According to CMC data, OKX ranks fourth among the top crypto exchanges in terms of trading volume and liquidity. Therefore, if you are looking for an exchange that offers crypto trading features with good liquidity and features, it might be your choice. Our OKX review will cover its pros and cons, security measures, fees, customer service, and whether it suits your trading needs. OKX stands out as one of the leading cryptocurrency exchanges, emphasizing its strong market position.

Key Takeaways:

- OKX is a crypto exchange where you can buy and sell different types of digital assets (like Bitcoin and Ethereum) using fiat currencies like EUR and USD with your bank account, credit card, or debit card.

- The platform offers all trading features such as spot and derivatives markets, staking services, a copy trading portal, and DeFi crypto wallet tools like swaps and an NFT marketplace.

- OKX charges a small fee when you buy or sell crypto, starting at 0.08% for makers and 0.1% for takers in the spot market, 0.02% for makers and 0.05% for takers in futures, with zero deposit and withdrawal fees.

OKX Review: Quick Summary

|

Types |

Crypto trading platform |

|

Headquarters Location |

Seychelles |

|

Year Founded |

2017 |

|

Founder |

Star Xu |

|

Supported Countries |

100+ (excluding Canada and the US) |

|

Number of Supported Cryptocurrencies |

327 crypto tokens and 533 trading pairs |

|

Types of Trading |

Spot Trading, Margin Trading, Futures, Options, Copy Trading, P2P Trading, etc. |

|

Fiat Currencies Supported |

USD, EUR, GBP, etc. |

|

Deposit Methods |

Bank transfer, credit/debit card, third-party payment providers like MoonPay and Mercuryo, etc. |

|

Trading Fees |

|

|

Staking Options |

Fixed/flexible staking, on-chain DeFi staking, structured products like dual investment and snowball |

|

NFT Marketplace |

Yes (10+ blockchains) |

|

Security Measures |

2FA, cold storage, insurance funds, PoR data, anti-phishing code, address whitelisting, and more |

|

Customer Support Channels |

Live chat, email, support ticket system |

|

Mobile App |

Android and iOS |

What is OKX (Formerly OKEx)?

OKX is a global crypto trading platform known for its high-trading volume and deep liquidity. Star Xu founded it back in 2017. Initially known as OKEx, the company rebranded to OKX in 2022. Headquartered in Seychelles, they maintain a global presence in over 100 countries with offices in major hubs like Dubai, Hong Kong, and the Bahamas.

The exchange has an impressive selection of over 327 supported digital assets and 533 trading pairs, with popular options like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Tether (USDT), and many more. You can easily buy and sell these assets with over 100+ fiat currencies and 900+ local payment methods supported worldwide.

For experienced traders, you can employ advanced strategies using OKX’s derivatives offerings. These include traditional futures, perpetual contracts, and options contracts. It also provides ways to earn passive income on your crypto holdings. This includes staking, savings products, and other yield-generating opportunities like crypto loans.

About OKX’s Web3 portal, it has an integrated OKX wallet, a non-custodial multi-chain wallet that supports 70+ blockchain networks. It also connects to over 400 decentralized applications (DApps) and NFT marketplaces to explore the Web3 ecosystem.

Pros of OKX

- The unified account model lets you trade across spot, margin, and derivative markets without having to transfer funds between different wallets

- Demo trading environments, letting you practice strategies with virtual funds

- Competitive trading fees for spot and derivatives market

- Up to 100x leverage for futures trading and 10x for margin trading

- “Learn” section for new users, featuring crypto trading tutorials and market analysis

Cons of OKX

- Not available for the crypto traders in Canada and the United States

- Advanced trading tools and the DeFi ecosystem can be daunting for beginners

OKX Trading Features Review

Spot Trading

Spot trading is the most straightforward way to buy and sell cryptocurrencies. OKX supports over 327 cryptocurrencies paired against popular currencies like USDT (a stablecoin pegged to the US Dollar), USDC, or even other cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). It also offers charting tools, technical indicators, and various order types to further simply your crypto trading process.

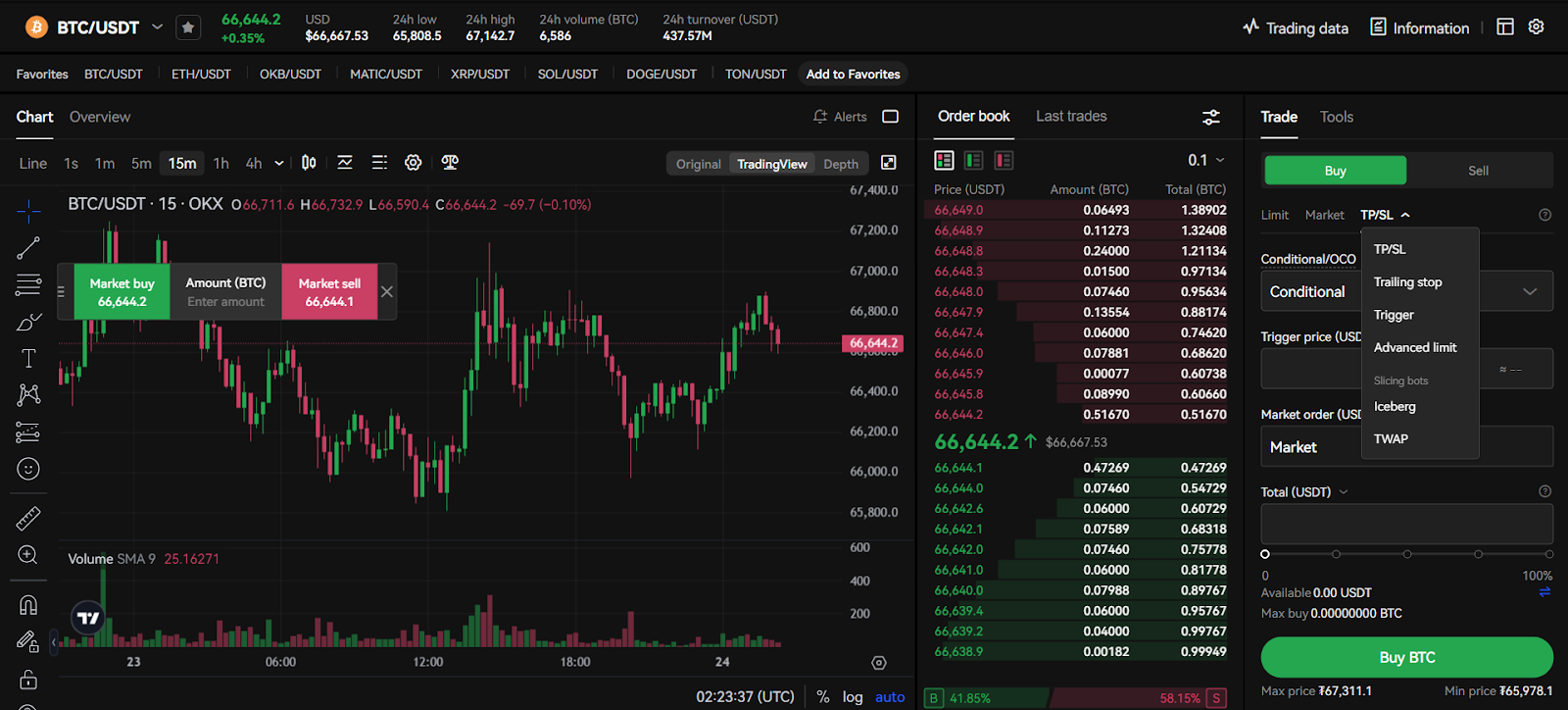

Here are some of the popular spot market order types on the OKX exchange:

- Limit: A limit order allows you to buy or sell a cryptocurrency at an exact price you set. The order will be executed only when the market price reaches your target price. This gives you greater control over your entry or exit points.

- TP/SL (Take Profit / Stop Loss): It helps manage your risk. You set a take-profit price (where you’d like to lock in gains) and a stop-loss price (to limit losses). Once either price target is hit, a corresponding market or limit order automatically triggers.

- Trailing Stop: This is a dynamic type of stop-loss order. Instead of a fixed price, you set a trailing amount (in percentage or currency). As the price of your asset increases, your trailing stop-loss follows along.

- Trigger: This order waits for a certain price or condition you set before placing a buy or sell order (which could be a limit or market order).

- Iceberg: An iceberg order breaks a large order into many smaller ones, displaying only a portion of your full order in the order book. This helps minimize price slippage when trading large amounts.

- TWAP (Time-Weighted Average Price): It splits a large order into smaller chunks executed over a specified time. This aims to achieve a price closer to the average price over that period.

Futures Trading

OKX offers a robust futures trading platform featuring 228+ cryptocurrencies. You’ll find support for up to 100x leverage on popular assets like BTC and ETH, while other coins like MATIC, ADA, XRP, DOT, and SOL have a maximum leverage of 50x.

