You may have seen some of the ads for eToro and are now thinking, “Is eToro safe” or “Is it worth it?” Well, in this eToro review we are going to take a deep look at the things that set this platform apart.

eToro lies somewhere between a trading site and the social media of online brokerage, but unlike other social brokers with multiple traders, you can learn from or copy trades directly. But does that mean it’s right for you? In this review, we will take a look at eToro and what makes it unique along with its security features as well as an overview of its pros & cons.

Key Takeaways:

- eToro is the best broker for trading various asset classes, allowing you to invest in stocks, cryptocurrencies, ETFs, and commodities, all under one platform.

- eToro offers crypto services for over 100 assets including BTC and ETH, charging a competitive 1% fee on trades.

- The platform features a unique CopyTrader tool, allowing you to mimic the trades of successful investors and learn from the best.

eToro Overview: Quick Summary

| Platform Name | eToro |

| Founded | 2007 |

| Founders | Yoni Assia, Ronen Assia, David Ring |

| Headquarters | Israel |

| Primary Service | Social trading and investment |

| Key Features | CopyTrader, Smart Portfolios, demo trading |

| Asset Types | Stocks, ETFs, Crypto, Forex, Commodities, CFDs (6,000+ assets) |

| Supported Cryptos | 100+ |

| User Base | Over 30 million globally |

| Available Countries | 140+ |

| Regulation | FinCEN (US), FCA (UK), CySEC (EU), ASIC (AU) |

| Minimum Deposit | $10 (varies by region) |

| Mobile App | Yes, iOS and Android |

| Fees on Stocks | Commission-free |

| Crypto Trading Fee | 1% per transaction |

| Withdrawal Fee | $5 per transaction |

| Inactivity Fee | $10 monthly (after 12 months) |

| Demo Account | Yes, $100,000 virtual funds |

| Security Measures | SSL, KYC, 2FA |

| Customer Support | Live chat, email, Help Center |

What is eToro?

eToro, which launched in 2007, started as a social trading platform and has since grown into a global trading and investment hub. Founded by Yoni Assia, Ronen Assia, and David Ring, the platform is regulated in major countries like the UK, USA, Cyprus, and Australia. It’s a favorite for its variety of investment options: you can trade in stocks, ETFs, cryptocurrencies, forex, commodities, and more – all in one account.

What really draws many to eToro is the “CopyTrader” feature, which lets you mimic other traders’ trade in real-time. If you’re a beginner or just want to test new strategies, this can give you a leg up without having to be an expert yourself. Plus, you can try out different investment methods risk-free using their demo account.

eToro fees are generally fair or should we say high in the case of crypto trading. For example, crypto trades come with a 1% fee, while stock and ETF trades are commission-free. And if you’re interested in crypto, eToro has over 100 coins to choose from, so there’s a decent variety. They even offer staking options for crypto, which means you can earn extra on certain coins by holding them over time.

Their mobile app is user-friendly and works smoothly for tracking portfolios, checking charts, or managing your trades on the go. There’s also a separate eToro Money wallet app that lets you hold crypto securely.

