable NFTs.

Blend: Leading the NFT Lending Landscape

While Blend leads the market, other platforms such as Arcade and NFTfi hold smaller market shares but are witnessing significant quarter-on-quarter increases in lending volumes. Arcade and NFTfi hold 2.8% and 2.2% respectively. Smaller platforms like X2Y2 and BendDAO each hold a 0.8% market share, while Parallel Finance accounts for 0.5%. The introduction of new tokens by Arcade and the anticipated release by NFTfi are closely monitored for their potential impact on the market. As the industry expands, more players are expected to enter, offering additional options for NFT holders.

Currently, Ethereum NFT collections dominate the collateral landscape in the NFT lending market. However, with the rise of alternative blockchain platforms for NFT hosting, such as Binance Smart Chain and Flow, the landscape may diversify in the future.

Final Thoughts

The NFT lending market’s rapid growth and diversification signal an exciting period ahead. With Blend leading the industry and other platforms expanding their offerings, NFT holders have more options to leverage their assets. As the market continues to evolve, driven by both established players and newcomers, it promises further innovation and competition in the realm of NFT finance.

Read the full article here