The platform offers two main types of futures trading. Traditional Futures and Perpetual Futures

- Traditional futures have a predetermined expiration date after which the contract must be settled. In this case, prices may deviate more significantly from the underlying asset’s spot price as the expiration date approaches.

- Perpetual contracts do not have an expiry. This offers more flexibility for traders to hold their positions for an indefinite amount of time.

OKX also provides both cross and isolated margin modes. Cross mode utilizes your entire available margin balance across all positions. Isolated mode limits the margin used for each specific position. It helps in reducing risk by restricting losses in one trade from affecting other open positions.

Similar to the spot market, the OKX futures portal is equipped with an array of tools and order types to suit different trading strategies. These include market orders, limit orders, stop-limit orders, and advanced order types like trailing stops.

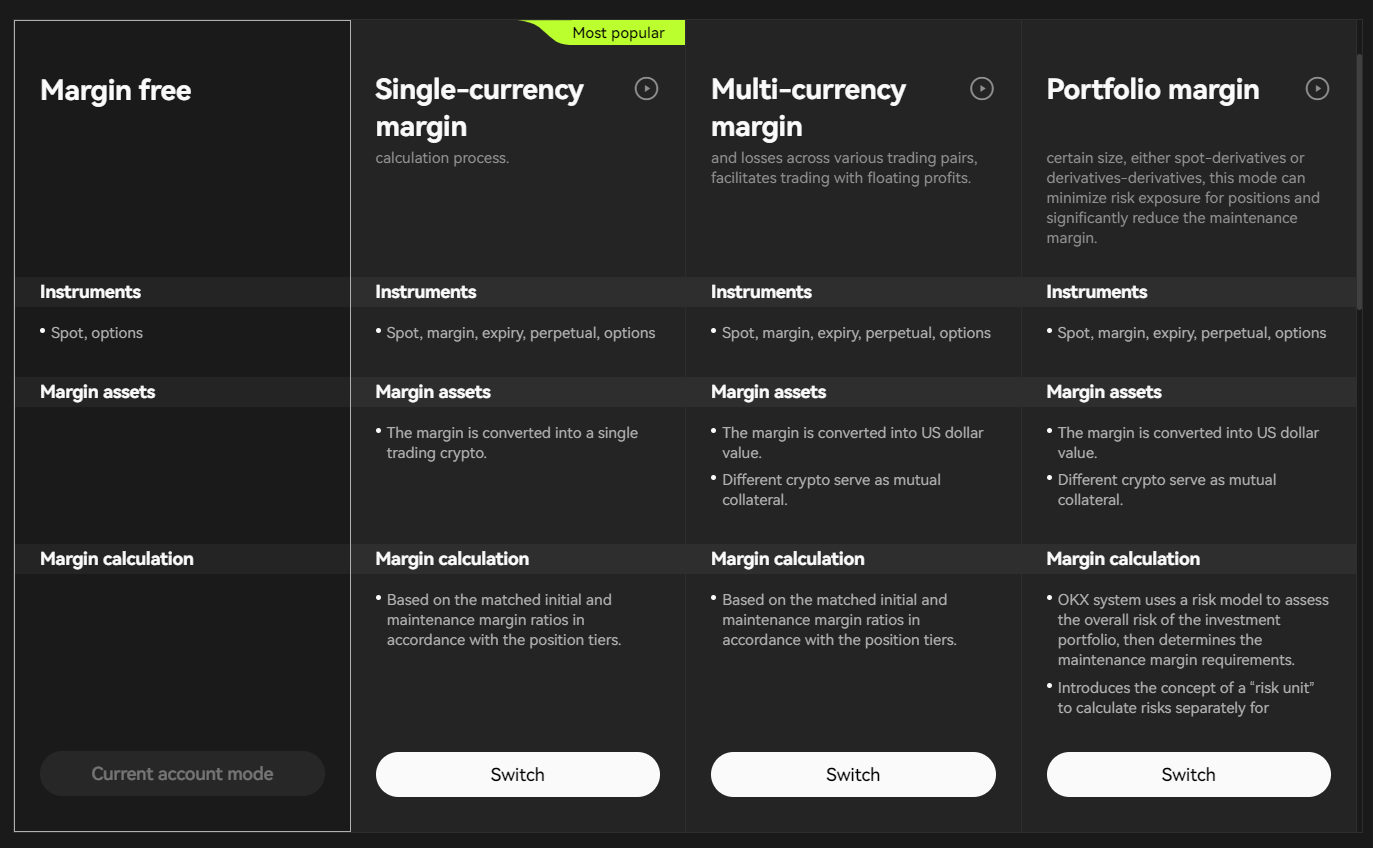

OKX offers four different types of futures trading modes: Margin free, Single-currency margin, Multi-currency margin, and Portfolio Margin.

- Margin Free: No upfront margin is required. Profits from open positions act as your collateral.

- Single-Currency Margin: Uses only one specific cryptocurrency as a margin for all your futures positions.

- Multi-Currency Margin: Allows using multiple supported cryptocurrencies in your account as a margin.

- Portfolio Margin: Calculates risk across your entire portfolio, potentially lowering margin requirements.

Margin Trading

Margin trading allows you to borrow funds from OKX to increase your buying power. The OKX margin trading currently offers up to 10x leverage on popular assets like BTC, ETH, OKB, MATIC, SOL, and DOGE. Other assets support only up to 5x leverage.

To initiate a margin trade, you first need to have some of your own funds as collateral. This acts as security for the loan you’ll be taking from the exchange.

There’s also a crucial concept called “maintenance margin.” This is the minimum amount of collateral you must keep in your account to keep your position open. If the market moves against you and your collateral falls below the maintenance margin, your position will be liquidated. That means your assets are sold to repay the loan.

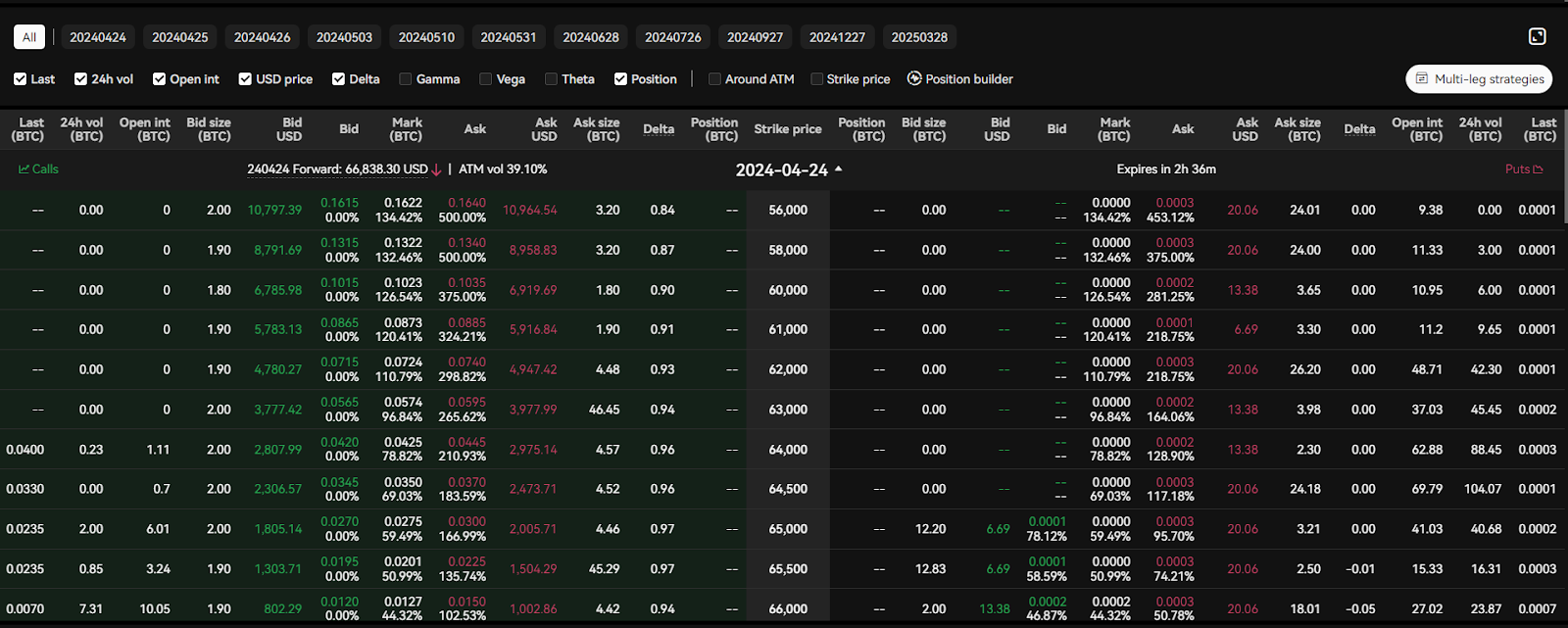

Options Trading

Options contracts are slightly more complex than spot trading. With options, you have the flexibility to buy (call option) or sell (put option) the underlying cryptocurrency at a set price (strike price) on or before a specified date (expiry date). Importantly, you have the choice, but not the obligation, to do so.

