As the digital asset or NFT market evolves, Non-Fungible Tokens have developed as a distinct type of blockchain-based property. NFT lending enables owners to utilize their digital assets as collateral for loans, creating new opportunities for liquidity in the crypto economy.

In this guide, we will go over the principles of What is NFT lending, its benefits, risks, and the best NFT lending platforms to search for.

Key Takeaways:

- NFT lending lets you use your NFTs as collateral to secure loans.

- There are various types of NFT lending, such as peer-to-peer, peer-to-protocol, NFT rentals, and non-fungible debt positions.

- NFT lending can help you gain liquidity but also comes with risks, including high volatility and potential loss of assets.

- The best NFT lending platforms are NFTfi and Arcade due to their excellent loan-to-collateral ratios and secure NFT transactions.

What is NFT Lending?

NFT lending is a way for users who own non-fungible tokens (NFTs) to get loans using their digital assets as collateral. This means that instead of selling their NFTs, owners can borrow money against them. It’s like getting a loan from a bank, but instead of using a house or car as collateral, you use your digital art or collectibles.

NFTs are unique digital items stored on a blockchain, which is a type of computer network. These items can be anything from digital art and music to virtual real estate in online games. Each NFT has a special code that makes it one-of-a-kind, which is why they’re called “non-fungible”.

NFT lending has become popular because it gives NFT owners a way to get money without having to sell their digital assets. This is helpful for traders or investors who think their NFTs might go up in value over time but need cash or crypto assets right now. Also, check out our guide on how to buy NFTs.

How does NFT lending work?

First, the NFT owner (borrower) deposits their NFT as collateral on a lending platform. Then, the borrower sets the terms of the loan they’re seeking, including the amount, duration, and interest rate.

Lenders review the available NFT-backed loans and choose which ones to fund based on the terms and the value of the NFT collateral. Once a lender agrees to the terms, the loan is issued to the borrower in the form of cryptocurrency. The borrower repays the loan plus interest according to the agreed-upon terms.

If the borrower repays the loan successfully, the NFT is returned to them. If they default, the lender may claim the NFT as compensation.

This process allows NFT owners to access funds without selling their assets, while lenders can earn interest on their cryptocurrency holdings.

Types of NFT Lending

There are a few different ways to do NFT lending. Let’s look at the main types:

1. Peer-to-peer NFT lending

In peer-to-peer (P2P) NFT lending, one person lends directly to another person. There’s no big company in the middle. Here’s how it usually works:

- An NFT owner puts their NFT up as collateral on a P2P lending platform.

- They say how much money they want to borrow and for how long.

- Lenders on the platform can see the offer and decide if they want to lend the money.

- If a lender agrees, the deal is made and the money is sent to the borrower.

This type of lending can be good because it lets people set their own terms. However, it might take longer to find a lender, and the deals might not be as safe as other types of lending.

2. Peer-to-protocol NFT lending

Peer-to-protocol lending involves borrowing through a decentralized lending protocol. Here, NFTs are deposited into the protocol, which then facilitates loans based on pre-set conditions.

Smart contracts manage the entire process, reducing human involvement and errors. This type typically provides more consistency and reliability in loan terms.

Difference between Peer-to-Protocol vs Peer-to-Peer NFT lending

| Peer-to-Protocol Lending | Peer-to-Peer Lending | |

| Lending Model | Directly with a protocol or platform | Directly between two users |

| Liquidity | Higher liquidity through pooled funds | Lower liquidity (depends on finding a match) |

| Interest Rates | Often algorithmically determined | Negotiated between lender and borrower |

| Flexibility | Less flexible, standardized terms | More flexible, customizable terms |

| Risk | Lower risk due to a broader pool of assets | Higher risk, reliant on individual counterparties |

| Speed | Faster, automated processes | Slower, requires manual agreement |

3. Non-fungible debt positions

Non-fungible debt positions (NFDPs) are a more complex form of NFT lending. In this system, the debt itself becomes an NFT. This debt NFT can be traded or used as collateral in other DeFi protocols.

It allows for more complex financial instruments and strategies in the NFT space. NFDPs are still an emerging concept and are less common than other forms of NFT lending.

4. NFT rentals

NFT rentals involve leasing NFTs rather than using them as loan collateral. This model is prevalent in gaming or virtual worlds where NFTs represent in-game items or virtual property. The renter pays a fee to use the NFT for a certain period, while ownership remains with the original owner.

