Hyperliquid is redefining DeFi by thriving without relying on Binance listings or venture capital funding. With record-breaking trading volumes, unique tokenomics, and explosive growth, discover why Hyperliquid is attracting traders and investors – and why it could be the next big opportunity in 2025.

What is Hyperliquid?

Hyperliquid is a decentralized exchange (DEX) that runs on its own Layer-1 blockchain, HyperEVM, which is designed for high performance and scalability. The platform focuses on providing a high-speed, low-fee trading experience for perpetual futures contracts, offering advanced features like scale orders and copy trading.

Learn more: What is Hyperliquid?

Why Hyperliquid Doesn’t Need to List on Binance

Decentralization and Autonomy

As a DEX, Hyperliquid operates independently without relying on centralized exchanges like Binance. Listing on Binance may not align with the project’s decentralized philosophy.

Impressive Trading Volume

Record Trading Volume

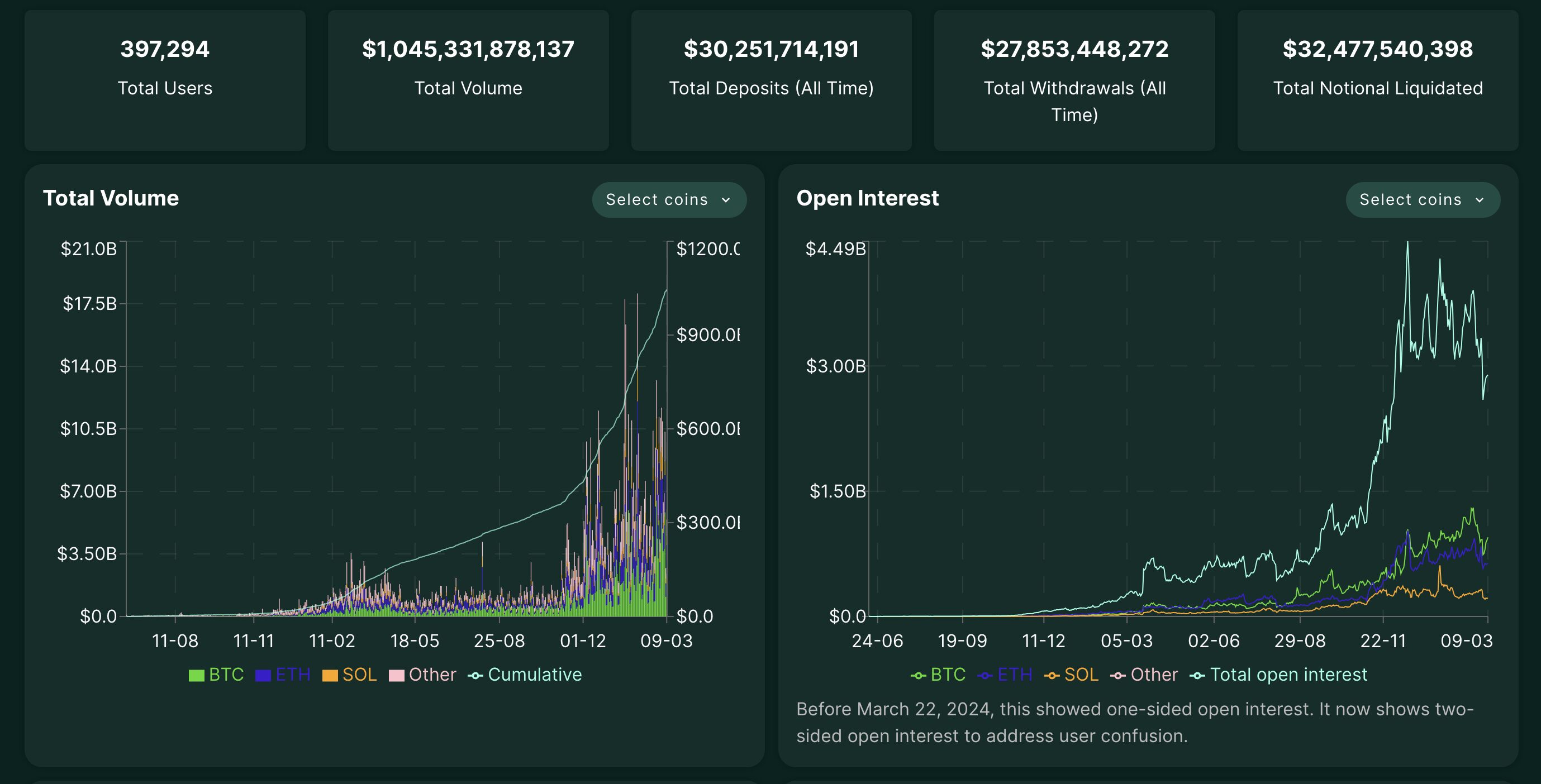

On December 5, 2024, Hyperliquid reached a 24-hour trading volume exceeding $10 billion, accounting for approximately 7% of Binance’s derivatives trading volume at the same time. This achievement highlights the platform’s strong appeal to users and liquidity providers—without relying on centralized exchanges like Binance.