Pros

- Intuitive design, easy for beginners to trade and invest

- Social trading allows users to copy successful traders’ portfolios

- 6,0000+ assets such as stocks, crypto, forex, and commodities

- Zero fees and commission on stocks

- Operates under multiple regulatory bodies in the US, UK, and Australia

- $100,000 demo trading account to test strategies

Cons

- High non-trading fees such as charges for withdrawals and inactivity

- A 1% crypto trading fee is higher compared to other exchanges

- Limited in-depth analysis tools compared to competitors

- Higher spreads on cryptocurrency trades

- Many important features are restricted for U.S. eToro customers

eToro Trading and Investing Services Reviewed

Cryptocurrencies

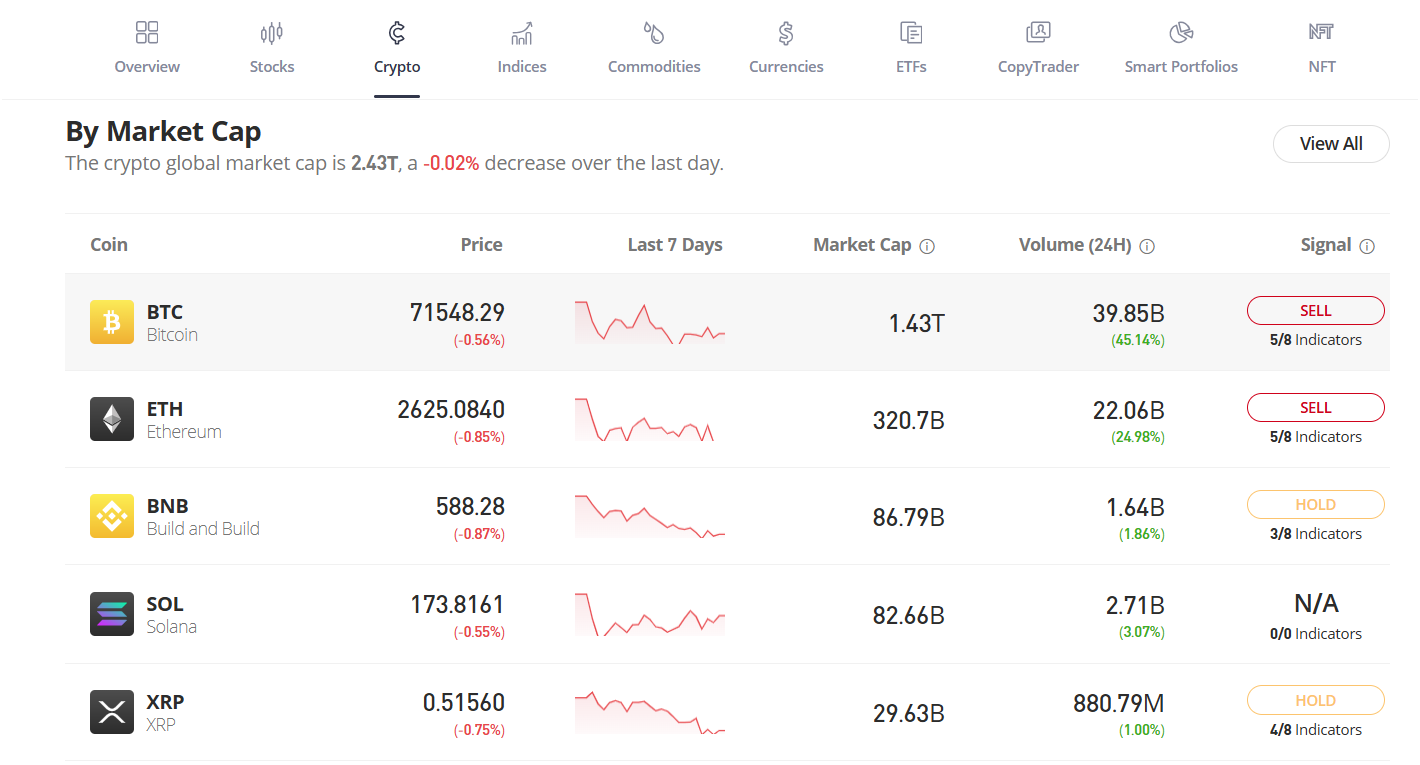

eToro offers a straightforward approach to crypto trading and investing. They’ve got about 100 of the major cryptocurrencies, like Bitcoin and Ethereum. And since it’s mostly high-market-cap coins, there’s a bit more stability, which is nice if you’re looking to stick with well-known assets. But keep in mind, if you’re in the U.S., there might be fewer coins to choose from because of different regulations, so it’s worth checking what’s available in your region.

The eToro crypto portal also has a “Discover” feature that makes exploring the crypto market easy. You can browse through the day’s top gainers to catch up on coins performing well. Plus, there are filters so you can zero in on coins with a high market cap, so if you want to focus on stable, well-known assets, you can do that too.

And if you’re interested in seeing what experienced investors are up to, there are portfolios from pro traders that you can check out, which gives you an idea of how they’re building their crypto investments.

Important Note: Only cryptocurrency trading on eToro is provided by eToro USA LLC. This company is not a registered broker-dealer or a member of FINRA, and your cryptocurrency assets are not insured by the FDIC or SIPC.