Best NFT Lending Platforms

NFTfi

NFTfi is a peer-to-peer protocol that lets you use your NFTs (Non-Fungible Tokens) as collateral to borrow or lend money.

It supports a wide range of NFTs, including art, digital collectibles, and items from games, allowing you to unlock cash without selling your valuable assets. NFTfi does not charge any fees to borrowers. However, lenders on the platform are required to pay a fee of 5% of the interest they earn from loans.

You will find all types of NFT available for lending or NFT borrowing including Bored Ape Yacht Club, Doodles, Cryptopunks, and more. NFTfi has a growing community, making it easier for borrowers and lenders to connect and complete transactions.

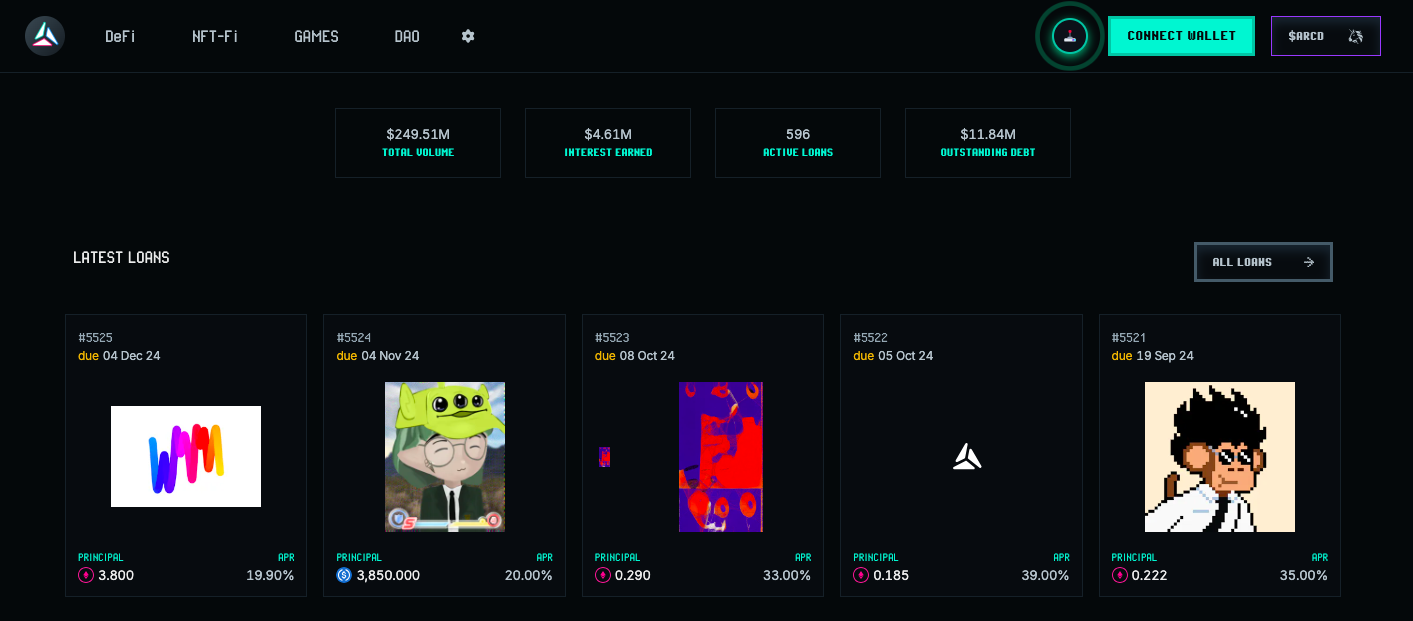

Arcade

Arcade is a DeFi platform on the Ethereum blockchain where you can lend and borrow using NFTs as collateral. It allows you to use your NFTs to secure loans or offer your assets as loans to others.

On Arcade, you can list your NFTs with specific loan terms to receive offers or choose to deposit them into a Vault for quick NFT borrowing options. As a lender, you can fund loans based on set terms or create custom offers for individual NFTs or entire collections.

If you are a lender, you earn interest on the loans you fund. In cases where borrowers fail to repay, you can extend the repayment period or claim the NFTs used as collateral, depending on what was agreed. Arcade currently supports a variety of assets, including popular ERC-20 tokens like WETH, USDC, USDT, DAI, and APE for funding loans.