OKX options are European-style, meaning you can only exercise them at expiry, not before. Unlike some platforms with stablecoin-settled options, OKX settles its options contracts in the underlying cryptocurrency (e.g., BTC or ETH).

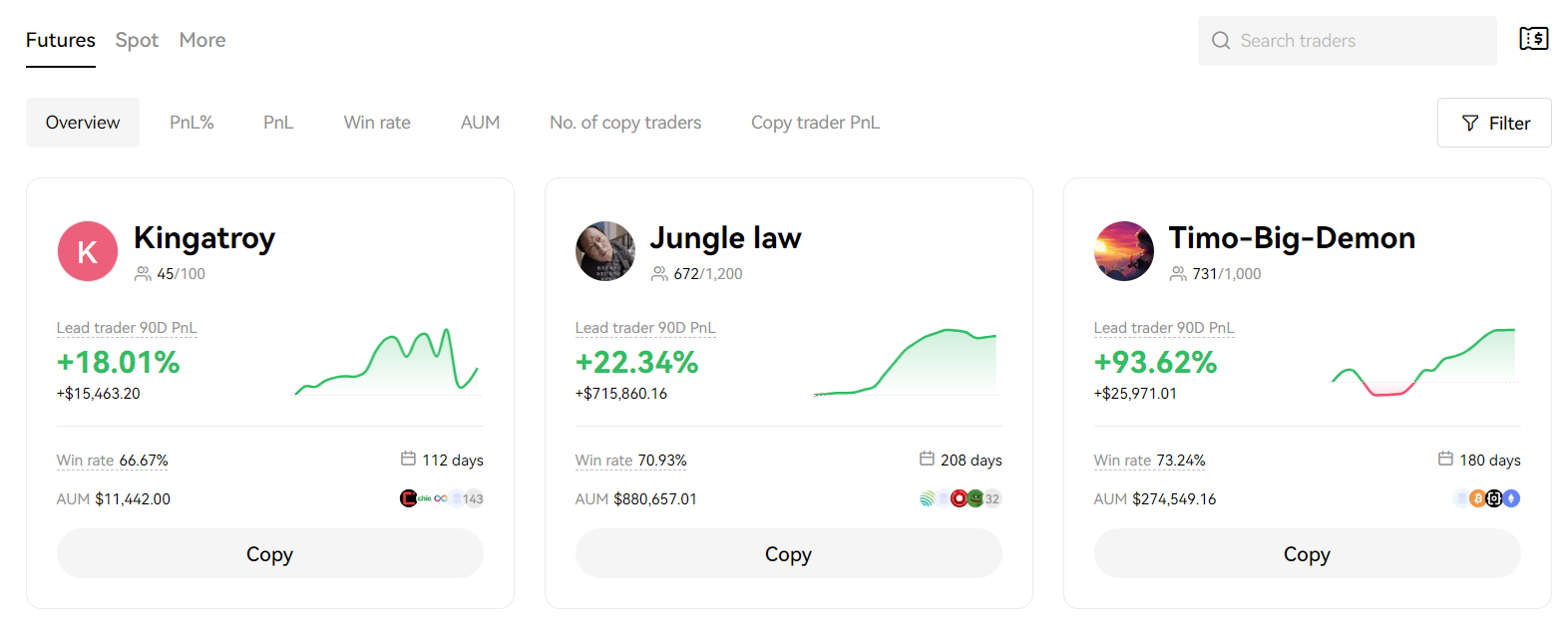

Copy Trading

Copy trading lets you automatically mimic the trades performed by another trader, referred to as a “master trader.” On OKX, you choose a master trader based on factors like their past performance (PnL), trading strategy, and risk tolerance. When they open or close positions in the spot market, your account does the same trades. OKX copy trading is available for both spot and futures markets.

OKX provides a list of master traders with detailed performance histories, win rates, AUM, number of followers, PnL%, and more. Instead of copying master traders exactly, you can also set your own investment parameters. It offers flexible options to set either a fixed amount per trade or a maximum total investment amount.

P2P Trading

P2P, or peer-to-peer trading, is a way to buy and sell cryptocurrencies directly with other users. Here, OKX acts as a middleman. To protect P2P users, the platform uses a secure escrow system. This means that when you initiate a trade, the cryptocurrency involved is temporarily frozen by OKX until both the buyer and seller have confirmed the successful completion of the transaction. On OKX P2P, you don’t pay any fees to the platform for your trades.

The exchange currently supports 4 cryptocurrency assets (USDT, USDC, BTC, and ETH) on its P2P market. OKX also supports more than 100 fiat currencies and 900+ payment methods, covering your local e-wallets, bank transfers, credit/debit cards, and direct cash transactions.

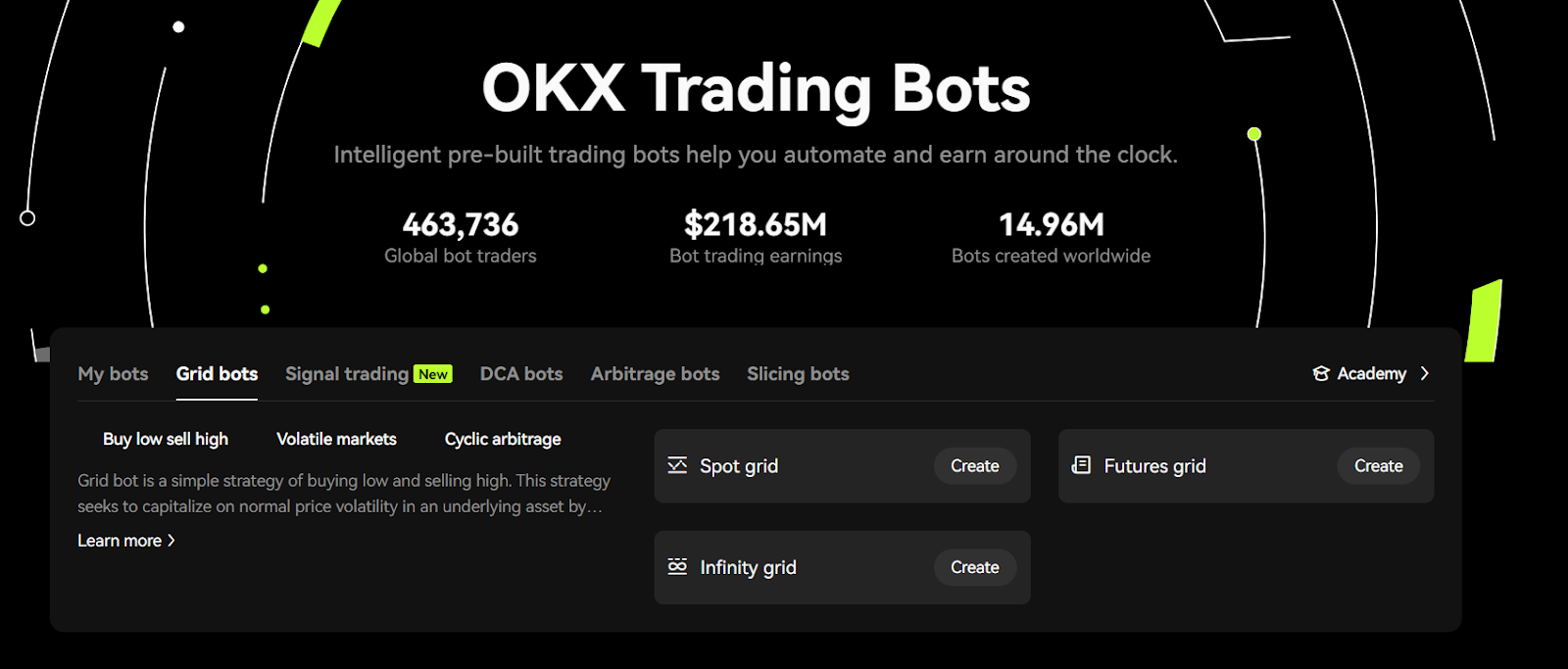

Trading Bots

These OKX bots can create professional trading strategies, all automated. You can either use an existing bot or create your own trading bots with different strategies.

OKX offers 5 different types of trading bots: grid bots (spot, futures, and infinity grid), signal trading, arbitrage, DCA, and slicing bots.

- Grid Bots (Spot, Futures, Infinity Grid): These bots work like a ladder of buy and sell orders. They aim to make small profits within a price range, buying when prices dip and selling when they go up.

- Signal Trading Bots: They work based on third-party signals. You can either integrate TradingView or create your own trading signals. There is also a signal marketplace on the platform.

- Arbitrage Bots: They look for tiny price differences across different markets (like spot vs. futures) and try to make quick profits from those gaps.