Unique Token Allocation Strategy

During its launch event on November 29, 2024, Hyperliquid distributed 31% of its total 1 billion HYPE token supply to the community through an airdrop, equivalent to 310 million tokens. Notably, the project did not allocate any tokens to private investors, centralized exchanges, or market makers, reinforcing its commitment to fairness and transparency. The remaining tokens were designated for future emissions and community rewards (38.8%), the Hyper Foundation fund (6%), grants (0.3%), and core team members (23.8%), with a vesting schedule extending until 2028.

Strong Value Growth

Following its launch, the price of HYPE nearly doubled within 12 hours, rising from $3.90 to $6.48, pushing its market capitalization past the $2 billion mark.

Why is Hyperliquid rapidly becoming a leading DeFi platform and maintaining a top 3 position among DEXs for so long?

Revenue-Backed Airdrop Model Fuels Sustainable Growth

Hyperliquid made headlines with one of the most lucrative token launches ever. In late 2024, it airdropped 27.5–31% of its HYPE token supply (roughly 310 million tokens) to over 94,000 early users – a community distribution far larger than typical airdrops (usually 5–15%). This massive giveaway, now worth about $7.5 billion, became the most valuable airdrop in crypto history.

Crucially, Hyperliquid excluded venture capital (VC) investors entirely from its token allocation, meaning there were no private VCs waiting to dump tokens on day one. In fact, outside investors who wanted HYPE had to buy on the open market alongside retail, which created organic buy pressure and helped drive a strong price surge post-launch.

Hyperliquid’s tokenomics further set it apart through a “revenue-backed” approach. The team established a HYPE Assistance Fund that uses actual protocol revenue (trading fees in USDC) to buy back token HYPE on the market every day. In other words, real cash flows from the exchange fuel continuous demand for the token, making the airdrop sustainable rather than a one-off gimmick. This built-in buyback mechanism has been a boon for HYPE’s price stability and growth.

Since its TGE, HYPE has skyrocketed over 500–600% in value, vastly outperforming other DEX airdrops (which often stagnate once initial hype fades). By returning value to users through revenue instead of relying on external capital, Hyperliquid achieved a rare feat: distributing huge rewards while maintaining a strong post-TGE ROI.

The fair launch, which did not involve any insider allocations, successfully ended the issue of token dumping after the airdrop, fostering a devoted community and cultivating a cult following for the HYPE token.

Hyperliquid Dominates 60%+ of the Decentralized Derivatives Market

Currently, Hyperliquid controls over 60% of the decentralized derivatives trading market, significantly outpacing competitors. More than just an exchange, Hyperliquid has built an optimized blockchain ecosystem, combining trading and smart contract deployment on a unified network.

Competitive Advantages of Hyperliquid:

- All-in-One Integration: Trade and deploy smart contracts within the same ecosystem.

- Lower Barriers for Users: Simplified trading processes attract more traders.

Hyperliquid: The Highest Revenue-Generating Blockchain SurpassingEthereum & Solana

When it comes to transaction fee revenue, Hyperliquid ranks above major blockchains like Ethereum, Solana, BNB Chain, Avalanche, and Polygon.

According to DefiLlama, as of March 11, Hyperliquid’s revenue reached 2.2 million USD, significantly outperforming Ethereum (897,367 USD), Solana (452,947 USD), and BNB Chain (32,903 USD).

This massive revenue stream not only reinforces Hyperliquid’s dominance in the DEX space but also highlights its potential to become a leading blockchain ecosystem.

Is $HYPE Undervalued?

Despite Hyperliquid’s rapid growth, $HYPE is still trading at a lower valuation compared to blockchains with similar revenue levels.

What does this mean?

- Investors may see $HYPE as an attractive opportunity if Hyperliquid continues its growth trajectory.

- If the token adjusts to its true market value, there’s strong potential for significant upside.