Benefits of NFT Lending

NFT lending offers several advantages:

- Access to Liquidity: You can access funds without having to sell your NFTs, allowing you to utilize the capital tied up in your digital assets.

- Flexible Terms: Borrowers and lenders can negotiate terms that best fit their needs, including loan amounts, interest rates, and repayment schedules.

- Retention of Assets: You can retain ownership of your NFTs, allowing you to benefit from potential future value increases.

- Earning Opportunities: For lenders, providing loans can generate passive income through interest payments.

- Access to Capital: It offers a fresh way to get loans, particularly to people who would not otherwise have access to traditional banking services.

Risks of NFT Lending

While NFT lending offers benefits, it also comes with several risks:

- Market Volatility: The value of NFTs and cryptocurrencies can fluctuate dramatically, affecting both lenders and borrowers.

- Liquidation Risk: If the value of the collateral NFT drops significantly, borrowers may face liquidation.

- Escrow Smart Contract Vulnerabilities: Bugs or exploits in the lending platform’s smart contracts could lead to loss of funds.

- Regulatory Uncertainty: The legal status of NFTs and NFT lending is still evolving in many jurisdictions.

- Illiquidity of NFTs: Some NFTs may be difficult to sell quickly, potentially leaving lenders with hard-to-liquidate assets in case of default.

- Valuation Challenges: Accurately valuing unique NFTs can be difficult, leading to potential mispricing of loans.

- Counterparty Risk: In peer-to-peer models, there’s a risk that the other party may not fulfill their obligations.

Final Thoughts

NFT lending is a promising development in the field of decentralized finance, providing new opportunities to use digital assets. It gives liquidity to NFT holders while also allowing lenders to earn rewards. However, like any financial activity, particularly in the quickly growing crypto realm, it has hazards.

As the NFT business grows and matures, we should expect further developments in NFT financing. This might include more advanced valuation models, interaction with traditional finance, and new forms of NFT-based financial products.

Those considering participation in NFT lending, whether as borrowers or lenders, must clearly grasp the process, carefully assess the dangers, and only engage with a reliable NFT lending platform.

FAQs

How to get a loan on NFT?

To secure a loan using your NFT, you’ll need to choose a lending platform that accepts NFTs as collateral. After listing your NFT, you negotiate loan terms with a lender. Once an agreement is reached, the NFT is locked in a smart contract, and you receive the loan amount. After repaying the loan, your NFT is returned to you.

Can we withdraw money from NFT?

NFTs cannot be taken out as cash straight away since they are not a traditional financial asset. However, there are a few methods that you might be able to access cash via NFTs:

The NFT may be sold on a cryptocurrency exchange marketplace and converted back into fiat currency. As mentioned in this guide, another choice is to use the NFT as loan collateral. Finally, if the NFT has usable value (such as in-game items), you can think about renting it out.

How NFT fractionalization is good for lenders?

NFT fractionalization involves breaking down an NFT into smaller, tradeable pieces. NFT fractionalization, while not directly related to lending, can benefit lenders in several ways:

- Increased Liquidity: Fractionalized NFTs are more liquid, making it easier for lenders to sell collateral if needed.

- Lower Entry Barrier: Lenders can participate in high-value NFT loans with smaller amounts of capital.

- Diversification: Lenders can spread their risk across multiple fractions of different NFTs.

- More Accurate Valuation: Fractionalization can lead to more efficient price discovery, helping lenders better assess the value of NFT collateral.

How did NFT loan platforms work?

NFT loan platforms generally operate in the following steps:

- Account Creation: Borrowers and lenders sign up on the platform and link their NFT crypto wallets to their accounts.

- Collateral Listing: Borrowers offer their NFTs as collateral by listing them on the platform and setting the terms they desire for the loan.

- Loan Matching: Lenders explore the available collateral listings to choose loans they want to fund, or the platform may use algorithms to automatically connect suitable lenders and borrowers.

- Smart Contract Creation: Once a loan is agreed upon, a smart contract is generated to enforce the loan conditions, manage the collateral, and handle repayments.

- Disbursement of Funds: The loan amount is transferred to the borrower, while the NFT is securely locked within the smart contract for the duration of the loan.

- Loan Repayment: The borrower makes repayments, including the agreed interest, as per the terms laid out in the smart contract.

- Settlement or Default: Upon full repayment, the smart contract releases the NFT back to the borrower. If the borrower fails to repay, the smart contract transfers the NFT to the lender as compensation for the loan default.

Read the full article here