- DCA (Dollar-Cost Averaging) Bots: These bots are all about steady investing. They buy a set amount of your chosen cryptocurrency at regular times. This helps smooth out the impact of price swings. It also consists of “Recurring Buys”.

- Slicing Bots: The slicing bots are best for big trades or orders like Iceberg or TWAP (as discussed above). They break down a large order into smaller pieces and execute them over time to help get a better overall average buying price.

Liquid Marketplace

The OKX Liquid Marketplace is designed specifically for institutional traders and large-volume cryptocurrency traders. It functions as an over-the-counter (OTC) platform. This means trades are negotiated and settled directly between the two parties involved. This approach offers privacy, customization, and better pricing compared to traditional open-order-book exchanges.

Request-for-quote (RFQ) is another powerful tool within the OKX Liquid Marketplace. It’s essentially a way to source the best prices for your desired trade. An RFQ is your way of saying: “Hey, I’m interested in buying or selling this specific amount of a cryptocurrency, what’s your best offer?”

The RFQ is sent to multiple market makers (basically, professional liquidity providers) who compete to provide the most competitive price. This process can help you find significantly better deals than you might get on a standard exchange.

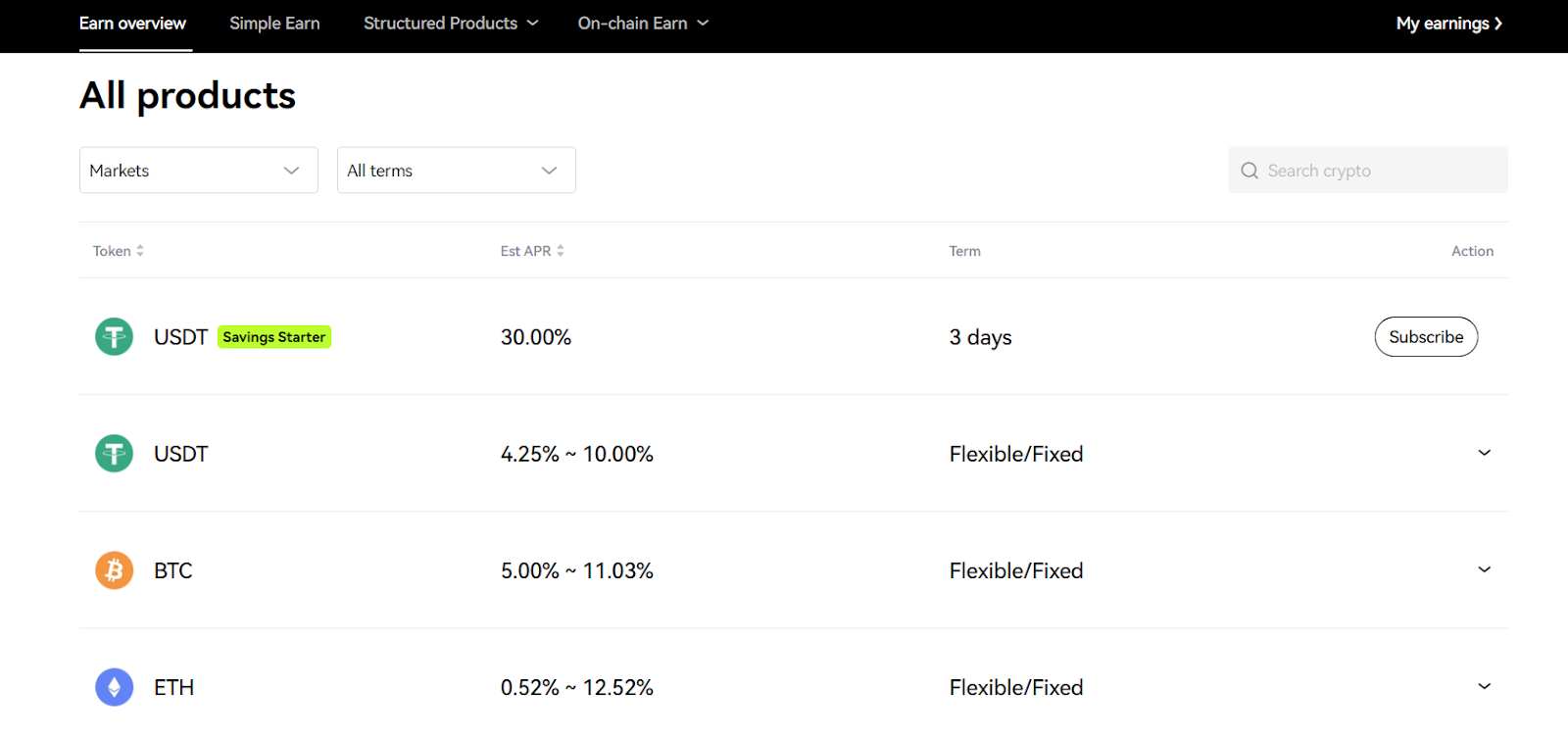

OKX Earn Services

Staking

OKX offers a variety of ways to earn passive income on your cryptocurrency holdings through staking. Simple Earn is the easiest way to start. It offers two categories:

- Flexible (Savings): This option allows you to deposit your crypto and earn interest with maximum flexibility. You can withdraw your funds anytime. Flexible options typically offer lower interest rates compared to fixed-term staking.

- Fixed (Staking): Here, you lock your crypto for a set period for potentially higher yields. During this time, your assets actively participate in securing the blockchain network, therefore earning a bigger reward. Interest rates on fixed staking depend on the specific cryptocurrency and the chosen lock-up time. For a rough idea, you can earn up to 100% APY on certain coins and even more.

Now, you have another option with “OKX Structured Products”. These products often combine staking with market predictions or strategies.

- Dual Investment: You predict if the price of a cryptocurrency will go up or down by a certain date. If your prediction is correct, you earn a high return. In this case, you deposit a single asset but get paid in a different one.

- Seagull: It is designed when you think the market will move much in one direction. With this product, you choose between Bullish BTC or Bearish BTC. You can potentially make bigger profits if the price of the crypto moves significantly as you expected.

- Snowball: This automatically reinvests your earnings back into the staking pool, essentially compounding your returns.

On-chain earning is another way to earn passive money on OKX. This option allows for direct on-chain staking, where you contribute to validating transactions on proof-of-stake blockchains. You can explore options like “ETH staking”.

Crypto Loan

The OKX Crypto Loan feature is a way to borrow cryptocurrency without having to sell your existing holdings. You use your cryptocurrency as collateral. This means you put up some of your crypto as a guarantee that you’ll pay back the loan. If you don’t, OKX can keep your collateral.

The exchange offers many assets for loans such as BTC, ETH, USDT, ALGO, APT, etc. You can choose loans with either flexible interest rates, which change hourly based on market conditions, or fixed rates for predictable costs. Flexible loans don’t have fixed repayment periods, so you have greater control over when you pay it off.

OKX features an average hourly APR of about 1% (subject to change). This means your interest rate changes hourly based on the lending market. How OKX determines this rate depends on factors like:

- Loan to Value Ratio (LTV): How much you borrow compared to your collateral’s value. Higher LTVs generally mean higher interest.

- Supply and Demand: How many lenders and borrowers are active influences the interest rate.

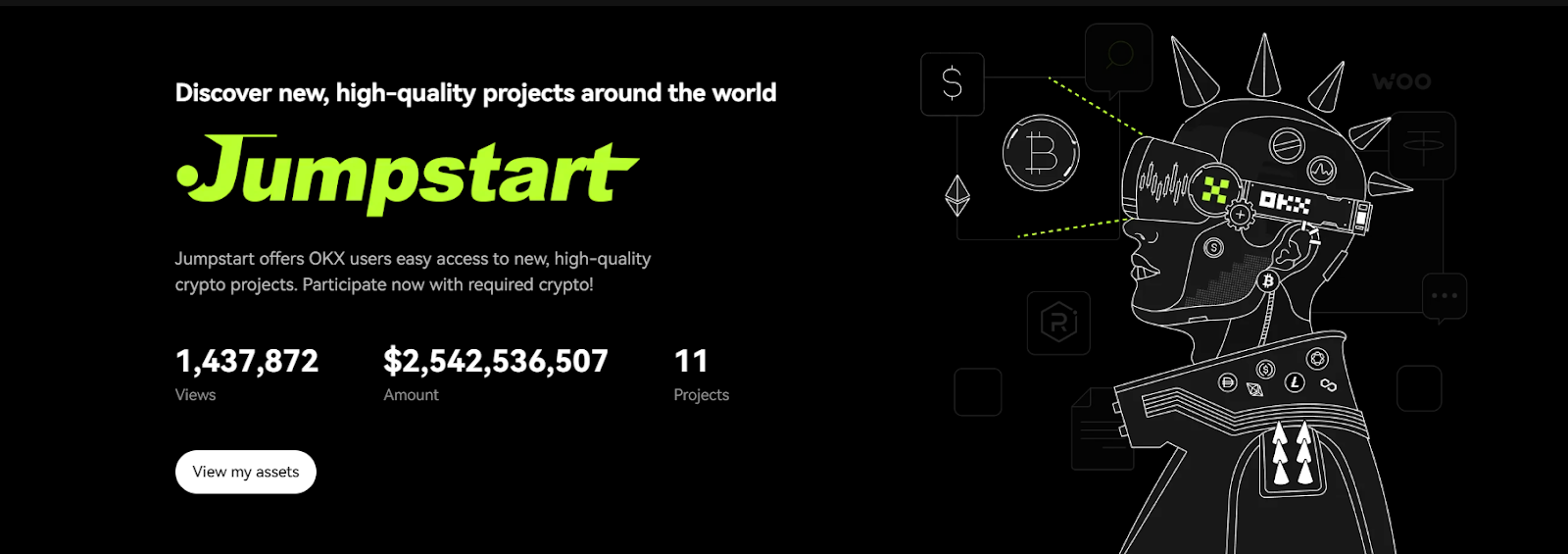

Jumpstart (Launchpad)

OKX Jumpstart acts like a launchpad for new blockchain projects. Currently, OKX has launched 11 new projects on its Launchpad and raised a total of $2.54 billion.