Hyperliquid Hits New ATH: $15 Billion Daily Trading Volume

Hyperliquid recently set a new all-time high (ATH) of $15 billion in daily trading volume.

Key Drivers Behind This Surge:

- First to list perpetual contracts for $TRUMP, a highly volatile asset.

- Captured massive trading interest, bringing in significant capital inflows.

Record-breaking Revenue: $3M in a Single Day

Thanks to this explosive volume, Hyperliquid generated $3 million in daily revenue, its highest-ever recorded earnings.

Clear Future Vision: Towards a Fully Decentralized DEX

Hyperliquid is aiming to build a fully decentralized exchange—operating like Bitcoin, free from any centralized control.

Financial Aggregator Model

Hyperliquid is testing a next-gen DeFi model where all transactions occur on a single blockchain, optimizing speed, cost, and scalability.

Transparent Tokenomics – No VC Dependence

Unlike many blockchain projects, Hyperliquid has fairly distributed its token supply, avoiding heavy allocations to venture capital (VC) firms.

- Reduced risk of price manipulation

- Stronger community trust and decentralization

Hyperliquid Challenges CEX Giants Like Binance & OKX

As Hyperliquid gained traction, leveraged traders have been flocking to its platform – and the numbers prove it. The exchange’s flagship perpetual futures (perps) market now accounts for roughly 70% of all decentralized perps trading volume, leapfrogging rivals like GMX and dYdX. Daily volumes on Hyperliquid have been climbing fast (recently about $470 million per day, nearly double the start of 2025), cementing its status as the largest perps DEX by volume. This surge of activity reflects traders choosing Hyperliquid over legacy DeFi platforms, and a few key factors are driving the migration:

- CEX-Level Performance on Chain: Hyperliquid operates a fully on-chain order book on its own high-performance Layer-1. Its HyperBFT consensus enables ~100,000 orders per second and sub-1 second latency – performance approaching centralized exchanges while remaining transparent. Traders get lightning-fast execution without trusting a third party.

- Deep Liquidity & High Leverage: With an order book model (often dubbed the “on-chain Binance” by its community), Hyperliquid offers deep liquidity across many trading pairs. Users can take positions with up to 50× leverage – similar to Binance or Bybit – but in a decentralized environment. Large trades can be executed without the slippage and price impact issues seen on AMM-based DEXs.

- Low Fees, No Gas Hassles: Trading on Hyperliquid is gas-free for users, and fees are extremely competitive (maker 0.01% / taker 0.035%). Active traders even get volume-tier discounts. These low costs make it more profitable for high-frequency and high-volume strategies compared to older DEX models.

- Superior Pricing & Risk Management: Unlike GMX’s pool/oracle model that can suffer from stale prices or “toxic flow” arbitrage, Hyperliquid’s on-chain order matching ensures real-time market pricing. Liquidations and funding payments are executed atomically on-chain, avoiding the transparency issues or delays of off-chain systems. This robust design gives traders confidence that they won’t be sandwiched by oracle lags or hidden mechanics.

Core Technology

Hyperliquid’s core technology centers around its custom-built and optimized Layer 1 blockchain, which operates independently of frameworks such as Cosmos SDK. Below are the key components:

HyperBFT Consensus Algorithm

Hyperliquid utilizes the HyperBFT consensus algorithm, inspired by Hotstuff and its derivatives, optimized for end-to-end latency. With an average latency of 0.2 seconds and 99% of transactions experiencing latency under 0.9 seconds, it empowers users to execute automated trading strategies with instant feedback through the interface. The system currently supports approximately 100,000 orders per second, with the potential to scale to millions as further optimizations are applied.

HyperCore and HyperEVM

- HyperCore: Manages on-chain order books for perpetual contracts and spot trading. Every order, cancellation, trade, and liquidation occurs transparently with finality within a single block, thanks to HyperBFT. Currently, HyperCore handles 200,000 orders per second, with performance continuously enhanced through node software optimizations.

- HyperEVM: A smart contract platform similar to Ethereum, enabling the development of decentralized applications (dApps) on Hyperliquid. HyperEVM integrates high-performance financial principles and liquidity from HyperCore, unlocking opportunities for users and developers.

On-Chain Order Book

A fundamental design principle is the elimination of reliance on off-chain order books, ensuring full decentralization with consistent trade ordering. This distinguishes Hyperliquid from many other decentralized exchanges (DEXs), enhancing transparency and security while mitigating risks from oracle attacks.

