New data from crypto insights firm Galaxy Research finds that during the first quarter of the year, venture capitalists poured in billions of dollars into the digital assets industry.

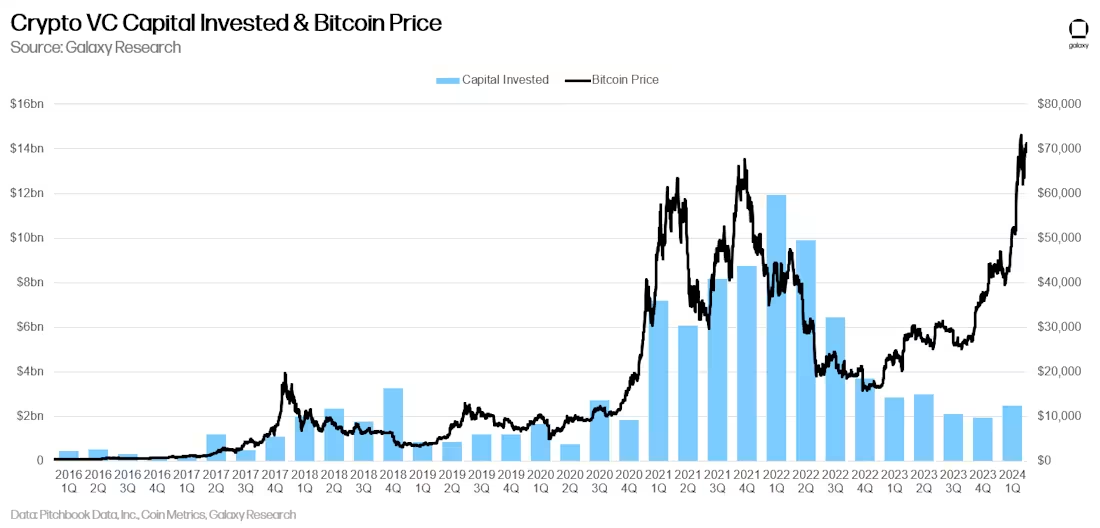

In a new article, Galaxy Research says that venture capitalists invested $2.49 billion into cryptocurrencies during Q1 of 2024, a 29% quarter-over-quarter (QoQ) rise.

The analytics platform says that heavy investments during Q1 of 2024 signal that Q4 of 2023 could have been the bottom of the market.

“In Q1 2024, venture capitalists invested $2.49 billion (+29% QoQ) into crypto and blockchain-focused companies across 603 deals (+68% QoQ).

This was the first rise in both capital invested and deal count in three quarters, perhaps signaling that Q4 2023 was the ‘bottom,’ although a continuation of QoQ increases – and a more meaningful increase – would confirm that over the coming quarters.”

Galaxy Research goes on to note that while venture capitalist investments into the crypto space have correlated with the price of Bitcoin (BTC) in the past, the crypto king’s massive rise in 2024 caused them to decouple.

“While venture capital investment in the crypto sector has typically correlated to the Bitcoin price, that correlation has broken down over the past year, with bitcoin rising significantly since January 2023 but VC activity mostly languishing.

Q1 2024 saw a significant rise in BTC, and while capital invested also rose, the investment activity is still nowhere near the levels when Bitcoin last traded over $60,000.

The combination of crypto industry-native catalysts (Bitcoin exchange-traded funds, new areas like restaking, modularity, Bitcoin layer-2s, etc.) and macro headwinds (rates) contributed to the notable divergence.”

Bitcoin is trading for $62,754 at time of writing, a 5.2% increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Follow us on X, Facebook and Telegram

Generated Image: Midjourney

Read the full article here