Crypto Staking

The staking options of eToro let you earn between 4% to 6% APY on crypto assets like Ethereum, Solana, Cardano, and Tron, but there’s a catch. The rewards vary by membership level, so if you’re a “Non-Club” member, you get to keep 45% of the rewards, while a “Diamond” member keeps 90%.

So, eToro takes a decent chunk of the rewards, which can be pretty high compared to crypto exchanges like Binance and OKX which don’t charge these fees.

And for eToro ME users, staking is limited to Cardano, Solana, and Ethereum only. Plus, for those in the U.K. who joined after February 8, 2022, as well as Germany and the U.S., eToro staking services aren’t available at all.

Stocks

With the eToro trading platform, you can start stock trading with as little as $10. This low entry makes it easy for beginners to dive in, and you can even buy fractional shares. So, even if a stock is pricey, you can still invest a small amount. And with over 4,500 stocks from big exchanges like New York and Hong Kong, there’s a lot to explore. You can pick stocks from industries like tech or healthcare, and see prices in real-time, so it feels like you’re right there trading on an exchange.

But keep in mind that eToro isn’t a traditional exchange, so you won’t be able to move your open stock positions to another broker later. That might feel restrictive if you’re used to more flexibility. Also, while most trades don’t have a commission, there are still some fees, like currency conversion charges for non-U.S. stocks.

CFD Trading

When you look at eToro for CFD trading, you see a lot of options. You can trade over 6,000 assets. This includes popular stocks, currencies, commodities, and indices.

You can apply leverage here. It means you can control a larger position with a smaller amount of money. For example, with leverage, you can open a $1,000 position with just $200. You can also go short. This is great if you think an asset’s price will drop. You can profit from falling prices.

Exchange-Traded Funds (ETFs)

eToro gives you access to more than 300 ETFs, which are types of funds that let you invest in various things, from stock indexes to specific assets like commodities.

- Index ETFs: These ETFs aim to follow major market indexes, like the S&P 500, and give you a broad view of the stock market’s performance. By investing in these, you’re essentially betting on the general movement of the economy without picking individual stocks.

- Dividend ETFs: These funds focus on stocks from companies that have a strong history of paying regular dividends.

- Bond ETFs: These are lower-risk ETFs that invest in bonds, offering a steady return. Ideal if you’re looking for a stable income and want to avoid the higher ups and downs seen with stocks.

- Commodity ETFs: With these, you can invest in raw materials like gold, oil, or silver without directly buying them. They help diversify your portfolio, especially if you’re looking to hedge against inflation or other market risks.

Indices

eToro’s indices let you invest in big-picture market trends instead of picking individual stocks. You’ll find popular indices like the S&P 500 and NASDAQ 100 here, meaning you can track big parts of the U.S. economy. On eToro, you actually trade Contracts for Difference (CFDs), so you’re betting on price changes without actually owning the assets.

Leverage is available if you want to start with smaller amounts but can still be risky – up to 20x on main indices for European clients, and even 100x for eToro Seychelles clients.

What’s cool is that with CopyTrader, you can copy trades from experienced traders, letting you get familiar with index investing without feeling lost. Minimum trades start at $1,000, though leverage options make it accessible for lower budgets, and real-time data tools are built into eToro’s platform to keep you updated.

Forex Market

In the Forex market on eToro, you’ll find options to trade all major currencies, including the USD, EUR, and GBP, as well as a range of minor and exotic pairs. With Forex, you’re trading on the exchange rates between two currencies, aiming to benefit from fluctuations.

eToro’s leverage in Forex is significant – up to 30x for major pairs in Europe. Trading hours are nearly continuous since the global currency market operates 24/5, meaning you have flexibility with time zones and markets.

Market spreads, beginning at 1 pip, vary depending on the currency pair and market conditions, and you can set stop-loss or take-profit limits to manage risk automatically.

Commodities

On eToro, trading in commodities is all about getting exposure to raw materials prices without needing to own them. Basically, you’re trading contracts based on the price movements of things like oil, gold, wheat, and coffee.

Say, instead of owning barrels of oil, you invest based on how much oil prices go up or down.