It has different ways to participate. Sometimes you might “mine” tokens by staking existing cryptocurrencies you already own. In other cases, you might need to pledge the OKB token (OKX exchange’s own cryptocurrency) to have a chance of buying the new project’s tokens.

OKX DeFi Ecosystem

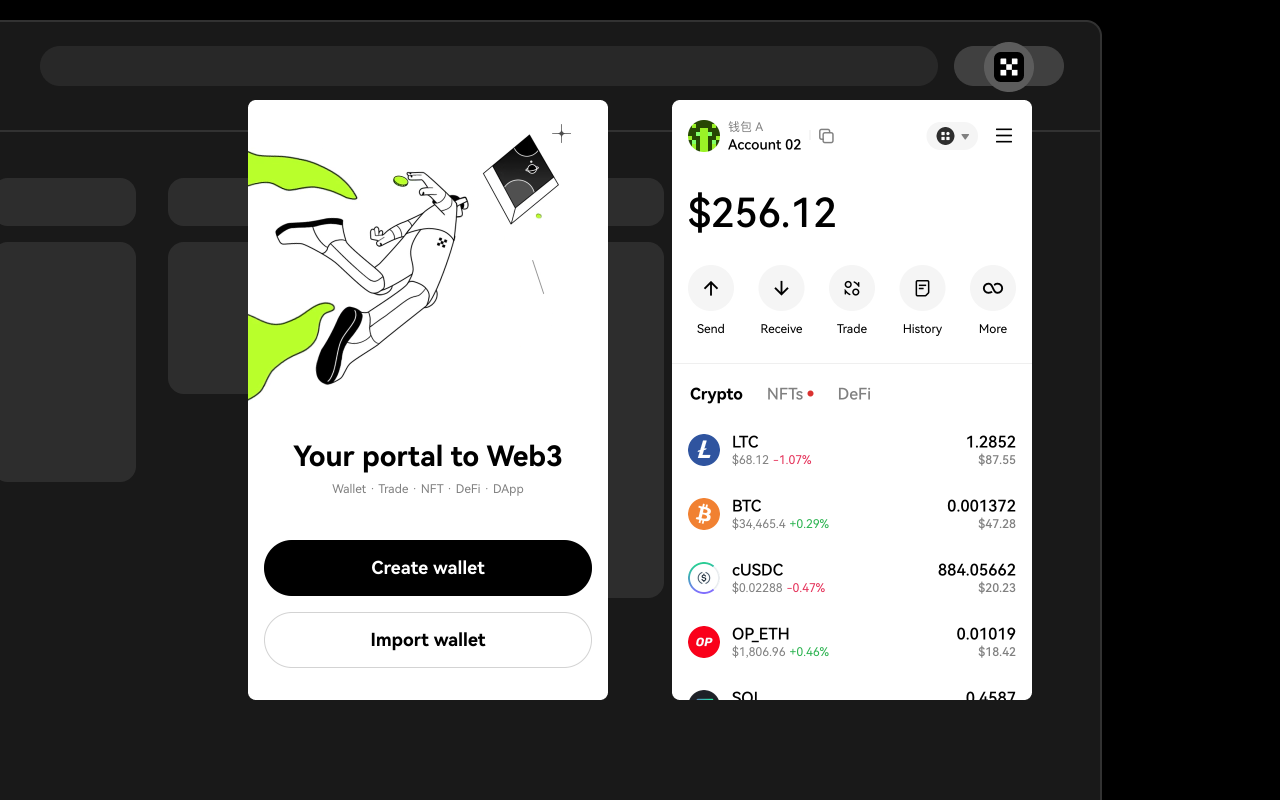

OKX Wallet

With OKX Wallet, you can easily interact with decentralized applications (DApps), trade on decentralized exchanges (DEXs), explore NFT marketplaces, and much more.

It’s designed to be user-friendly. You can easily send, receive, and store a massive range of cryptocurrencies across a whopping 70+ blockchains. The wallet also includes a built-in DEX for instant token swaps. The OKX DEX aggregator searches through more than 400 DEXs and over 20 cross-chain bridges across more than 20 networks to find the best Bitcoin and crypto prices.

OKX Wallet is non-custodial, meaning you, and only you, hold the keys to your assets. The Wallet is available on different operating systems. You can use it as a browser extension or utilize the dedicated mobile app for both Android and iOS devices. And, for smooth transitions between platforms, you can easily connect your OKX Wallet to the OKX centralized exchange.

OKT Chain

OKX Chain, or OKTC, is an EVM-compatible layer-1 blockchain built on Cosmos (ATOM). The blockchain is also 100% open-source.

The OKT chain is capable of handling 6,000 transactions per second, which is very high compared to Ethereum 12-15 TPS. Using OKTC generally costs very little ($0.01) compared to some older blockchains like Ethereum. The OKX chain also has a native token (OKT).

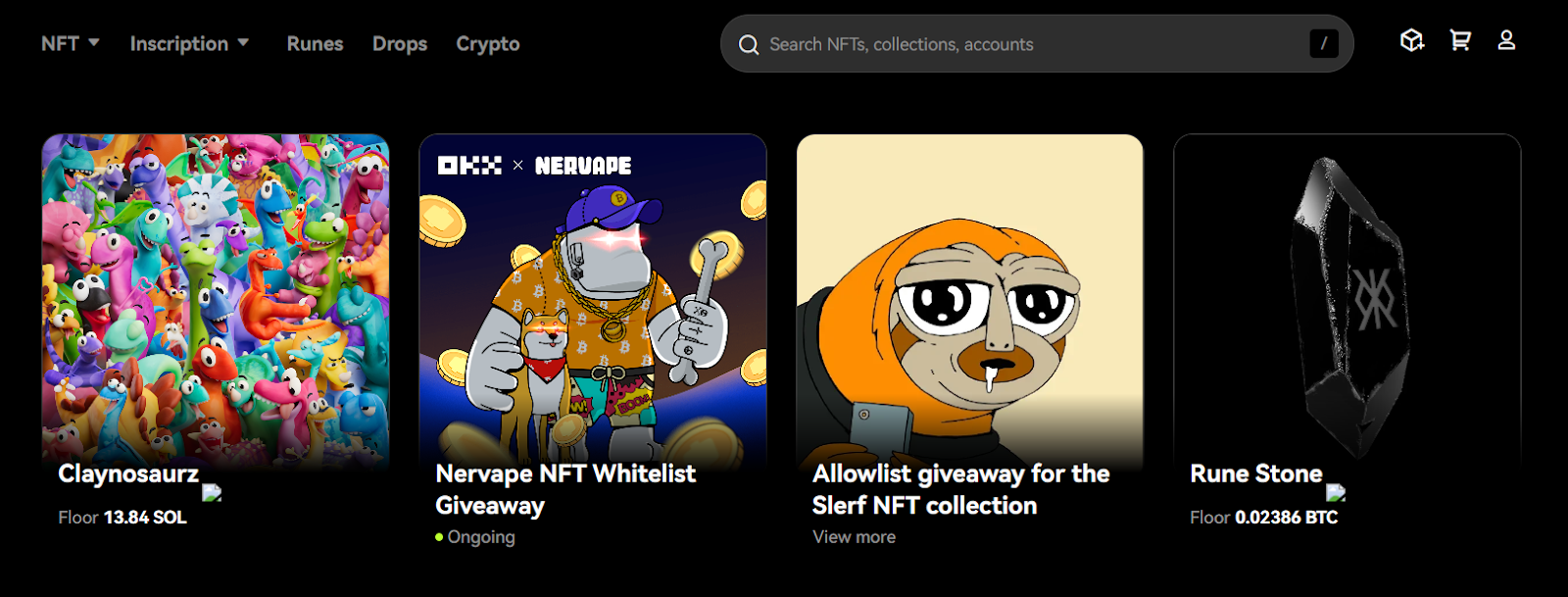

NFT Marketplace

OKX also offers an NFT marketplace. It supports NFTs across a wide range of categories – art, collectibles, music, game items, and even virtual land. The platform isn’t restricted to a single blockchain.