Performance Optimization

The blockchain is coded in Rust for state transition logic, paired with an ABCI server interfacing with Tendermint, guaranteeing both performance and safety. The system supports 20,000 operations per second, making it ideal for high trading volumes, with ongoing research aimed at achieving near-instantaneous transaction settlement times.

Additional Technical Features

Token Standards

Hyperliquid has introduced HIP-1 and HIP-2, native token standards designed to facilitate token creation and ensure liquidity. An example is PURR, the first token launched with spot trading functionality.

EVM Compatibility

The platform supports EVM bridging for interoperability, currently from Arbitrum, secured by Hyperliquid L1 validators and audited by Cyfrin.

Fees and Leverage

Hyperliquid offers a fixed taker fee of 2.5 bps and a maker rebate of 0.2 bps, with no fees charged during the first 3 months of the closed alpha phase. It also supports leverage up to 50x, backed by margin maintenance logic to manage liquidations effectively.

Market Turmoil Gives Hyperliquid a Competitive Edge

Recent security scandals at major centralized exchanges (CEXs) have created an ideal market environment for Hyperliquid to thrive. In early 2025, Bybit, one of the largest crypto exchanges, experienced a devastating $1.4 billion hack. This hack, linked to North Korean hacker groups, became the largest crypto theft ever recorded. News of the exploit sent shockwaves through the trading community, reigniting fears about the security of centralized exchanges.

Shortly after, MEXC faced severe backlash due to transparency scandals on its perpetual platform. Users accused MEXC of freezing accounts and unfairly clawing back profits from successful trades. Multiple traders reported that MEXC had removed or deducted substantial funds after big wins. This raised critical questions about the exchange’s fairness and trustworthiness.

These incidents highlight the significant risks involved when holding assets on centralized exchanges. Traders face threats from potential hacks, opaque policies, and unpredictable fund seizures. In contrast, Hyperliquid offers a decentralized alternative that eliminates these vulnerabilities. Traders on Hyperliquid retain complete custody of their assets, meaning there is no centralized pool vulnerable to hackers.

Hyperliquid’s model ensures full transparency by recording every transaction, liquidation, and fee directly on the blockchain. Unlike centralized exchanges, Hyperliquid does not engage in hidden risk management interventions or arbitrary fund seizures. Instead, smart contracts enforce clear and transparent trading rules, reassuring traders.

This transparent approach has resonated strongly within the trading community, especially during a time of uncertainty surrounding centralized platforms. Hyperliquid further boosts trader confidence through a robust insurance fund and responsible risk management practices. Adjusting margin requirements after significant market events demonstrates Hyperliquid’s commitment to protecting users.

Ultimately, Hyperliquid is capitalizing effectively on the shortcomings of centralized exchanges. By prioritizing security, transparency, and fairness, Hyperliquid has positioned itself as the ideal solution for traders seeking safer, more reliable alternatives.

Leading the Broader Shift from CEX to DEX

The success of Hyperliquid also reflects a wider industry migration from centralized exchanges to decentralized alternatives. Even though as of late 2024 only about 3–5% of crypto derivatives volume was on DEXs (the rest still on CEXs) , that percentage is steadily climbing.

Hyperliquid is at the forefront of this transition by proving that a DEX can offer security, transparency, and efficiency without sacrificing performance. It has shown that traders – from retail enthusiasts to institutional investors—will gravitate to DeFi platforms when they can trade with CEX-like speed and liquidity in a trustless environment. This model addresses the key pain points that have historically kept institutions wary of DEXs (like low throughput or poor UX), thereby expanding the DeFi user base.

Moreover, Hyperliquid’s rise is inspiring a rethinking of how new crypto projects launch and grow. Its on-chain fair launch (no centralized listing, community-priced from day one) was a stark contrast to the traditional route of big exchange listings that often favor insiders. The fact that HYPE’s value surged while over 80% of tokens listed on Binance in the same period lost value in their first six months highlights a shift in market preference toward on-chain provenance and fairness.

We are likely witnessing the beginning of a “new era” where launching on a DEX like Hyperliquid is seen as more credible and community-aligned than a flashy CEX listing.

Learn more: Hyperliquid (HYPE) Price Prediction

Comparison Table: Hyperliquid vs. Other Projects

Conclusion

Hyperliquid has proven that a DEX can achieve performance and user experience on par with, or even superior to, CEXs. With advanced technology, impressive trading volume, and a strong focus on user experience, Hyperliquid does not need to be listed on Binance to establish its position. Its independence and self-sufficiency enable Hyperliquid to sustain and grow in the highly competitive DeFi landscape.

Read the full article here