With eToro, you can access more than 34 different commodities. They’ve got energy products like crude oil and natural gas, precious metals like silver and gold, and even agricultural commodities like wheat or cotton. Each commodity is influenced by unique factors. Energy, for example, often moves with global events, while wheat prices might swing with seasonal weather changes

Social & Copy Trading on eToro

It is a social platform where you witness trade from others, comment on, and in fact ideas from all over the globe. This is like a social network for traders, where you can see what others are putting their money on in terms of trading strategies. You can even track top traders and get notifications regarding their moves. It’s welcoming and accessible and doesn’t make you feel like you should be an expert.

If you want a more hands-off approach, eToro’s copy trading is made for you. Here, you don’t just follow people – you can actually copy their trades automatically. You choose a trader you like, maybe someone who has a high success rate or low-risk trades, and when they make a move, your account mirrors it. It’s like investing by watching someone more experienced without doing the work yourself. And you can start small; you don’t need thousands to join in.

There’s even a demo version for copy trading where you can use $100,000 virtual money. This helps you try it out, check if the trader you’re copying is a good fit, and get comfortable with the idea of investing through others.

eToro Smart Portfolios

eToro’s Smart Portfolios are like ready-made investment packages or bundles. These portfolios group together multiple assets, such as stocks or cryptocurrencies, based on specific themes or industries.

For example, there might be a portfolio focused on clean energy or big tech companies. Each portfolio is managed professionally by eToro, so you don’t have to pick stocks or worry about balancing it yourself.

You invest a single amount, say $500 or $1000, and that investment is automatically spread across all the assets in the portfolio. eToro offers many different Smart Portfolios, so you can pick one that matches your interests or goals, like lower-risk stocks or high-growth tech companies. They’re a good choice if you want a simpler, more hands-off way to invest in multiple assets.

eToro Fees and Commissions

| Investment Type | Fees |

| Account Opening | Free |

| Account Management | Free |

| Stock and ETFs | No commission fees on trades. Spread fees apply based on market conditions. |

| Cryptoassets | 1% fee on buy/sell transactions; 2% transfer fee to external wallet |

| CFDs | Varying spread fees based on asset; overnight fees apply for leveraged and short positions |

| Withdrawals | $5 per transaction (no fee for GBP and EUR accounts in some cases); minimum withdrawal amount is $30 for USD accounts |

| Inactivity Fee | $10/month after 12 months of no account activity |

| Currency Conversions | Conversion fees based on currency type and account level; GBP and EUR accounts may avoid conversion when trading in these currencies |

| Overnight Fees | Apply to CFDs, depending on leverage and position size |

| CopyTrading | No additional fees for copying traders, but the same spread and overnight fees apply as for manual trades |

Account, Deposit, and Withdrawal Fees

To start, you won’t face any charges for opening an account, and eToro doesn’t impose a deposit fee, which makes it easy to start.

But if you decide to withdraw funds, you’ll be charged a flat $5 fee per transaction unless your account is in GBP or EUR, where some exceptions may apply.

For USD accounts, though, the fee is consistent regardless of the withdrawal amount, though eToro does set a minimum withdrawal threshold of $30 for USD.

Inactivity Fees

Another aspect to watch for is eToro’s inactivity fee. If you don’t log into your account for a continuous 12 months, eToro will deduct a $10 fee per month from your balance. This fee continues until you log back in or your account runs out of funds.

It’s essentially a charge for keeping your account open and your data available even if you aren’t actively using it, but you won’t be charged if you don’t have any funds available in the account.

Note: Currency conversion fees apply if you’re moving funds between currencies. eToro charges a conversion fee, and the rate varies depending on the type of conversion (like GBP to USD) and whether you’re in certain membership tiers within the eToro Club.

Trading Fees

For regular trading fees, eToro generally offers free stocks and ETF trading, which is a big draw for users. Unlike some brokers, eToro doesn’t charge a commission for buying or selling stocks in certain regions or account types.

They do, however, charge a spread, which is a slight difference between the buying and selling prices of assets. This spread is how eToro earns on trades, and it varies based on the asset being traded and market conditions.

eToro also charges a small percentage fee when trading crypto, set at 1% for each buy or sell transaction, with no additional hidden charges.

If you decide to transfer crypto from your eToro account to an external wallet, though, you’ll encounter a transfer fee of 2%, which reflects both the transaction and the costs of moving assets on blockchain networks.