It supports NFTs on multiple chains like Ethereum, Polygon, Base, Solana, BNB chain, and more. This is because it gathers NFTs from all popular marketplaces like OpenSea, Blur, LooksRare, X2Y2, MagicEden, and many more. This gives you more flexibility as both a buyer and seller.

OKX Supported Cryptocurrencies

Currently, OKX supports an impressive selection of over 327 supported cryptocurrencies with a significant number of over 533 trading pairs. You’ll find coins focused on sectors like AI, the Metaverse, gaming, DeFi, smart contracts, and more.

While the number of coins is good, it might not be enough for people who want to invest in very new, low-cap coins. OKX usually focuses on listing older, more well-established coins. If you want those super new, riskier coins with the chance for big profits, exchanges like MEXC and Bybit often add them much faster than OKX.

Here are some popular cryptocurrencies you will find on OKX:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

- Aptos (APT)

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Polygon (MATIC)

OKX Fees Review

Trading Fees

OKX uses a maker-taker fee model for most spot and derivatives trading. This means that the fees you pay depend on whether you are adding liquidity to the market (maker) or taking liquidity away (taker).

It has a tiered fee structure based on your 30-day trading volume and OKB holdings. The higher your trading volume or OKB holdings, the lower your trading fees will be.

Firstly, let’s see what OKX fees look like with OKB holdings:

|

Tier |

OKB Holdings |

Maker Fees |

Taker Fees |

|

Lvl 1 |

< 100 |

0.08% |

0.1% |

|

Lvl 2 |

≥ 100 |

0.075% |

0.09% |

|

Lvl 3 |

≥ 200 |

0.07% |

0.08% |

|

Lvl 4 |

≥ 500 |

0.065% |

0.07% |

|

Lvl 5 |

≥ 1000 |

0.06% |

0.06% |

Now, if you don’t hold OKB tokens, you can also get a trading fee rebate based on trading volume. Here is the overview:

|

Tier |

30-Day Volume |

Maker Fees |

Taker Fees |

Withdrawal Limit |

|

VIP 0 |

– |

0.08% |

0.1% |

$10,000,000 |

|

VIP 1 |

≥ 5,000,000 |

0.045% |

0.05% |

$12,000,000 |

|

VIP 2 |

≥ 10,000,000 |

0.04% |

0.045% |

$16,000,000 |

|

VIP 3 |

≥ 20,000,000 |

0.03% |

0.04% |

$20,000,000 |

|

VIP 4 |

≥ 100,000,000 |

0.02% |

0.035% |

$24,000,000 |

Trading fees for futures contracts follow a similar tiered maker-taker model. For regular users, it starts with 0.02% maker and 0.05% taker. Similarly, it keeps decreasing with high trading volume and OKB holdings. For options trading, OKX charges 0.02% maker and 0.03% taker.

For more information, you can check out the full OKX fees overview.

Deposit and Withdrawal Fees

OKX does not charge any fees for cryptocurrency deposits. However, do remember that you’ll still need to pay network fees (also known as gas fees) associated with transferring cryptocurrencies on the blockchain.

Withdrawal fees on OKX vary depending on the cryptocurrency you are withdrawing. These fees are also updated regularly to reflect network conditions.

For fiat currencies, if you use third-party services such as Mercuryo or Moonpay to buy crypto, expect to pay additional fees and spreads ranging from 2% to over 10%. Credit/Debit card transactions also charge variable fees based on your country.

Payment Methods

OKX supports a variety of payment methods for buying crypto or making deposits. As discussed above, it supports over 900 payment methods on its P2P marketplace. But, if you want to deposit directly on the platform, you have somewhat limited options.

- Credit/Debit cards (Visa and Mastercard)

- SEPA

- Bank transfers

- iDEAL

- PIX

- Apple Pay and Google Pay (using debit cards)

- Moonpay

- Mercuryo

Deposit and Withdrawal Limits

Deposit and withdrawal limits on OKX can vary based on your fee level. Users with a higher VIP level will usually have higher limits. For fiat currencies, these limits can change based on payment methods.

|

Fiat Currency |

Payment Method |

Minimum Deposit |

Max. Deposit |

Max. Withdrawal |

|

EUR |

SEPA |

€1 |

€100,000 Daily €1,000,000 per 30 days |

€100,000 Daily €1,000,000 per 30 days |

|

EUR |

iDEAL |

€1 |

€100,000 Daily €1,000,000 per 30 days |

N/A |

|

BRL |

Pix |

$10 |

$20,000 Daily $50,000 per 30 days |

$20,000 Daily $50,000 per 30 days |

|

AUD |

Bank Transfer |

$10 for deposits and $5 for withdrawal |

$10,000 Daily $20,000 Weekly |

$10,000 Daily $20,000 Weekly |

OKX Security Measures

- Two-Factor Authentication (2FA): This is an absolute must! OKX supports 2FA through SMS, email codes, and authenticator apps like Google Authenticator. This adds an extra layer of protection.

- Passkeys: While not yet as common, OKX is exploring the use of passkeys as an alternative to passwords. Passkeys are more resistant to hacking and phishing attempts.

- Anti-Phishing Code: You can set up a unique code that will appear in all genuine emails from OKX. This helps you quickly spot fake emails trying to steal your data.

- Cold Wallets: Most of OKX’s cryptocurrency holdings are kept offline in “cold wallets”. A smaller amount is kept in online “hot wallets” for daily transactions.

- Multi-Signature Technology: OKX uses systems where several authorized people need to approve transactions. This prevents any single person from making unauthorized movements of funds.

- Proof-of-reserve data (PoR). The platform makes its solvency data public and you can verify it on DeFi blockchain explorers like Defilama. Currently, OKX has over $29.25 billion under its custody.

- OKX risk shield: It has an insurance fund set aside specifically to protect your assets in the unlikely event of a security breach. It is similar to Binance’s “SAFU”.

- Withdrawal Address Whitelisting: This allows you to whitelist addresses for withdrawing your funds. Any attempt to send funds to an unknown address will be blocked.

- Mandatory KYC (Know Your Customer): OKX requires users to undergo mandatory KYC verification. This helps prevent illegal activity and ensures users are who they say they are.

Mobile App

Many people trade crypto on their phones these days. If you’re one of them, you’ll be happy to know that OKX has a well-made mobile app, featuring advanced trading functionalities and robust security measures. It’s available for both Android and iOS phones. The app has all the important features you need to trade on the go. You can check prices, place orders, and manage your portfolio from anywhere.

The OKX mobile app also has a handy “Lite” mode. This is designed for people who are new to crypto and may want a simpler experience. However, more experienced traders might like the full set of features for better control over their trades.

Customer Service

When you’re dealing with crypto, it’s important to have good customer support if something goes wrong. OKX has several ways to get help if you need it. They have a help center on their website with lots of articles and answers to common questions.

For more specific problems, you can contact them in a few ways:

- Email: Send a message to okx@support.com. They usually answer within a day or two.

- Live Chat: On the OKX website, there’s a live chat option where you can talk to a customer service person right away.

- Social Media: OKX also has accounts on Twitter and other social sites where you can contact them.

Customers seeking assistance can reach OKX customer support through various methods, including submitting an online support request, opening a live chat window, or emailing the company. Additionally, an online support center is available with answers to frequently asked questions.

The exchange also receives pretty good ratings, such as 4.6/5 on the App Store and 4.5/5 on the Google Play Store. However, OKX has only received a Trust score of 1.9/5 on Trustpilot. We noticed that some users have mentioned that OKX’s customer service can be slow sometimes.

Trading Experience

OKX offers a good trading experience. They have a wide range of cryptocurrencies to choose from, and their trading fees are pretty low compared to some other exchanges. The mobile app is the cherry on top for on-the-go traders.

The trading platform itself is well-designed. It can be a little complex if you’re new to trading, but there are guides to help you get started. More advanced traders will find lots of tools for analyzing the market. These include charts and ways to set up different kinds of orders.

