Recently, after much speculation from the crypto community, Trump’s DeFi project—World Liberty Financial—has officially launched its own stablecoin named USD1, pegged 1:1 to the US dollar. The project promises to bring a fresh wave of innovation and drive the mainstream adoption of DeFi and cryptocurrency in the broader financial landscape.

New launching USD1 – what is it?

Recently, World Liberty Financial (WLFI) has officially launched USD1, a stablecoin pegged to the US dollar, fully backed by US Treasury Bills (T-Bills), USD deposits, and other liquid assets.

Meet USD1 — the stablecoin your portfolio’s been waiting for.

Built for institutions and retail alike. Backed by dollars. Custodied by BitGo.

No games. No gimmicks. Just real stability.https://t.co/vXPbZe0GPn— WLFI (@worldlibertyfi) March 25, 2025

Some key features of USD1 include:

- 100% backed by US Treasury Bills (T-Bills), USD deposits, and cash-equivalent assets.

- Third-party audits to ensure transparency and stability of reserves.

- Custodied by BitGo, a leading digital asset security provider.

- Initially issued on Ethereum (ETH) and Binance Smart Chain (BSC), with plans to expand to other blockchains in the future. Previously, most companies in the U.S did not widely recognize Binance Smart Chain (BSC) and the BNB token. This marks the first time BSC has been backed by a major project in the U.S.

- Designed for institutional-grade stability and liquidity, making it suitable for institutional investors and sovereign wealth funds looking to engage with DeFi without exposure to algorithmic or undercollateralized stablecoin risks.

Newcomers in the Wide Stablecoin Market

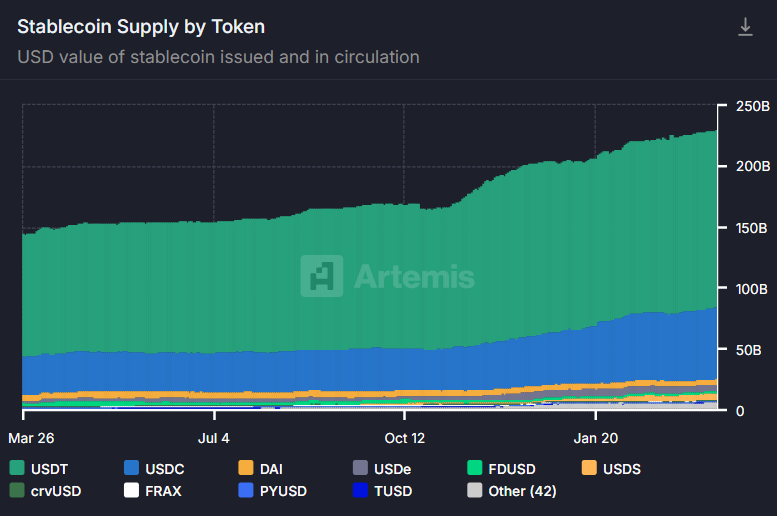

The year 2024 saw a strong surge in the stablecoin market, with total supply increasing 63%, from $138 billion to $225 billion. Monthly stablecoin trading volume more than doubled, rising from $1.9 trillion in February 2024 to $4.1 trillion in February 2025, marking a 115% year-over-year increase.

Unlike previous cycles, stablecoin minting primarily signaled a market-wide rally driven by DeFi applications. This time, the market did not rise proportionally with stablecoin growth. Instead, stablecoins are now being used for broader purposes beyond just trading, such as global payments and an inflation hedge in certain countries.

This makes it the perfect moment for USD1 to launch—a stablecoin that bridges Web3 and traditional finance, addressing the gaps in major players like USDT and USDC.

USD1 is the latest entrant in the highly competitive stablecoin race. Currently, USDT (Tether) remains the largest stablecoin globally, with a market capitalization of nearly $144 billion, significantly ahead of its closest competitor, USDC (Circle), which holds a market cap of approximately $60 billion.

WLFI’s move likely responds to tightening U.S. regulations, especially the GENIUS bill under Senate review. This bill could introduce stricter requirements on reserve assets and transparency for stablecoins.

About World Liberty Financial

World Liberty Financial (WLFI) is a DeFi protocol and governance, aim to make finance more open and accessible for everyone. Inspired by Donald J. Trump’s vision, WLFI aims to simplify decentralized finance (DeFi) by creating easy-to-use tools that help more people benefit from this new financial system. The platform focuses on transparency, security, and user empowerment, positioning itself as a leader in the future of DeFi.

Learn more: World Liberty Finance’s $48M Ethereum Purchase Sparks Speculation on Crypto’s Future

Previously, the crypto community suspected WLFI of quietly launching this stablecoin on BNB Chain about 20 days ago. Analysts detected the first test transactions earlier this month, showing a stable supply of 3.5 million USD1 across both blockchains.

Welcome to @BNBChain!

According to BSCScan, the smart contract was deployed 20 days ago. Build! 👏https://t.co/qr22y4pXqE https://t.co/J0TvwEnUin

— CZ 🔶 BNB (@cz_binance) March 24, 2025

As of March 26, 2025, WLFI holds 11 cryptocurrencies, including ETH, WBTC, LINK, TRX, AAVE, MOVE, ONDO, ENA, SEI, AVAX, and MNT. The latest addition, MNT (Mantle), totals 3.54 million MNT, valued at $3 million.

Read the full article here