When you open a leveraged position, like a CFD (Contract for Difference), or engage in short selling, there are additional fees associated with holding positions overnight. These fees depend on the value of the position and are essentially interest charges for maintaining leverage on your trades.

Check complete details about the eToro fee structure here.

eToro Payment Methods

Alright, so if you’re looking to deposit money into your eToro account, you’ve got several deposit methods to do it. Whether you prefer credit cards, e-wallets, or direct bank transfers, you can likely find a suitable method. However, note that the specific deposit options available to you will depend on your location, as eToro adapts its payment offerings to meet regional regulations.

For quick deposits, options like PayPal and credit/debit cards are popular choices due to their speed, while bank transfers offer a familiar and widely accessible option.

Popular payment methods available include:

- Credit/Debit Cards

- PayPal

- Bank Transfer

- Neteller

- Skrill

- Rapid Transfer

- iDEAL

- Klarna (Sofort Banking)

eToro Trustworthiness: Is eToro Safe?

eToro has several key security measures in place to help protect you and your investments. Here are some important points about how they keep your data and funds safe:

The eToro platform is licensed in major markets. In the U.S., it is registered with FinCEN and holds money-transmitter licenses in many states. They are also registered with the SEC, which helps to ensure they follow strict rules.

In the UK, eToro operates under the Financial Conduct Authority (FCA). In Europe, they fall under the Cyprus Securities and Exchange Commission (CySEC). In Australia, eToro is regulated by the Australian Securities & Investments Commission (ASIC). This regulatory framework builds trust.

Regarding personal safety measures, eToro uses SSL encryption to secure your information when you access their platform. It also has a mandatory ID verification (KYC measures). Plus, the platform keeps user funds in segregated accounts separate from operational funds. This means that even in the unlikely event of insolvency, your funds remain accessible.

Another strong measure is two-factor authentication (2FA). You need both your password and a security code sent to your phone to log in. Regular audits happen to ensure these security features are effective.

eToro Review: Mobile App

The eToro mobile app is available on both Android and iOS devices and mirrors the desktop experience closely, so users can easily switch between devices without feeling lost. eToro rated 4.3 out of 5 on the Apple App Store and 3.8 on the Google Play Store.

Instead of complex menus, it’s designed with a simple layout. You can scroll through options and easily see what other traders are doing, thanks to features like CopyTrader. It’s easy to set up a watchlist and check prices in real-time across assets, including stocks, ETFs, and certain cryptos.

Customer Support and User Experience

eToro customer support includes live chat, email and a Help Center with FAQ’s and resources. On the other hand, a few users from eToro state that response times on chat could be improved, and some questions need more personalized support than what it offers. In summary, there are support paths, which are good for quick questions but seem lacking if you need your hand held.

Overall user experience is also good, the app offers easy navigation and interaction. Despite this, a handful of users think the app’s basic approach ignores top features and advanced traders in need of powerful charting and customization may be disappointed.

Also, some users report occasional app lags, especially during high-traffic times. For many, though, eToro’s app is a great blend of simplicity and functionality, meeting the needs of social and newer traders well.

eToro vs Other Crypto Trading Platforms

| Feature | eToro | Binance | Coinbase | MEXC |

| Supported Assets | Stocks, Crypto, ETFs, Indices, Forex, Commodities | Crypto | Crypto | Crypto |

| Supported Cryptos | 100+ | 400+ | 240+ | 2,500+ |

| Trading Features | Buy/sell crypto, CFD trading | Spot, futures, margin, options, trading bots | Buy/sell crypto, 10x leverage | spot, copy trading, 200x perpetual futures |

| Copy Trading | Yes | Yes | No | Yes |

| Staking | Yes (limited options) | Yes (various plans) | Yes | Yes |

| Crypto Fees | 1% | 0.1% maker/taker | 0.4% maker and 0.6% taker | 0% maker and 0.01% taker |

| KYC Mandatory | Yes | Yes | Yes | No (No-KYC trading) |

How to Create an Account on eToro?

Here’s a step-by-step guide to creating an eToro account:

- Sign Up: First, head to eToro’s website and hit the “Sign Up” button. Fill out your info or link it with Google or Facebook if you want a quicker setup. After this, you’ll get a verification email – click to confirm, and you’re almost there.