OKX Alternatives to Consider

Binance and Bybit are popular alternative crypto exchanges to OKX. Here is a brief comparison:

|

Features |

OKX |

Binance |

Bybit |

|

Founded |

2017 |

2017 |

2018 |

|

Popular trading features |

Spot, margin, derivatives, OKX Earn, NFT marketplace, Web3 wallet |

Spot, margin, futures, P2P, Earn products, launchpad, staking, NFTs |

Spot and derivatives trading, copy trading, bots, Web3 ecosystem |

|

Web3 Wallet |

Yes |

Yes |

Yes |

|

Supported coins |

327+ |

381+ |

1,167+ |

|

Trading fees |

0.08% maker and 0.1% taker |

0.1% maker/taker |

0.1% maker/taker |

|

Deposit and withdrawal fees |

Zero fees |

Zero fees |

Zero fees |

|

US presence |

Limited (OKCoin operates) |

Separate platform Binance US available |

No availability |

|

Native token |

OKB |

BNB |

BIT |

How to Buy Crypto on the OKX Platform?

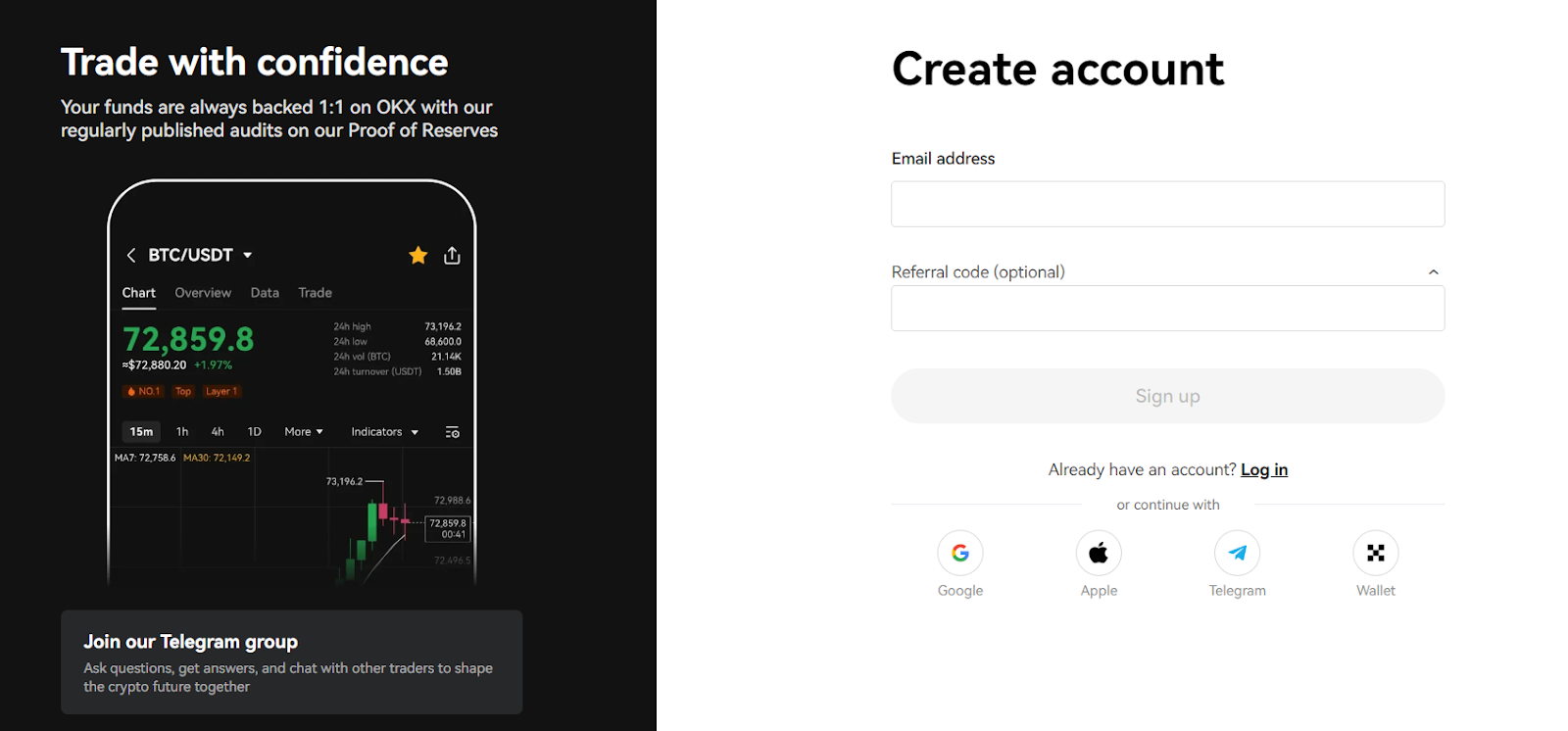

Step 1: Create an Account

Go to the OKX website or download their mobile app. You’ll see a button that says “Sign Up”. Click it. You’ll need to give some basic information like your email address and create a strong password. OKX will send you an email to verify your account. Click the link in the email to activate your account. Now, for security purposes, you have mandatory 2FA. You can use either SMS or Google Authenticator code.

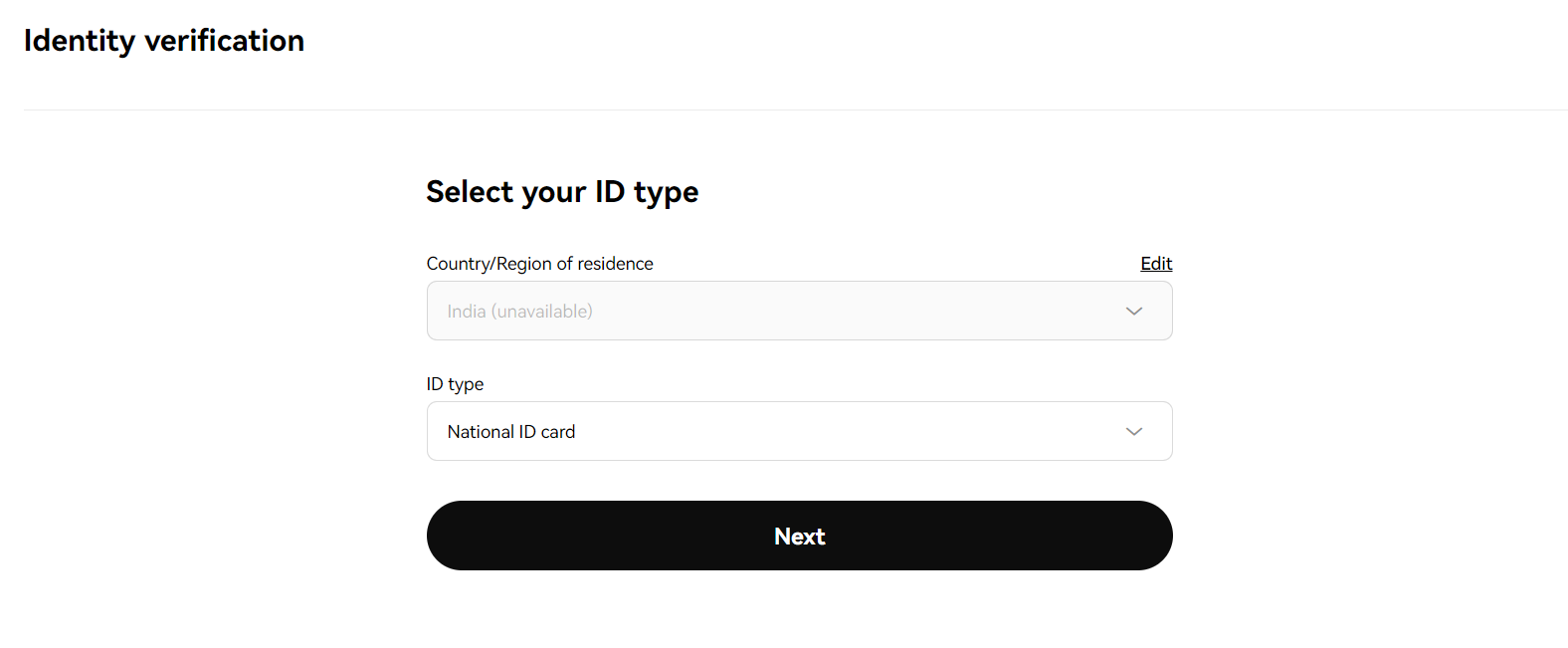

Step 2: Verify Your Identity (KYC)

Before you can start trading, OKX needs to verify your identity. This is mandatory! This process is called KYC (Know Your Customer) and is a standard security step on most exchanges.

Go to your profile section and select “Verification”. Click on this and follow the instructions. Usually, you’ll need to provide a picture of a government-issued ID (like a driver’s license or passport) and a selfie. The verification process can take a little time, sometimes a few hours or even a couple of days.