- KYC Verification: Since eToro is a regulated platform, it needs a bit more info to verify who you are. You’ll upload a government ID and proof of address. This check helps keep the platform secure and might take a few minutes to a day.

- Deposit Funds: Once your account is verified, add funds. You can use credit/debit cards, PayPal, or bank transfers, depending on what’s available in your area. The minimum deposit usually starts around $10, but it varies by country.

- Buy Assets: Now, you’re ready to buy assets. Explore the platform to check out stocks, crypto, or ETFs. Once you pick one, decide how much you want to invest and make your purchase – eToro makes this easy, especially for beginners.

- Use eToro Money Crypto Wallet: If you’re buying crypto, you can move your digital assets to the eToro Money wallet, a separate app that keeps your crypto secure. This wallet also makes transferring crypto off the platform easier if you need it.

See the full tutorial video at ETORO FOR BEGINNERS – How To Open An Account And Buy Your First Shares

Conclusion

eToro is a good platform for beginners and casual traders. It’s easy to use, and the CopyTrader feature lets you copy what other traders do. You can trade in different things like stocks, crypto, and commodities, so it’s easy to make a mixed portfolio.

However, there are some fees. There’s a 1% fee on crypto trades, withdrawal fees, and inactivity fees. These fees can reduce profits, especially for those who don’t trade often. Hence, eToro is simple and has social trading tools, but it’s best for people who are okay with these extra costs.

You can also check out our related guides on the best crypto exchanges in Australia and the best UK crypto exchanges.

FAQs

Is eToro good for beginners?

Yes, eToro is good for beginners. Its platform is designed with a straightforward, user-friendly interface. Features like “CopyTrader”, give beginners a practical entry point without requiring in-depth market knowledge. It also has an eToro Academy for learning materials.

The platform offers a demo account with $100,000 in virtual funds. It also has a variety of assets, including stocks, cryptocurrencies, and ETFs, all within one account. However, beginners should be cautious of fees on cryptocurrency trades and inactivity, which are quite high.

Who is eToro best for?

eToro is best for casual traders and those interested in social or copy trading. It’s ideal for users who prefer a simple, intuitive platform and want exposure to various asset classes like stocks, ETFs, forex, and cryptocurrencies.

Moreover, for users interested in socially responsible investing, eToro’s Smart Portfolios offer themed investment options, such as clean energy. The platform is less suited for high-leverage crypto traders.

Can you make money with eToro?

It is possible to make money with eToro. You can profit from traditional stock and crypto trades. eToro also offers opportunities for earnings through crypto staking, where users can hold certain coins to earn passive income.

What’s the minimum deposit for eToro?

The minimum deposit for eToro varies by country and payment method. In the U.S. and Australia, the minimum deposit is $10 for most users, which makes it accessible to a wide range of investors. For most other countries, the required minimum deposit can be between $50 and $200, depending on the region and payment method.

Is eToro available in the USA?

eToro is available in the USA and offered by eToro USA Securities Inc., but with some restrictions. U.S. users can trade crypto and stocks, but access to some asset classes, such as CFDs, is restricted due to regulatory reasons.

The platform is regulated in the U.S. and holds the necessary licenses to operate, providing American users with a safe and legitimate trading environment. However, the crypto offerings may be limited compared to other countries due to specific U.S. regulations.

Which is better, Binance or eToro?

Binance is known for its extensive cryptocurrency offerings, with 400+ coins available and lower transaction fees, making it popular among crypto enthusiasts. It also has more advanced trading tools like margin trading, options contracts, and trading bots.

On the other hand, eToro is a multi-asset platform that provides access to stocks, ETFs, and cryptocurrencies, which is suitable for users interested in diverse portfolios. It does not offer these advanced trading features like margin trading or automated bots.

Is eToro really free?

The eToro platform is partially free, but there are associated fees. The platform does not charge commissions on stock or ETF trades, which is appealing to many users. However, cryptocurrency trades incur a 1% spread fee, and there are additional fees for withdrawals and currency conversions. For instance, a $5 withdrawal fee applies for most transactions, and a $10 monthly inactivity fee kicks in after 12 months of account dormancy.

Read the full article here