Step 3: Deposit Funds

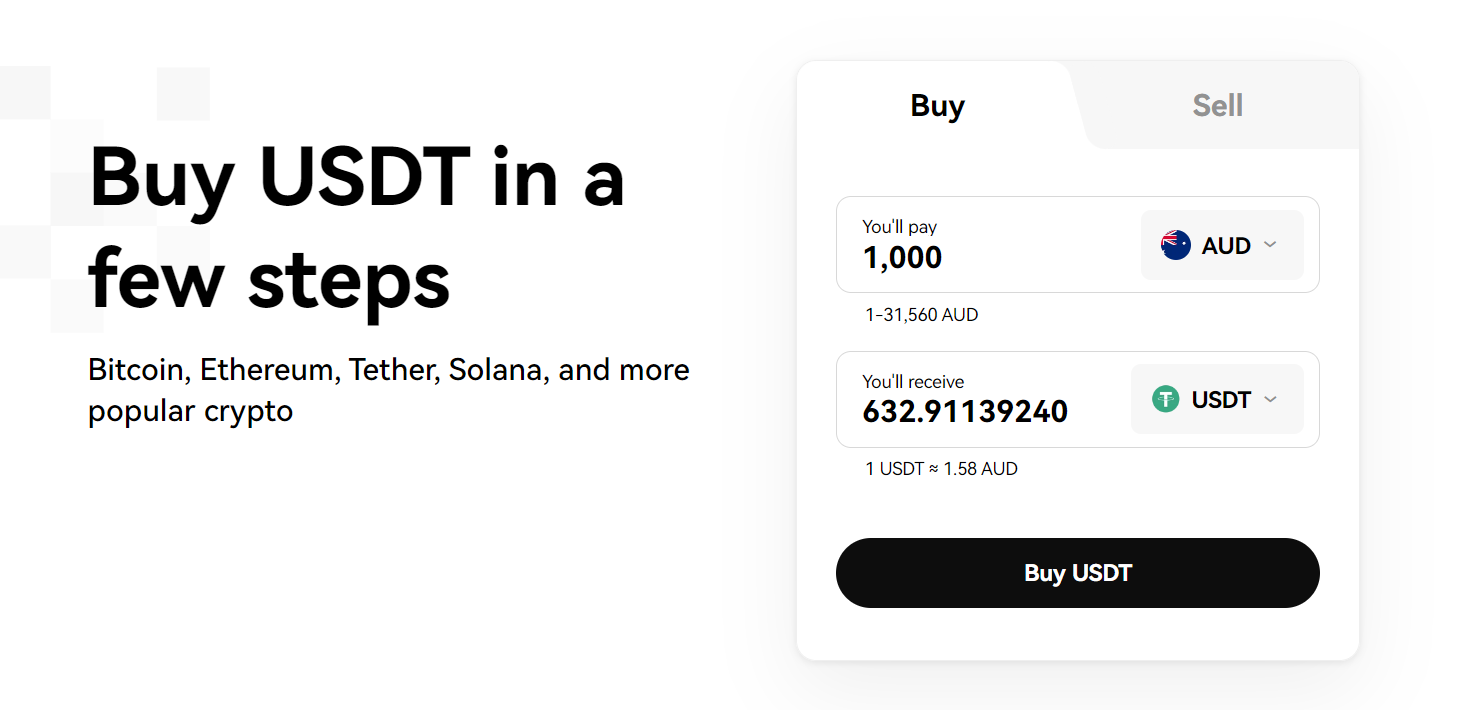

Once your account is verified, you’re ready to put some money in. Look for a section in the menu bar that says “Buy Crypto”. Now, you can use either “Express Buy” or “P2P trading”.

For this guide, we will be using “Express Buy”. Select your preferred fiat currency, cryptocurrency, and payment method. It may take some time for your deposit to show up in your OKX account, depending on the method you used.

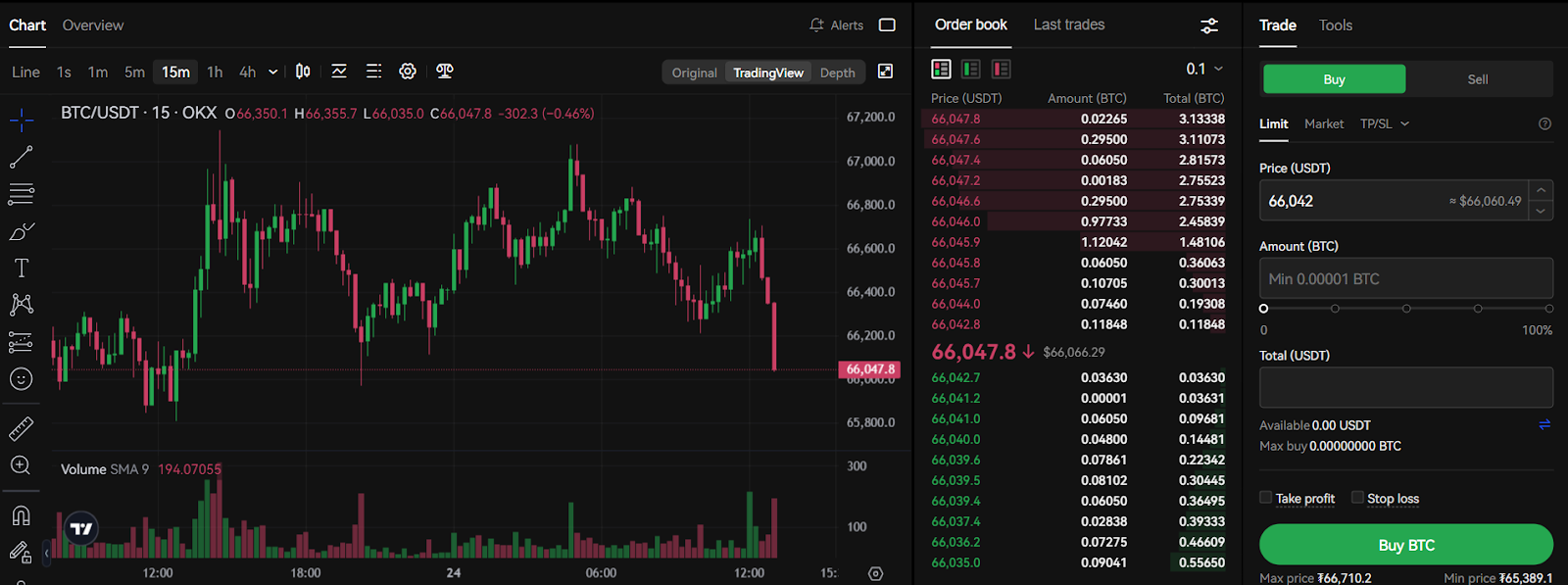

Step 4: Start Trading Crypto

Once the money is in your account, you can start buying crypto. Look for a section called “Trade” and select “Spot”. Here you’ll see a list of different cryptocurrencies that OKX offers. Find the trading pair you want to buy (for example, BTC/USDT or ETH/USDT) and click on it.

You’ll see a trading screen with charts and prices. Decide how much of the cryptocurrency you want to buy and what kind of order you want to place. A simple “market order” will buy your crypto right away at the current price. Once you’ve placed your order, OKX will do the rest and you will see your funds in the wallet.

Final Verdict

Our OKX review found that it is among the trusted cryptocurrency exchange apps for both beginners and experienced crypto traders. It has all popular coins and tokens to choose from. The fees are low, especially if you are a high-volume trader. The platform is also easy to use for beginners and there are lots of tools and features for experienced traders. OKX also has ways to earn interest on your crypto, which is a nice bonus.

However, the downside is that it is restricted in certain countries such as the US and India. Additionally, it does not list all new projects and low-cap altcoins for trading.

OKX Exchange Review: FAQs

Who is OKX Best For?

OKX is best for all ranges of cryptocurrency users. As a beginner, you will appreciate its features like spot trading, instant fiat-to-crypto convert, and P2P market for easy withdrawals and deposits.

Experienced crypto trader will appreciate its advanced trading tools, high leverage, and margin trading options. If you like earning passive income, OKX is great for that too, with staking, savings, and DeFi features. If you are a Web3 explorer, it has a non-custodial wallet, NFT marketplace, and decentralized swap features.

Is OKX legit & safe to use?

Yes, OKX has a solid reputation as a legitimate and secure exchange. It has more than 50 million users in over 100 countries. It is licensed in the Bahamas and recently acquired a VARA registration in Dubai. The exchange also uses industry-standard security measures like cold storage, multi-signature wallets, and publicly available PoR data for transparency.

Can US residents use OKX?

No, US residents cannot access the main OKX platform. Regulatory restrictions prevent OKX from offering its full range of services within the United States. However, US residents can potentially explore OKX’s decentralized options, like the OKX Wallet and NFT platform.

Is OKX good for new traders?

Yes, OKX has a lot to offer new traders. It has simple buy/sell functions, educational resources, and demo trading to practice without risking real money. However, its more complex features, like margin and futures trading, could be overwhelming for beginners. If you’re new, it’s wise to start with the basics on OKX and gradually explore its advanced features as you gain experience.

Is OKX a Chinese company?

Yes, OKX has Chinese origins. It was founded by Star Xu in China in 2017. Due to changing regulations in China regarding cryptocurrency, OKX moved its headquarters out of the country. It currently operates from locations like Seychelles and Dubai.

Read the full article here